Markets Report: when bullish seasonality?

Sector rotation

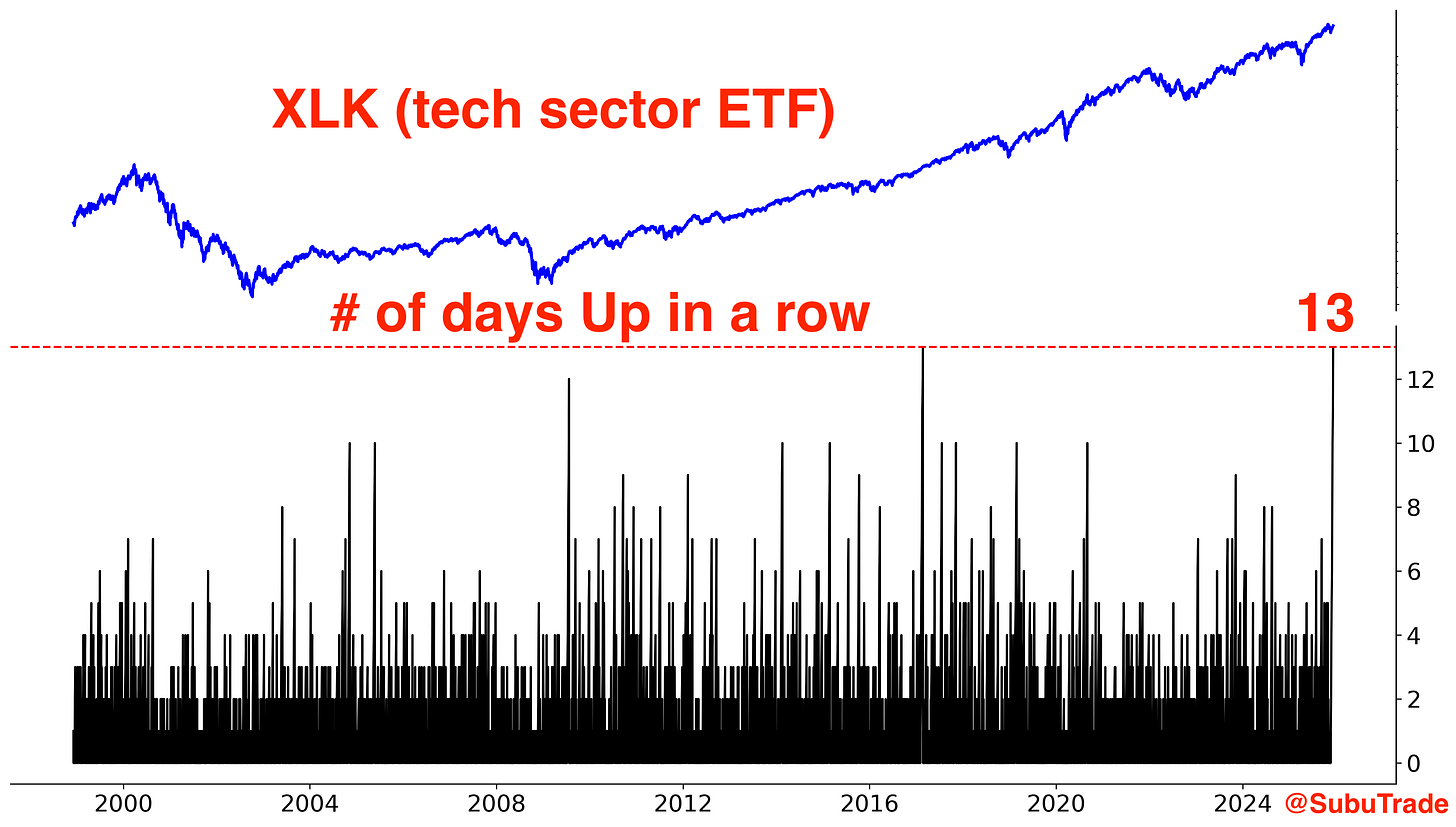

After making new all-time highs on Thursday, stocks fell on Friday. Tech in particular took a beating, snapping a 13 day winning streak:

We’re seeing clear signs of sector rotation right now. There are days when tech is strong & everything else lags. Then there are days when tech is weak & everything else rallies.

