Markets Report: the year ahead

Turning a page in the history books

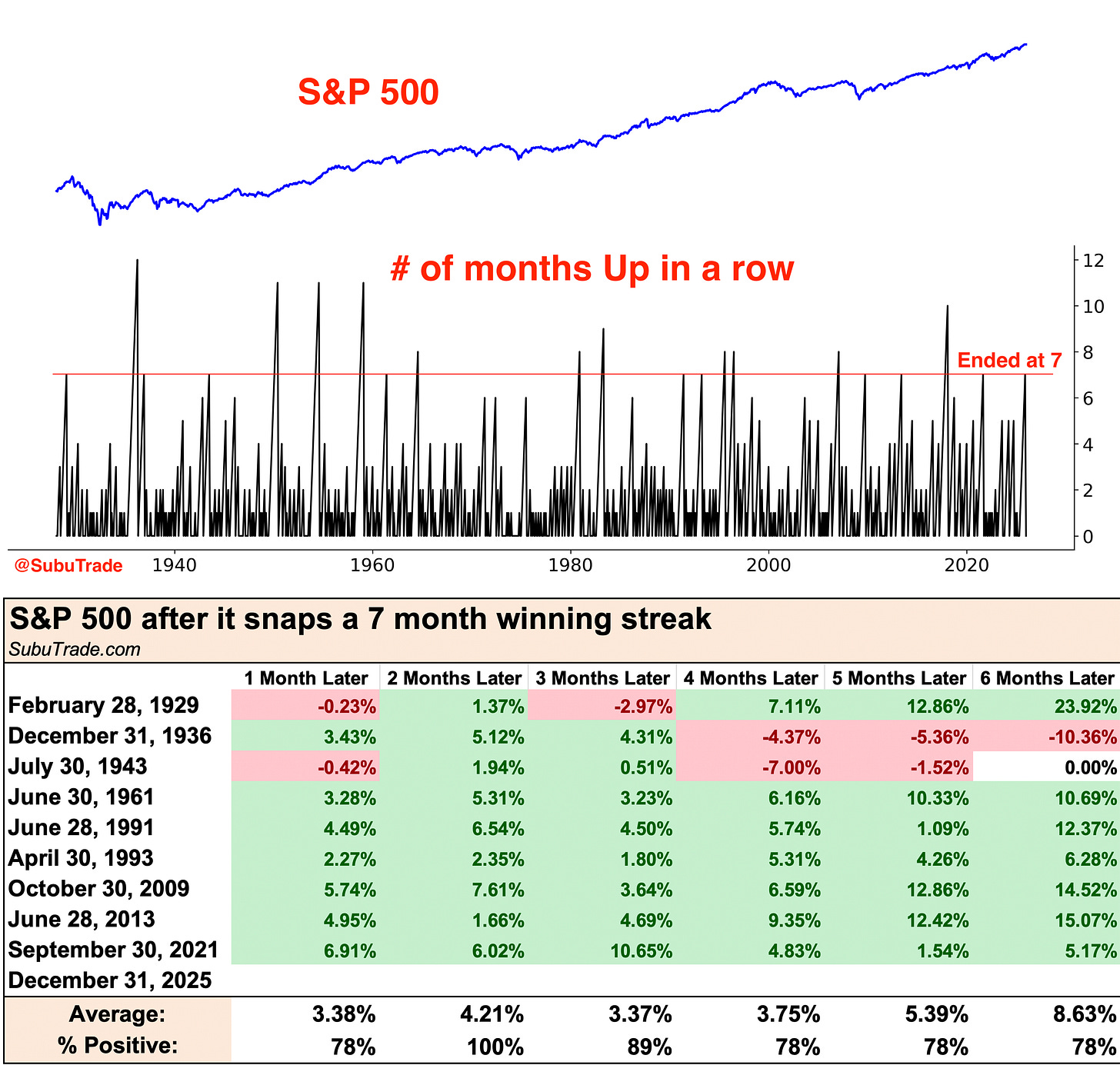

2025 is in the books. After a powerful rally from April-October, the S&P 500 has largely swung sideways. This pause is hardly surprising: markets don’t trend higher indefinitely without taking a breather.

