Markets Report Special Update: Panic Selling

There is panic in the markets.

Today’s post is a quick update. Stocks, particularly tech, got crushed today. In response, I increased my long exposure, raising my position from 1/3 of the potential max size to 40% of the potential max size. I am looking for a mean-reversion bounce and will scale in as the market declines.

This is a non-core mean-reversion position. Even at max size (100%), mean-reversion positions should not account for the majority of your portfolio.

Click here to read my latest full Markets Report (published every weekend).

Remember: when markets plunge, position sizing matters just as much as your market outlook.

With that being said, we saw some capitulation today. From 2008-present, there has been a tendency for the NASDAQ 100 to bounce over the next week when its RSI got this low:

The % of NASDAQ 100 stocks that are oversold is increasing:

VIX term structure jumped again. The last 2 spikes marked tops for VIX:

Looking underneath the hood, we can see that some of the largest tech stocks have been crushed.

Tesla:

Ready for a bounce:

Amazon:

Nvidia:

Facebook:

Google:

Microsoft:

The selling is not limited to tech. Financials have taken a beating as well:

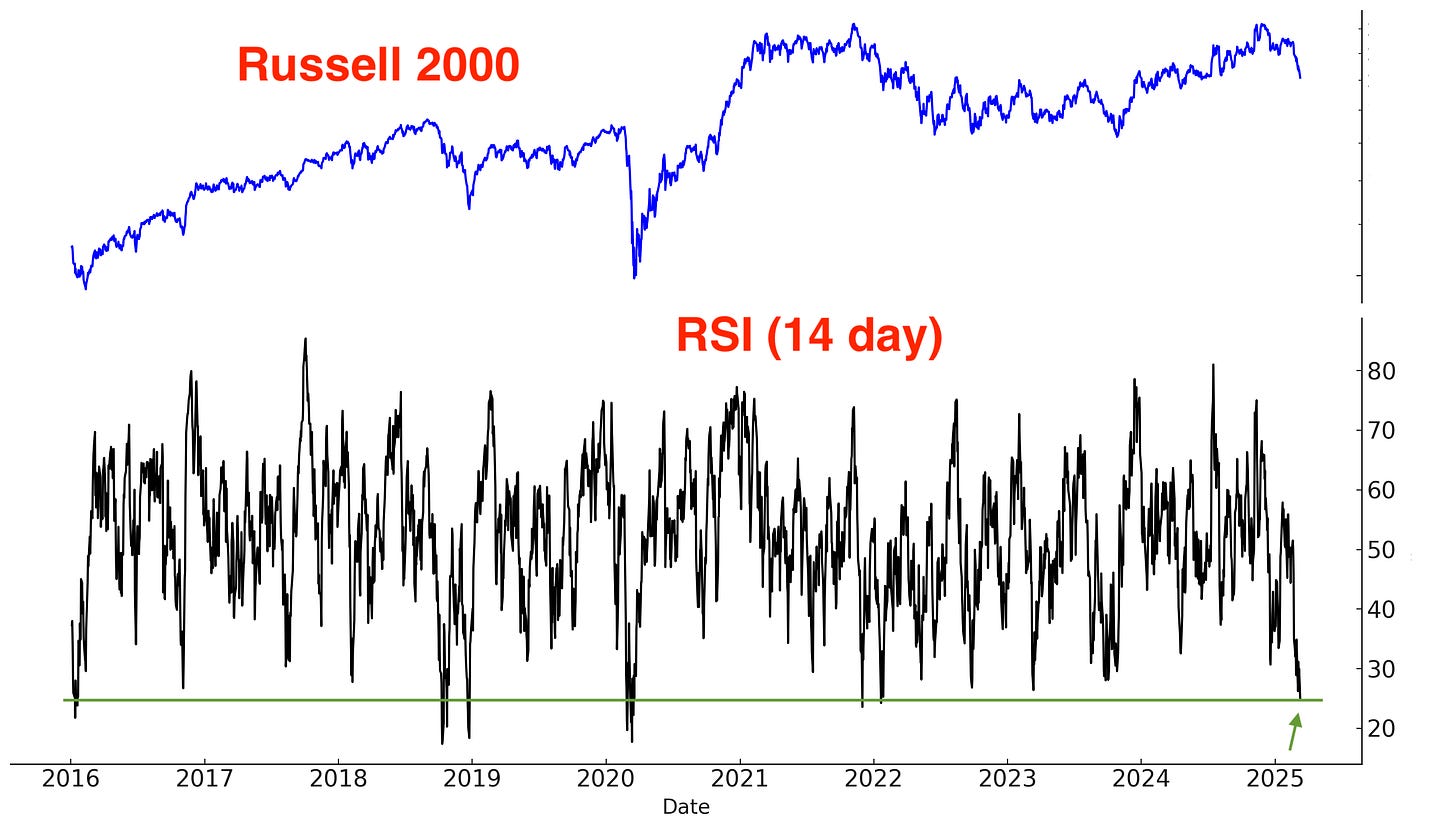

Small caps plunged:

Could stocks fall more? Yes.

But focus on Risk:Reward, and focus on position size for mean-reversion trades.

How you scale-in and manage your position size is of utmost importance for mean-reversion trades.

This is just a quick update. I will share my full weekly Markets Report this weekend. Click here for my previous report.

On my local la news the first story up was about stocks. This is usually a good indicator of a st bottom. I would like to see pc ratios up more but the long pole down in Nasdaq probably deserves at least a flag

As Walter Deemer famously says “when the time comes to buy, you won’t want to”