Markets Report: Year End Rally

Last leg of 2025

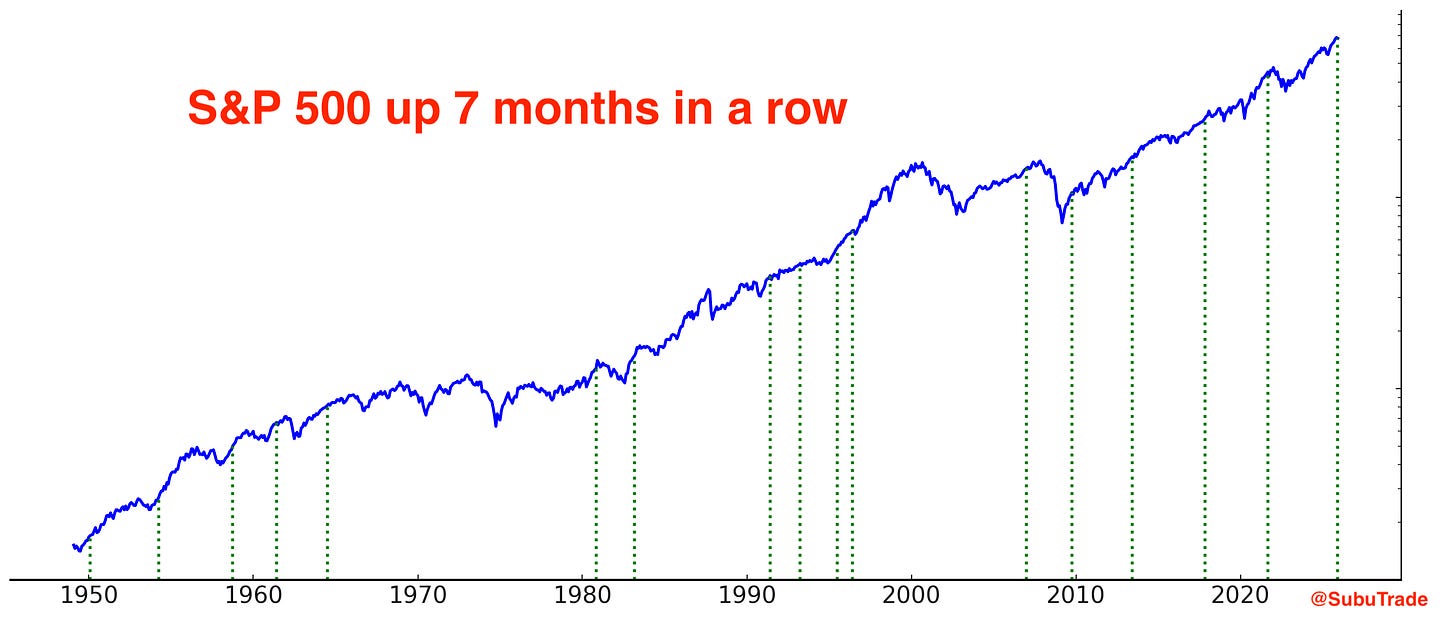

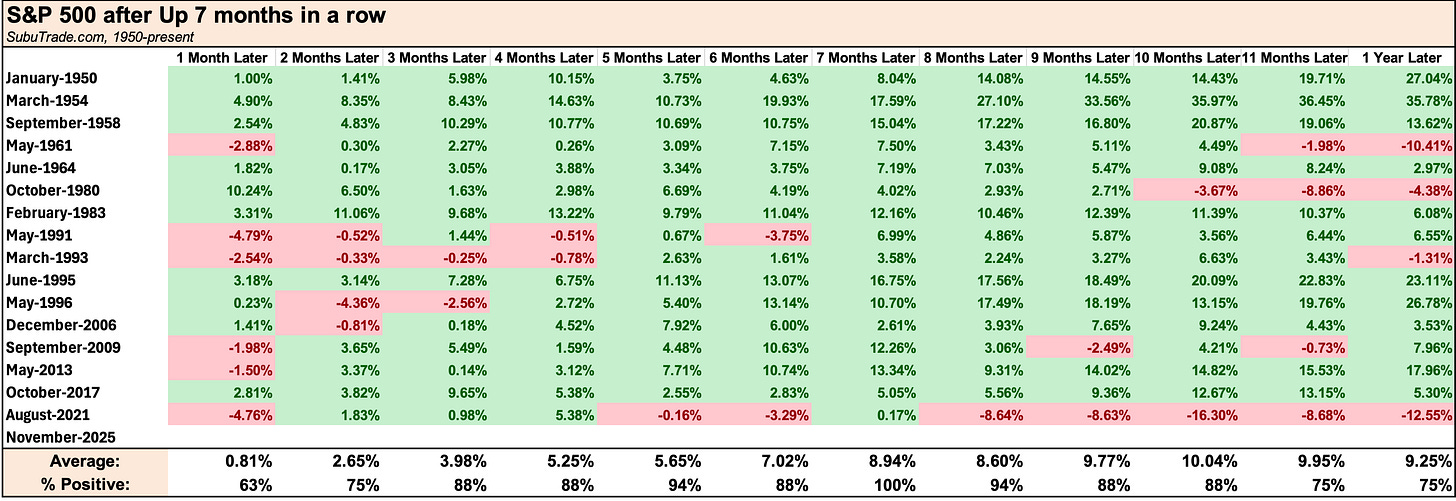

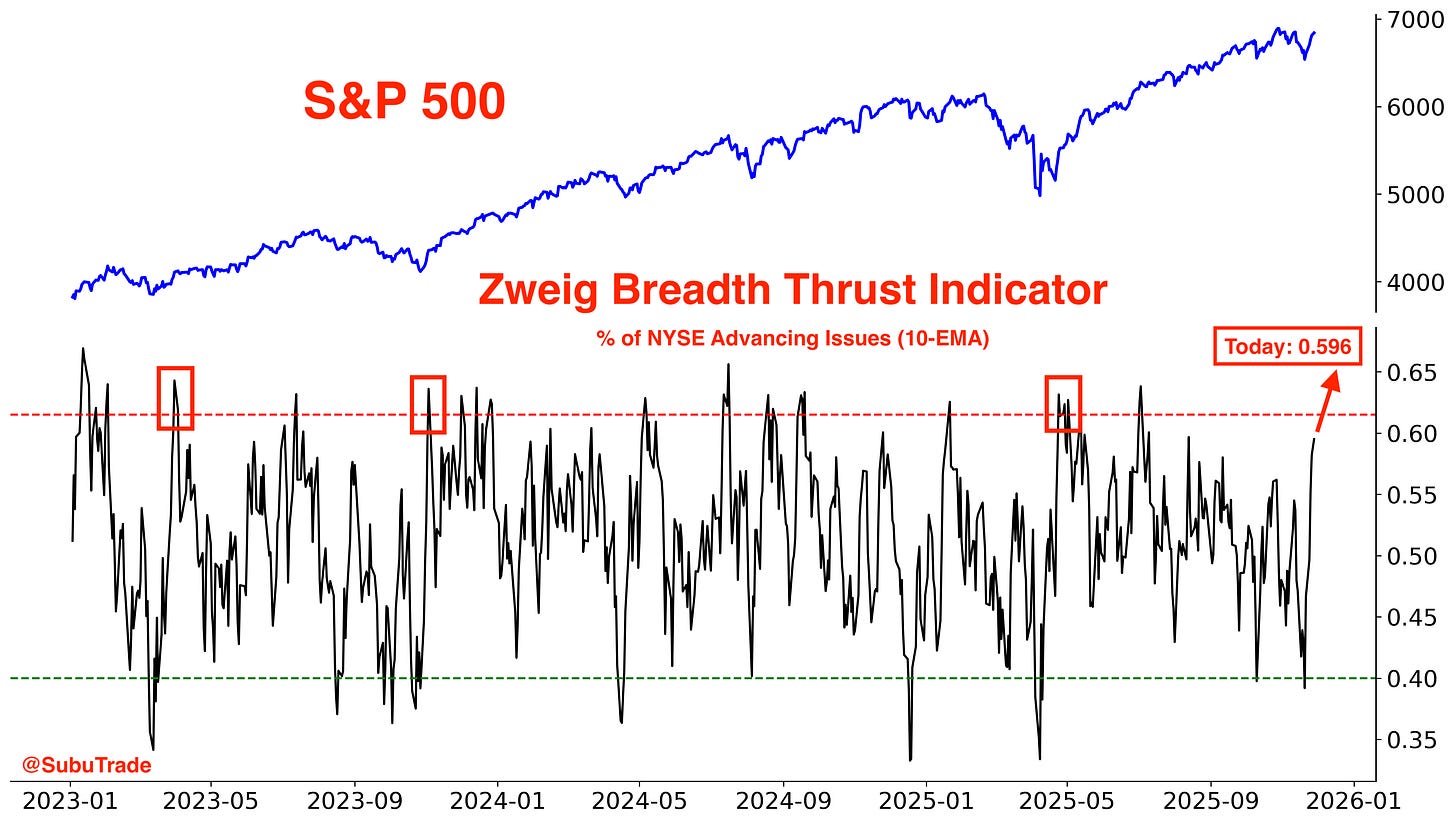

After a standard -5.1% pullback in November, the S&P 500 finished the month barely positive. It is now up 7 months in a row, while the NASDAQ 100 snapped a 7 month winning streak.

