Markets Report: stocks are rallying ahead of trade deals

U.S. stocks are rallying in anticipation of "trade deals". What's next?

U.S. equities have erased all losses since “Liberation Day,” with the S&P 500 having retraced more than 61.8% of the February–April decline. As the Trump administration works on trade negotiations, markets are front-running the anticipated positive news.

My Portfolio:

*Click here if you don’t understand how I trade

Mean-Reversion Position – Long Oversold Tech Stocks: Currently my largest position. Targeting a mean-reversion rally. Reduced my position size by 1/4 & took some profits. Keeping the remaining 3/4 position.

*A rally in stocks could also push Bitcoin higher.

No position in Gold. Gold could correct/consolidate for weeks/months to work off the recent excess.

Mean-Reversion Position (Non-Core): long energy stocks. Small position size, will increase position size if energy stocks fall.

Mean-Reversion Position (Non-Core) - Long Indian Equities: Big beneficiary of U.S.-China trade war. Small position size.

Mean-Reversion Position (Non-Core) – Long U.S. Treasury Bonds: Small position size.

U.S. Equities

U.S. equities are in the midst of a mean-reversion bounce, as expected. A common minimum target for such moves is the 61.8% Fibonacci retracement level, which the S&P 500 exceeded on Friday. I took some profits on my long tech stocks position and have kept the remaining 3/4 position.

I still expect stocks to trade in a wide and volatile range throughout 2025: not a runaway bull like 2023–2024, nor a bear market like 2022, and certainly nothing resembling 2008. That said, a marginal new high in the S&P 500 remains possible. I’ll adjust my view as conditions evolve—stubbornness is expensive for traders.

Options

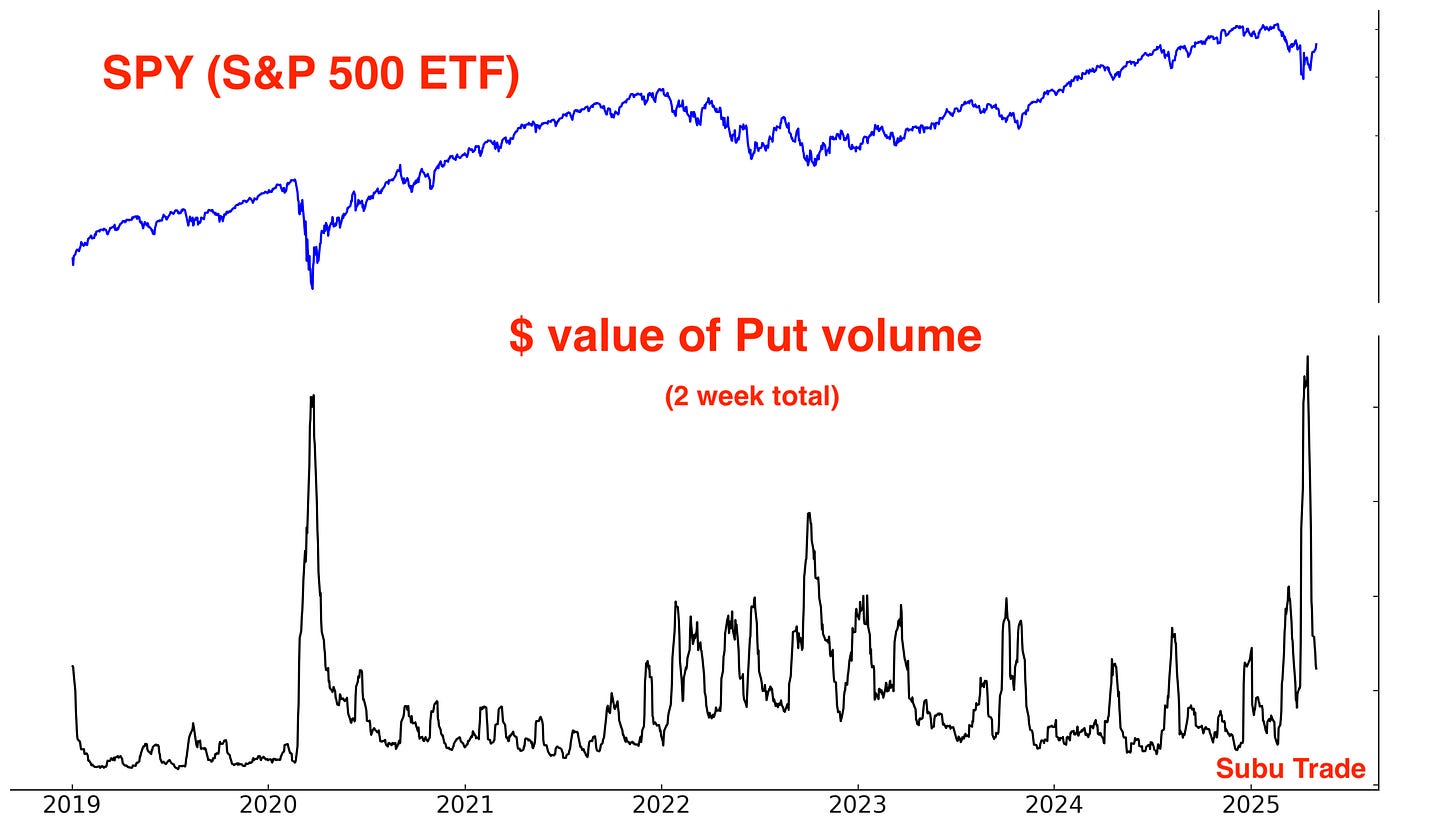

After a historic spike, the $ value of S&P 500 Put volume is coming down:

The dollar value of SPY Put volume is also coming down:

Sentiment Surveys

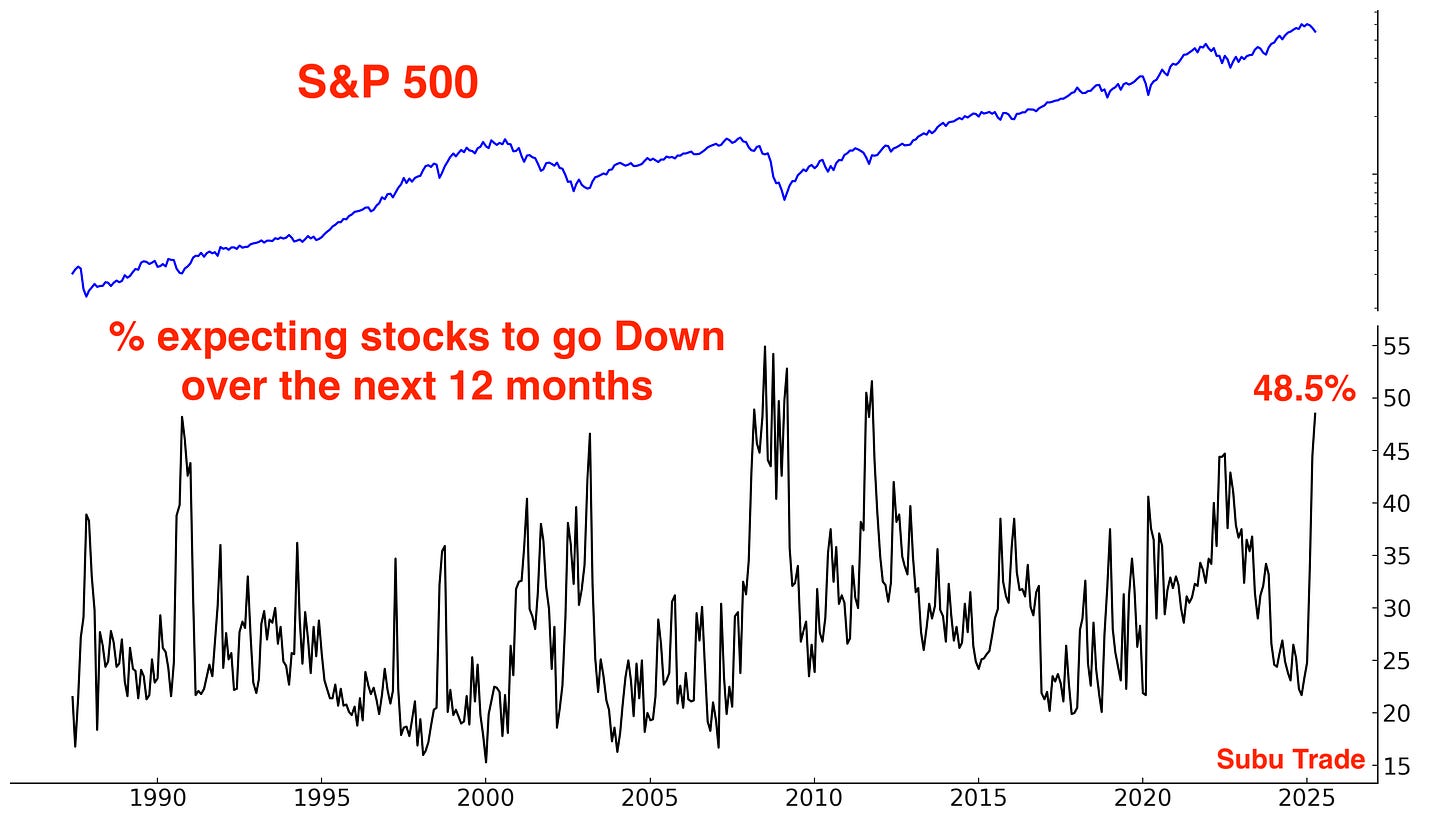

According to the Conference Board’s Consumer Confidence report, 48.5% of consumers expect stocks to fall over the next 12 months. This is the most pessimism since 2011:

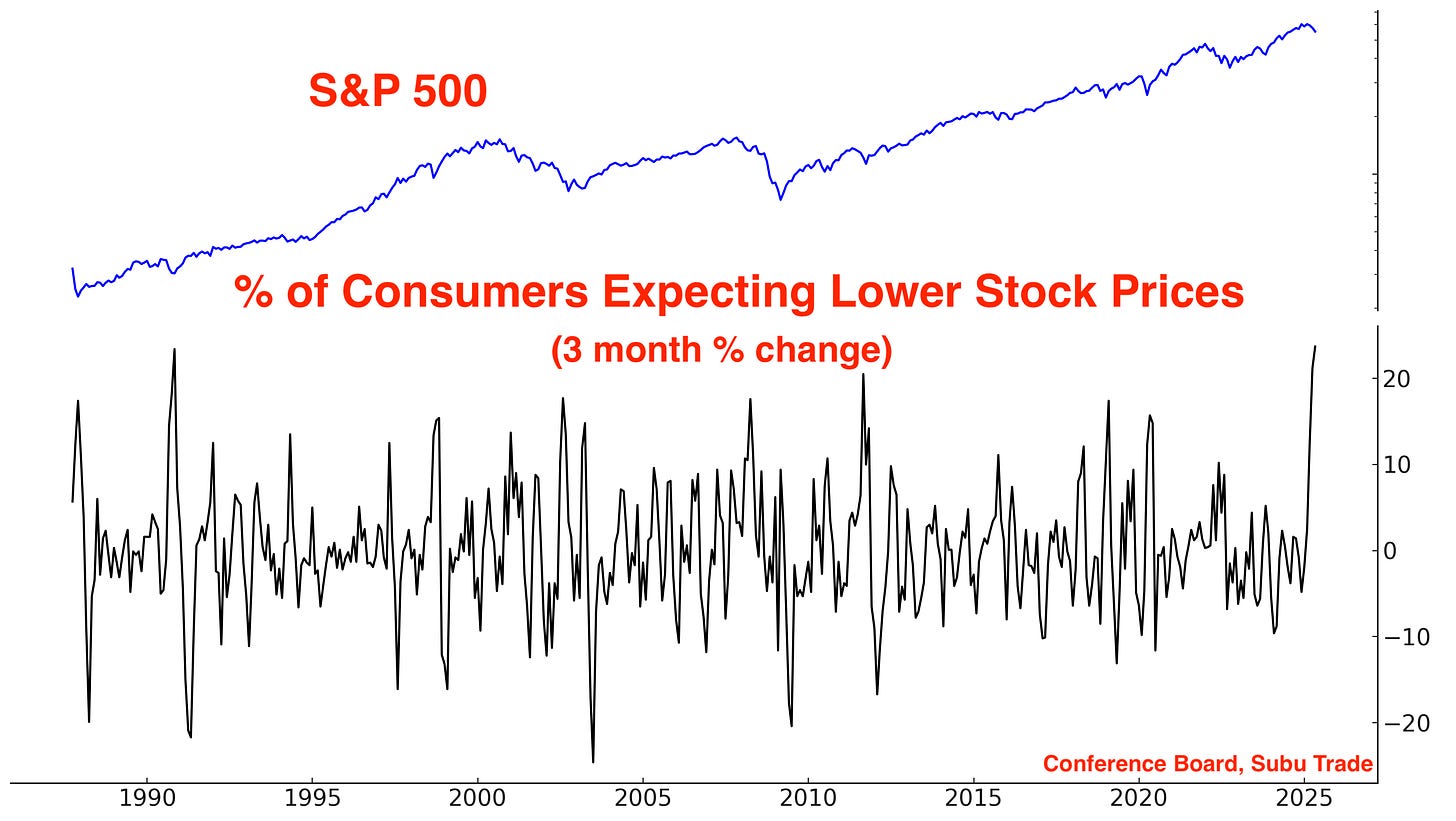

This figure increased by +23.7% over the past 3 months, the largest jump in pessimism ever:

Despite the rally, 59.3% of AAII participants remain bearish. The 10 week average for this figure has reached 58%, the highest ever:

AAII Bears have exceeded 50% for 10 straight weeks, a record streak:

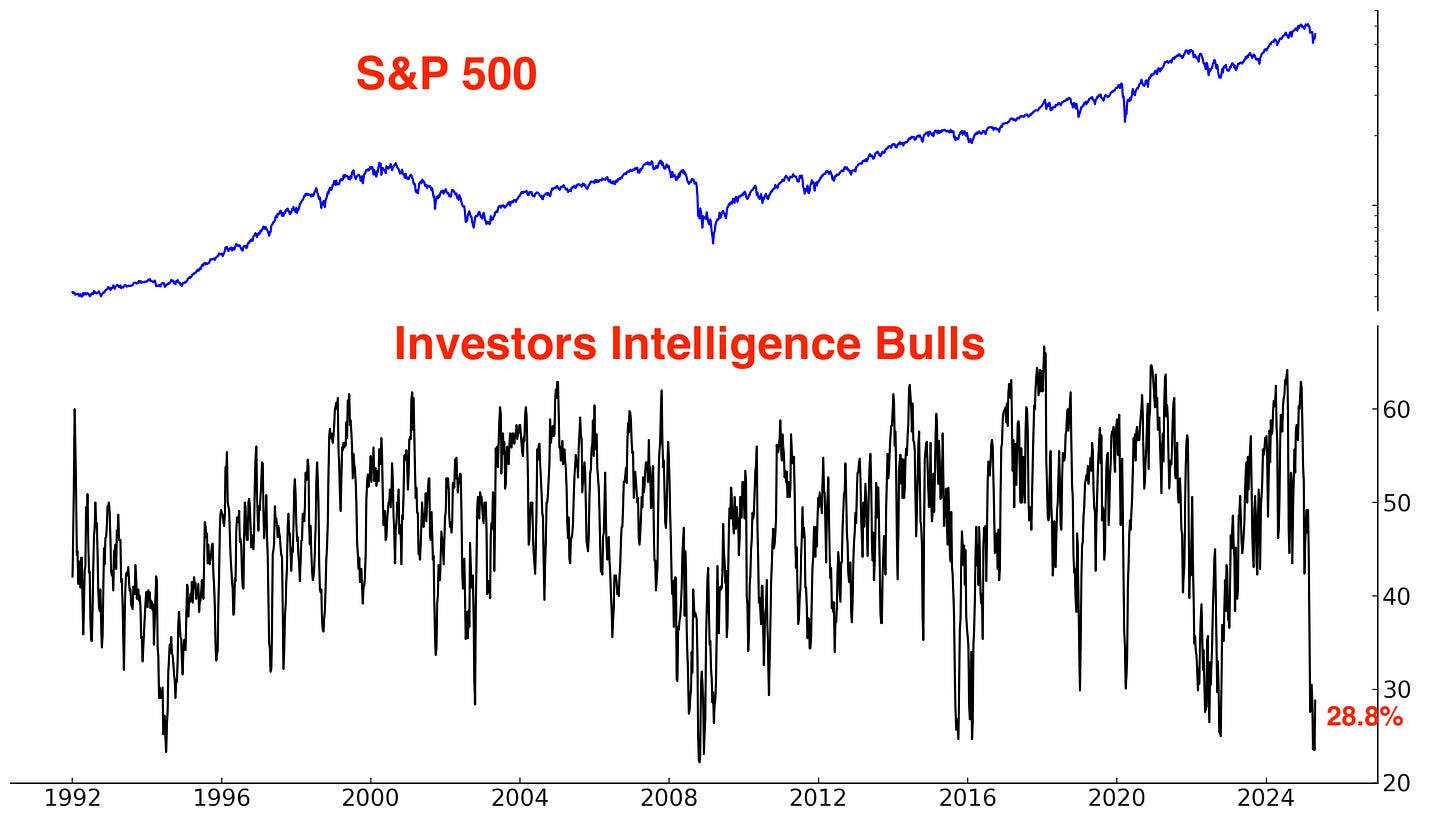

Investors Intelligence Bulls remains at 28.8%:

