The Great Rotation: Pump, Dump, and Rotate.

What's being pumped vs. What's being dumped

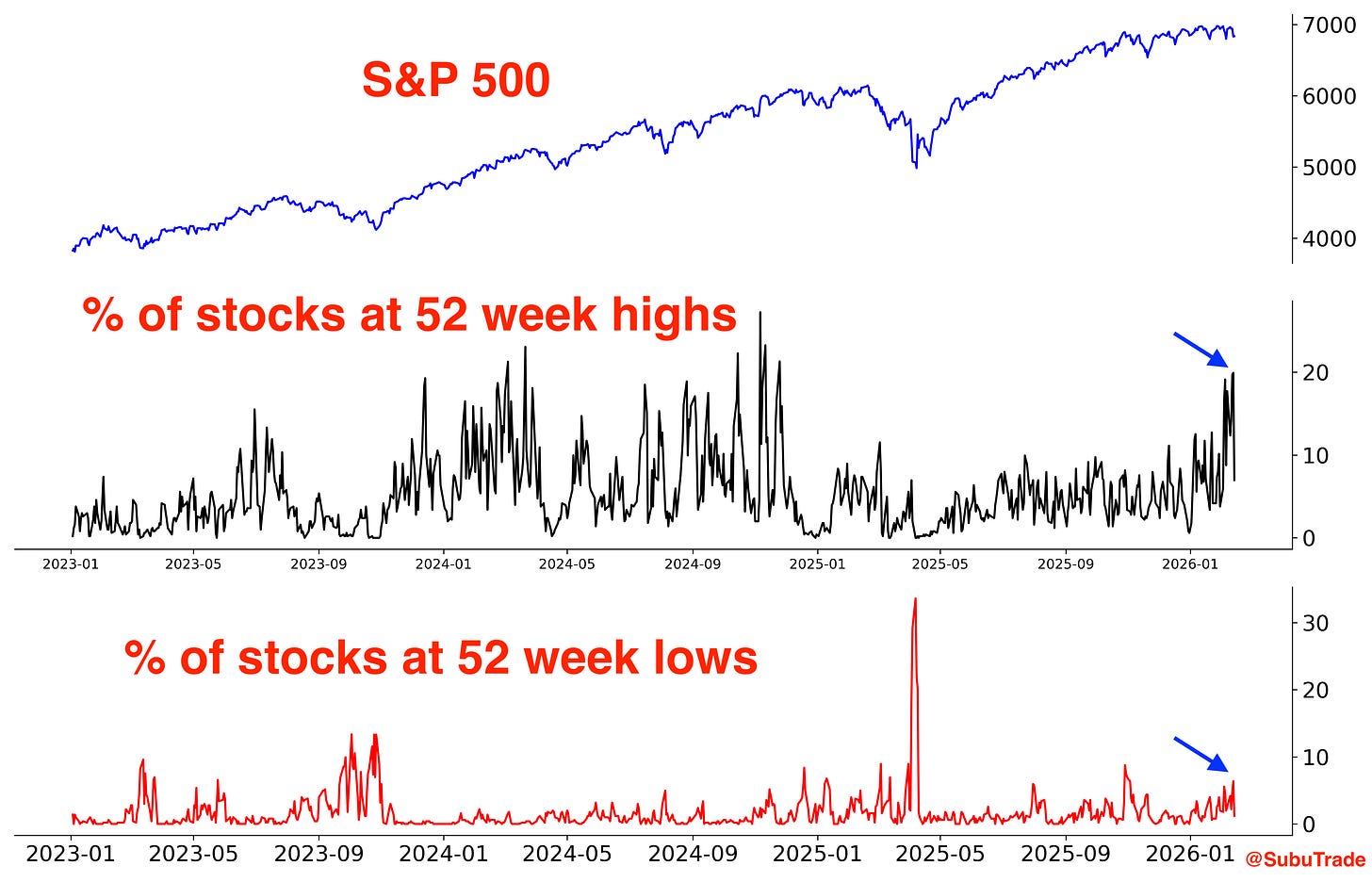

We’re in the middle of a Great Rotation. Capital is being re-allocated, which has pushed many stocks to new highs while others are sliding to new lows. Leadership is shifting. Many of the former high-flying tech and software names have been hit hard as investors rotate into other areas of the market.

Arguing about whether this is bullish or bearish skips the first and more important question: why is this happening in the first place? What’s causing this bifurcation?

To answer that, we have to look beneath the surface. Which sectors are moving higher? Which ones are breaking down?

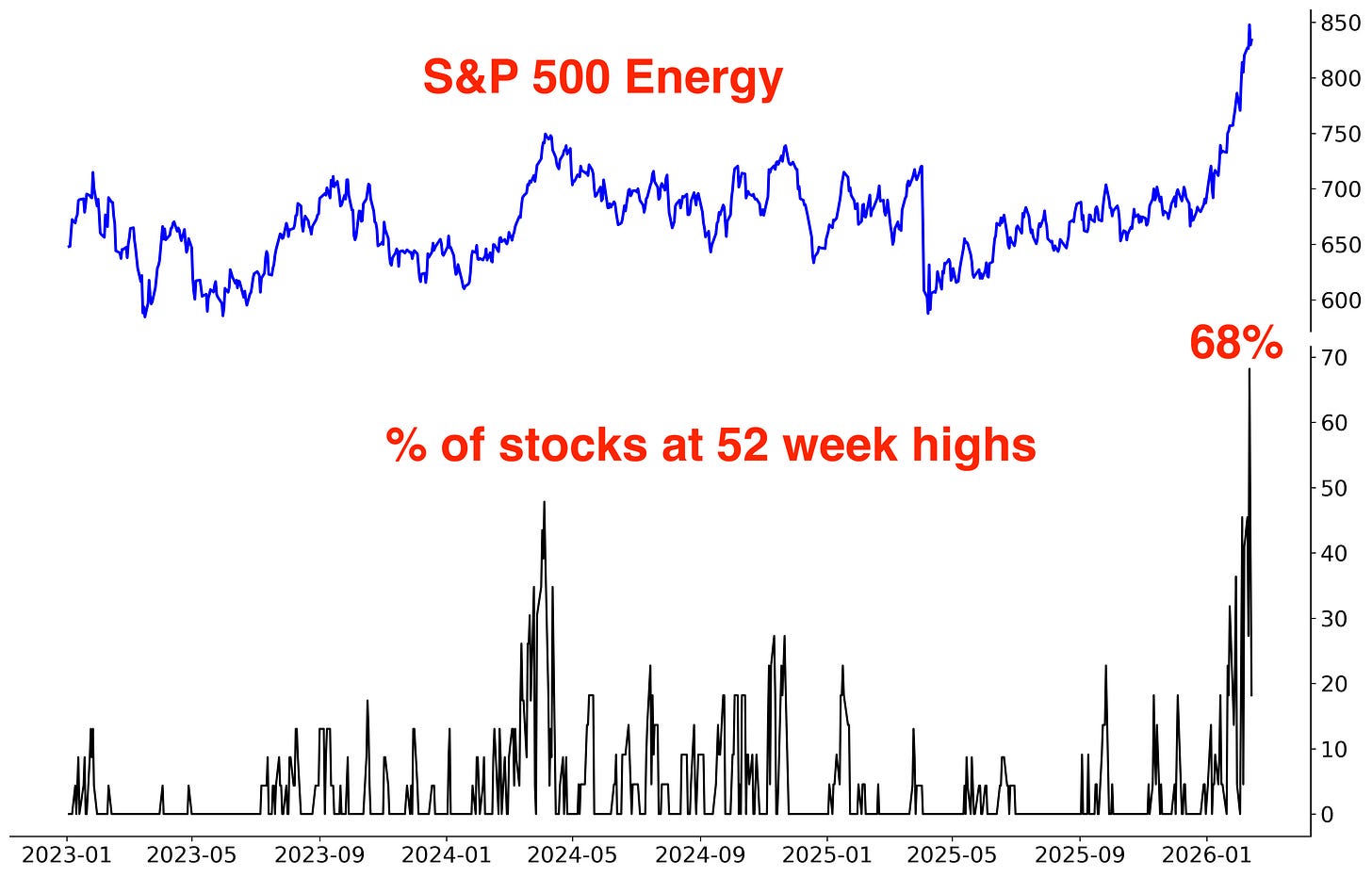

Energy (XLE):

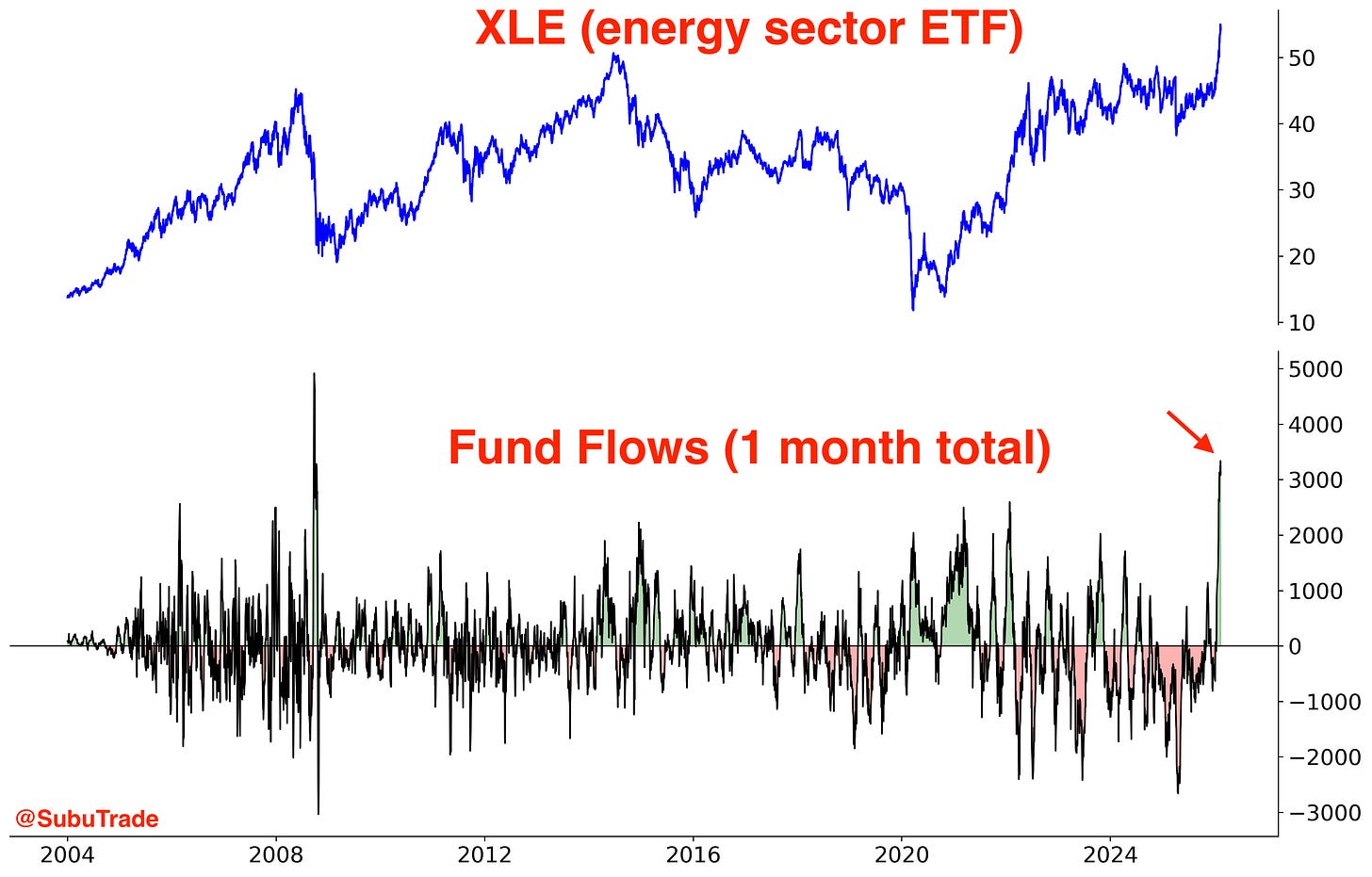

Massive inflows into XLE:

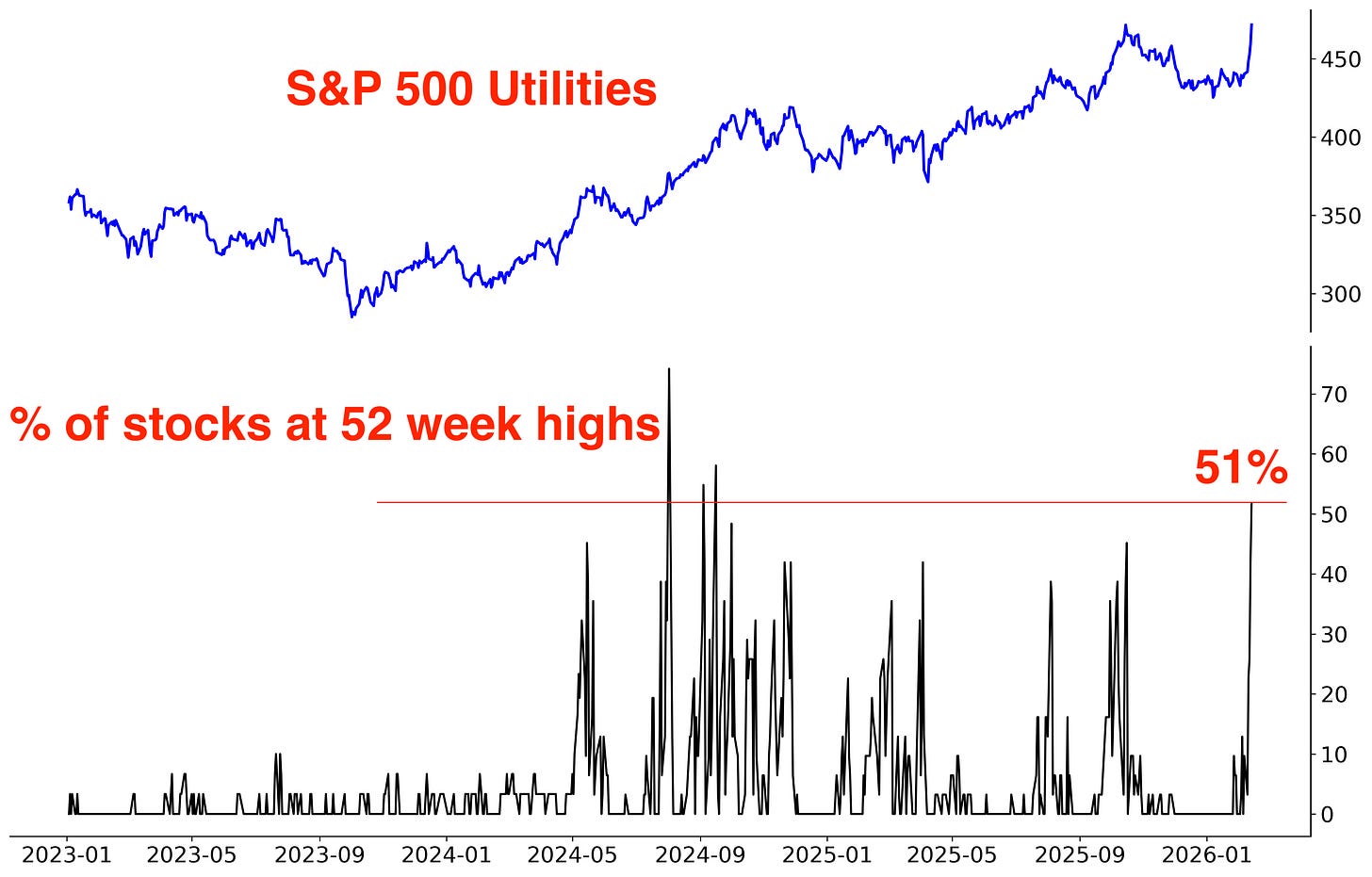

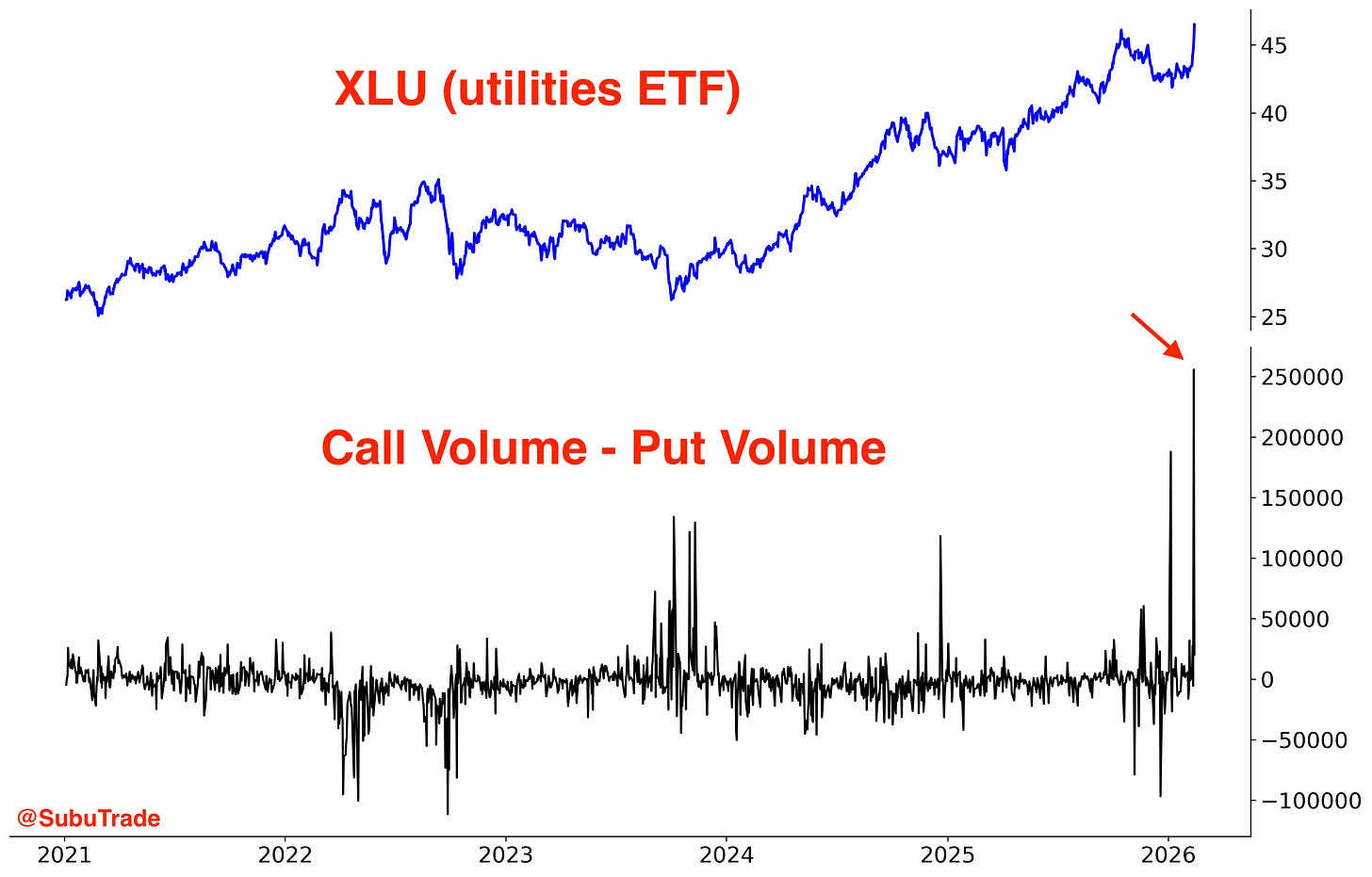

Utilities (XLU):

Friday saw historic Call Volume for XLU:

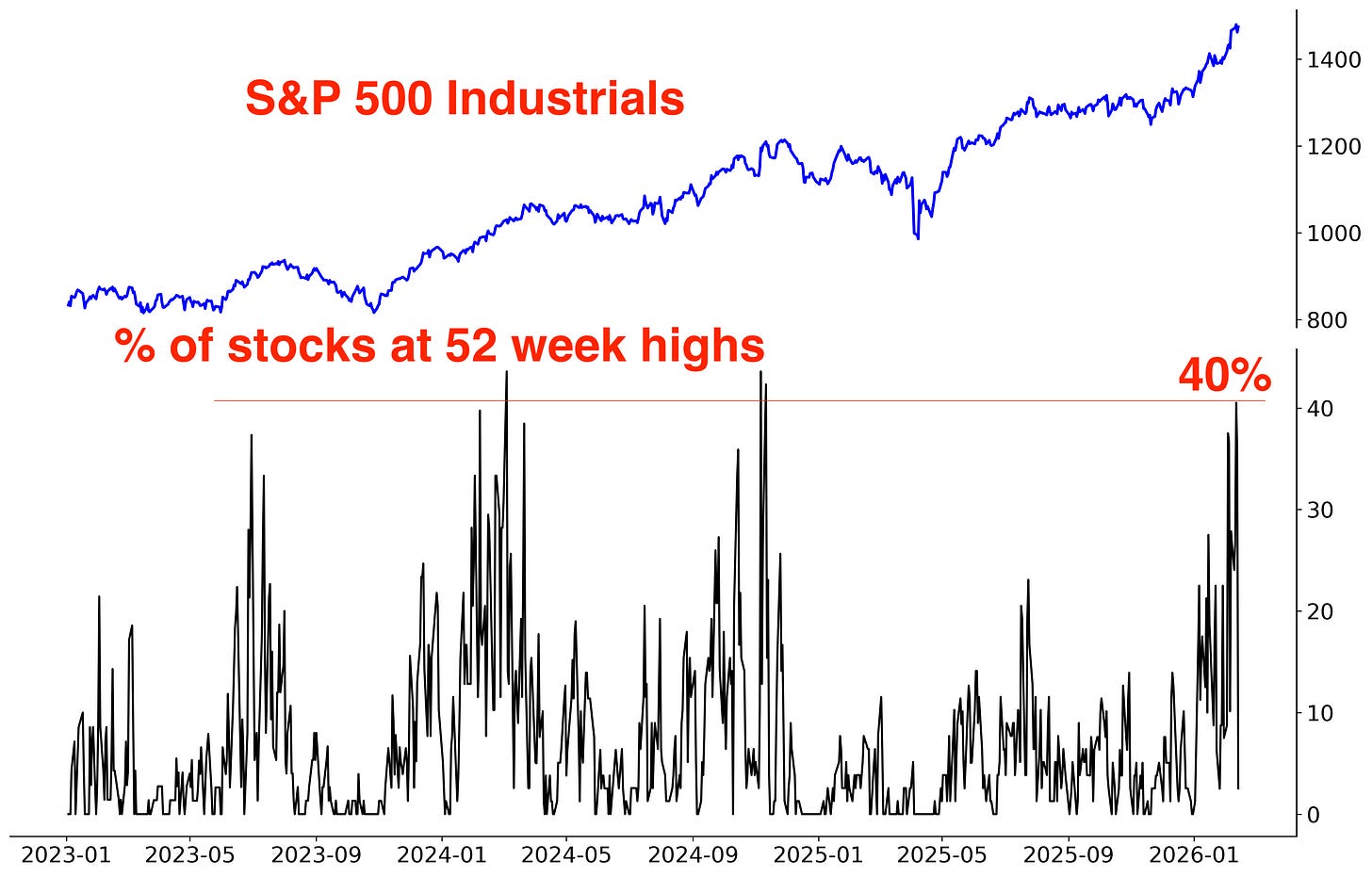

Industrials (XLI):