The S&P snapped a 7-month winning streak.

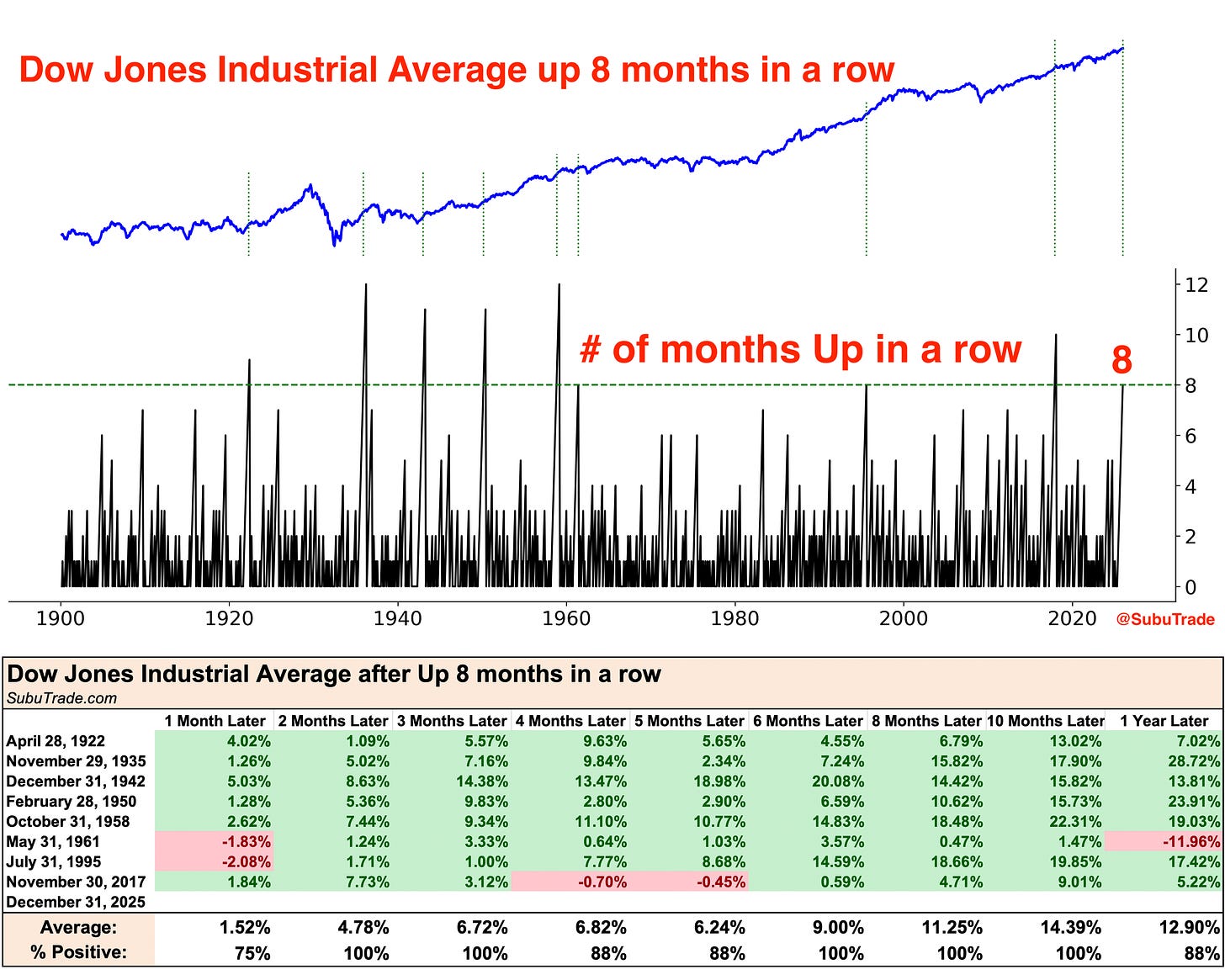

The Dow Jones Industrial Average is still up 8 months in a row:

The stock market’s momentum was strong from April-October. And while all streaks of strong momentum eventually end, they’re usually followed by a pullback and then new highs.