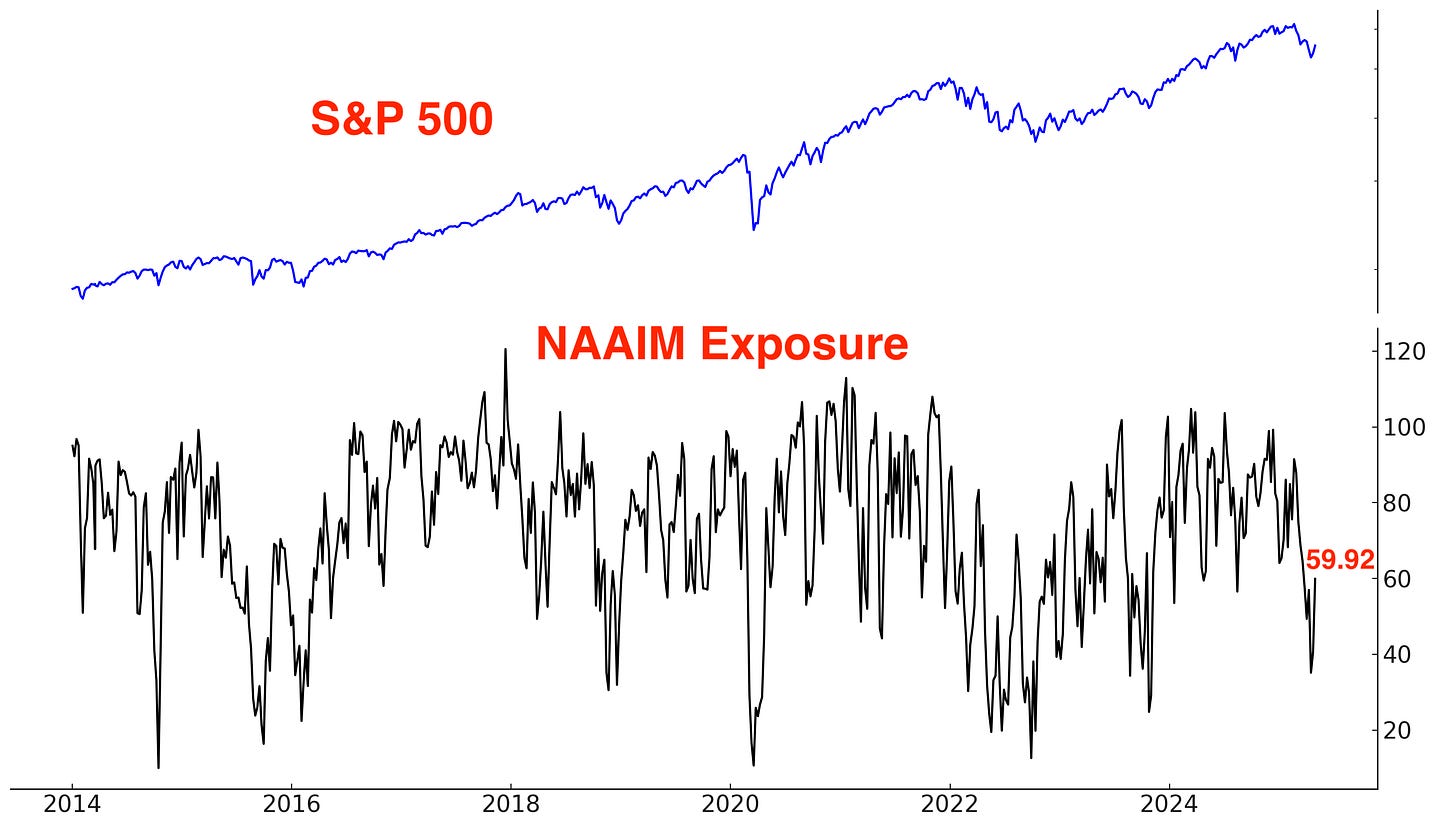

NAAIM Exposure Index climbed a little:

Overall, sentiment remains quite pessimistic. Few investors and traders believe in the rally, which has left them in the dust.

Breadth

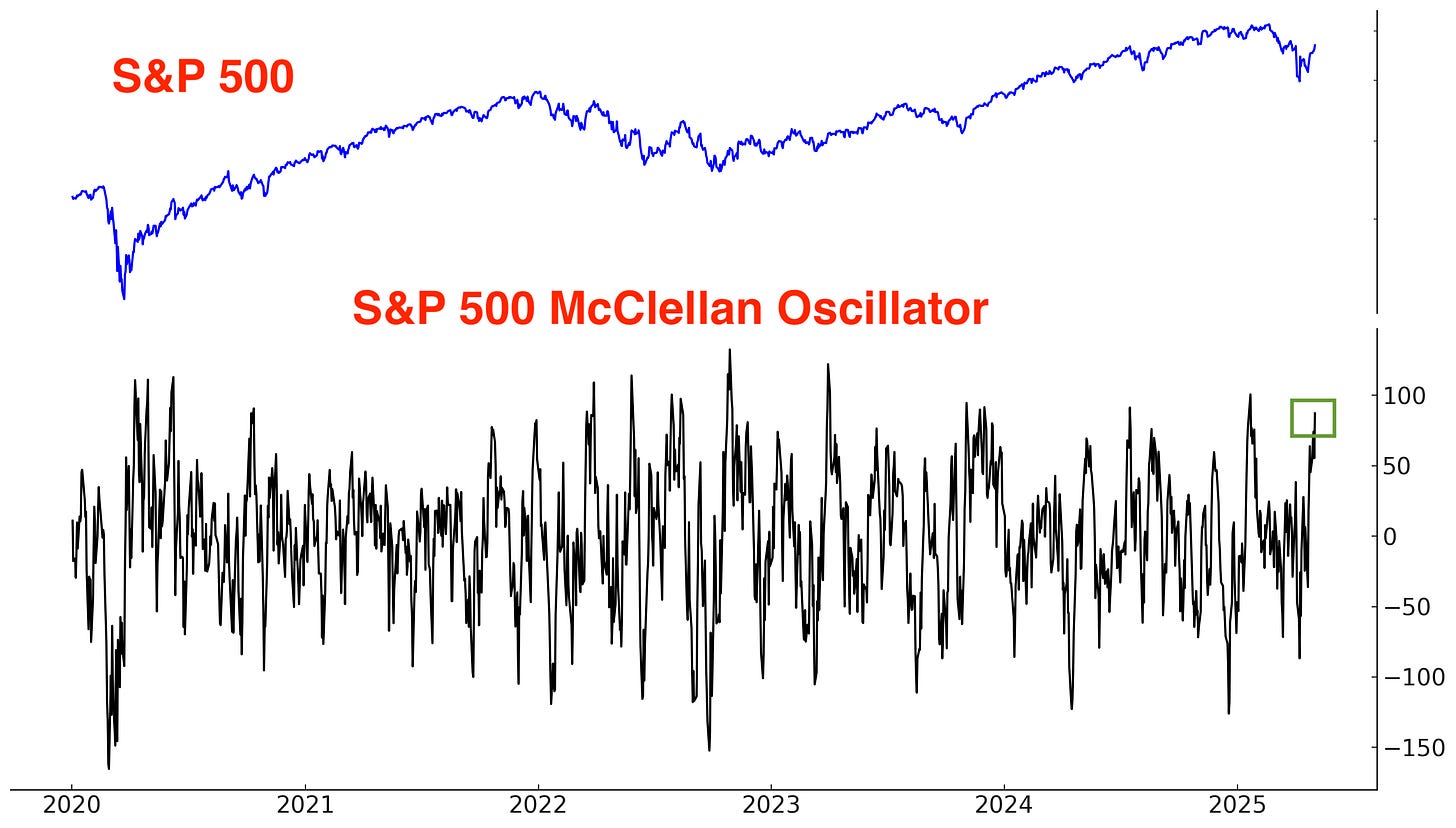

Breadth remains strong. The S&P 500 McClellan Oscillator is climbing. This could lead to a short term pullback, but such strength is usually bullish for stocks over the next few months:

Here are the % of S&P 500 stocks above their 200 and 50 day moving averages:

Here are the % of NASDAQ stocks above their 200 and 50 day moving averages:

Short-term Pullback?

