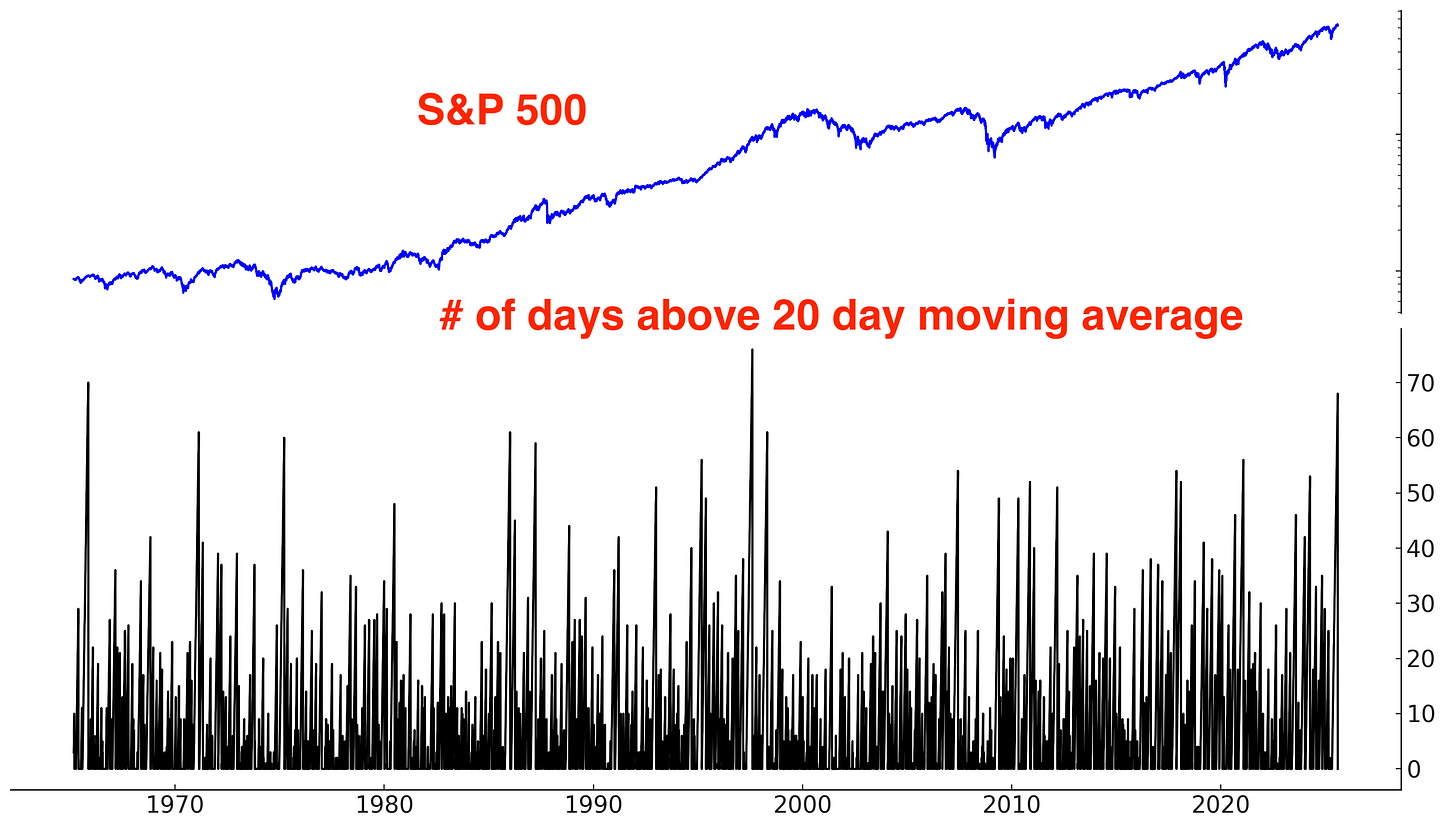

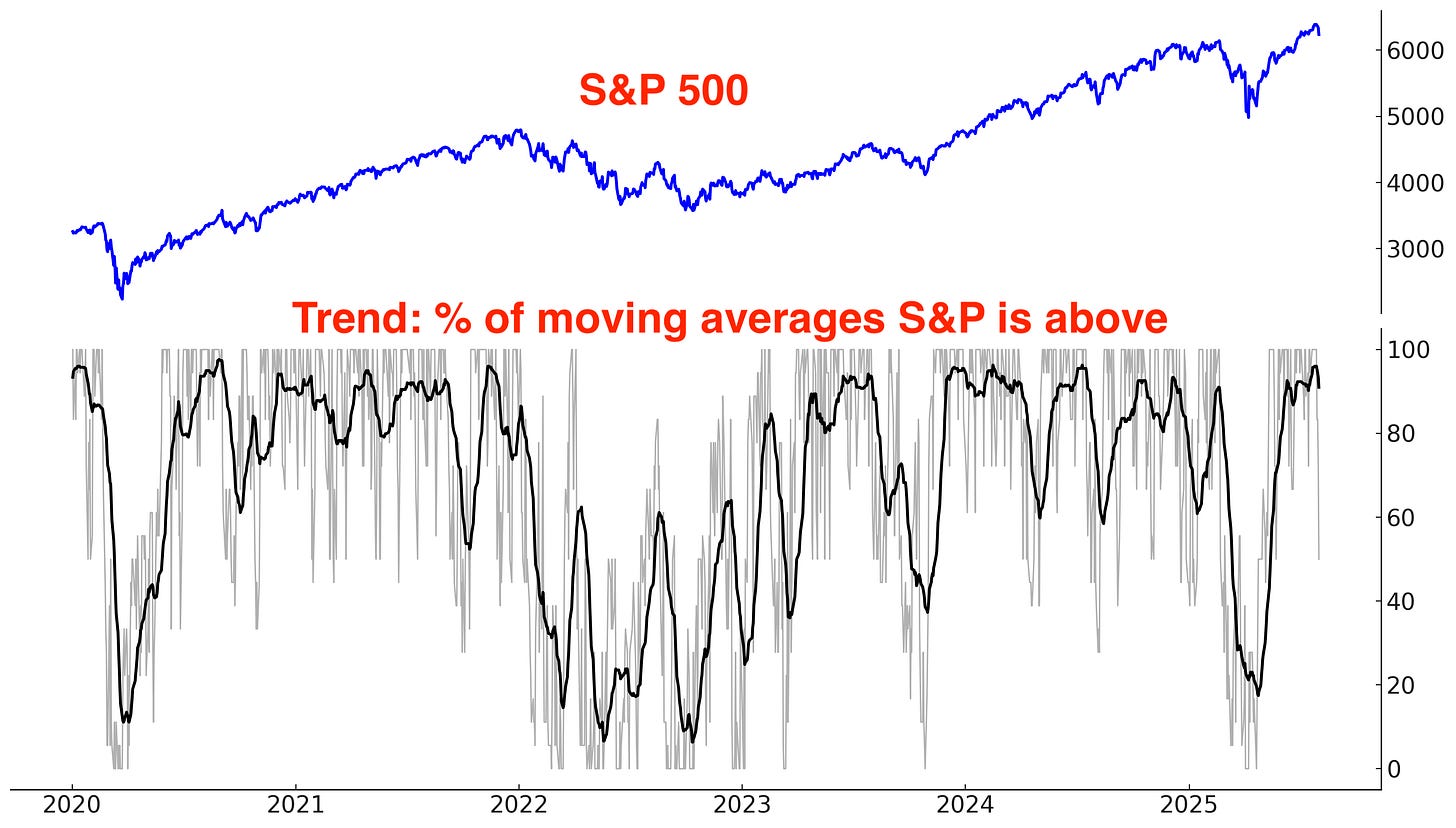

Stocks fell this week, ending a 68 day streak in which the S&P 500 traded above its 20 day moving average.