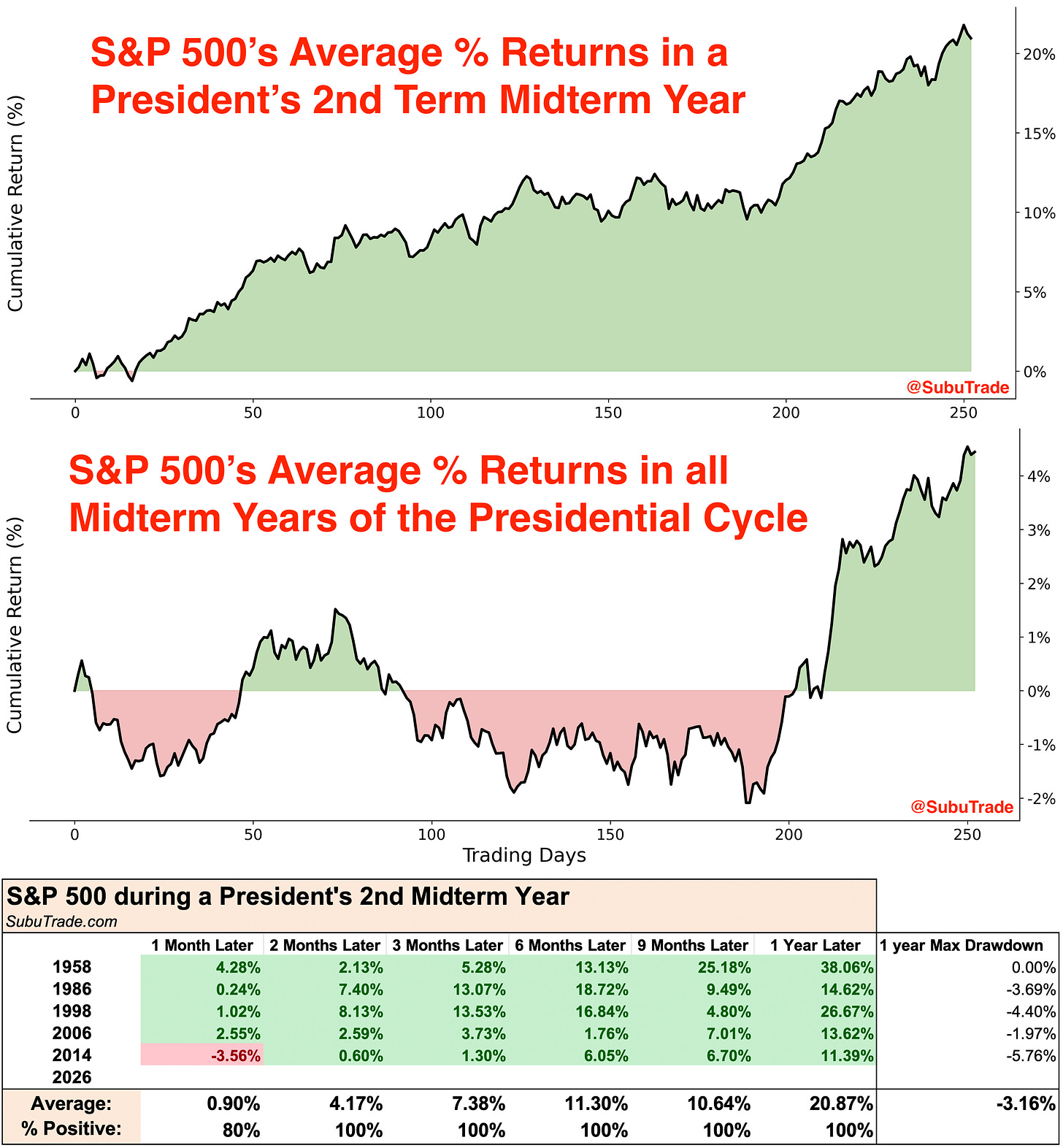

2026 is a Midterm Year, a seasonally weak year in the Presidential Cycle. But Midterm Years are quite bullish under 2nd Term Presidents (e.g. Trump in 2026).