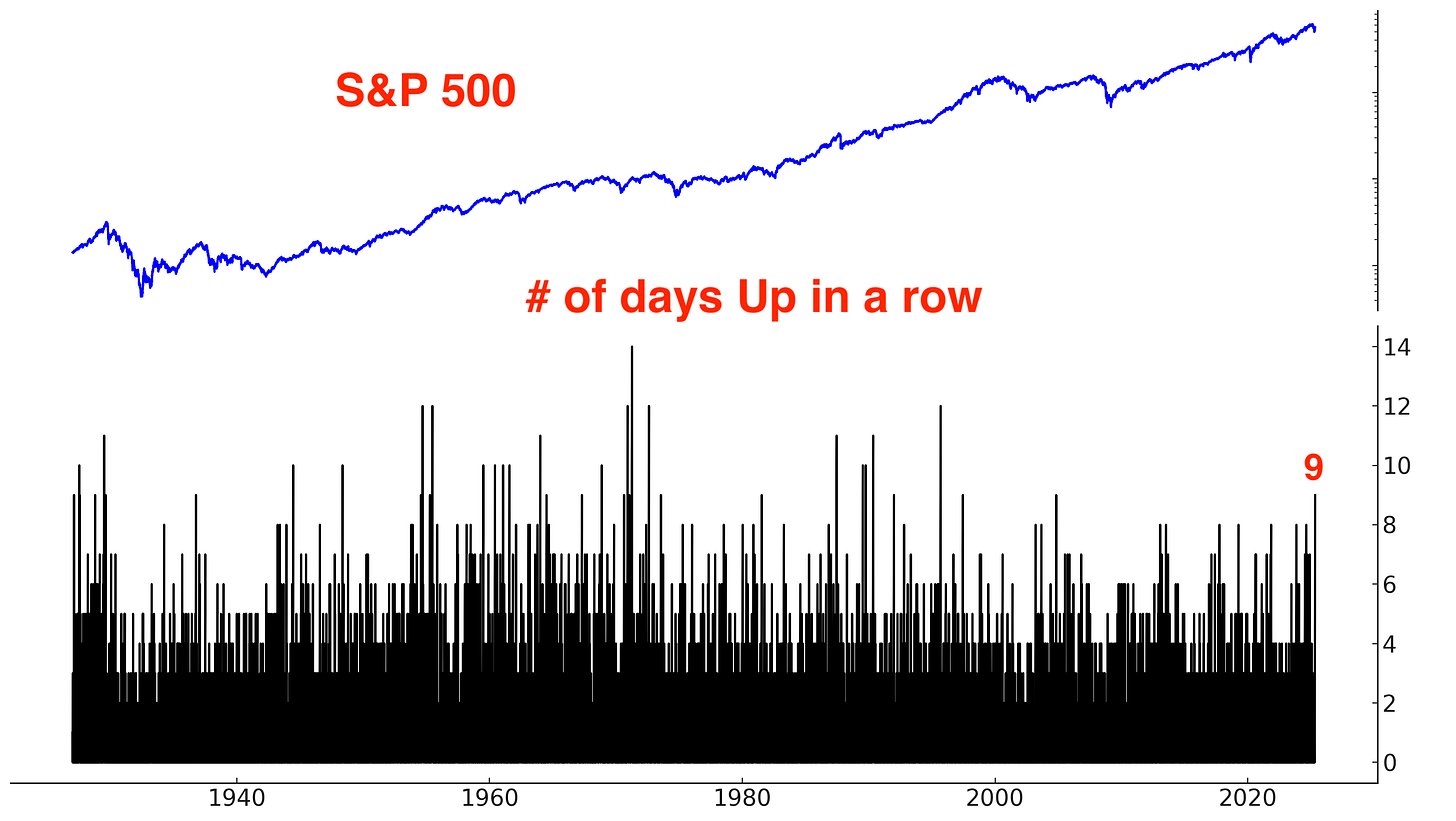

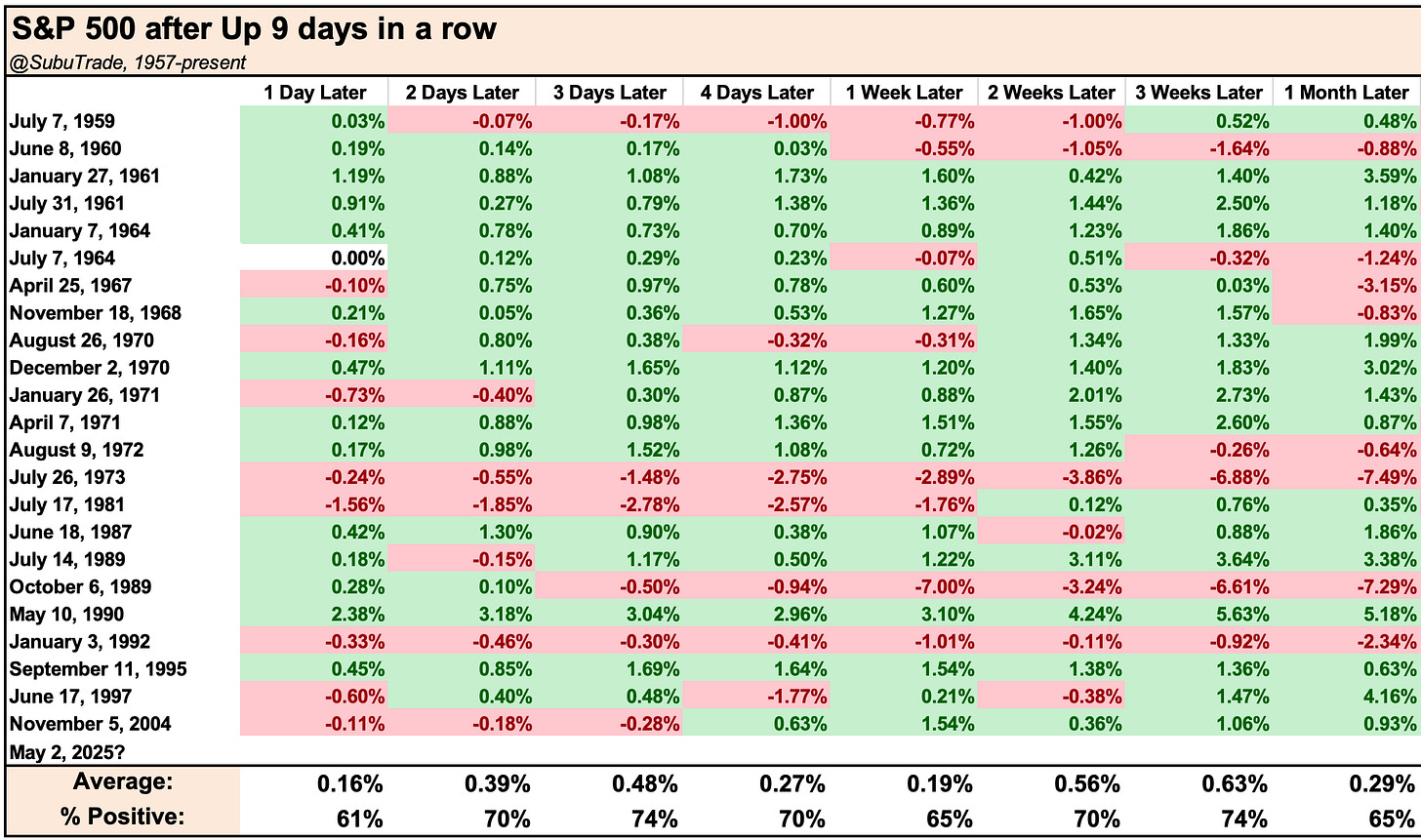

The S&P 500 is up 9 days in a row while still under its 200 day moving average. This is extremely rare; most 9 day streaks occur when the S&P is above its 200 day moving average.