S&P 500:

NASDAQ 100:

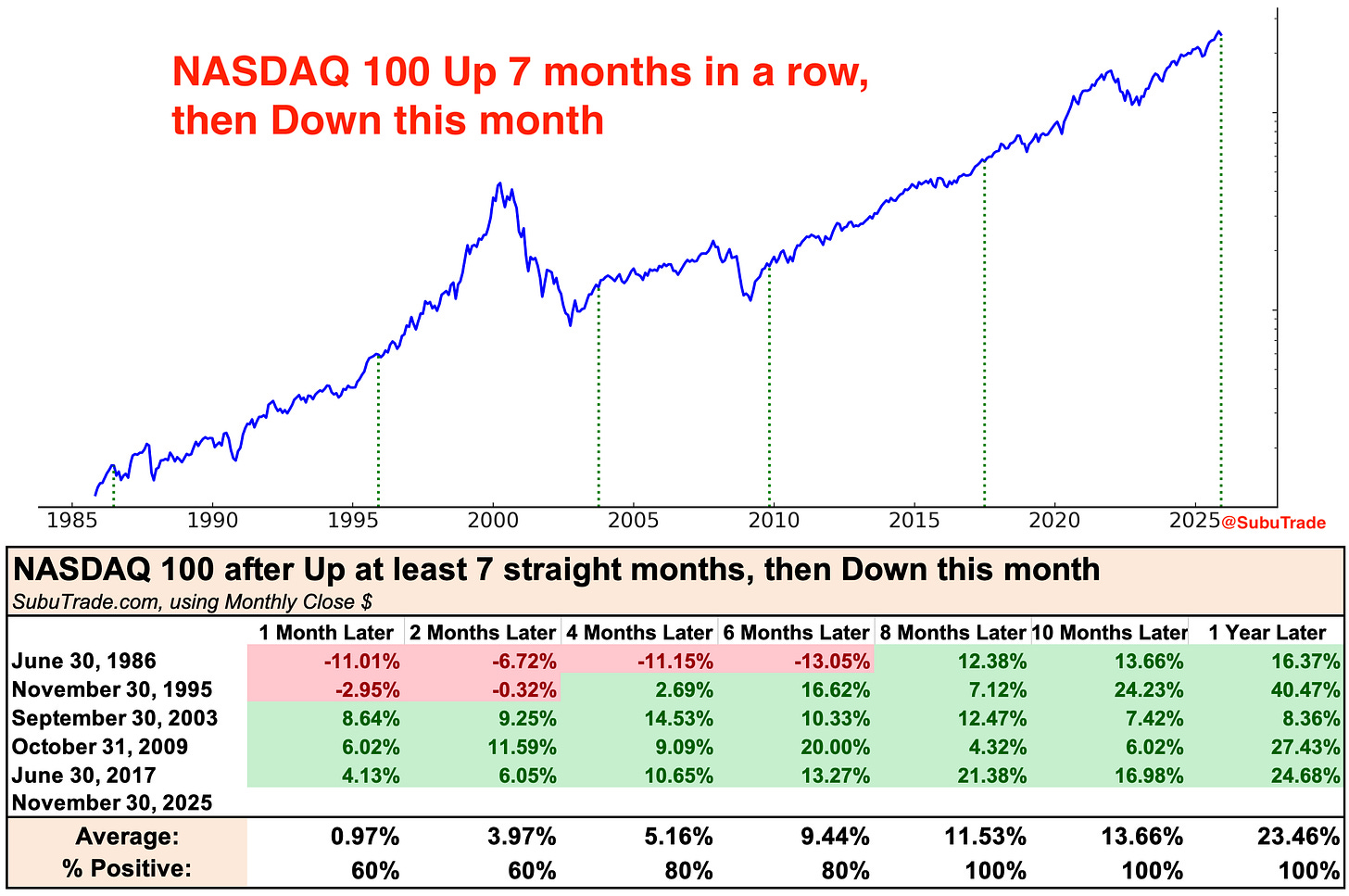

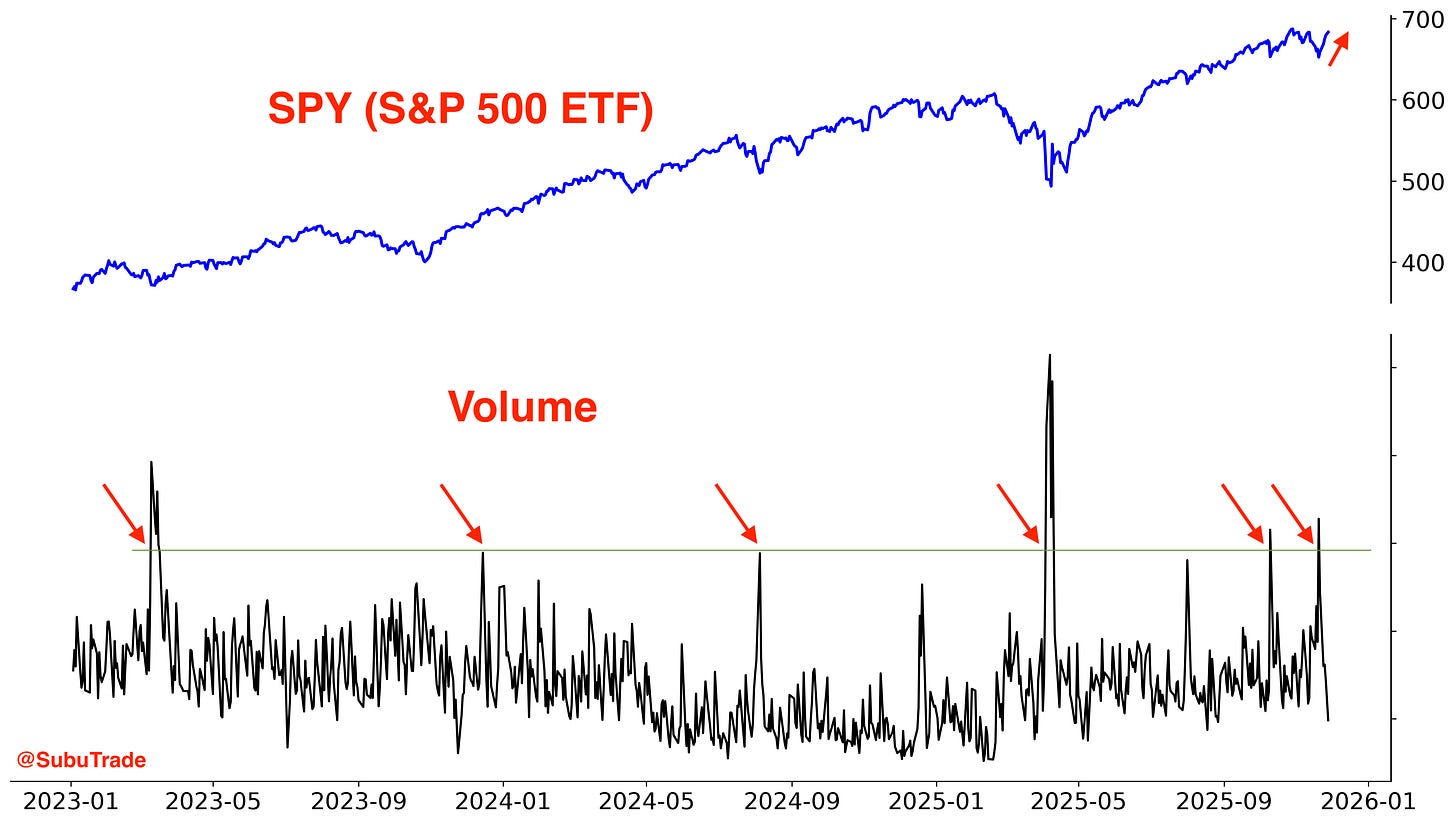

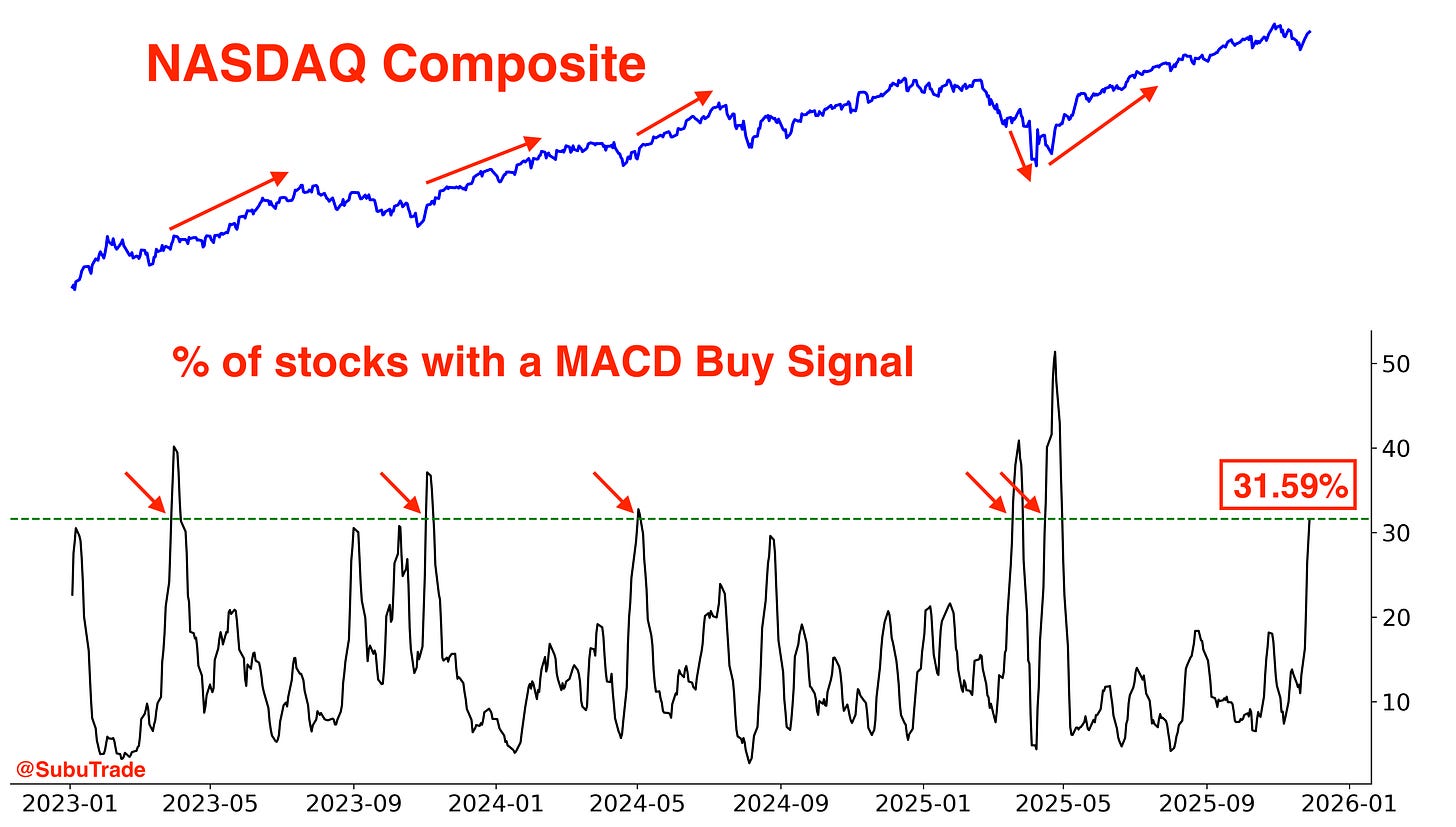