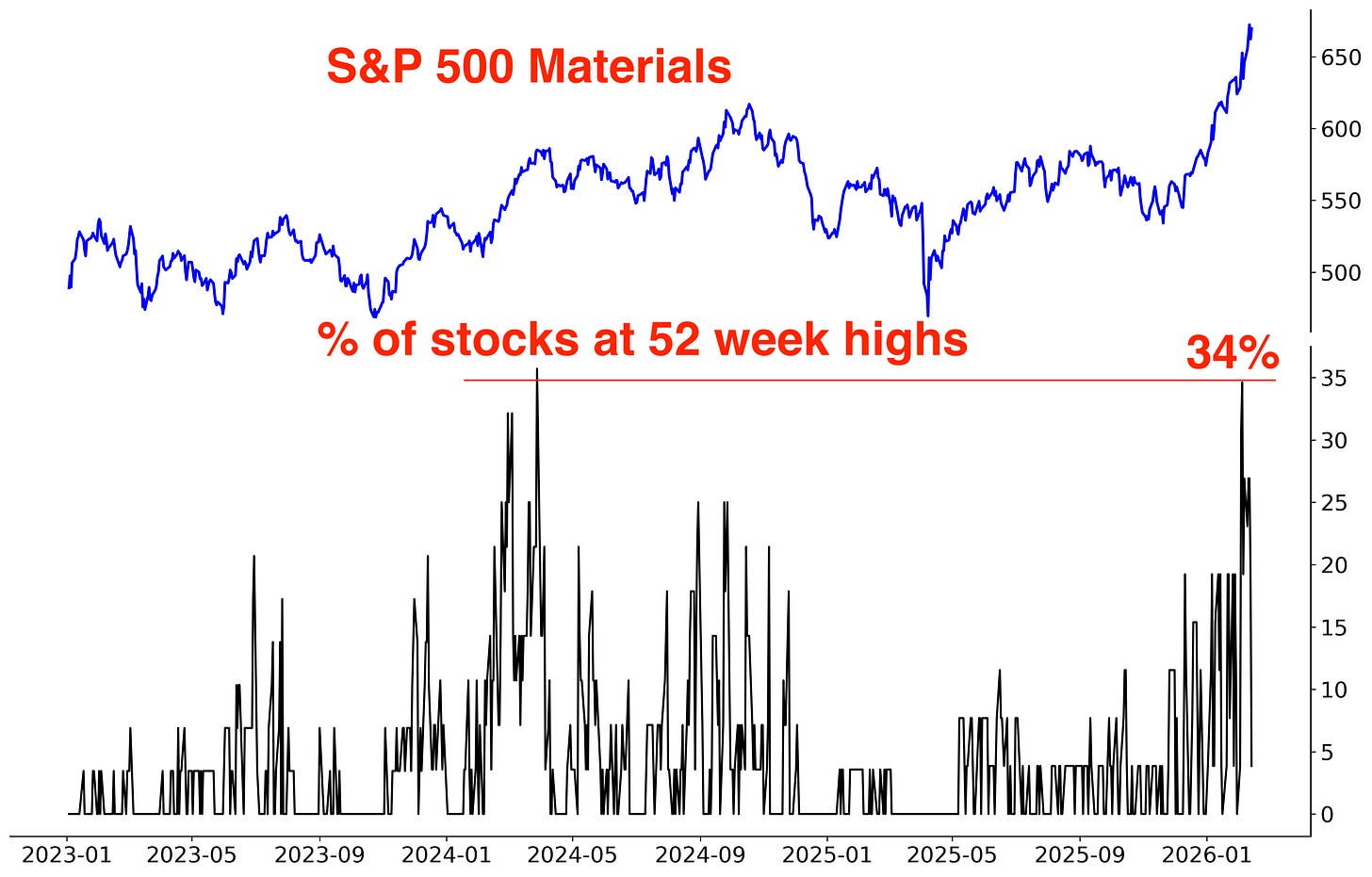

Materials (XLB):

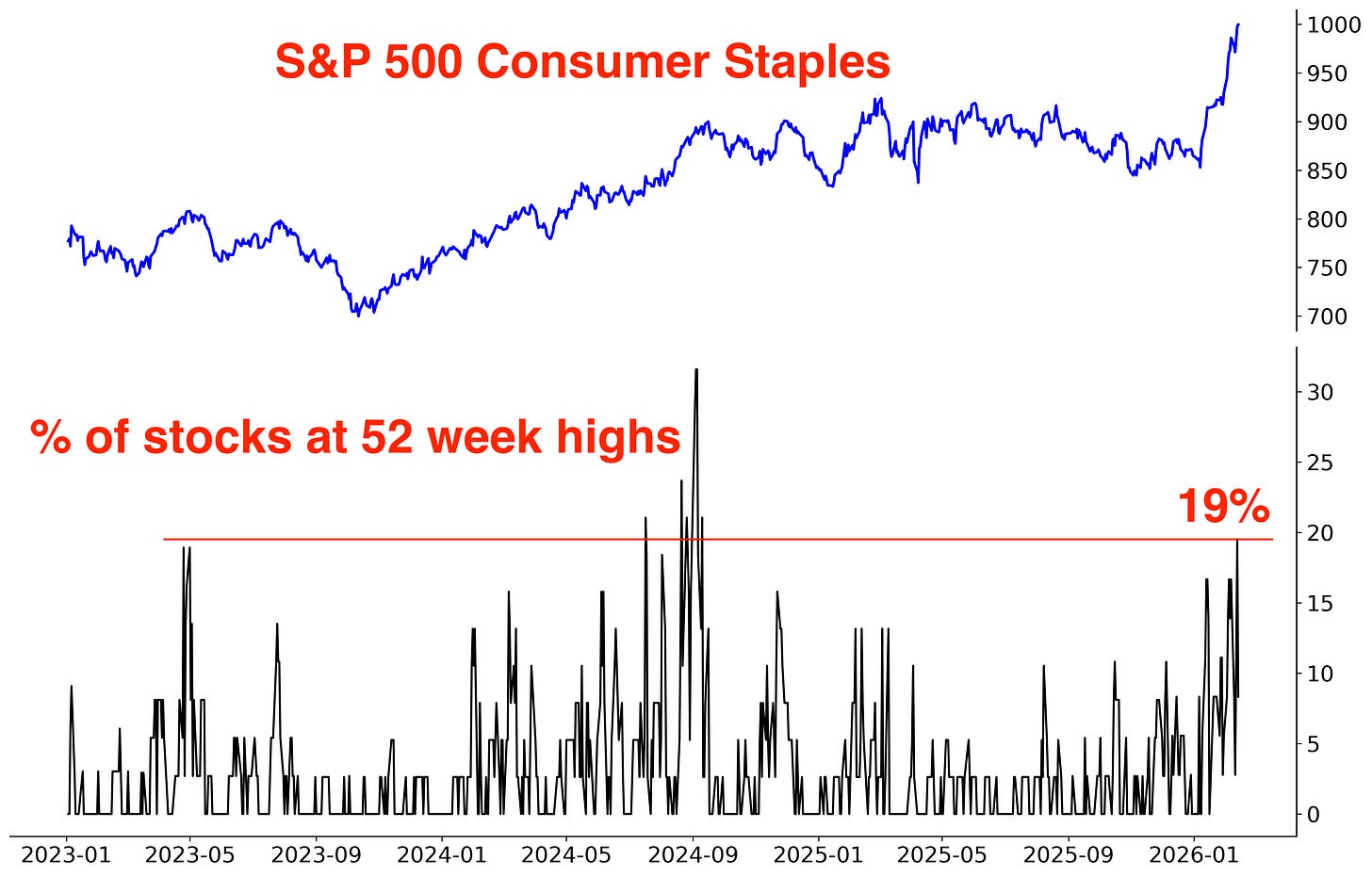

Consumer Staples (XLP):

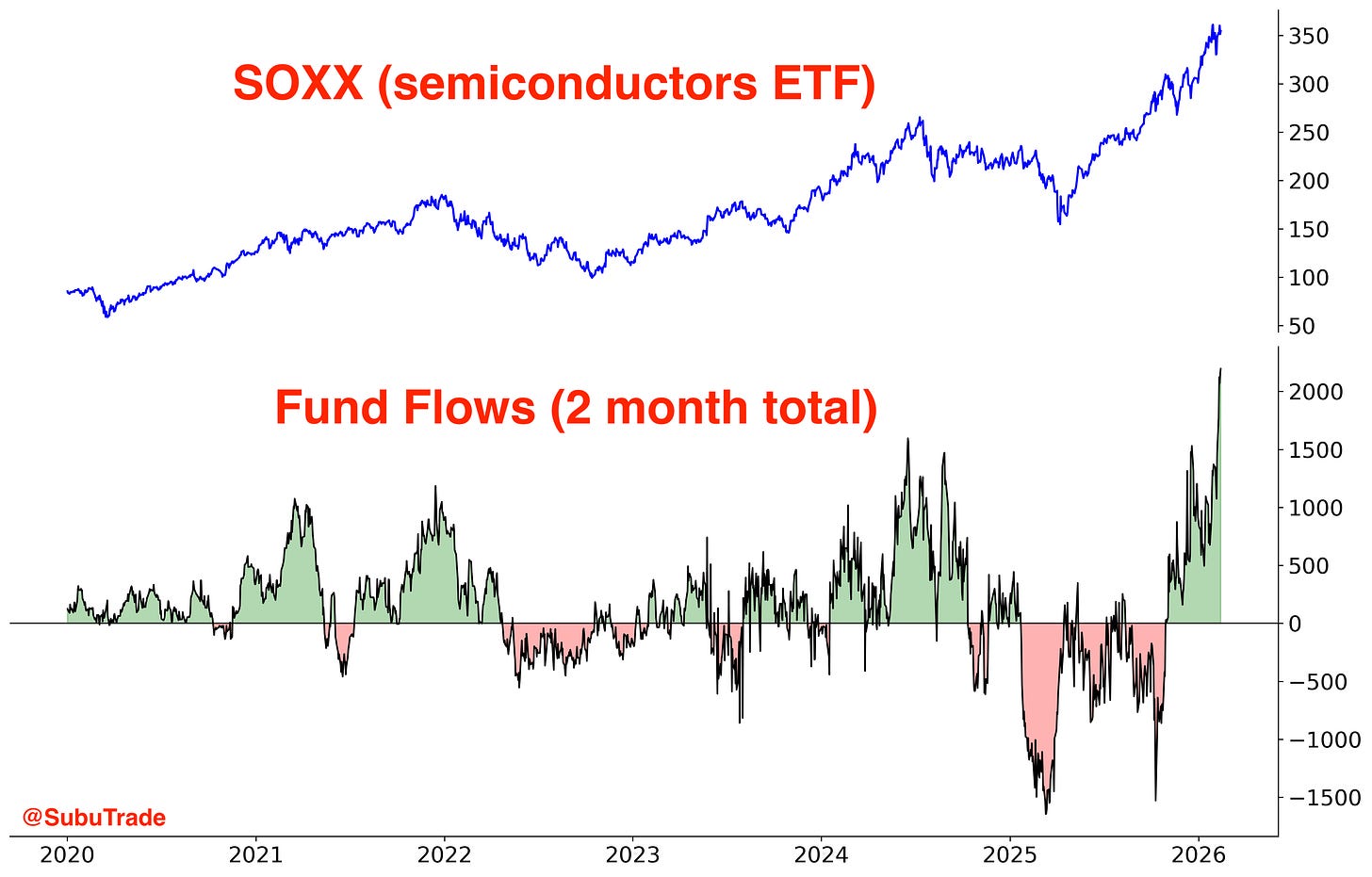

Semiconductors:

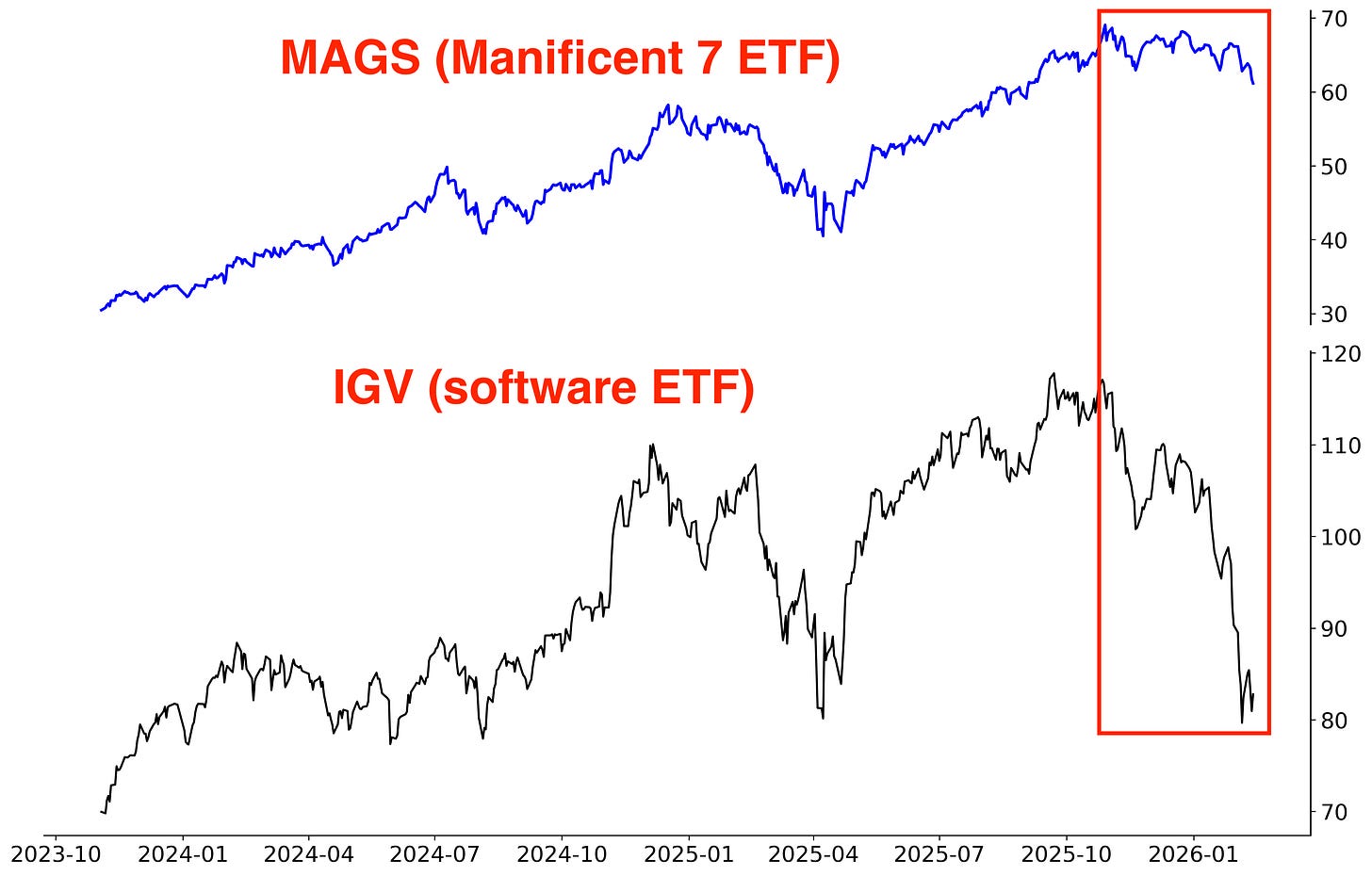

Even with all these sectors hitting new highs, the S&P 500 has barely moved since late-October 2025. Why?

Because the heavyweights - tech - have acted like an anchor on the index.

Large-cap tech (MAGS) is roughly back to its September 2025 levels and software stocks (IGV) have sharply declined.

It also doesn’t help that Financials, another major sector, have been essentially flat since December 2024.

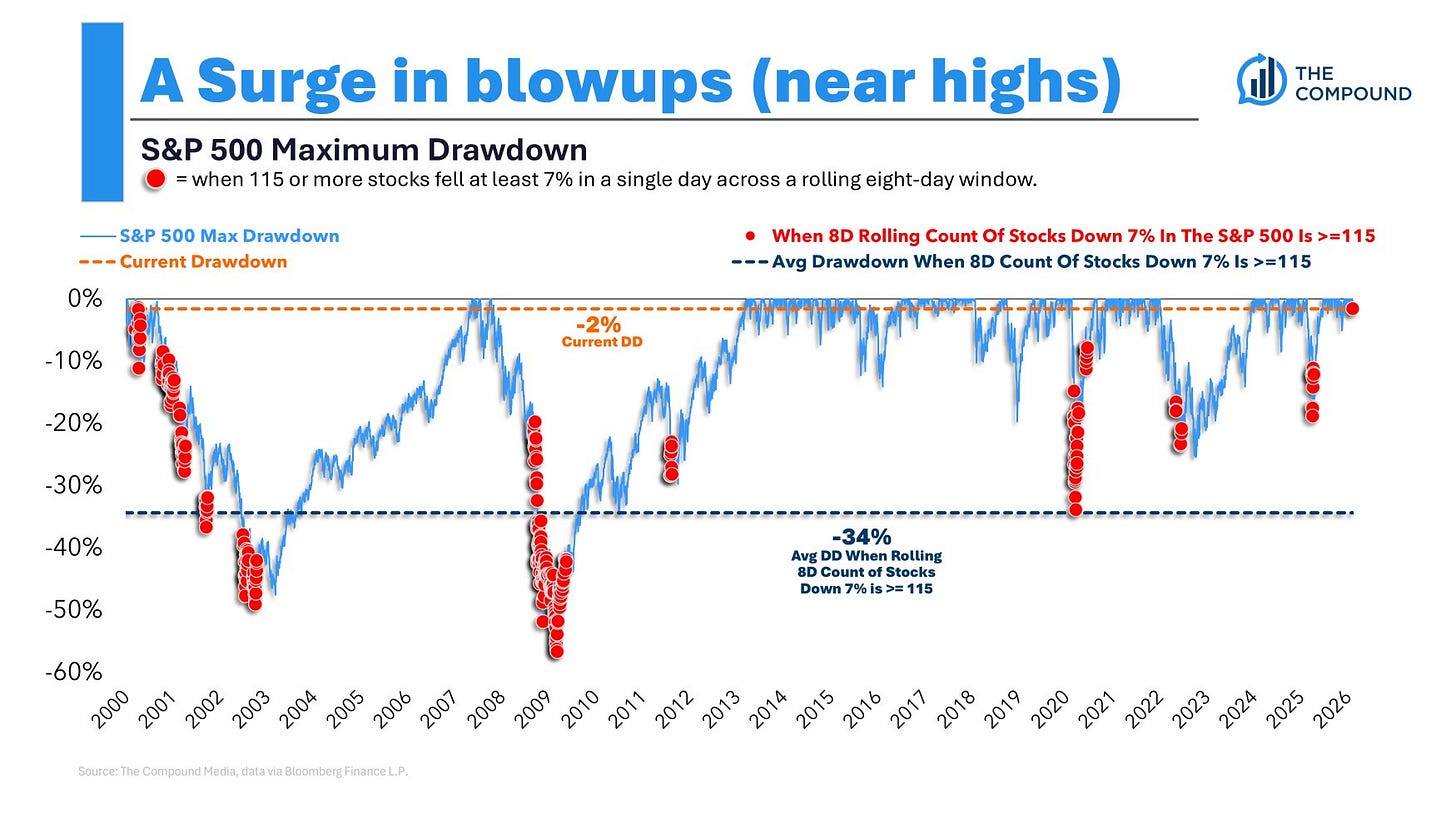

As Michael Batnick recently noted, many stocks have fallen sharply even as the S&P 500 sits near all-time highs. In other words, some stocks are breaking down hard, while others are rallying enough to offset those losses and keep the S&P 500 Index elevated.

This kind of split market is unusual. The last time we saw a similar setup was in 2000.

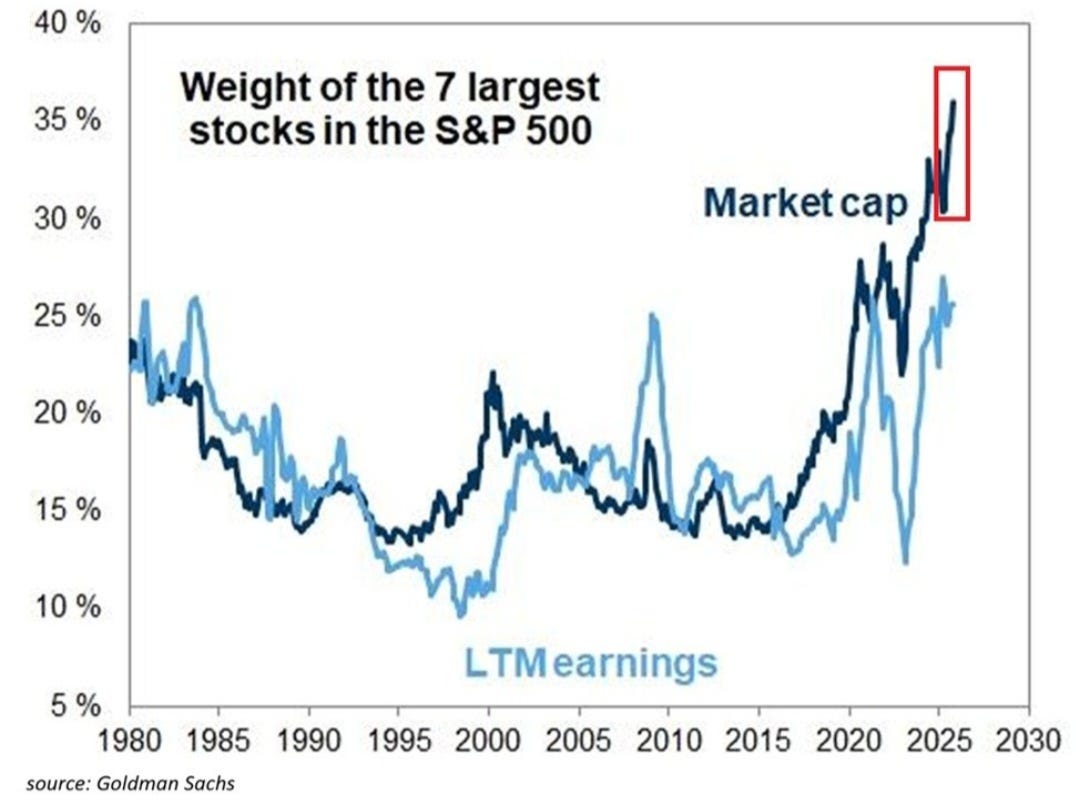

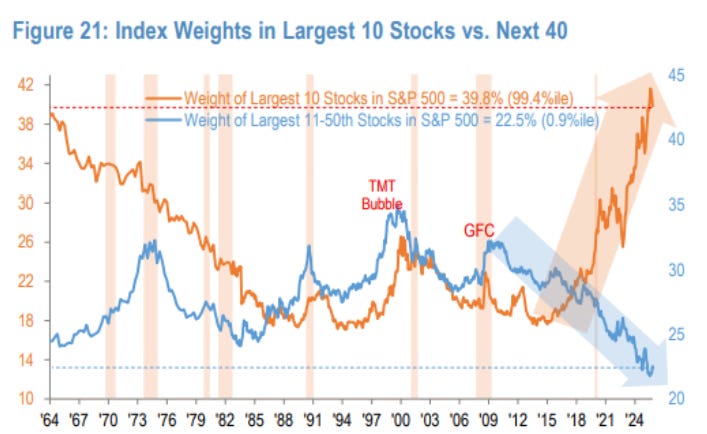

We live in a world that’s increasingly dominated by tech. The weighting of large cap tech is at the highest in decades.

From Markets4Mayhem:

Non-tech stocks can rally all they want. But if the biggest technology names aren’t participating, a market-cap weighted index like the S&P 500 won’t make much progress.