Could we see a quick pullback? Perhaps. But I’m generally cautious about trying to time minor dips, and I’d never short stocks based on the expectation of a 1–2 day decline. Short-term price action is highly unpredictable, and once momentum kicks in, rallies can overshoot far beyond what mean-reversion signals imply. Just look at Meta in January–February: it rallied 20 days in a row. These types of rallies are rare, but when they happen, shorting into strong momentum can be deadly.

Other Sentiment

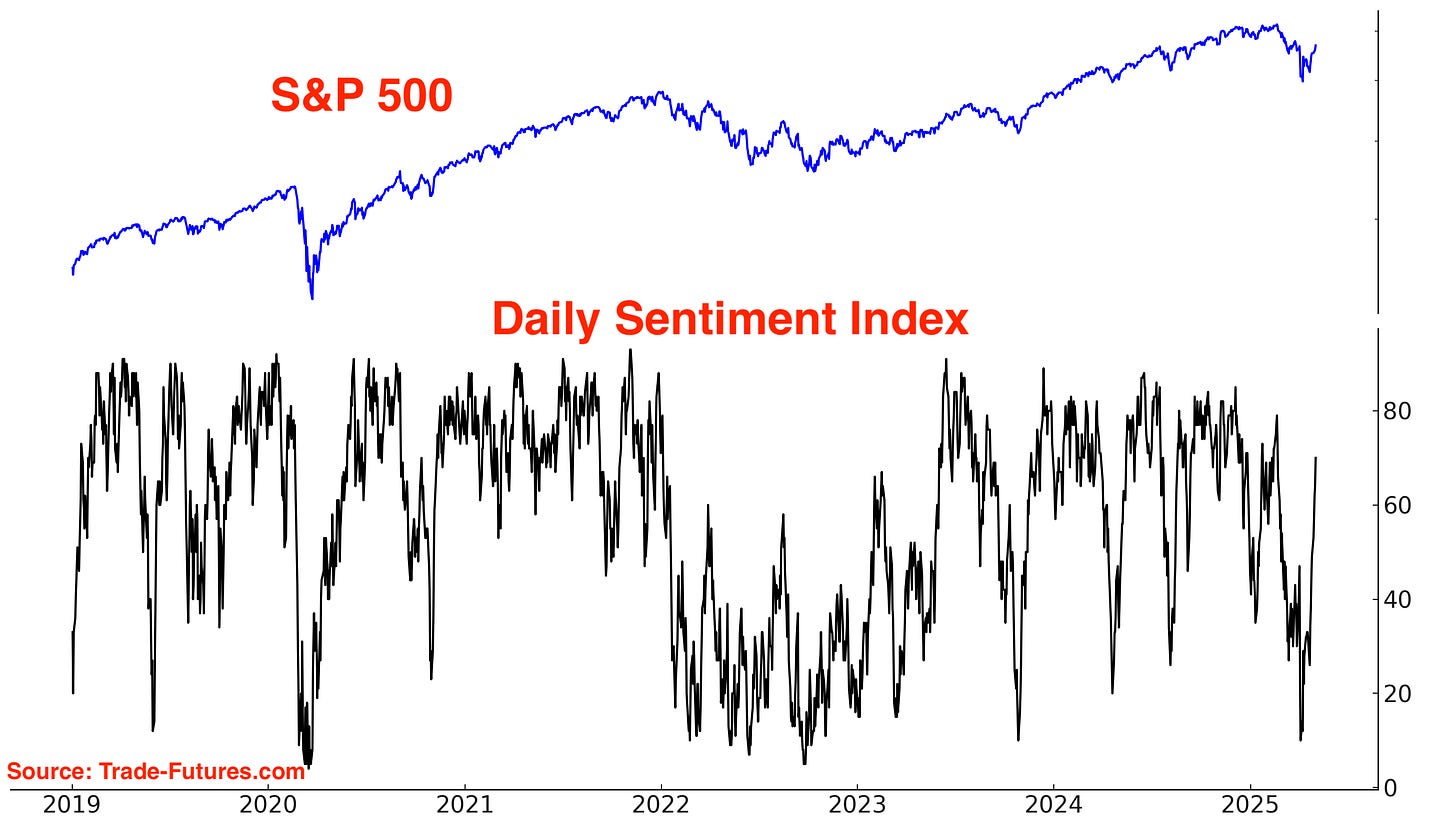

The S&P 500’s Daily Sentiment Index is mean-reverting upwards:

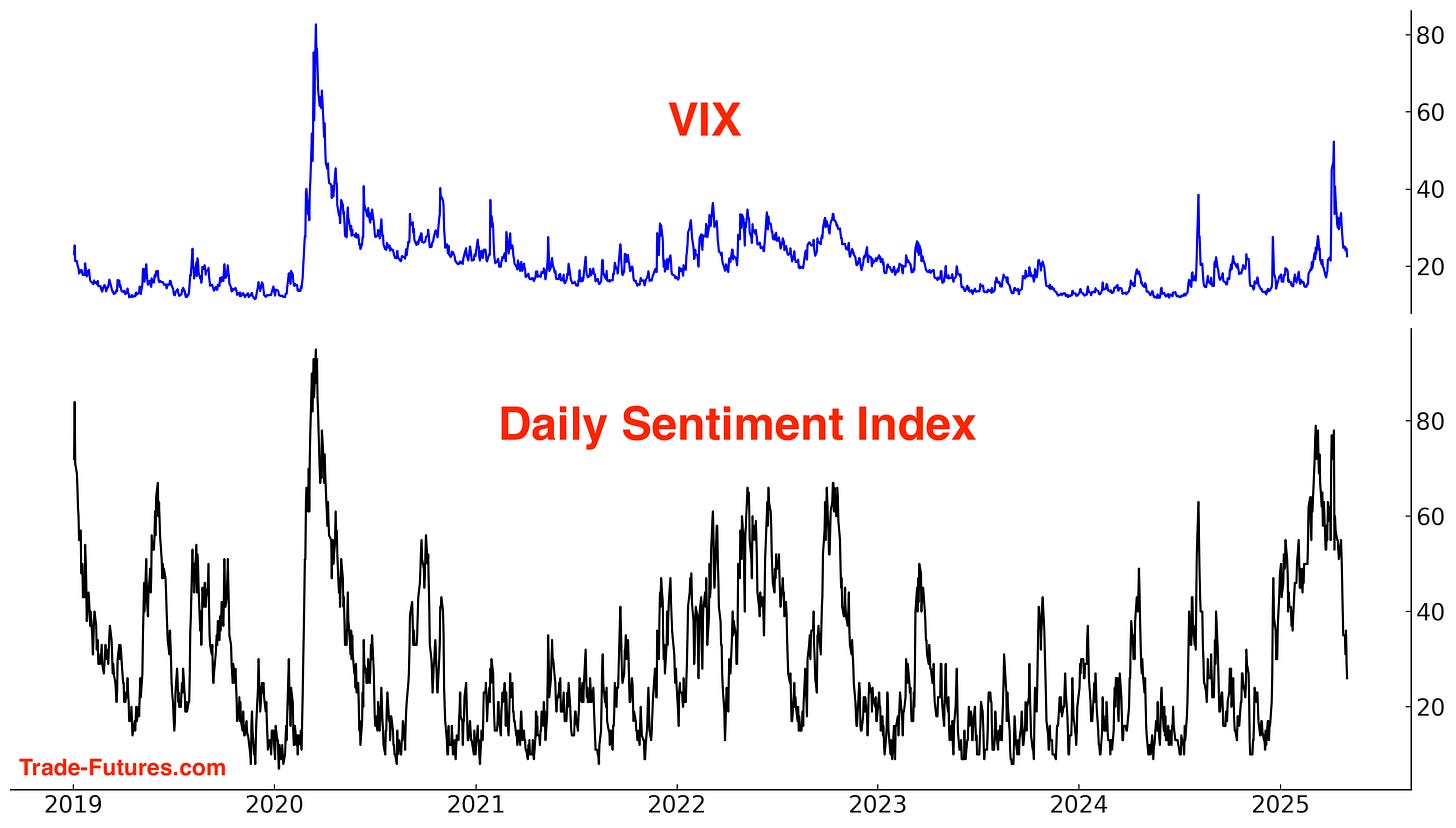

The VIX Daily Sentiment Index is falling along with VIX:

CNN Fear & Greed is mean-reverting upward:

Fund Flow

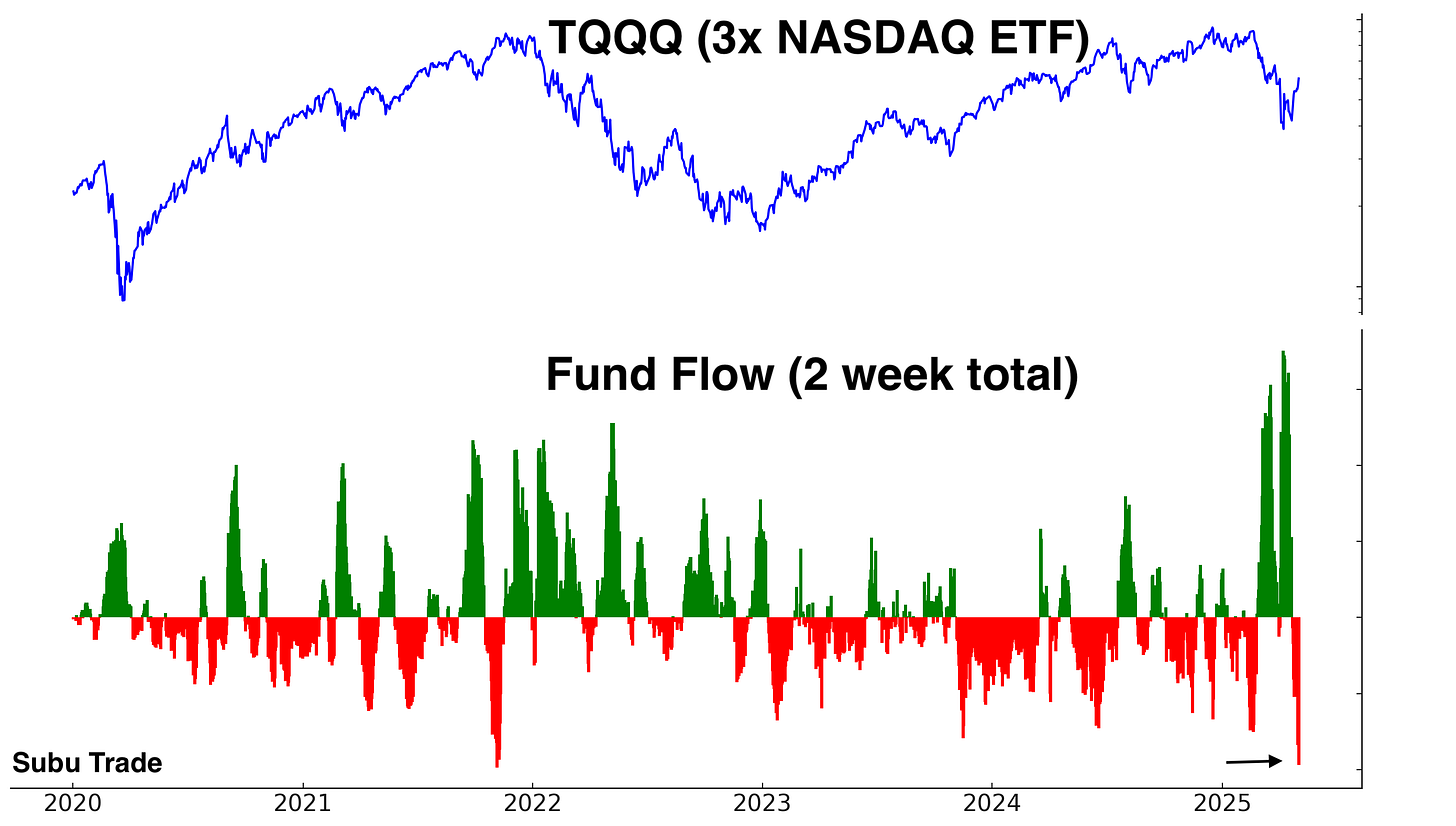

TQQQ traders are contrarian: they buy the dip and sell the rip. They’re now selling and taking profits on their long positions:

Corporate Insiders

The recent stock market crash was not accompanied by a notable spike in the Corporate Insider Buy/Sell ratio:

Global Earnings Revisions

World Earnings Revisions are deeply negative on tariff fears:

Trend

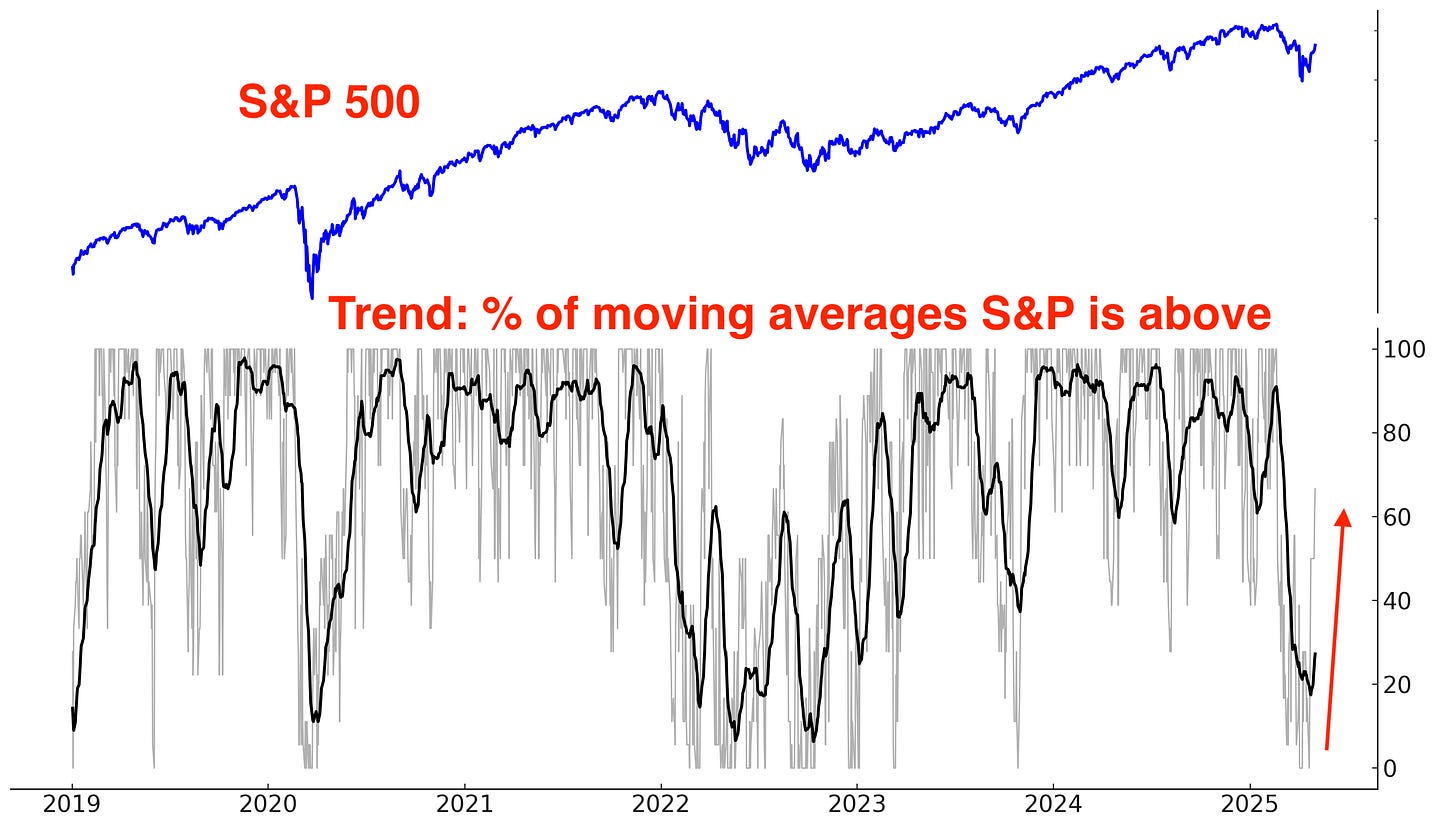

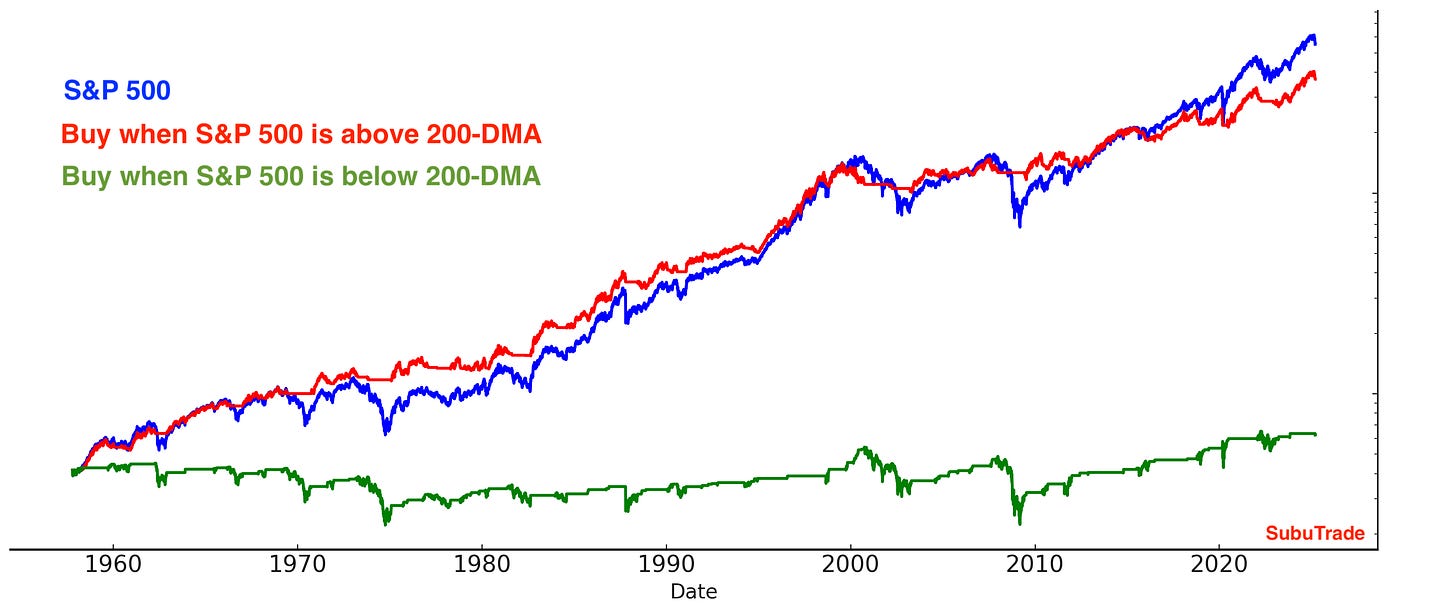

The trend is your friend, until it ends. The U.S. stock market is no longer trending downwards, and is now approaching the 200 day moving average.

Why does this matter? Because at least from a trend following perspective, it’s better to buy when the market is trending Up (e.g. above its 200-DMA) than when the market is trending Down (e.g. below its 200-DMA). This doesn’t mean that the market can’t rally from below it’s 200-DMA. It simply means that risk and volatility are higher down there.

Overall, U.S. stocks could make a quick 1-2 day pullback here, followed by another push higher. Traders who missed the bottom could chase the rally here, with their buying pushing stocks even higher. I remain long despite the risk of a short term pullback.

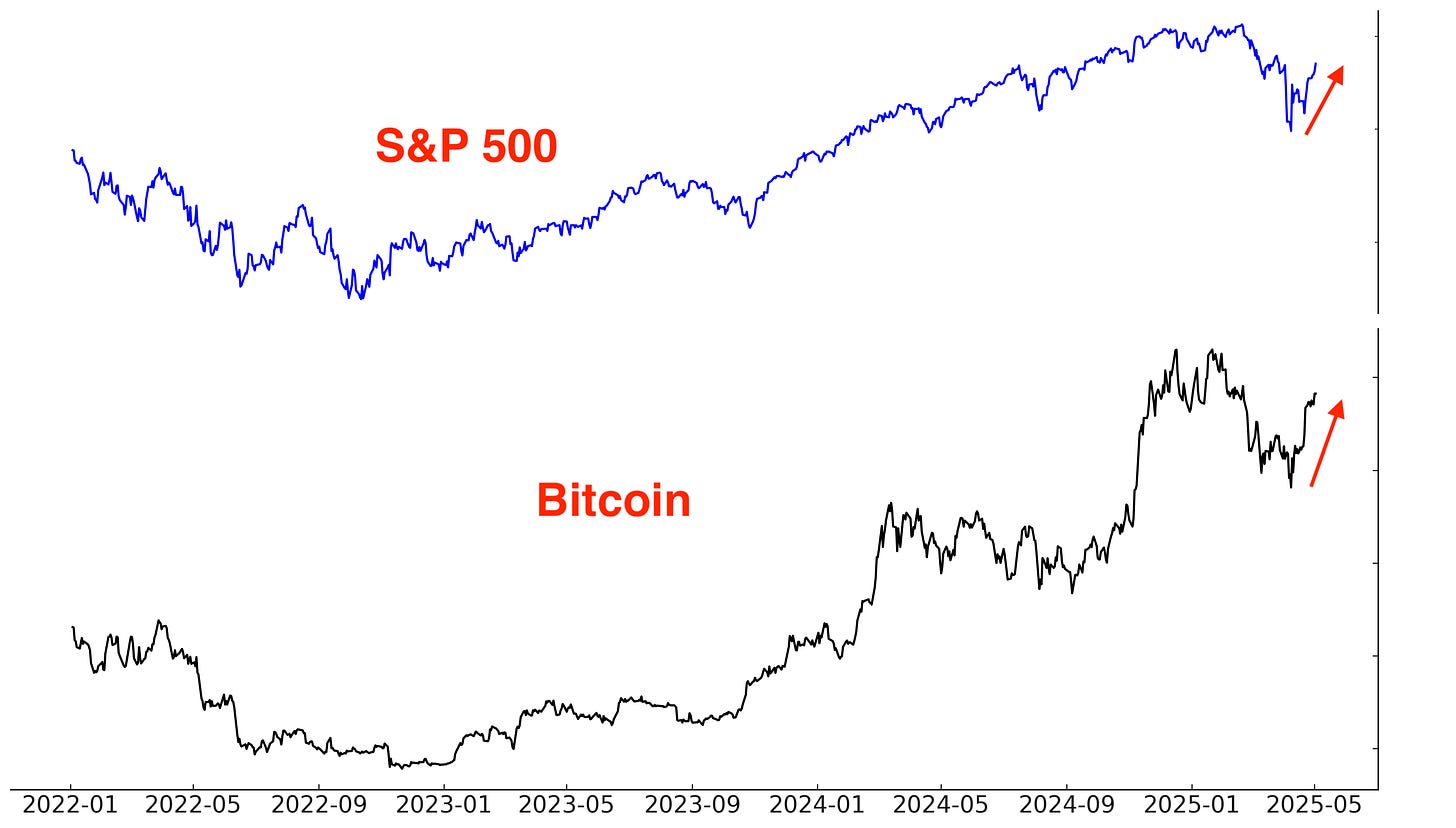

Bitcoin

Bitcoin is a high-beta, risk-on asset that generally rises when stocks rally and struggles when stocks fall. While its directional correlation with stocks is clear, its price action is unique—less wave-like, more staircase: sharp moves followed by prolonged consolidation.

Bitcoin performed relatively well when stocks crashed in February-April. I have no position in Bitcoin, but a stock market rally will probably coincide with a Bitcoin rally.