I tend to be skeptical of seasonality and do not use it in my trading. Markets often stray far from so-called seasonal patterns, and setups without a clear underlying rationale deserve lower confidence. In my opinion, a large portion of seasonality reflects statistical randomness.

So is the coast all clear for bulls? No.

There are several short to medium-term bearish signals worth monitoring.

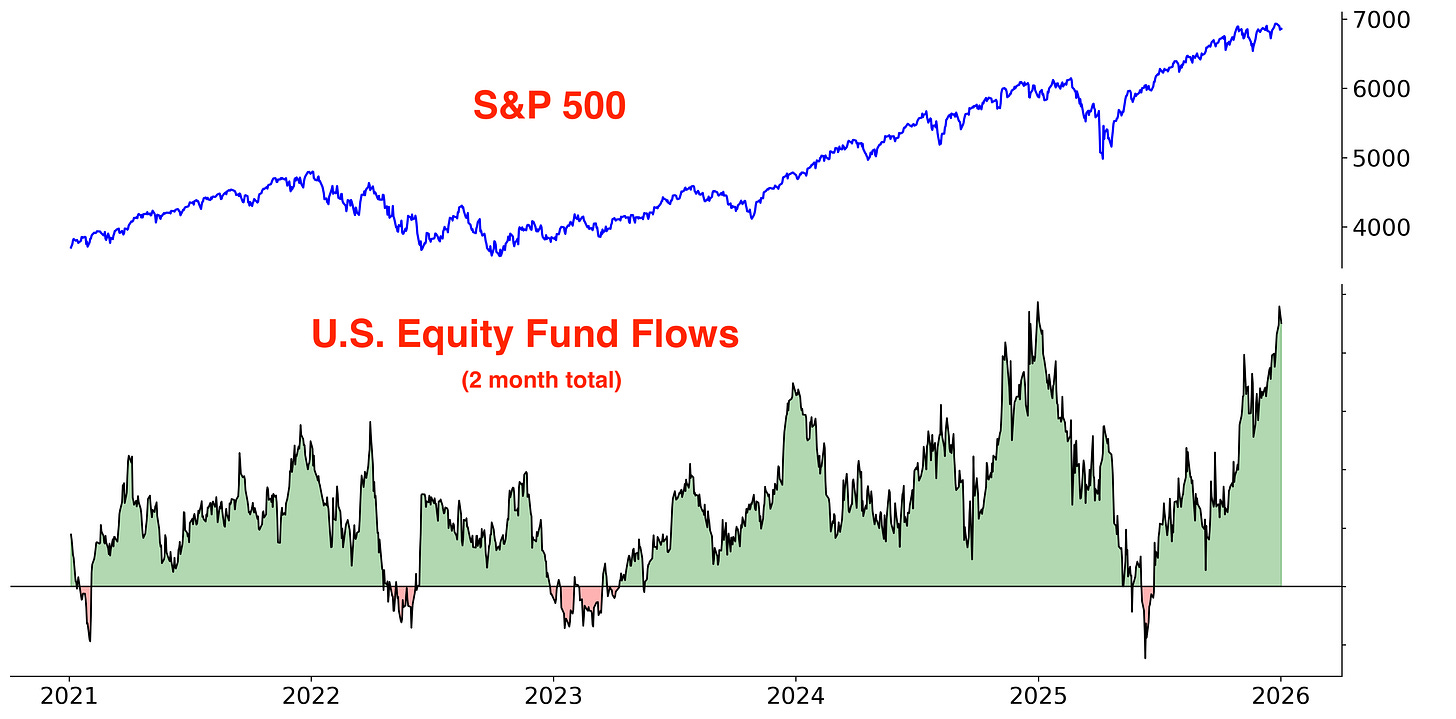

The past 2 months have seen massive equity inflows. The last comparable surge occurred in December 2025, after which stocks moved sideways for two months before breaking down amid Trump’s tariff announcements.