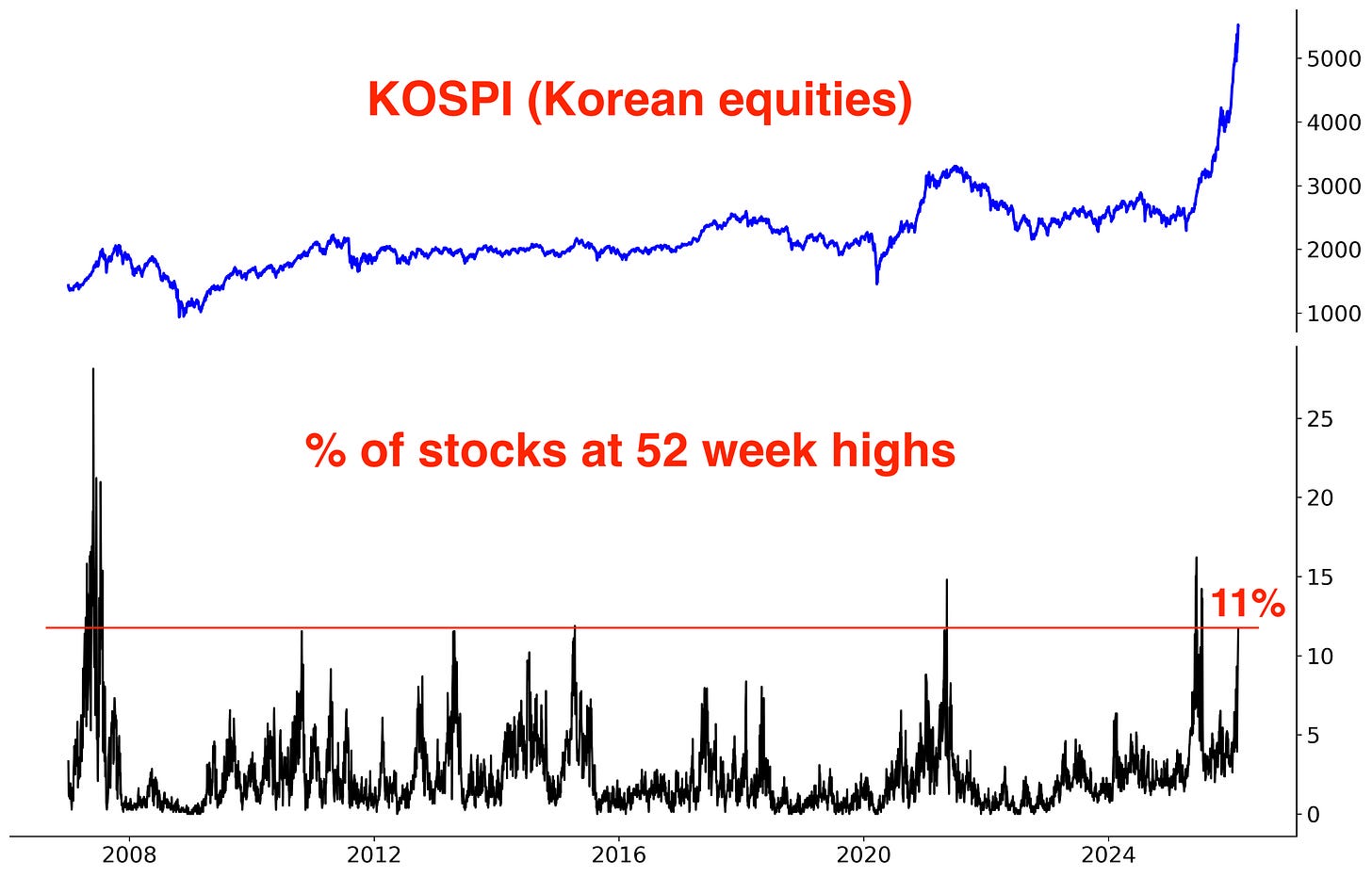

An extreme example is South Korea. On the back of the AI and memory boom, a handful of stocks have driven nearly the entire move. Just a few companies account for almost half of the KOSPI. In markets this concentrated, “breadth” matters less. All that matters is what the top 5 stocks are doing.

*The KOSPI has surged, but the number of stocks hitting new highs hasn’t surged with it:

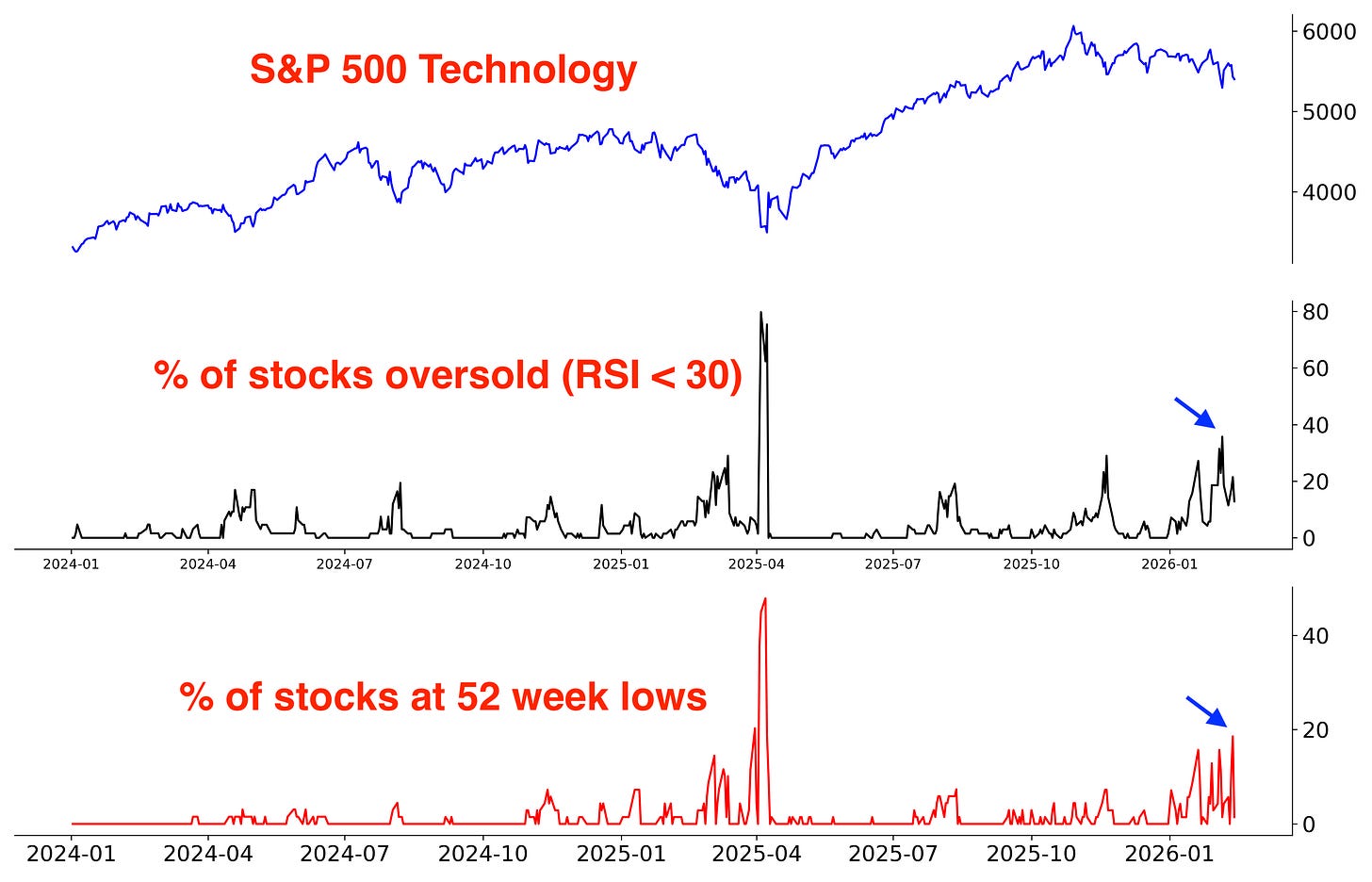

There are a few parallels between today and 2000. Defensive sectors like XLP (consumer staples) are rallying, while risk-on sectors like XLK (technology) are under pressure:

One thing I’ll always stress: the future is never “just like” the past. The next bear market won’t be “just like” the last one. The next bull market won’t either. Our brains are wired to spot patterns, sometimes even when there are none.

With all this being said, I don’t believe today is “just like” 2000. There are a few passing similarities, but there are more important differences.

When you see risk-on stocks selling off while defensive names rally, this resolves in one of two ways.

Scenario 1: The market rolls over, like 2000–2001. Weakness in tech spreads and drags the rest of the market down with it. I believe this is the less likely scenario.

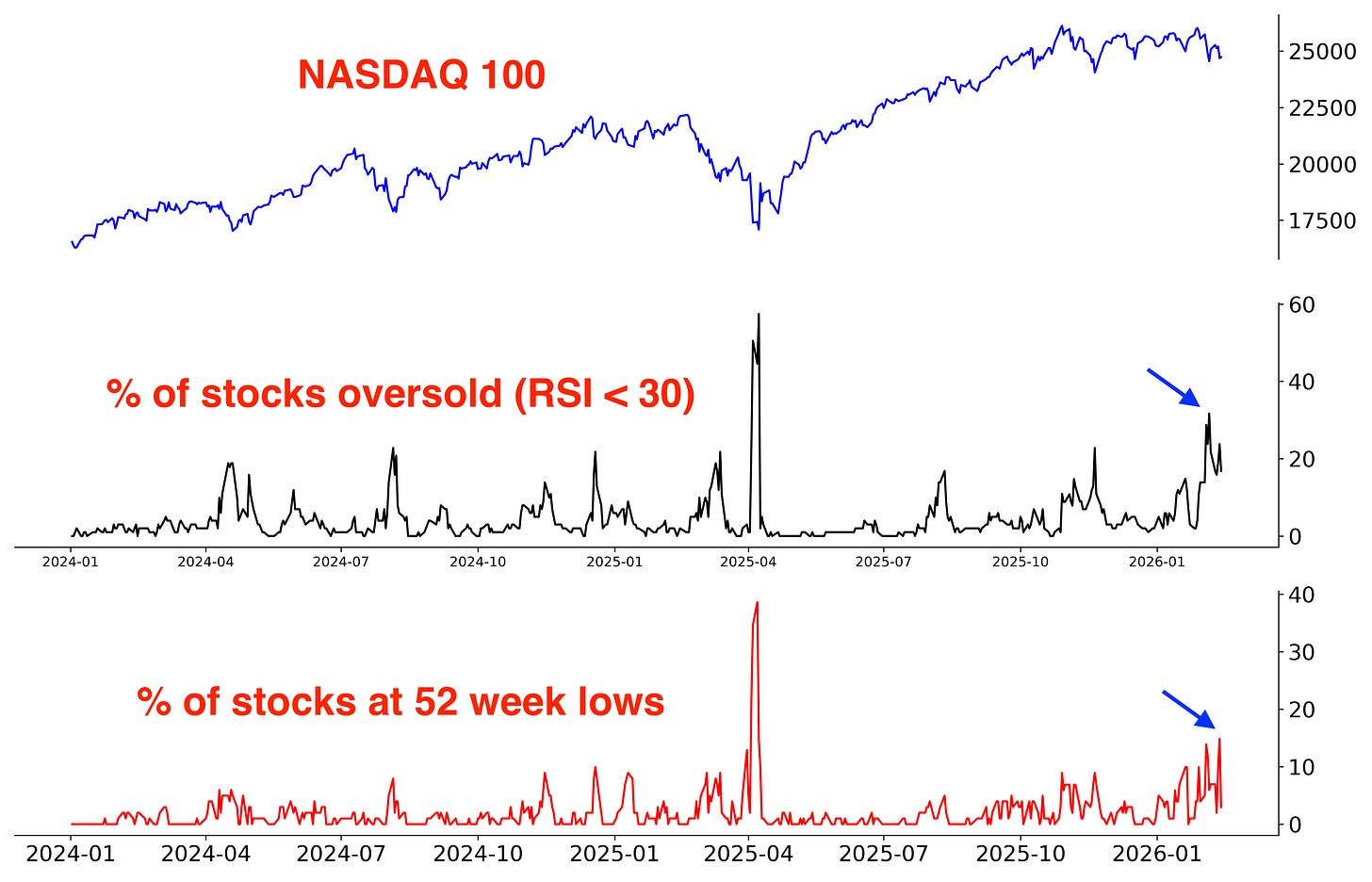

Scenario 2: Software and large-cap tech rebound from oversold conditions and rejoin the broader advance. In my view, this is the more likely path.

The recent selling in tech has been largely indiscriminate, a reminder of how quickly sentiment can flip. Just a few months ago, investors were applauding large-cap tech for aggressive AI spending. Now the narrative has shifted, with markets questioning whether those AI investments will deliver acceptable returns.

In a healthy bull market, leadership typically comes from growth sectors, especially tech. When “old economy” or defensive sectors start to lead, that’s usually not a great sign. For this bull market to keep going, growth and tech need to regain leadership. If they don’t, that’s when you start to worry.

Technology:

NASDAQ 100:

Aside from Old Economy U.S. equities, where else has capital been flowing into? And could it rotate out of those areas and back into U.S. large-cap tech?