No matter how you slice and dice the numbers, breadth notably improved this week. This is a welcomed development considering that weak breadth is what led to the pullback earlier in November.

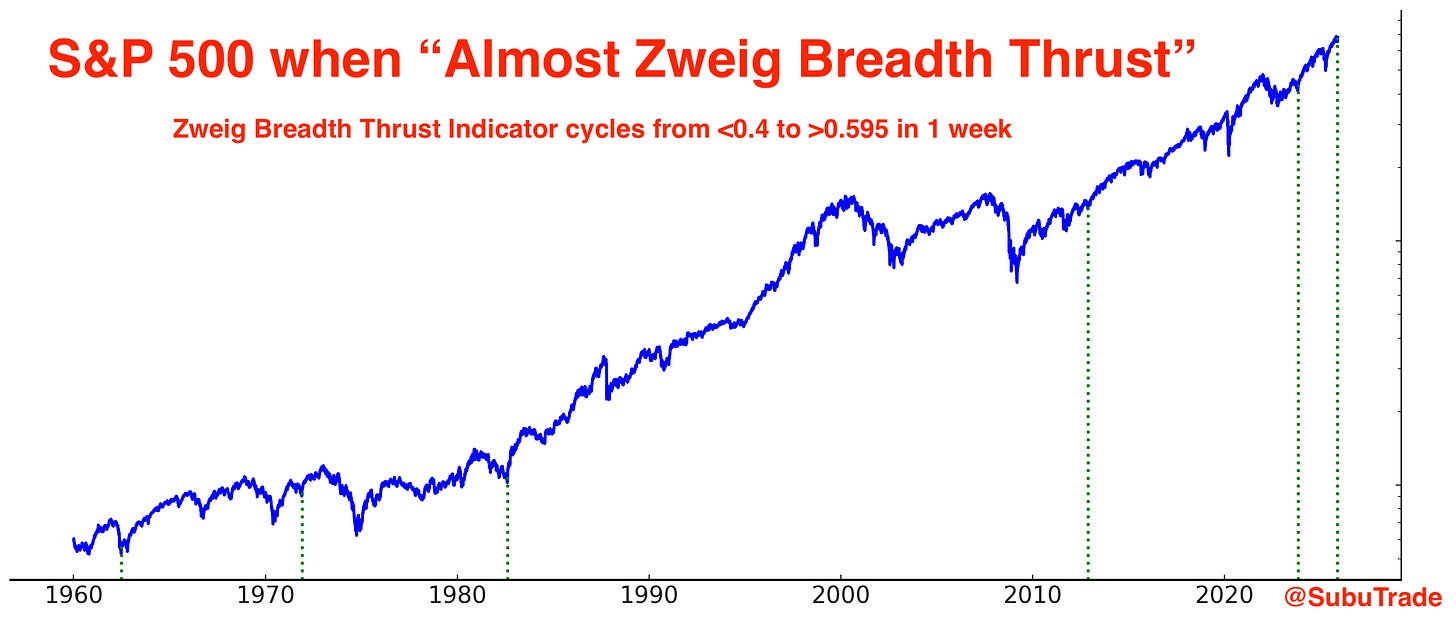

For example, we are close to triggering a Zweig Breadth Thrust.