U.S. Stocks

After a huge rally in which retail-favorite stocks exploded higher, the stock market is finally in the midst of an overdue pullback. This is the first meaningful pullback in 3 months.

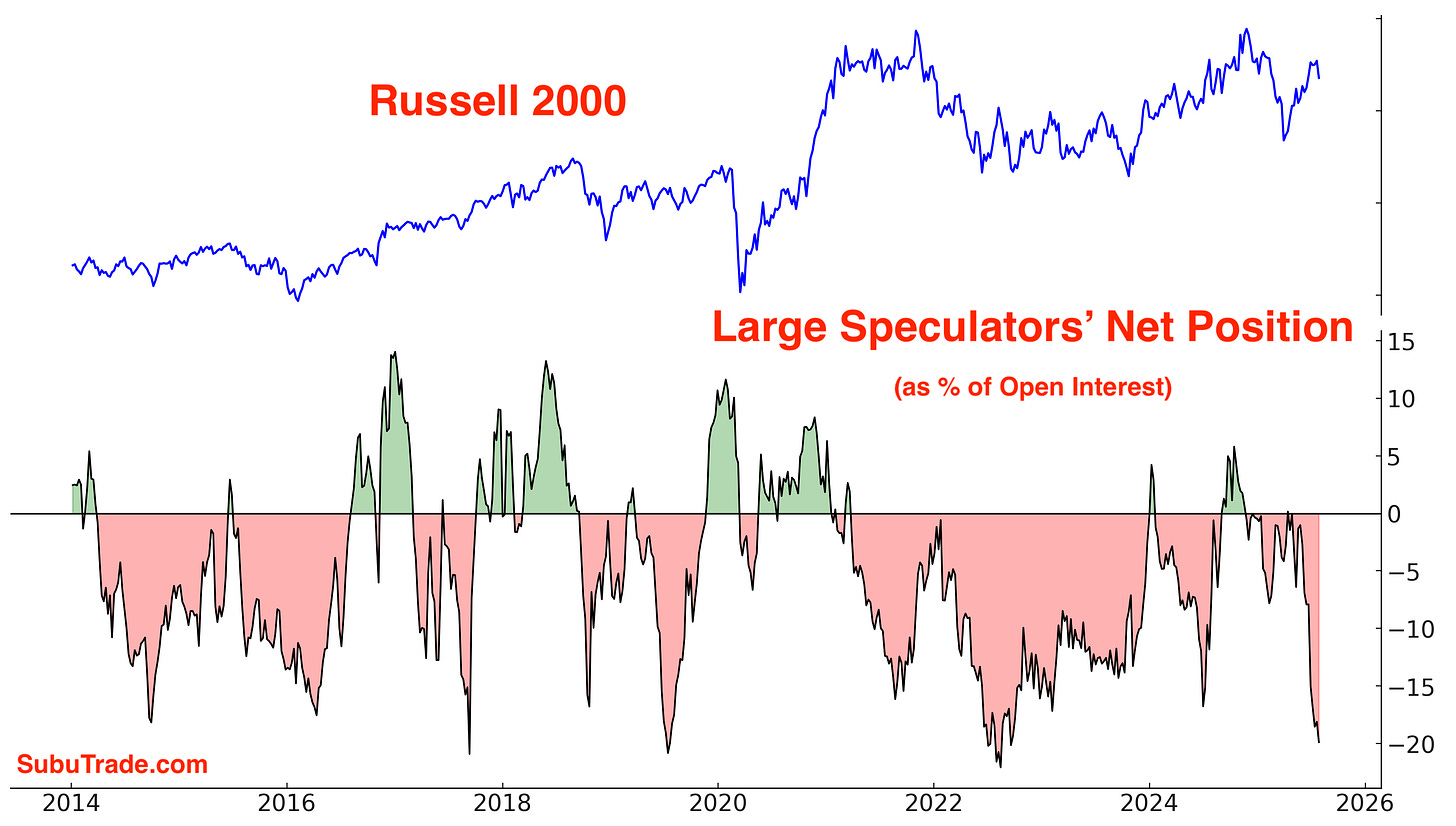

COT Report (Commitments of Traders)

Retail traders went all-in, bidding up the prices of many speculative, high-beta stocks. However, one area of market that was consistently avoided was Small Caps.

According to the COT Report, Large Speculators/Hedge Funds are extremely short Russell 2000 futures:

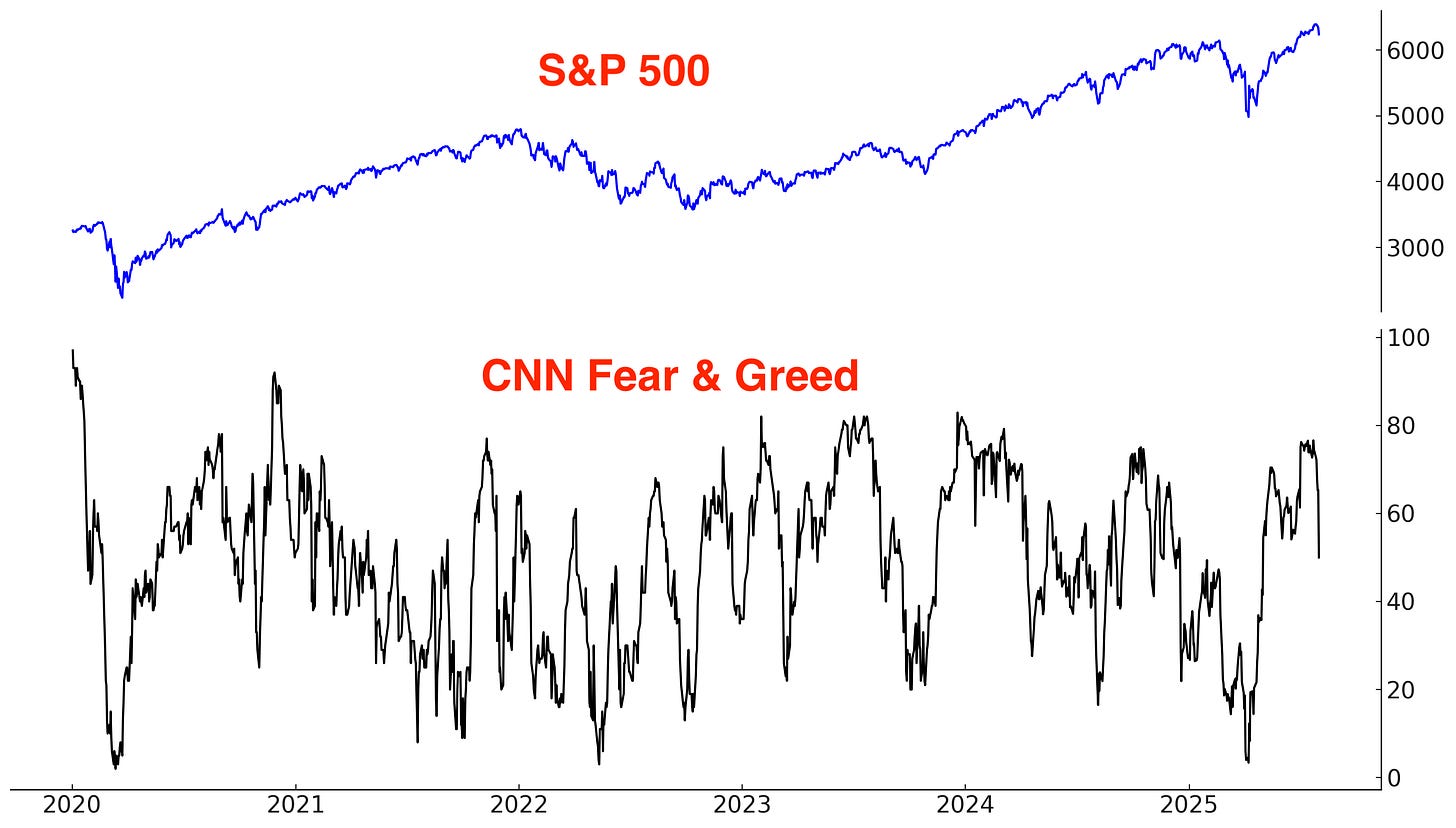

Sentiment Indicators

Sentiment is pulling back from “Extreme Optimism” territory. The CNN Fear & Greed Index is neutral:

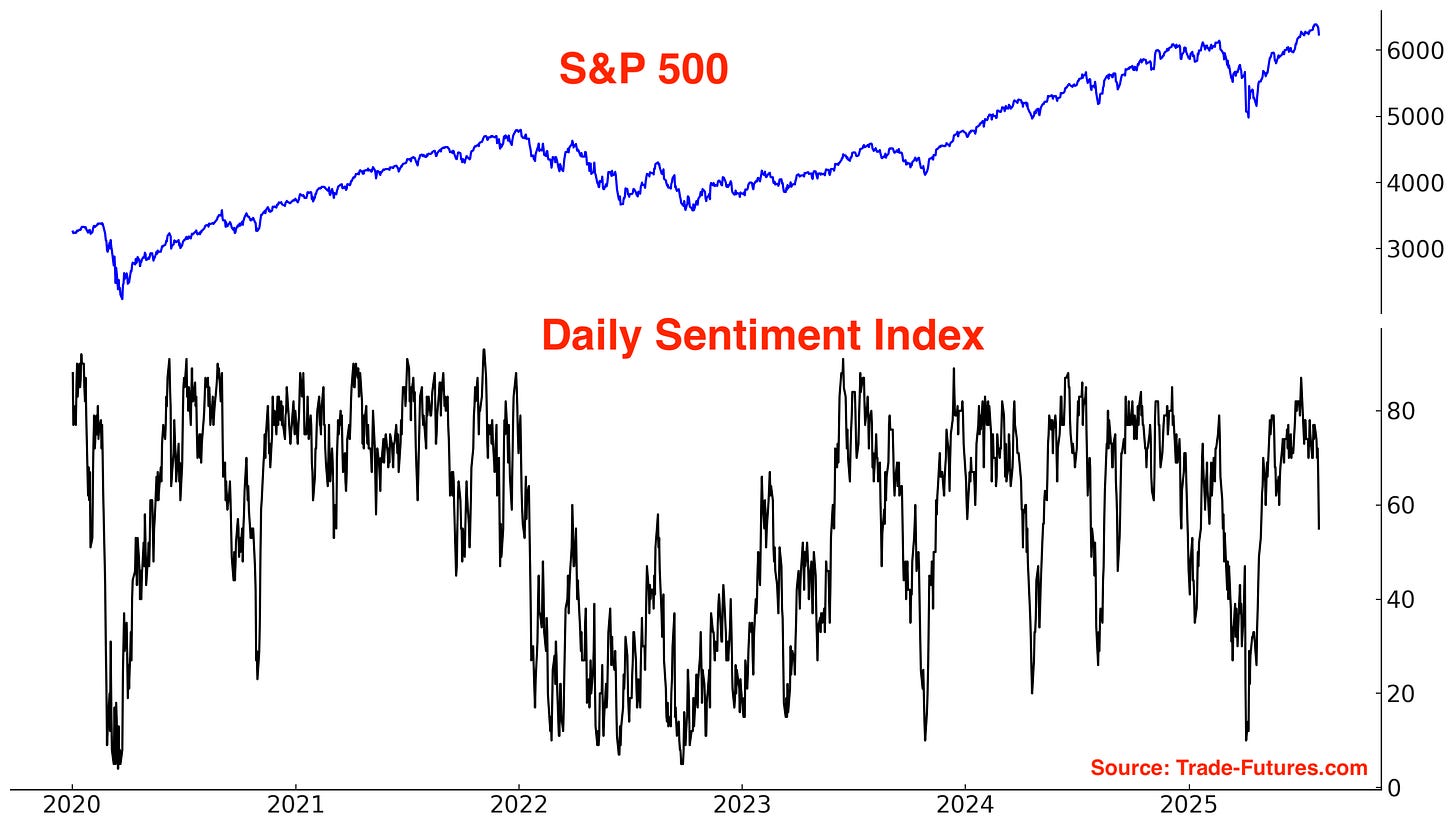

S&P 500’s Daily Sentiment Index has also pulled back from “Extreme Optimism” territory:

Sentiment Surveys

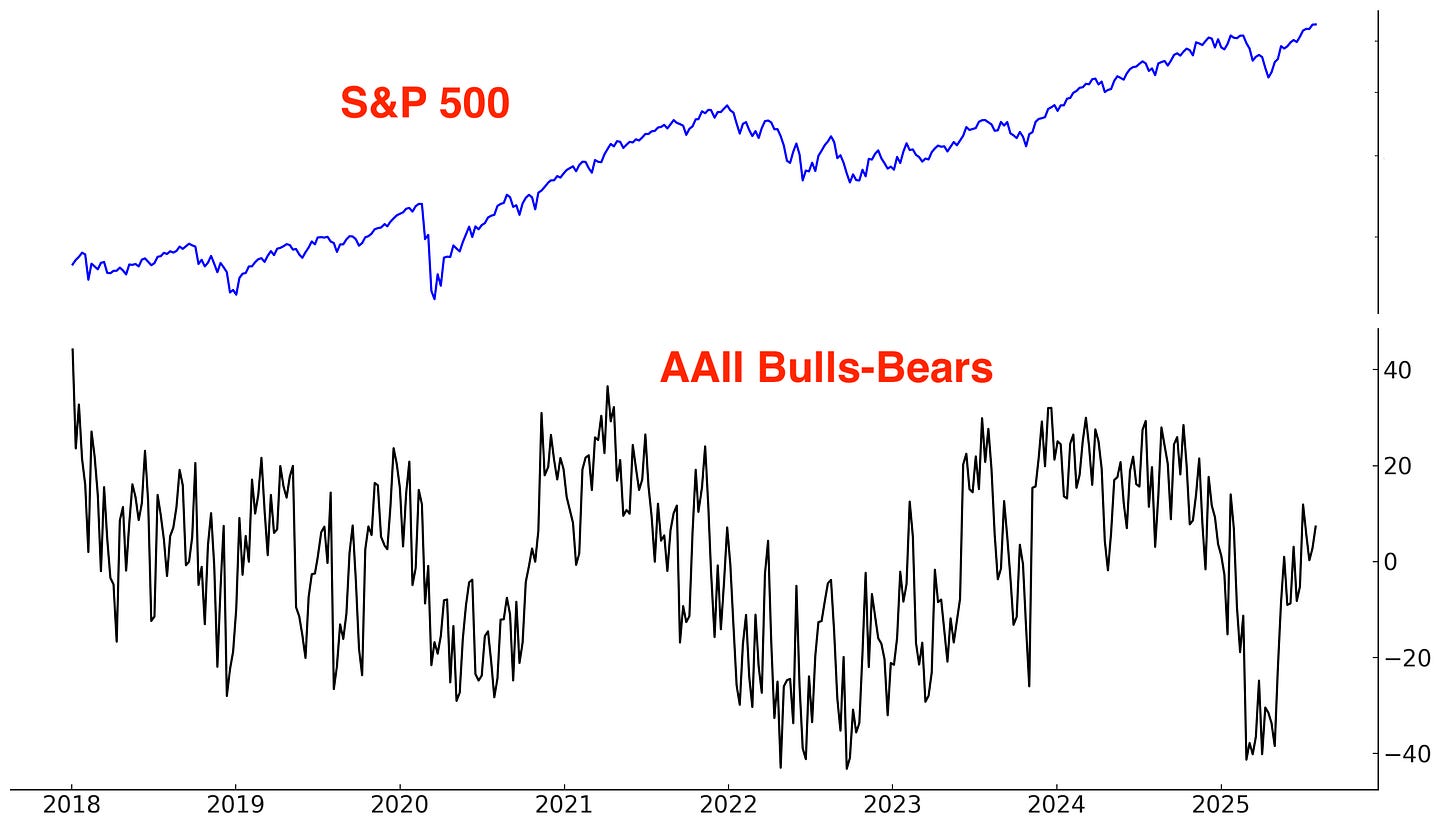

Sentiment according to the AAII survey is neutral:

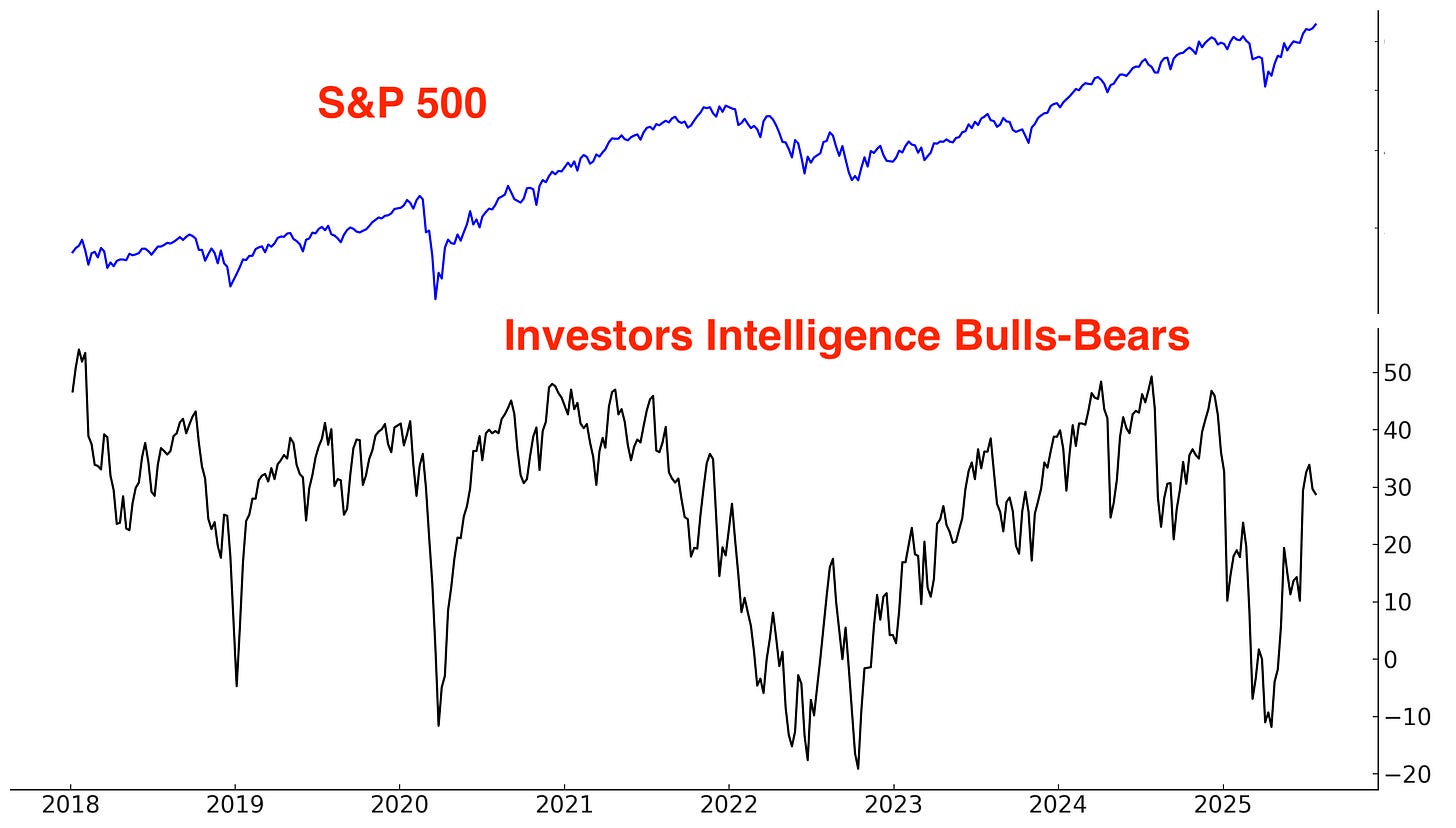

Investors Intelligence Bulls-Bears fell a little. Newsletter writers still lean bullish:

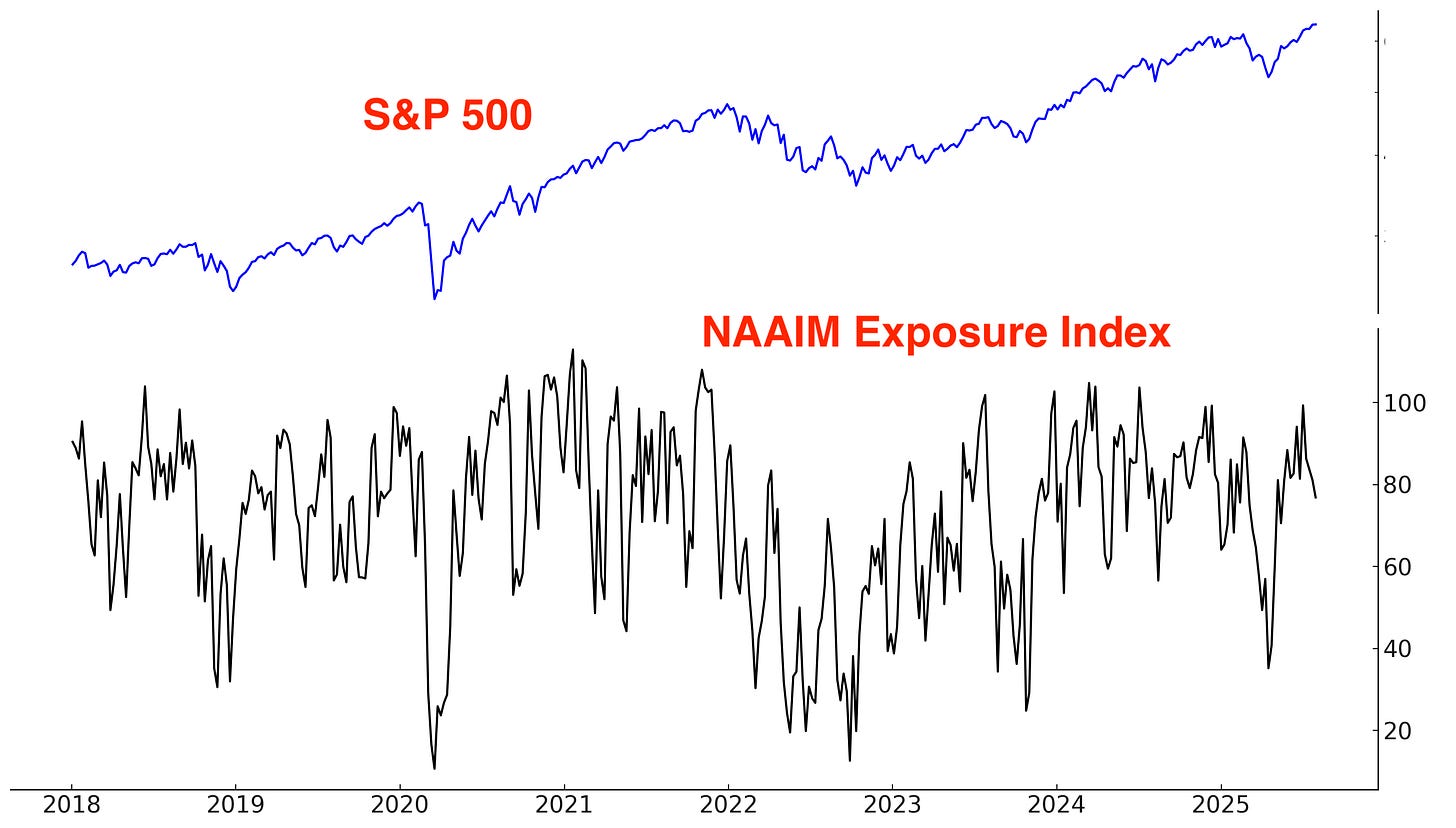

The NAAIM Exposure Index (National Association of Active Investment Managers) leans slightly bullish:

Corporate Insiders

The Corporate Insider Sell/Buy ratio fell as the number of Sellers decreased and the number of Buyers increased a little:

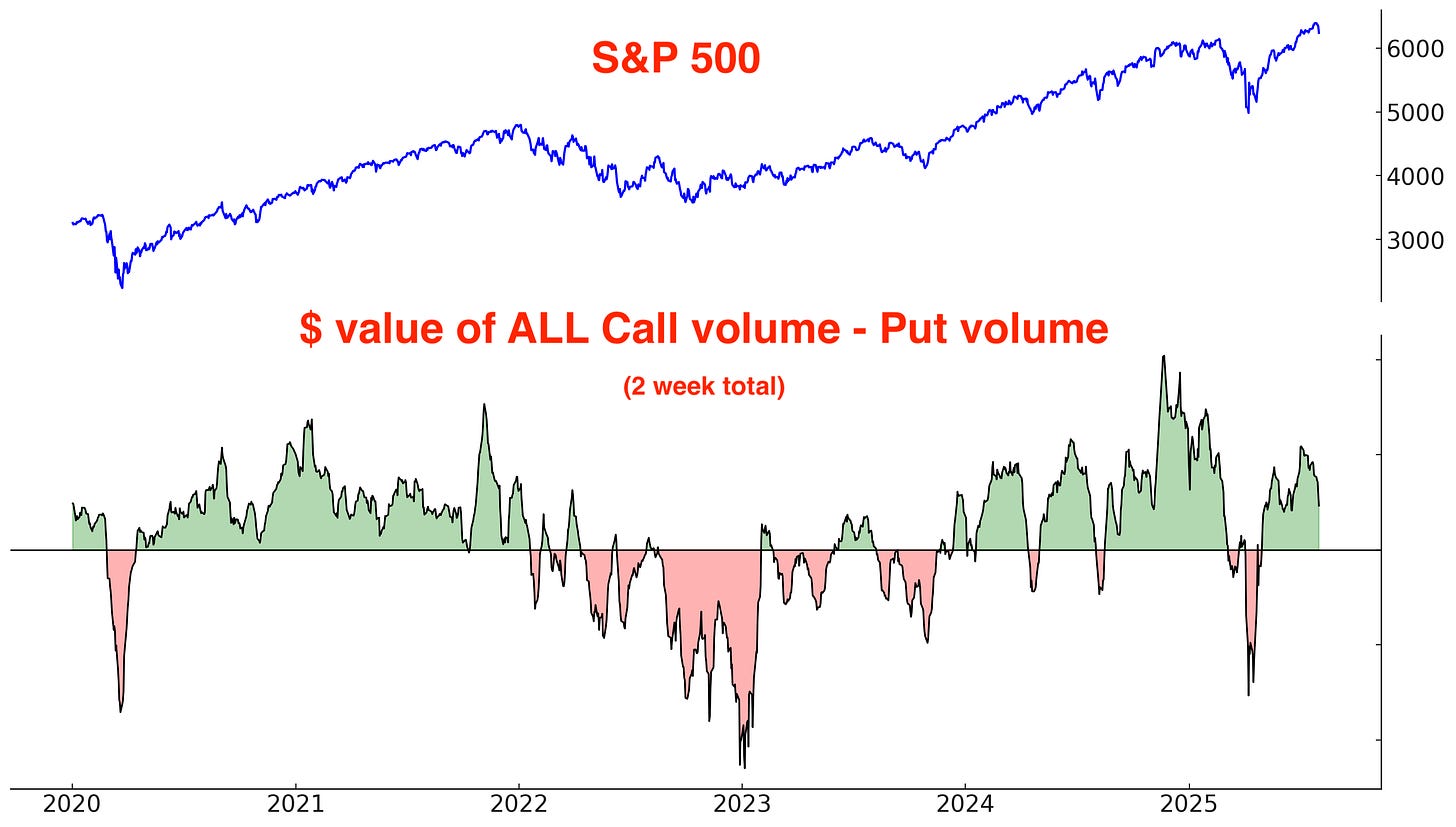

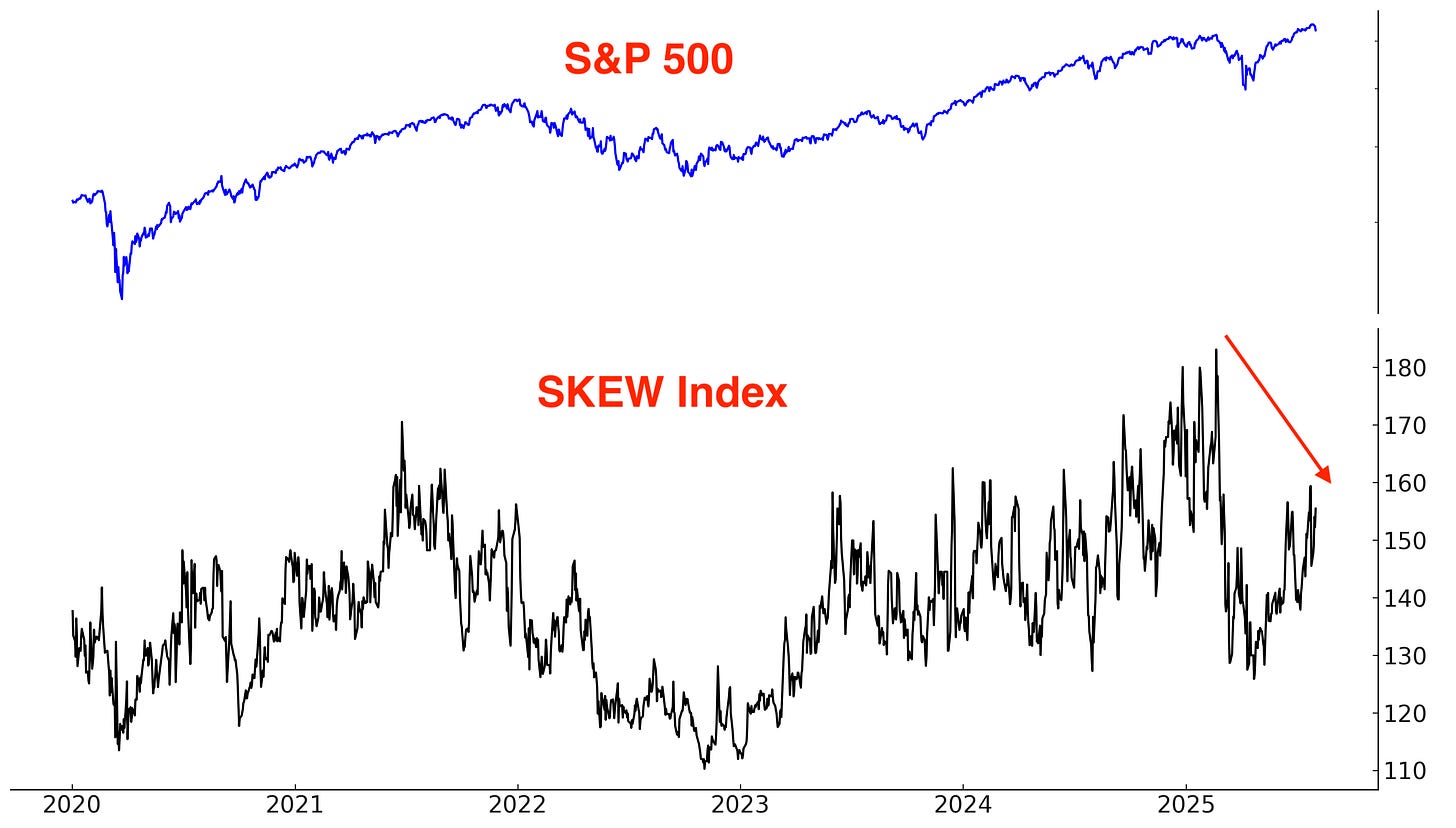

Options

The $ value of all Call volume - the $ value of all Put volume is starting to fall:

The SKEW Index, which reflects perceived tail risk in the options market — or the probability of extreme downside moves — remains muted. This suggests that the stock market’s pullback will not turn into a major crash.

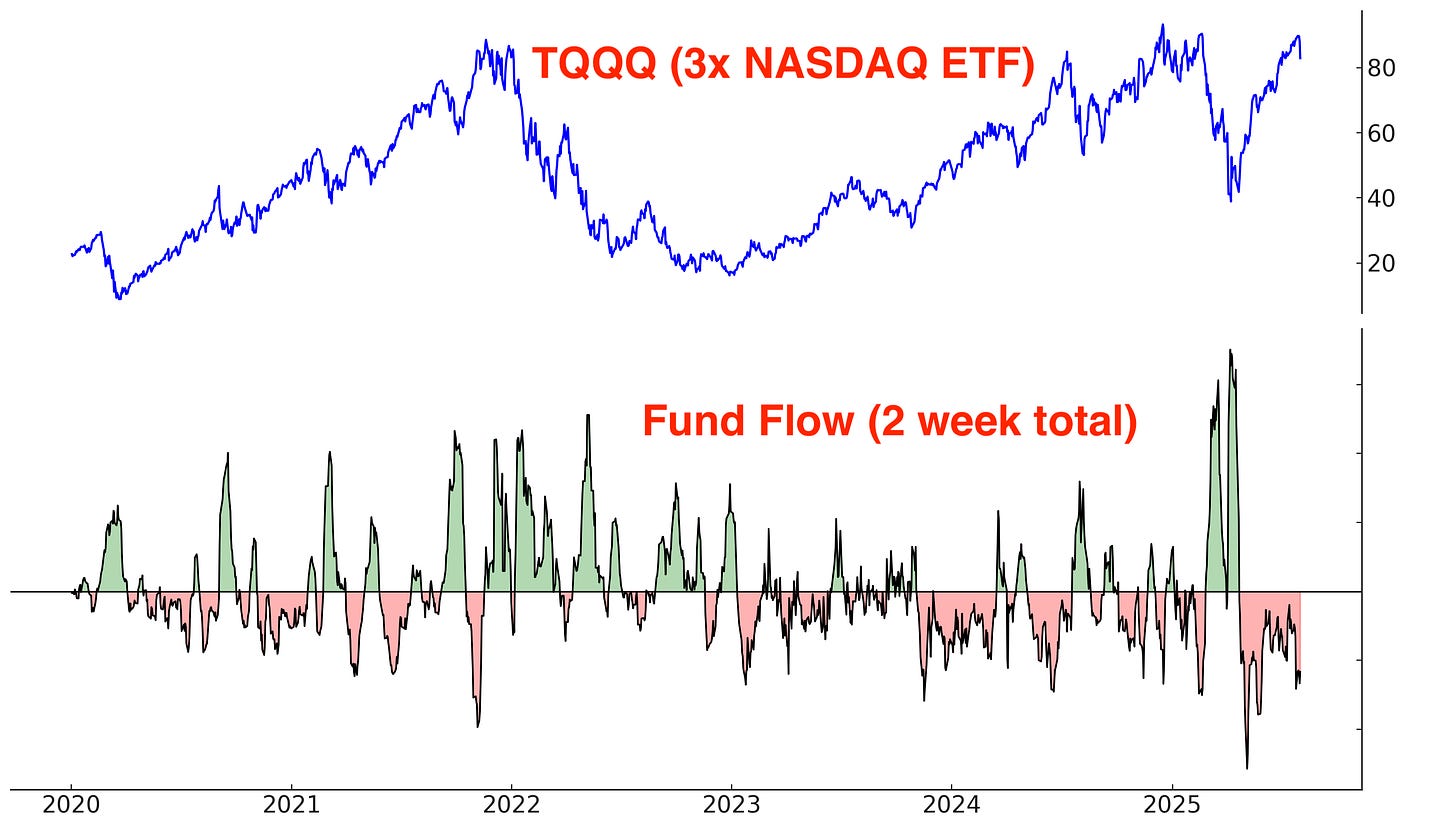

Fund Flows

*Fund flows aren’t automatically contrarian. It depends on what type of trader is buying/selling and why. Some ETFs are traded by mean-reversion traders, while other ETFs are traded by trend followers. Moreover, many ETFs are small relative to the underlying market, so fund flows don’t always reflect broad sentiment towards that market.

TQQQ is traded by mean-reversion traders who buy the dip when TQQQ falls and sell (take profits) when TQQQ rallies.

TQQQ is still seeing outflows. Endless profit-taking:

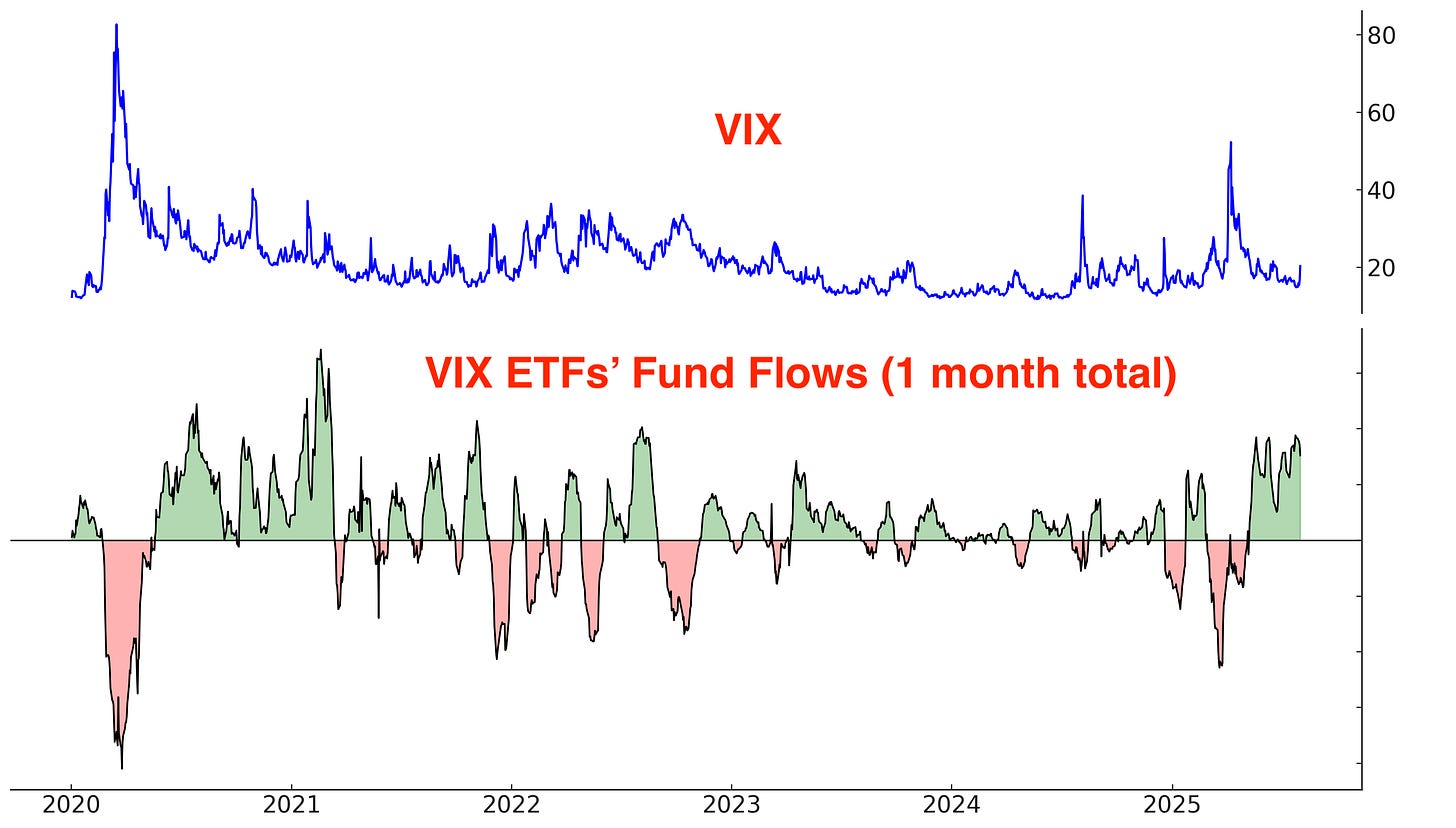

VIX ETFs are also traded by mean-reversion traders; they buy when VIX is low and sell (take profits) when VIX is high.

VIX ETFs have seen non-stop inflows over the past few months. These traders are betting on stocks to pullback and VIX to jump. VIX is now jumping higher:

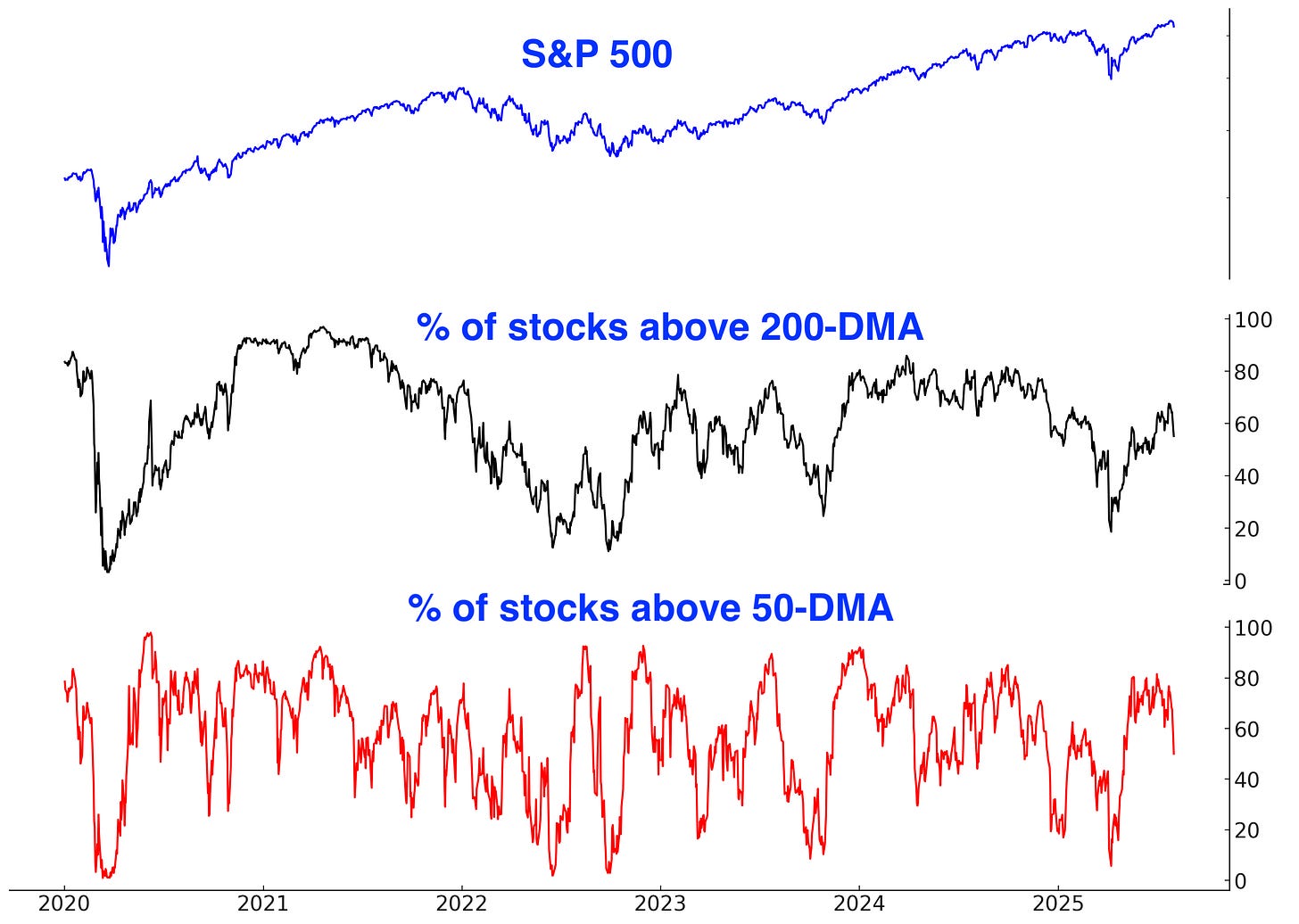

Breadth

Here are the % of S&P 500 stocks above their 200 and 50 day moving averages:

Trend

The trend is your friend, until it ends. Despite this pullback, stocks are still trending higher. This may change next week:

Why does trend matter? Because at least from a trend following perspective, it’s better to buy when the market is trending Up (e.g. above its 200-DMA) than when the market is trending Down (e.g. below its 200-DMA).

*There is nothing “special” about the 200 day moving average, except the fact that it’s popular. It is not significantly different from the 195, 190, 185, 180, 205, 210, 215, or 220 moving averages.