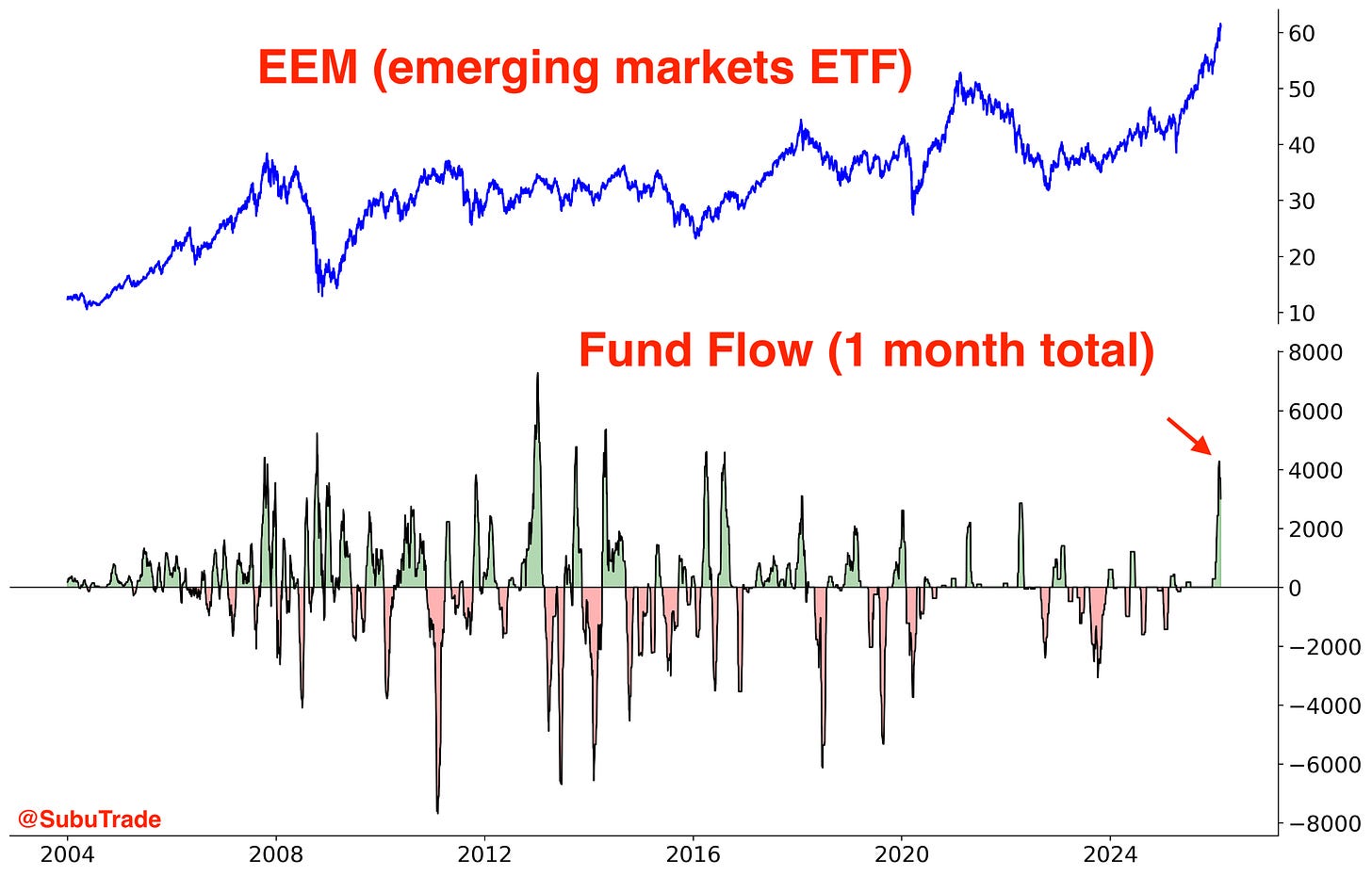

Emerging markets are a good example. EEM has seen its highest inflows in nearly a decade.

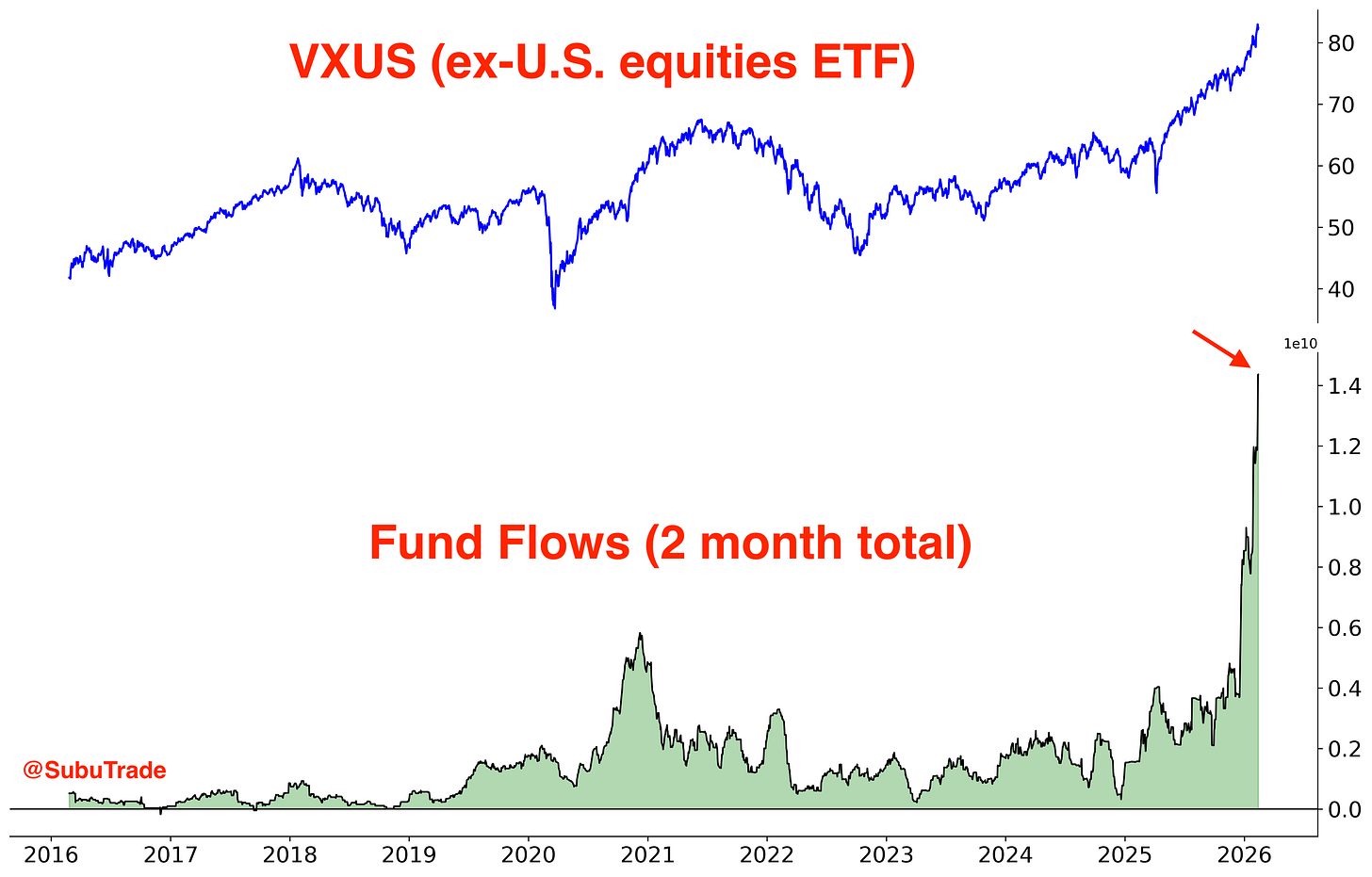

Massive inflows into ex-U.S. equities (large, mid, and small caps):

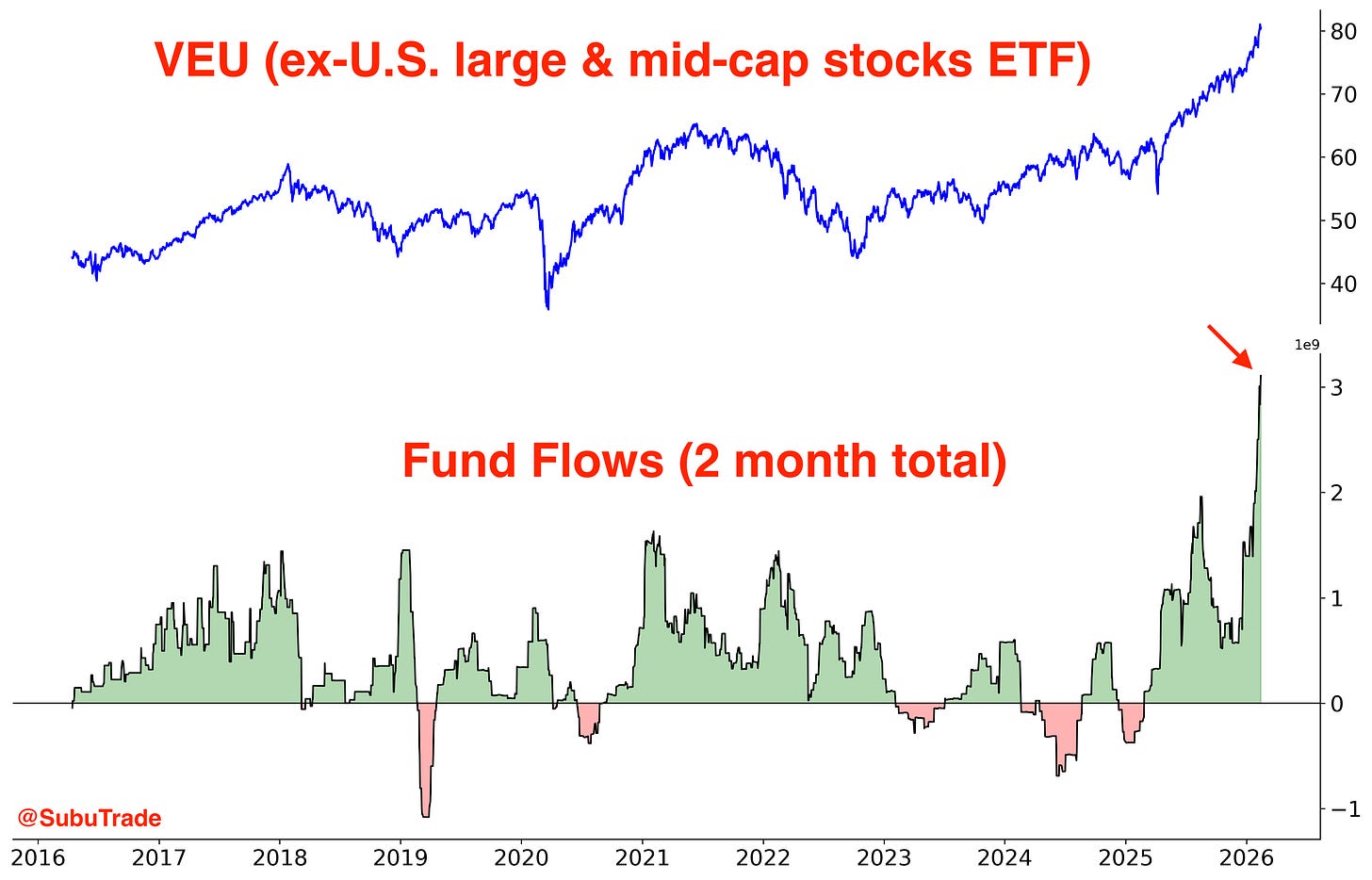

Similar chart for VEU:

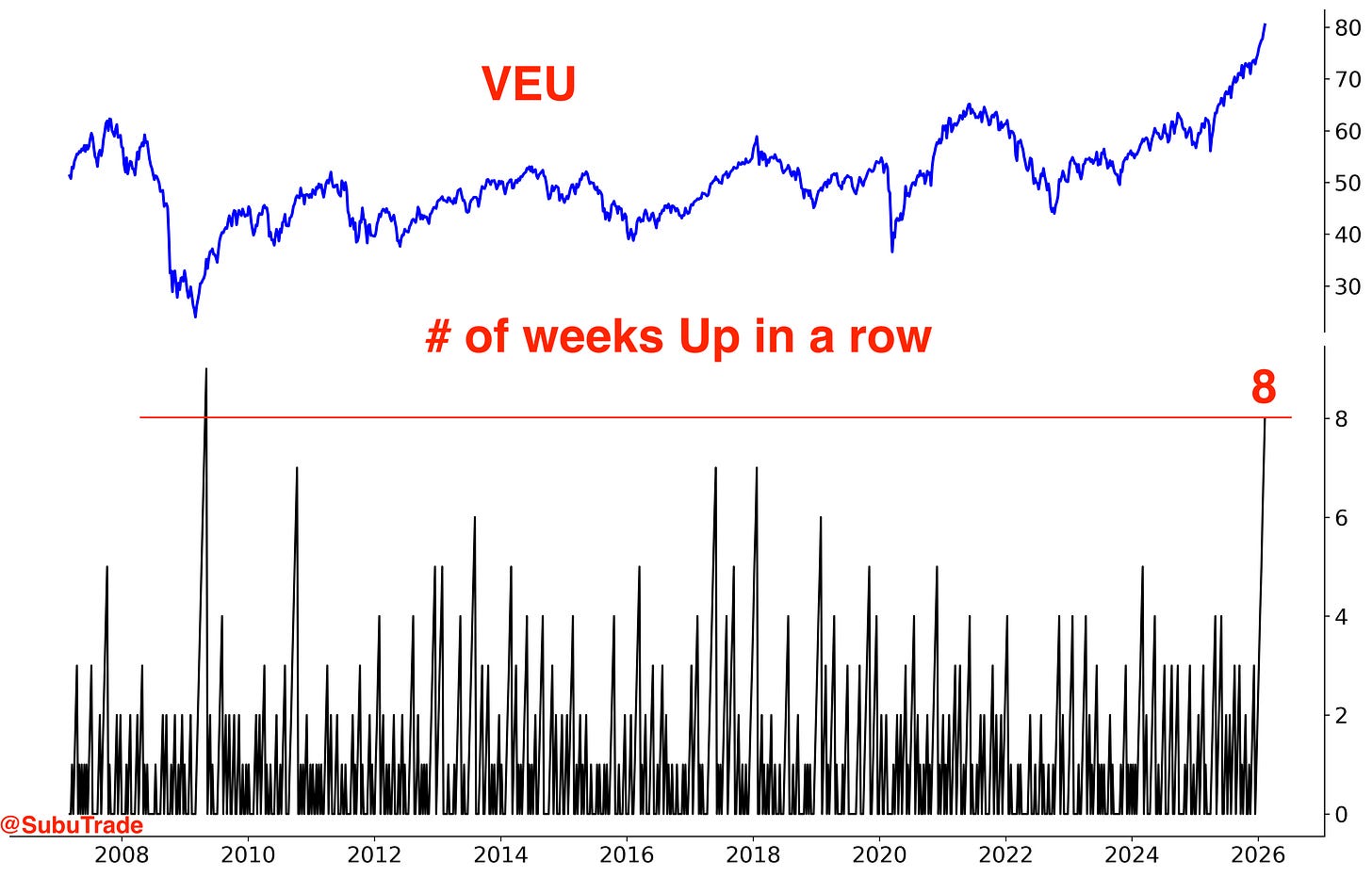

VEU is up 8 weeks in a row:

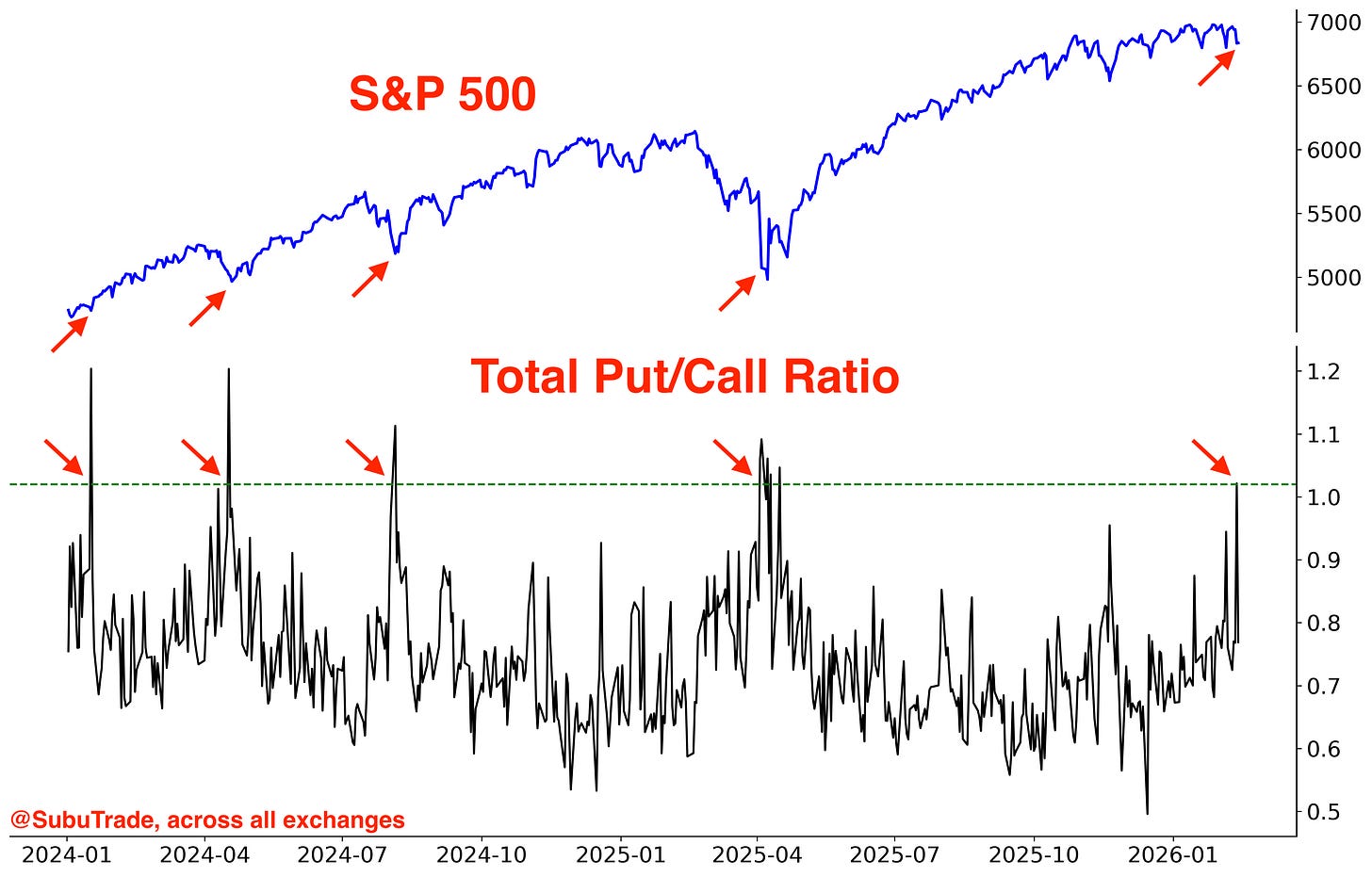

Rotation back into U.S. tech could spark a more meaningful rally in the S&P 500 index. It’s worth noting that the total Put/Call Ratio across all U.S. exchanges spiked on Thursday:

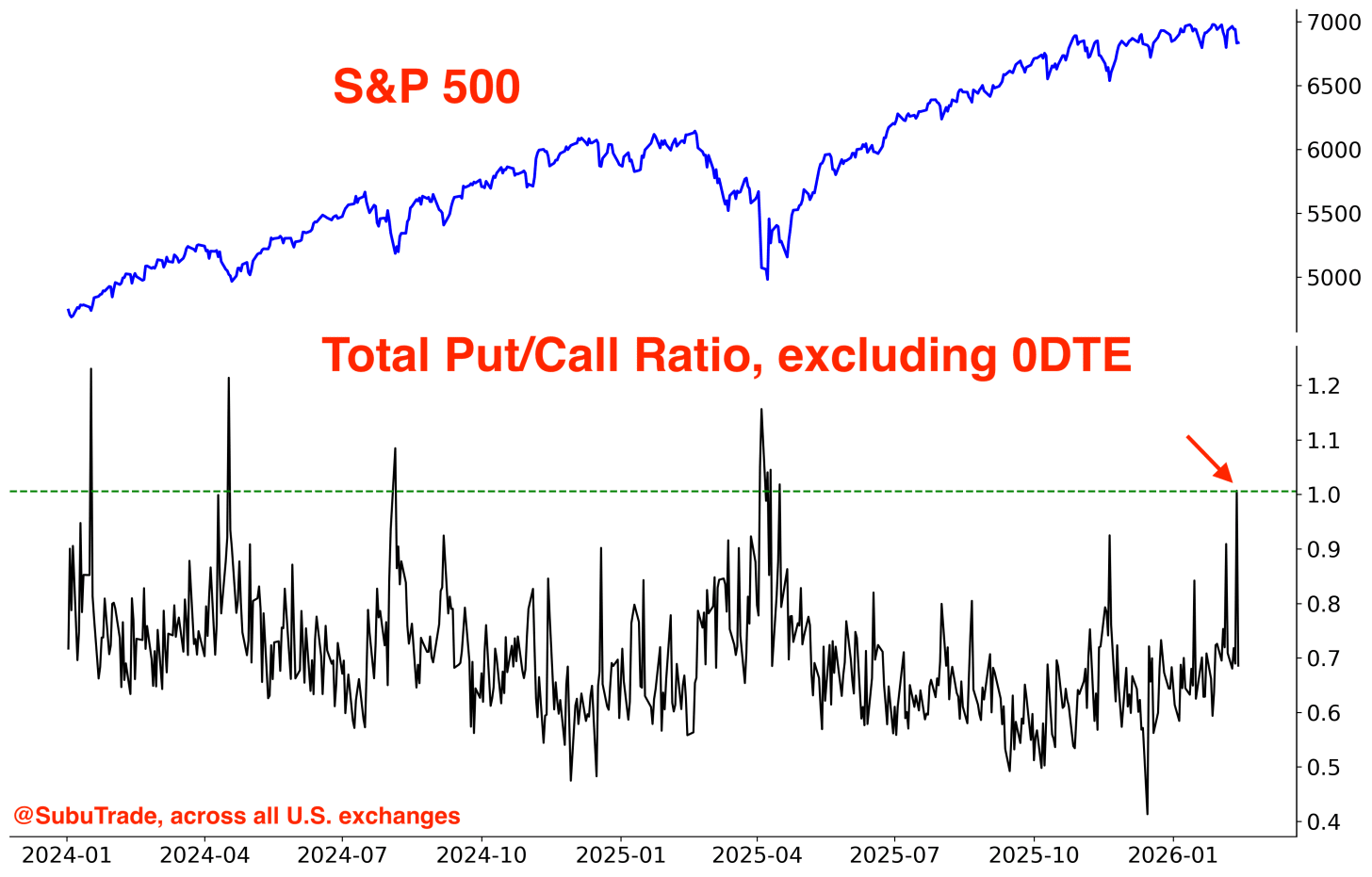

And no, the spike in Put/Call is not just because of 0DTE’s. Here’s the same indicator, excluding 0DTE’s:

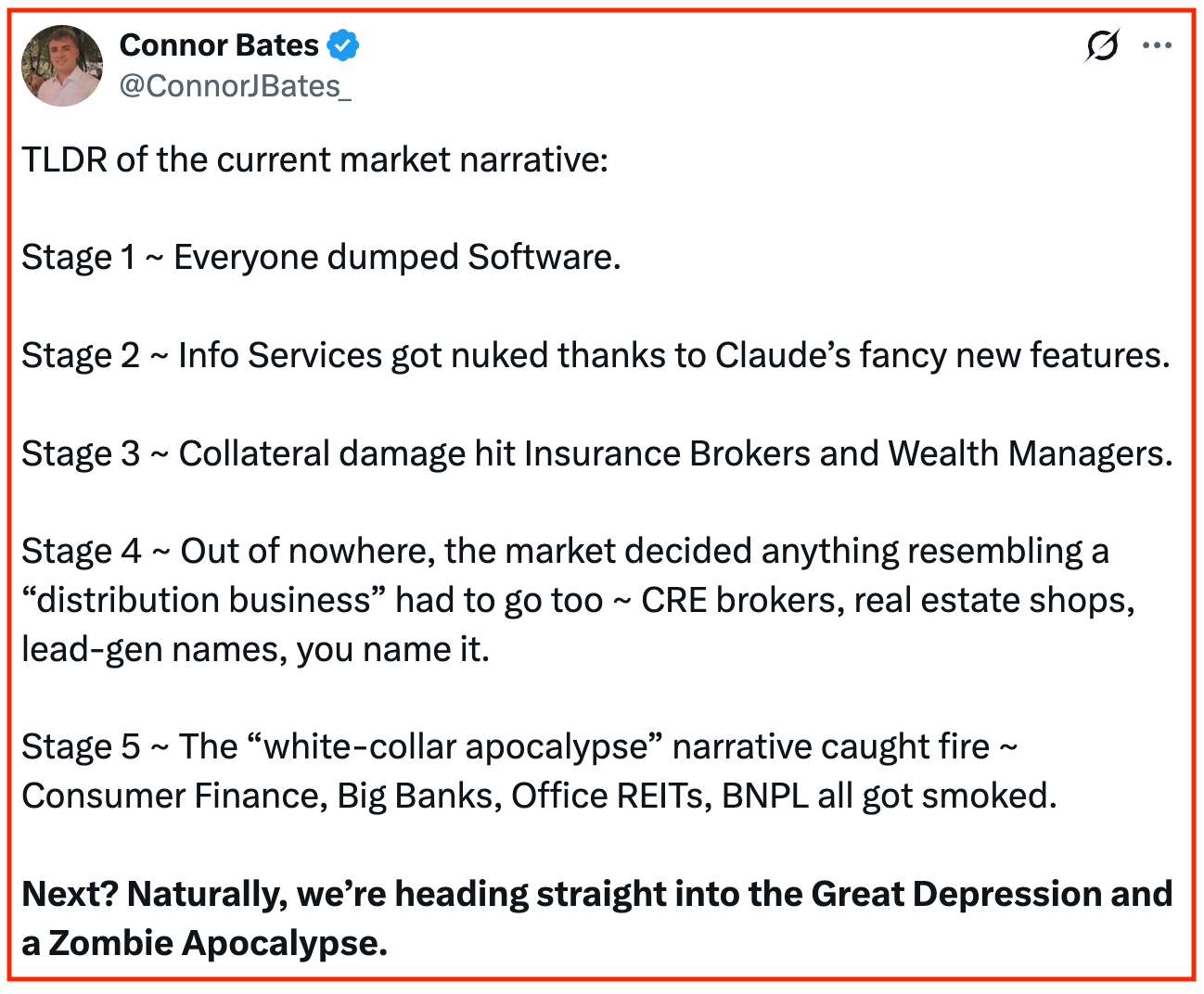

Connor Bates summed up the current market environment perfectly. Talk about “throwing the baby out with the bathwater”.

Stepping back and look at the bigger picture

Every so often, it helps to zoom out and look at the bigger picture. This doesn’t just help with understanding current market conditions. It also helps with improving your trading strategies.

We live in an era of Pump, Dump, and Rotate.

I started to notice this around 2018, and it’s become increasingly pronounced since COVID.

Momentum has always mattered, but capital today is more herd-like than ever before. Social media likely plays a role: everyone is watching and copying what everyone else is trading in real time.

Capital floods into a market, pushes it wildly higher, then pulls out and chases the next overlooked market. Then the cycle repeats.

Rather than a broad, steady rally, we’re seeing fast, aggressive rotations from one market to another.

I’ve already mentioned that capital has pumped ex-U.S. equities and non-tech U.S. stocks. But aside from that:

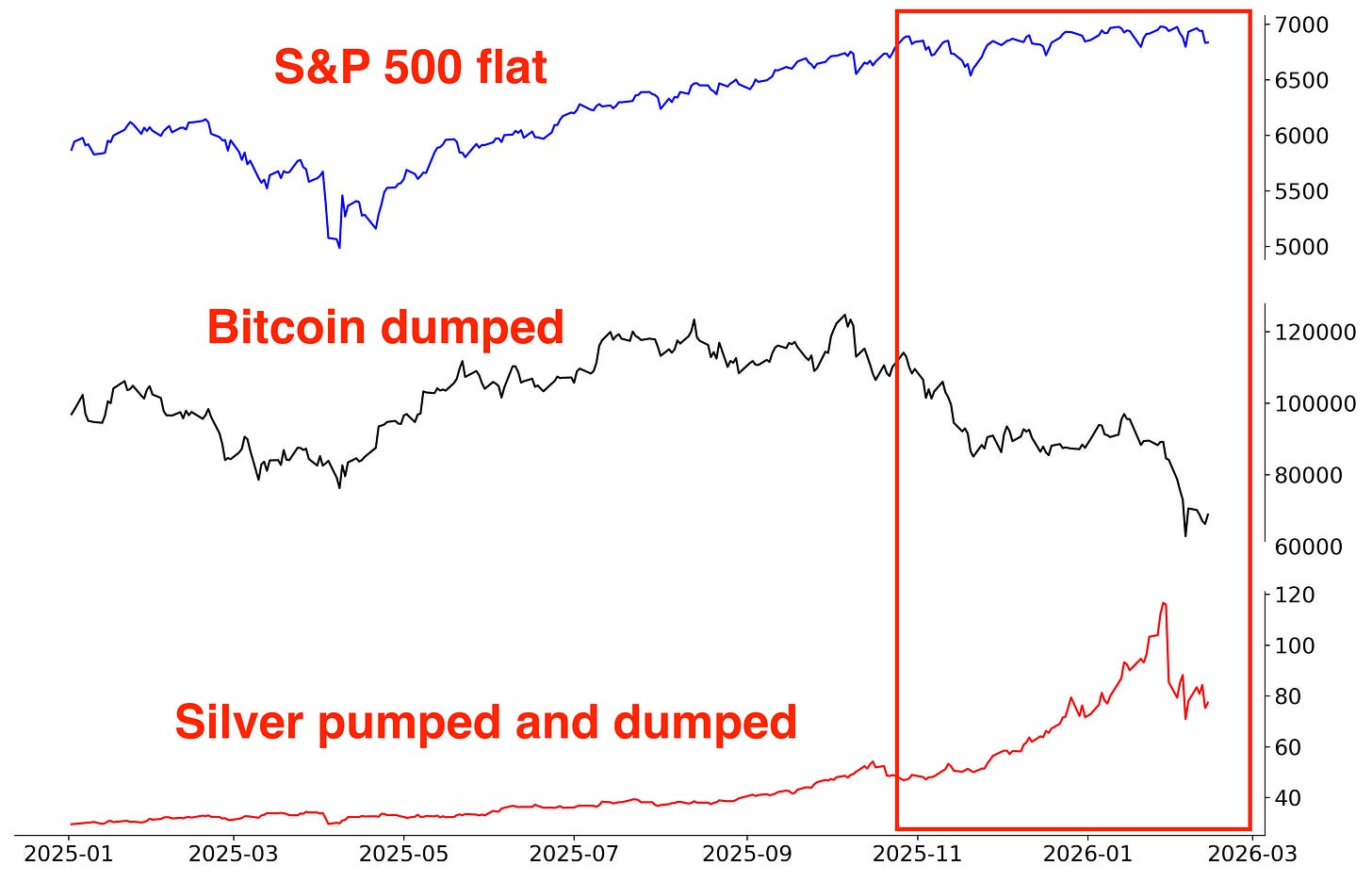

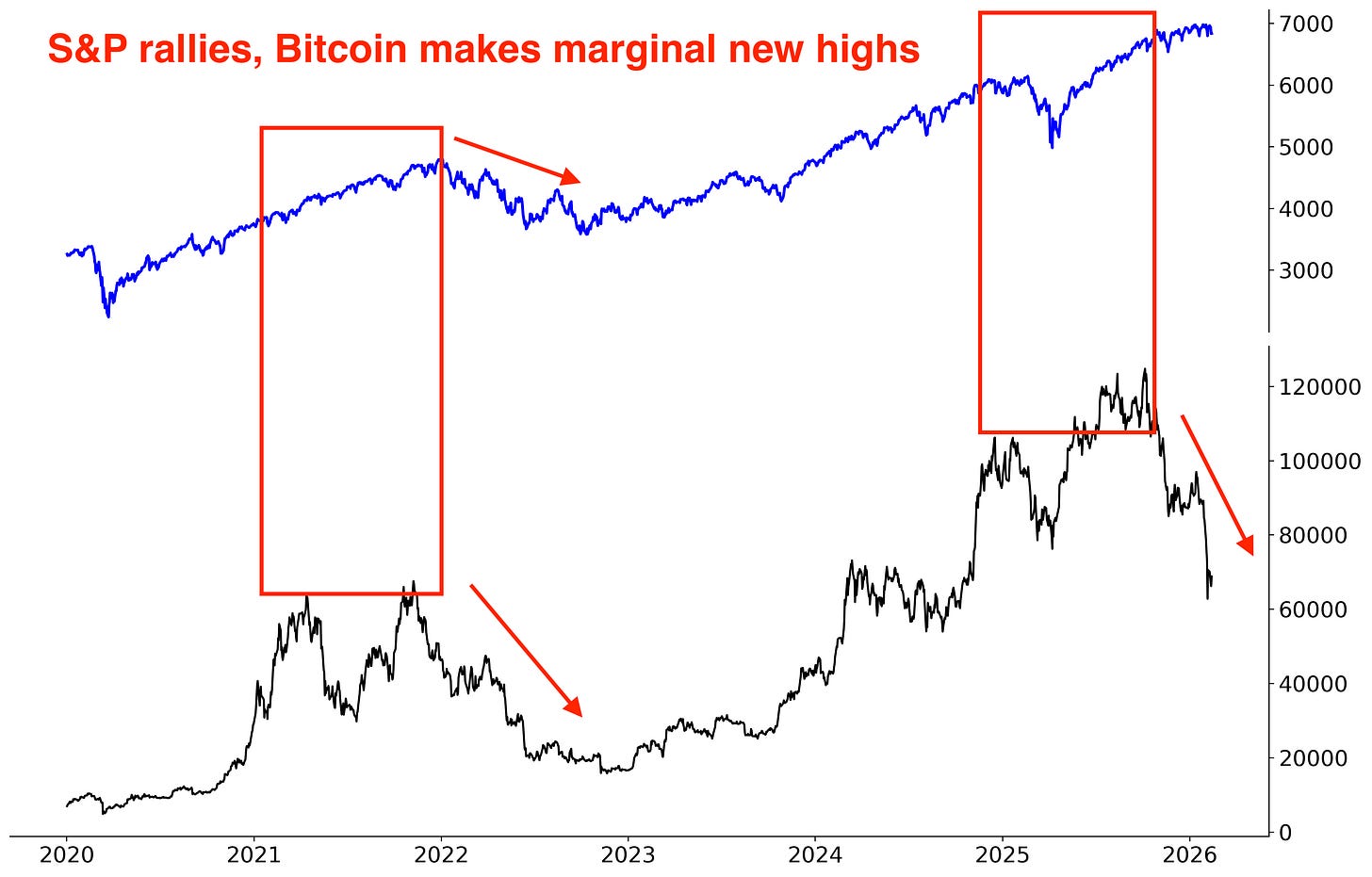

Bitcoin gave back all its post-election gains. Bitcoin often acts as a high-beta risk gauge: when “hot money” flows in, Bitcoin surges. When those flows slow down or reverse, Bitcoin stalls or collapses. That’s exactly what we’ve seen since mid-2025.

Silver pumped and dumped. Its parabolic surge really began in late-October, right as major U.S. indices peaked. Silver was an obvious target for the herd to pump. Silver is a much smaller market than gold and lagged significantly, with the Gold/Silver ratio near 90 (no historical precious metals bull market ended with such a high Gold/Silver ratio). Capital rotated in, pushed silver to the moon, and then left in a hurry.

A concern I’ve had since Q3 2025 was Bitcoin’s inability to make new significant highs. This is how the 2022 bear market played out:

The silver lining here is that Bitcoin is now deeply oversold, which increases the probability of a strong bounce. If that happens, stocks could rally as well.

Something to think about

From a trading standpoint, the message is clear: put more weight on Momentum, and less weight on Mean Reversion. Markets still mean revert, but only after pushing to bigger extremes.

What once topped out e.g. RSI 80 may now stretch to 85, 90, even 95 before finally turning Down.

What once bottomed at e.g. RSI 30 may now fall to 25 or 20 before finally turning Up.