Even “almost” triggering a Zweig Breadth Thrust is a bullish sign for stocks:

This week’s rally wasn’t unexpected. Last week saw several signs which suggested that we were either at or close to an intermediate term bottom.

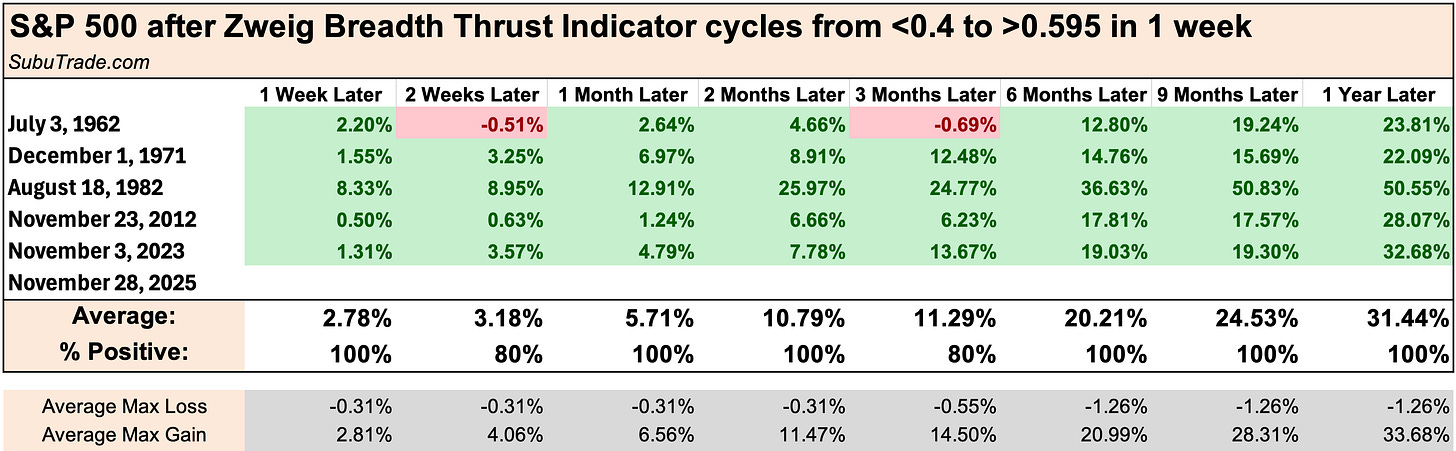

The % of NASDAQ 100 stocks that were oversold:

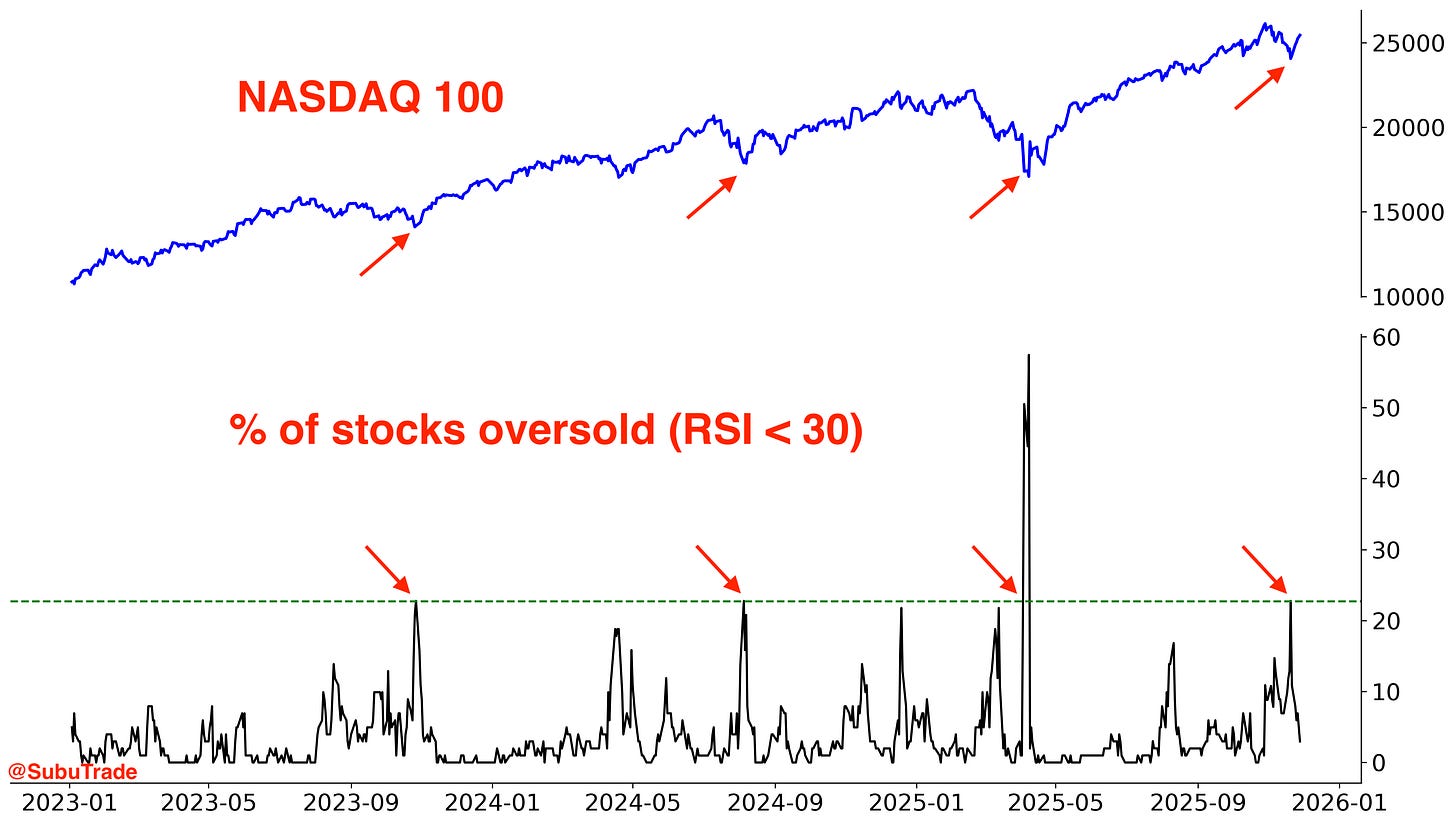

SPY volume spiked (volume tends to spike when markets fall):

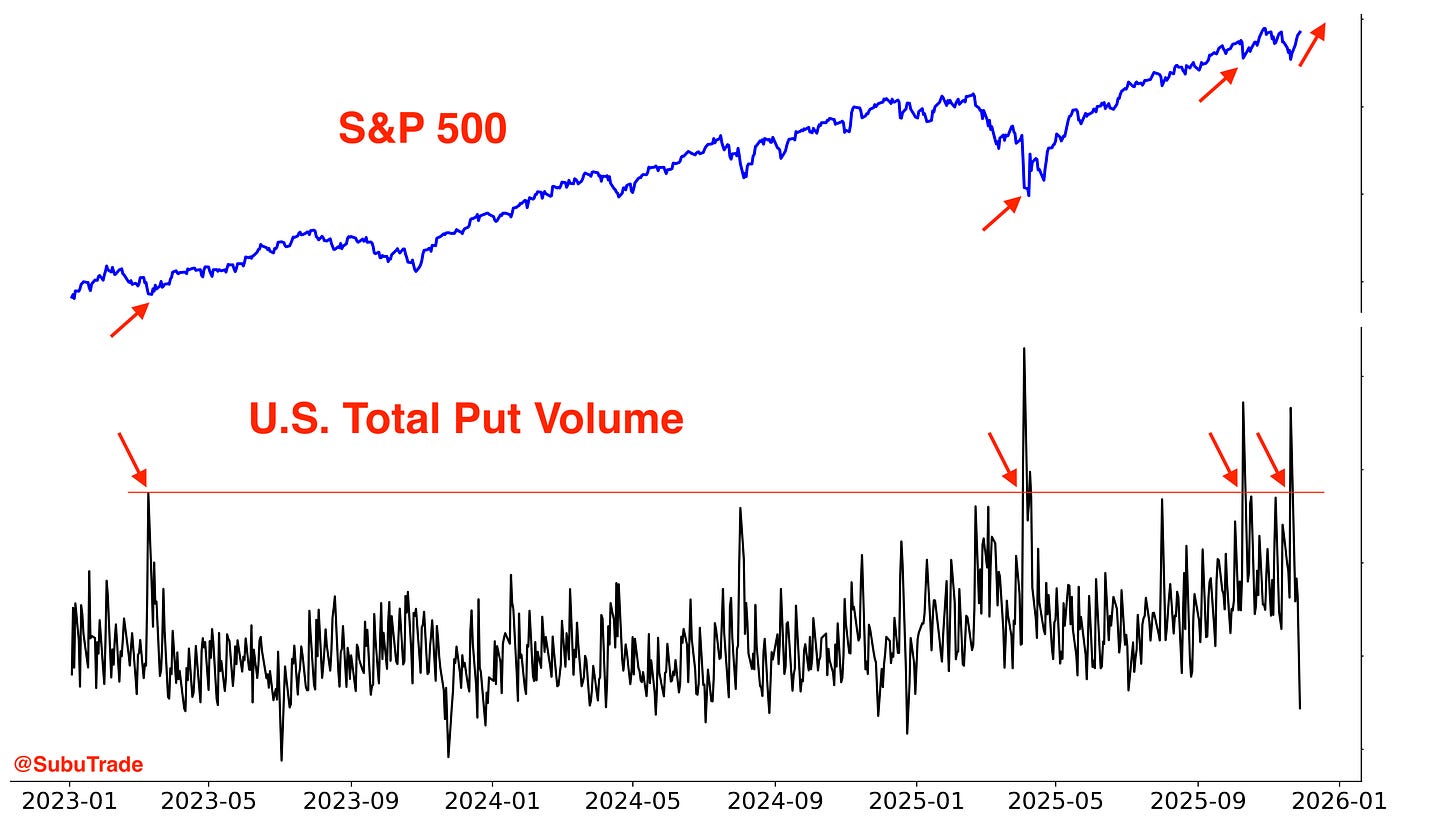

Total U.S. Put Volume spiked:

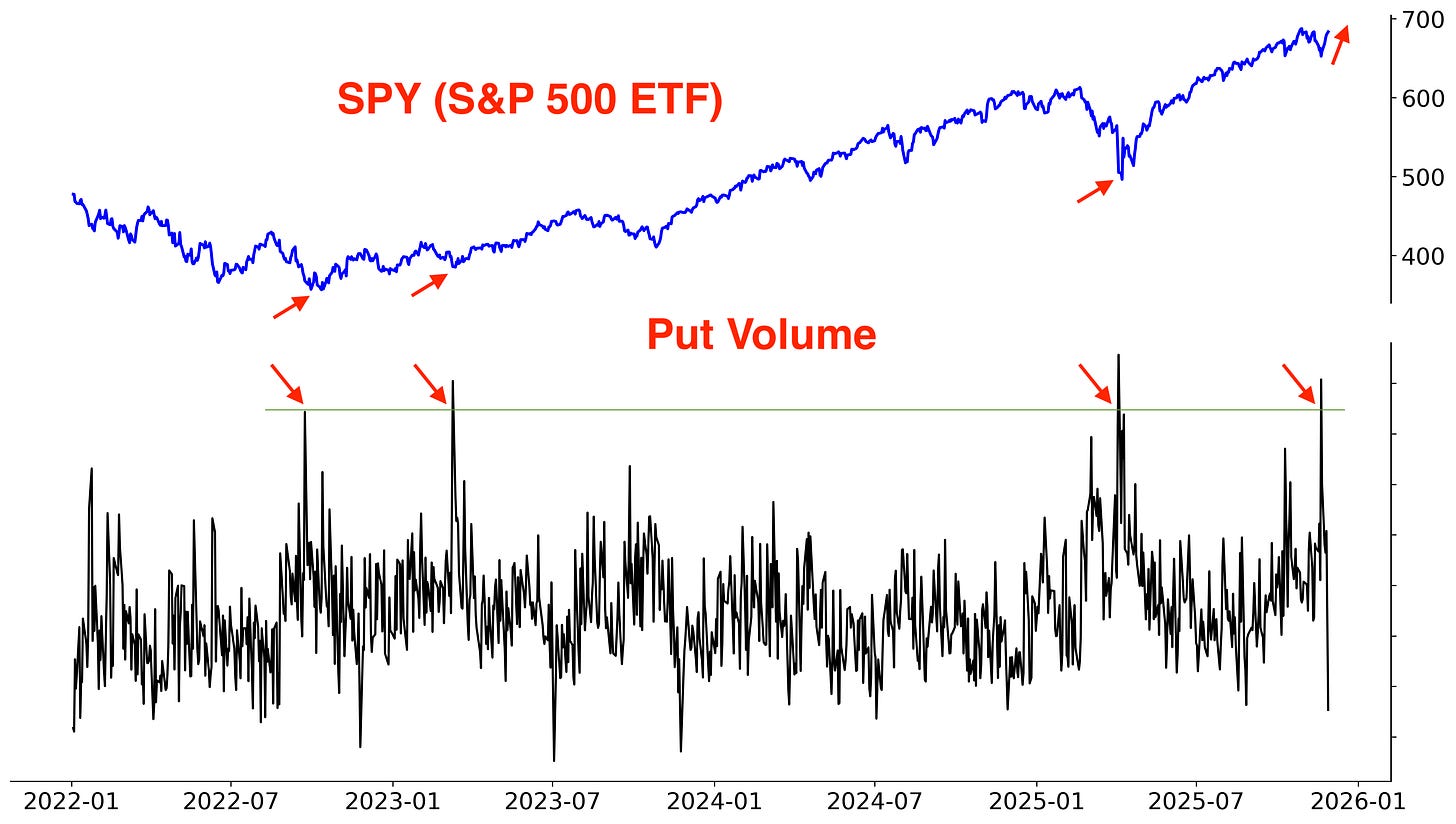

SPY’s Put Volume jumped:

All of this triggered a broadening rally:

With that being said, it’s important to put things into perspective.

2 weeks ago bears were taking victory laps on social media, making fun of bulls.

Today, bulls are taking victory laps on social media, making fun of bears.

It is better to approach markets with a humble attitude and when in doubt, always zoom out and look at the bigger picture.

Looking at the bigger picture, stocks are basically exactly where they were a month ago. FLAT.