Long above vs. below the S&P 500’s 200 day moving average:

Long above vs. below the S&P 500’s 50 day moving average:

Long above vs. below the S&P 500’s 20 day moving average:

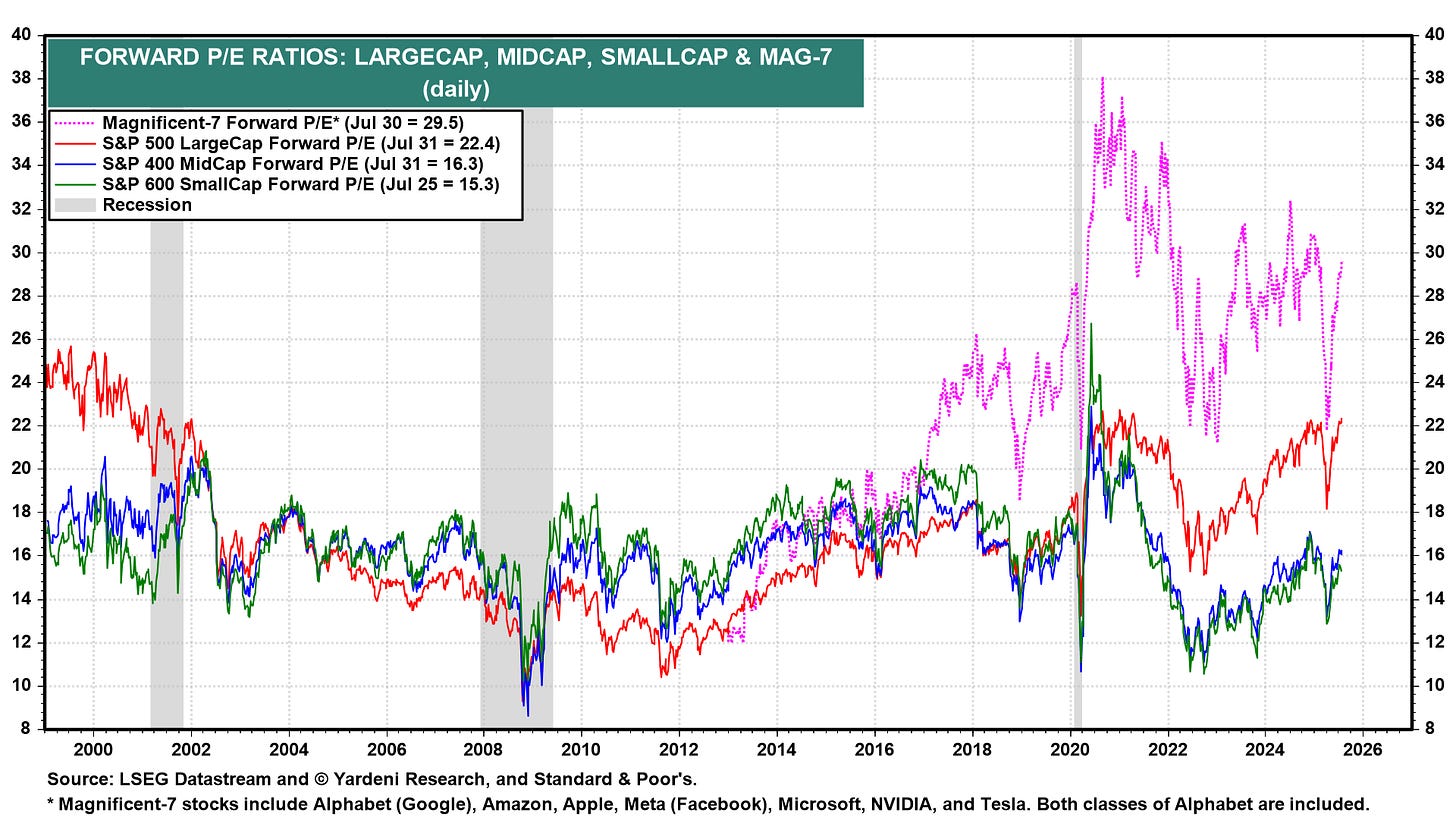

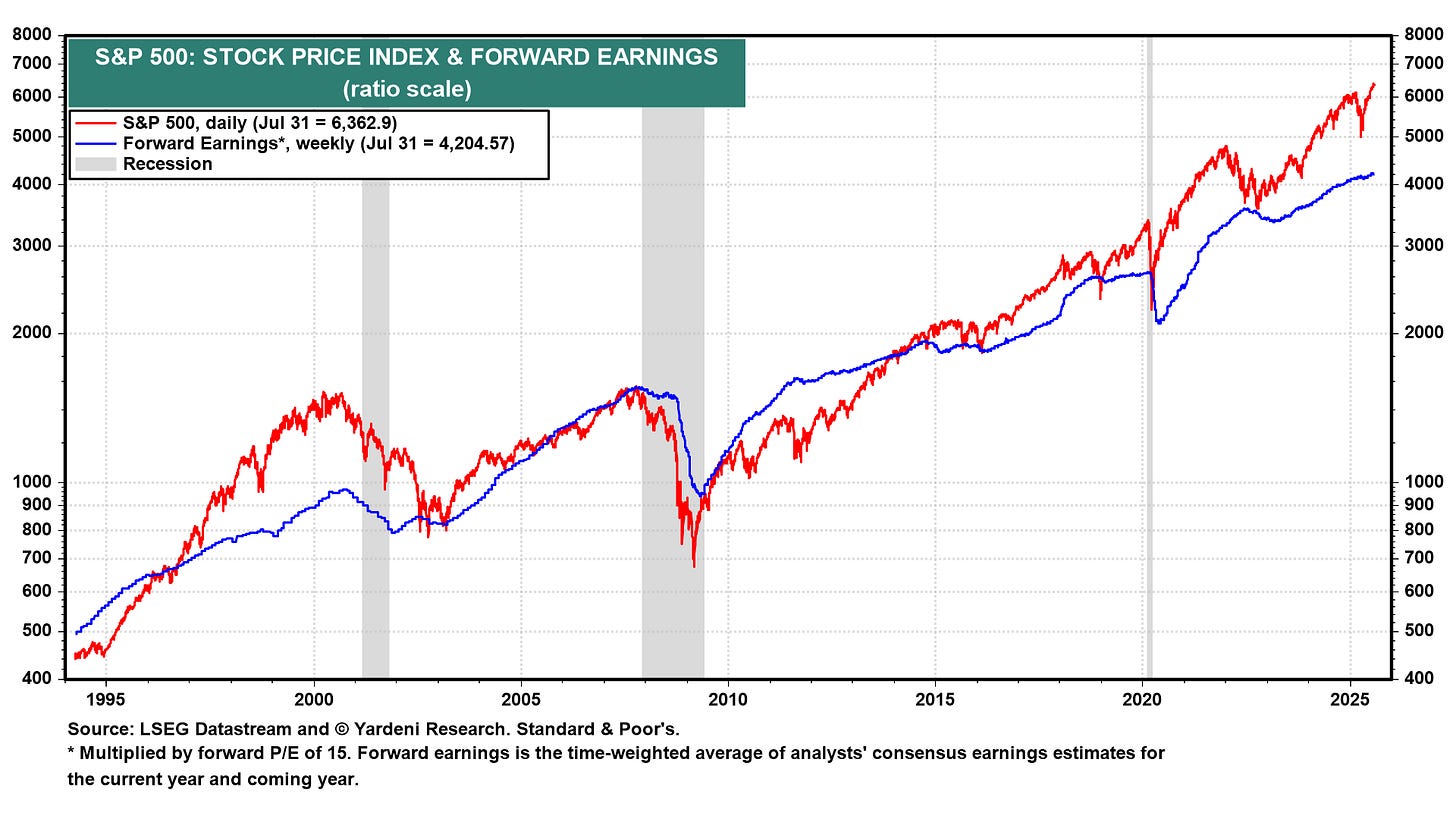

Earnings & Valuations

Some traders say that valuations and fundamentals are useless, and that “only price matters”. While this is true for day traders (valuations have zero impact on the market’s short term direction), fundamentals matter for traders and investors with longer term horizons.

Valuations for large cap stocks (S&P 500) remain elevated compared to their 10 year average:

Here’s the S&P 500’s forward earnings expectations. In the long run, earnings and stock prices move in the same direction. Earnings are still growing right now.