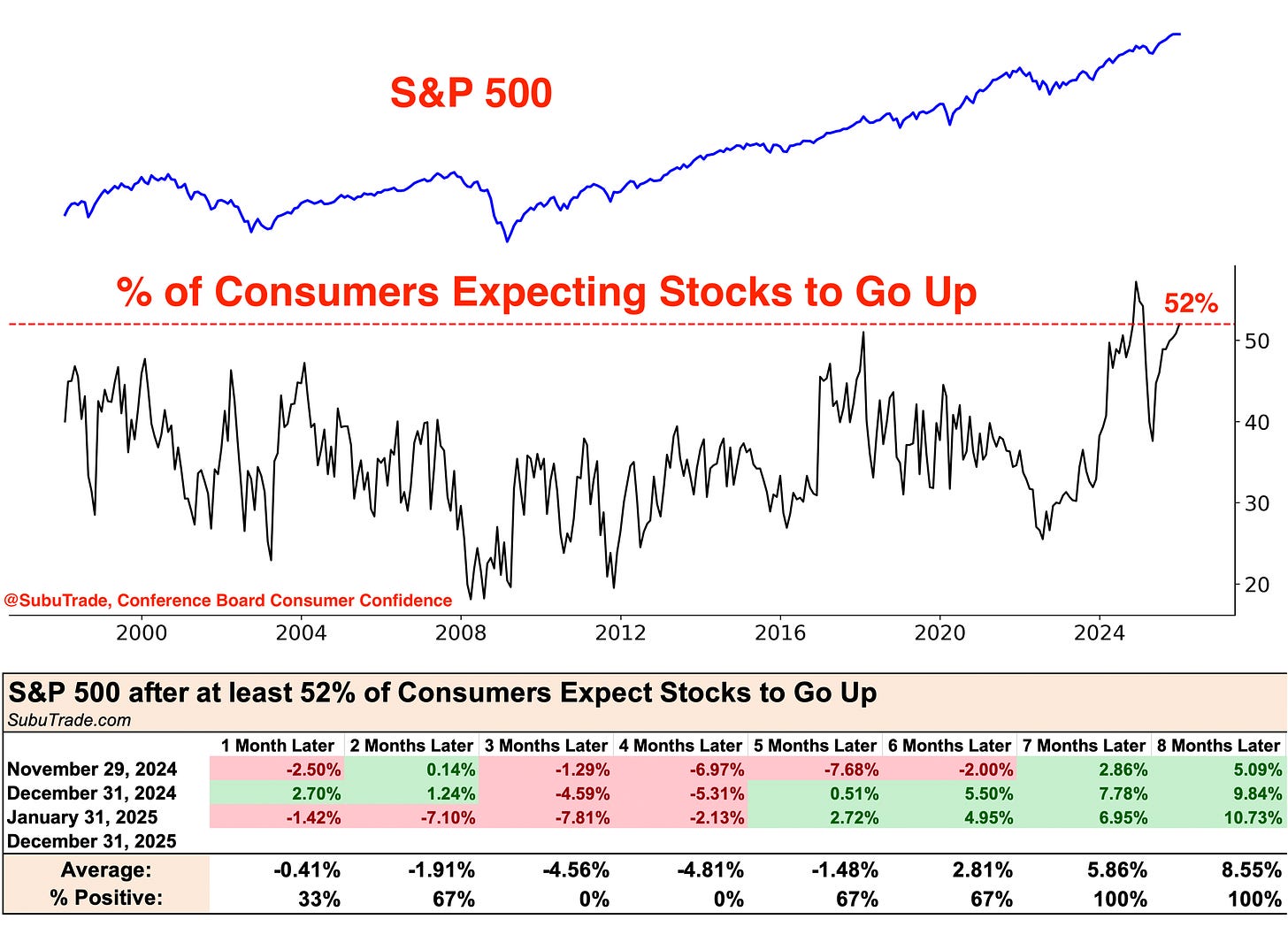

Similarly, consumers are incredibly bullish on stocks. According to the Conference Board’s Consumer Confidence report, 52% of Consumers expect stocks to go up in the next 12 months.

Such bullish sentiment was only matched in the November 2024-January 2025 period (last year). Back then, stocks went sideways for months before crashing under Trump’s tariff announcement.