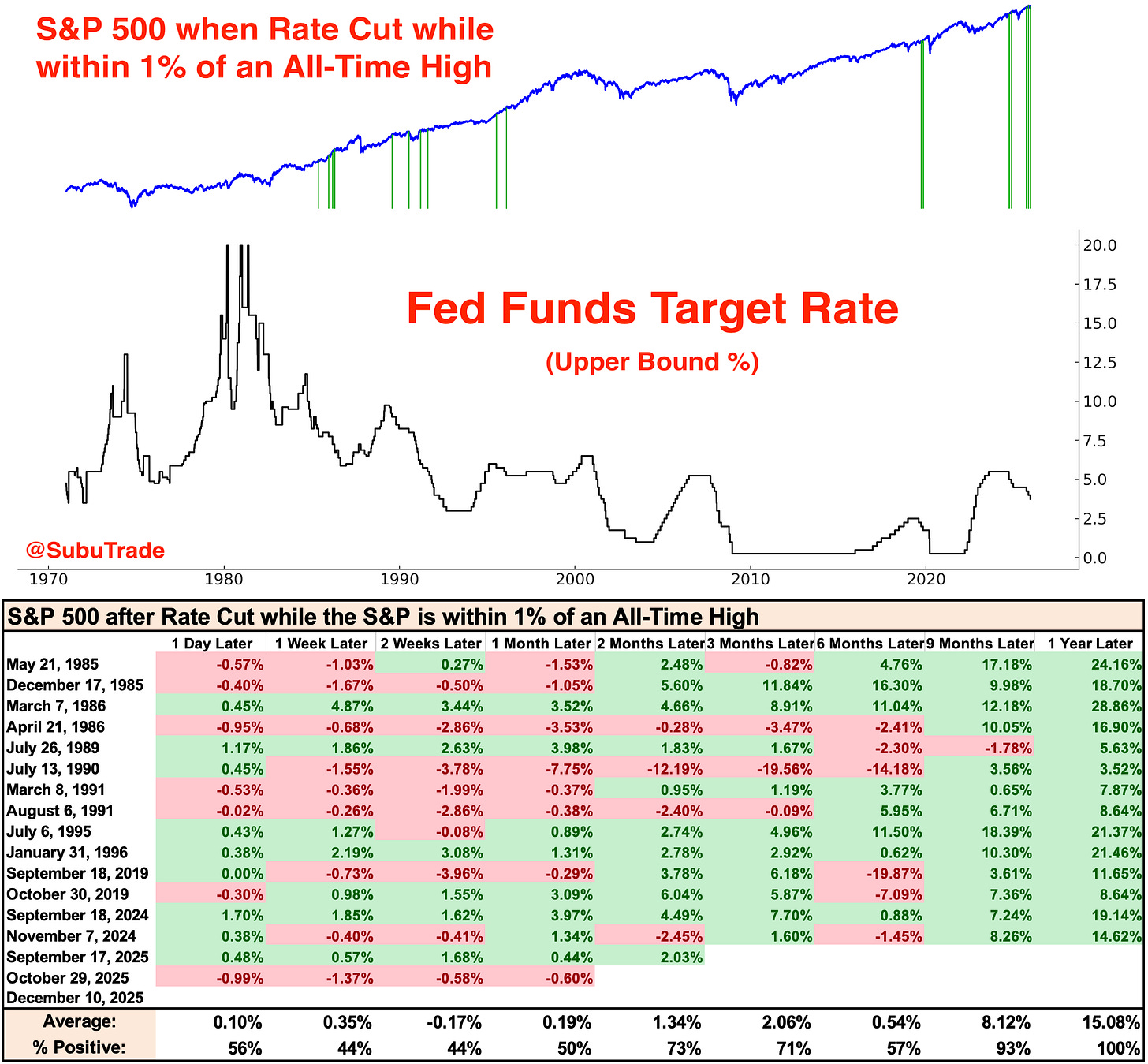

The Fed is cutting interest rates, which is generally a bullish factor for equities:

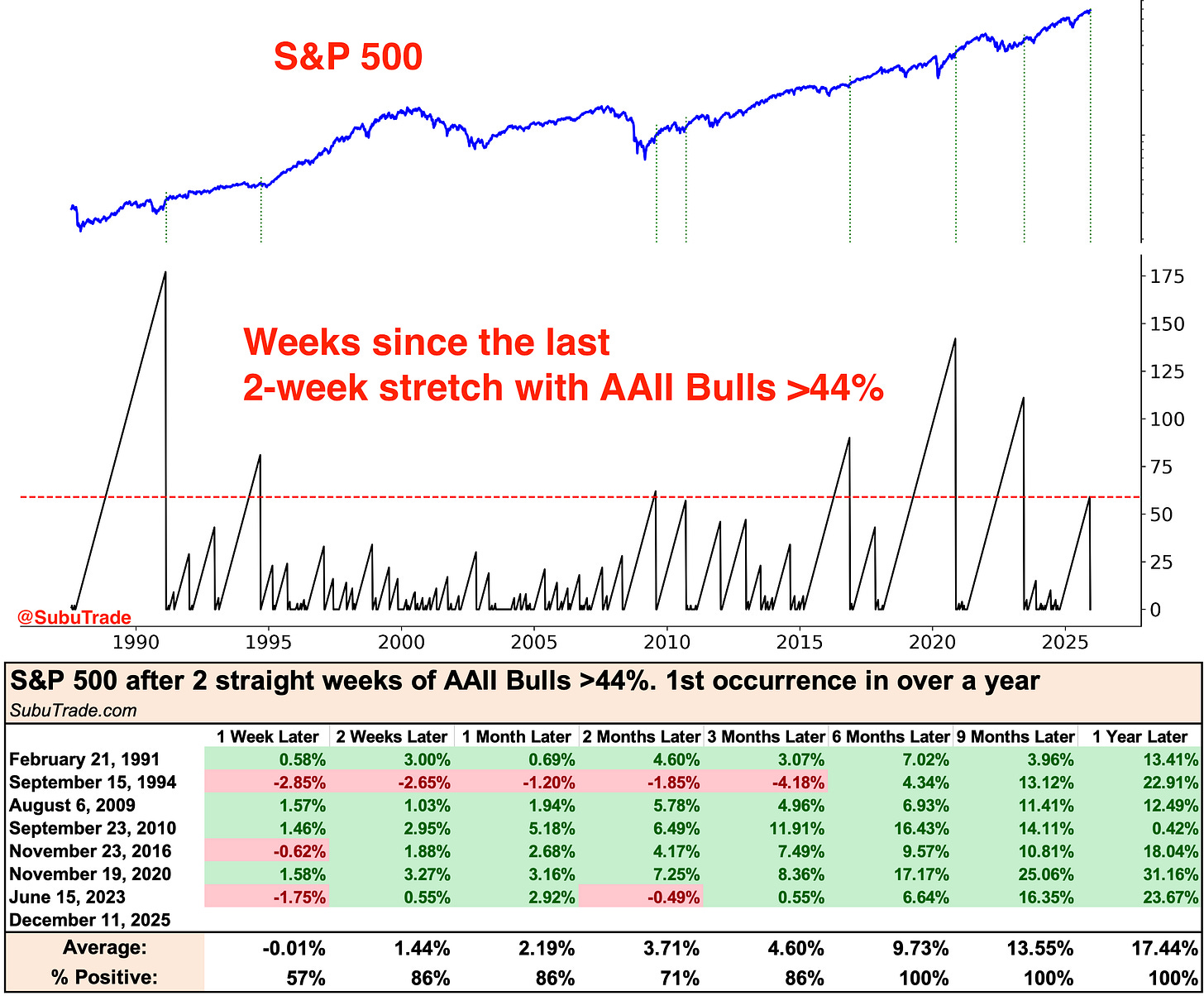

Sentiment is finally improving across the board. For the first time in over a year, we’ve just had 2 straight weeks where AAII Bulls exceeded 44%:

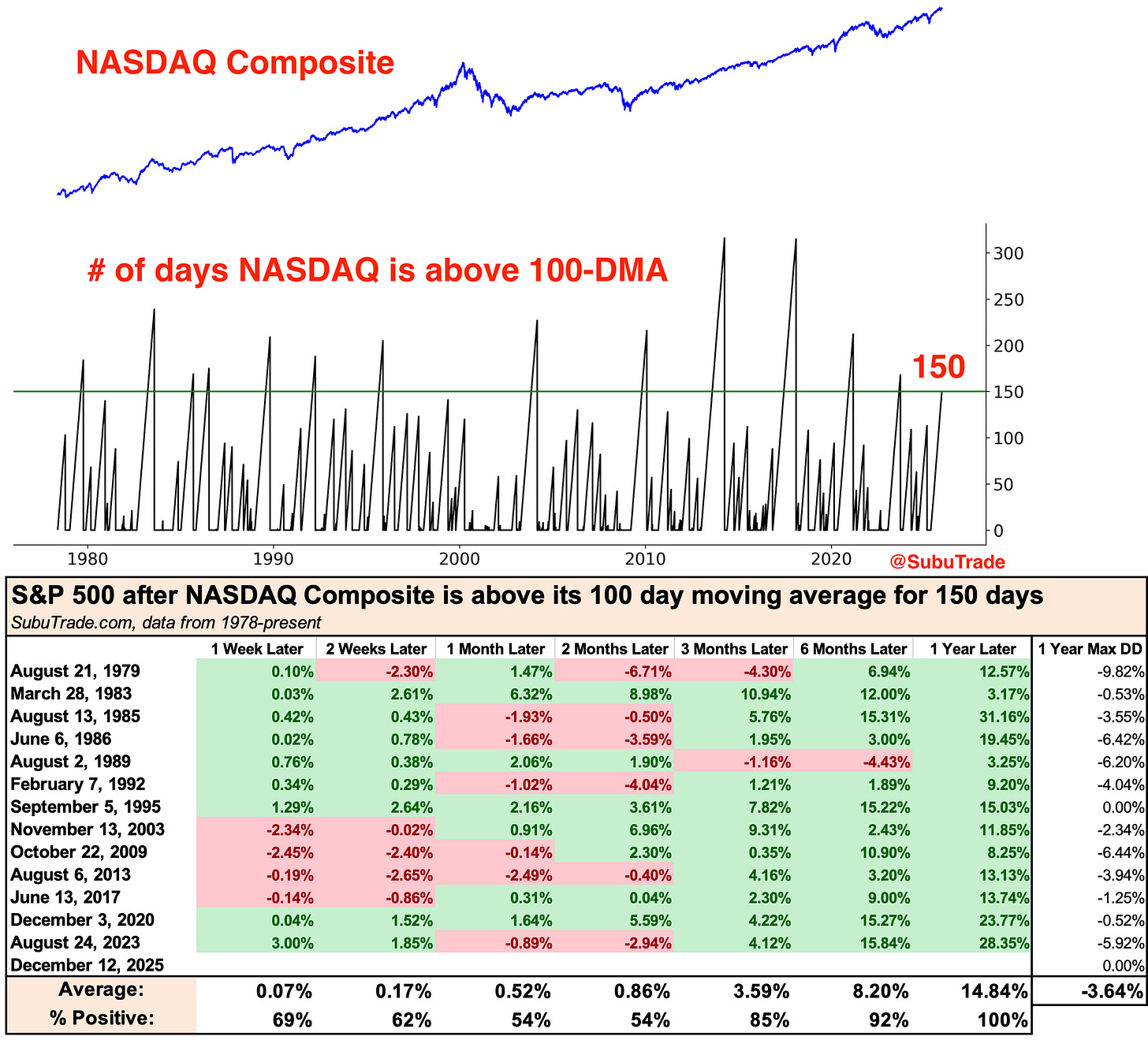

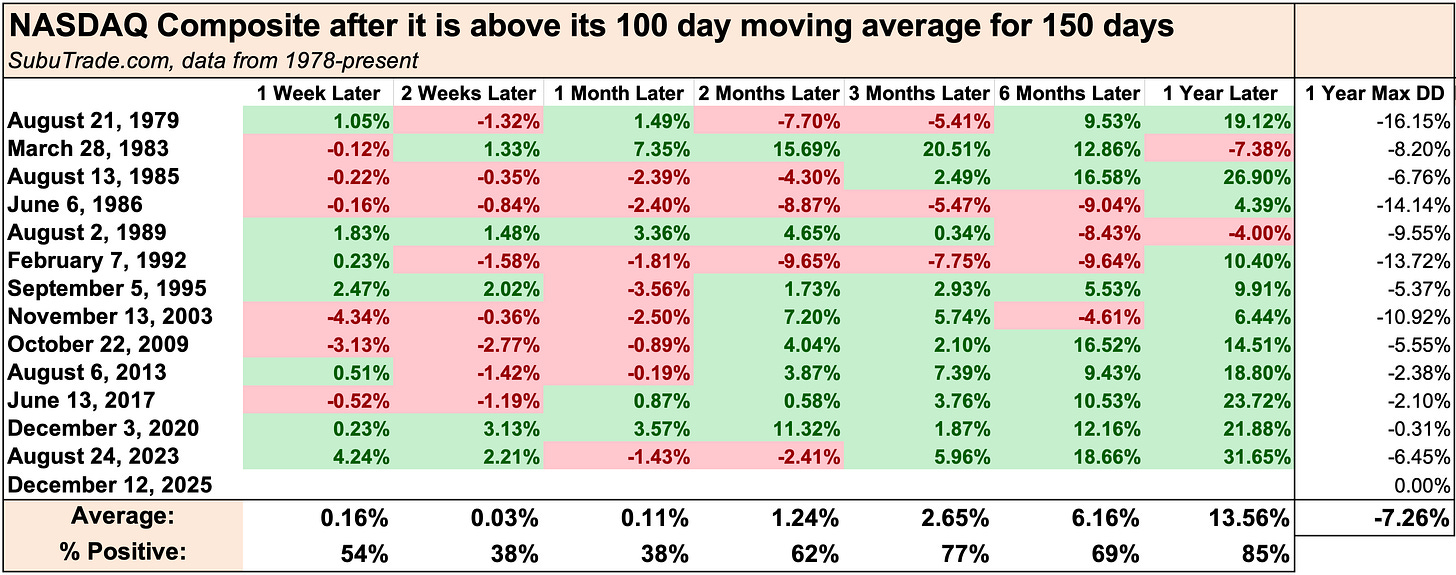

The NASDAQ Composite has remained above its 100 day moving average for 150 consecutive days. Interestingly, this was more bullish for the S&P 500 going forward than for the NASDAQ, which implies that tech may lag during the next leg of this bull market. More signs of sector rotation.

Taking a weight-of-the-evidence approach, here’s what all of this means for markets going forward and how we can form a complete trading plan.