Someone bought $2.1 million worth of IBIT calls (Bitcoin ETF), targeting a new all-time high by the end of July.

Gold, silver, and energy

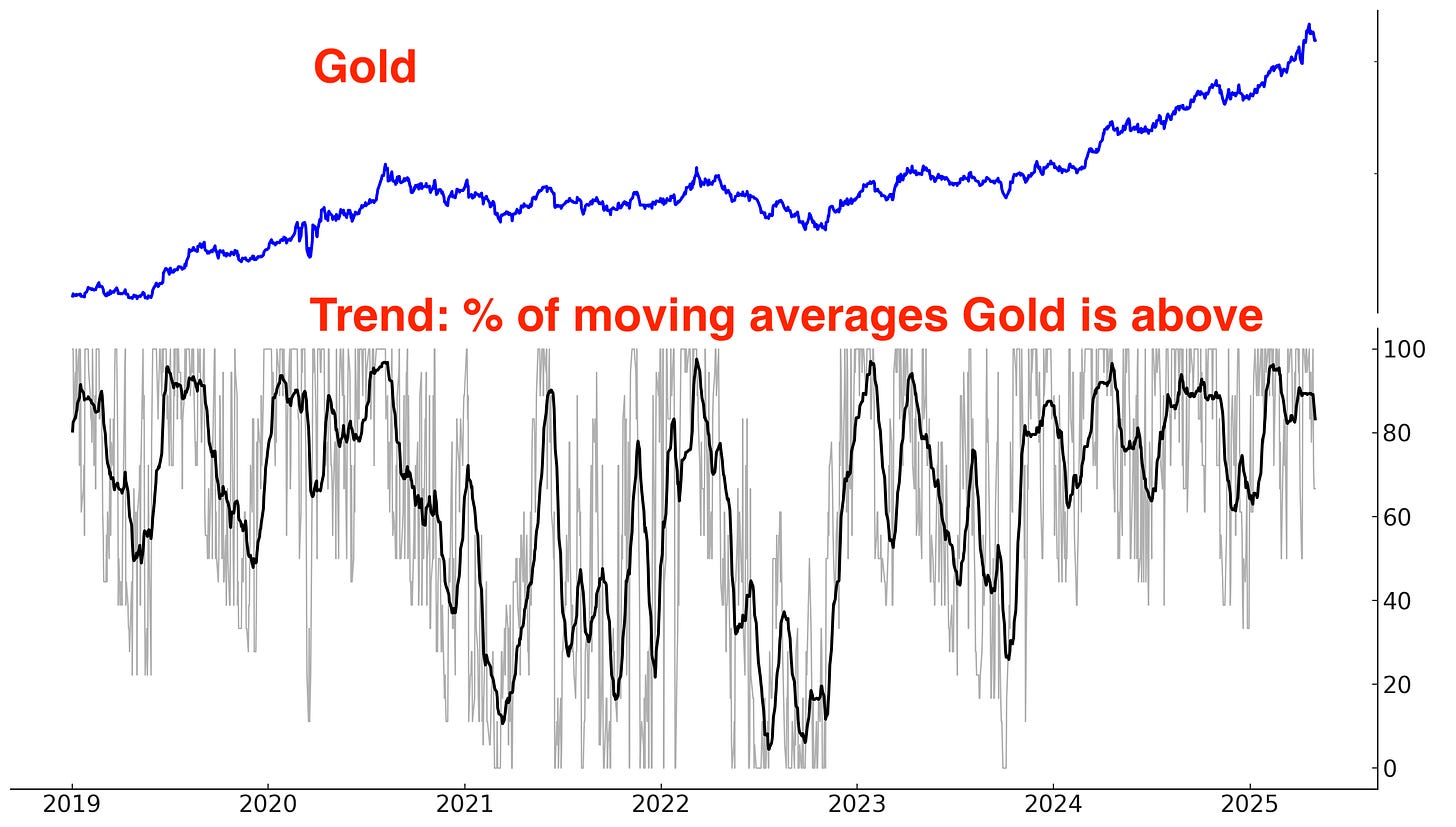

In a classic safe-haven move, gold spiked when stocks struggled 2-3 weeks ago. Now that stocks are rallying, safe-haven demand is falling and gold is in a corrective/consolidation phase.

Gold could take several weeks/months to work off its extreme overbought conditions. The bullish theme/narrative for gold is still alive, but I will re-evaluate the bull case later when this correction/consolidation is over.

Trend

After a huge spike, gold is starting to trend sideways.

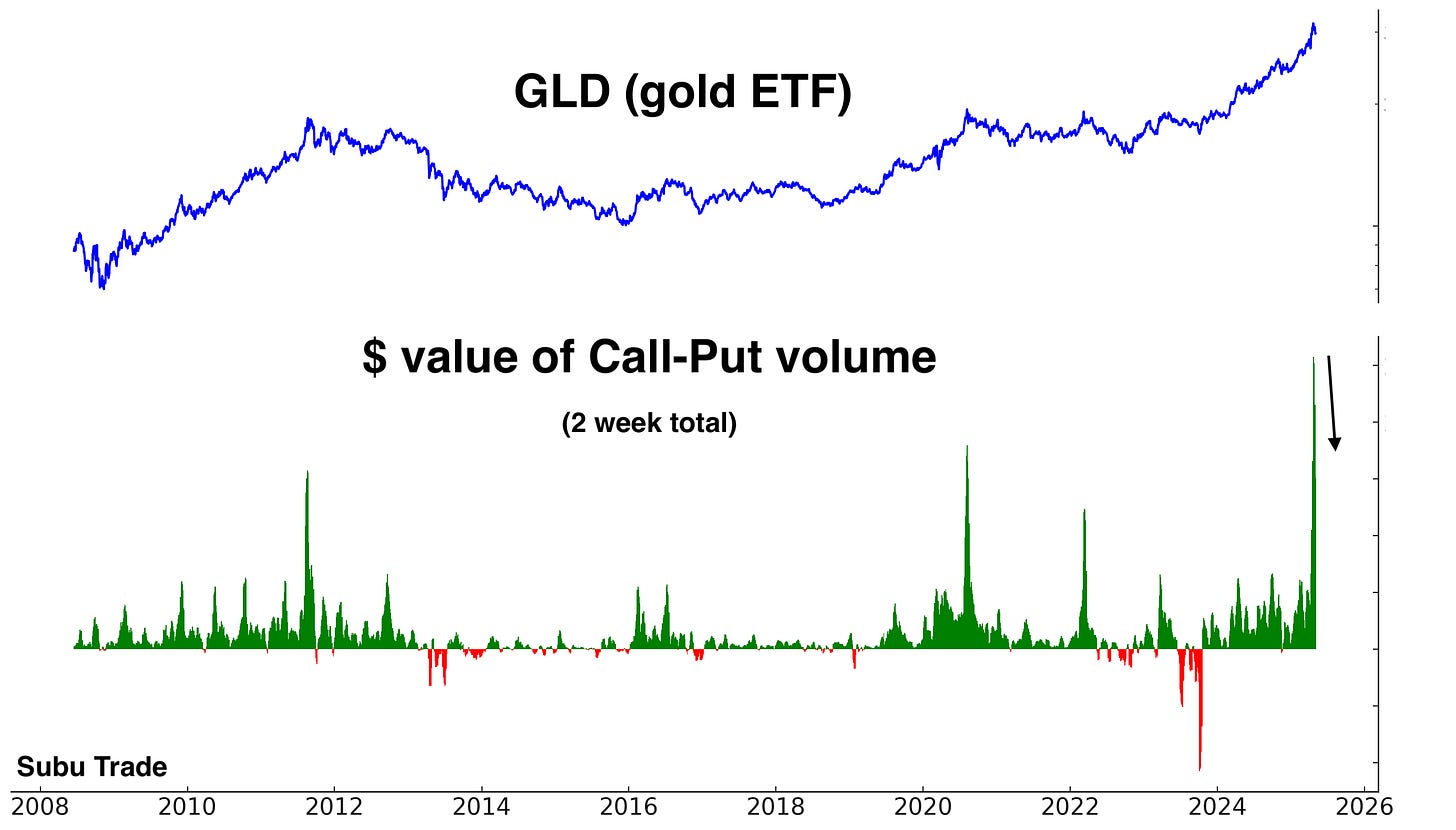

Options

The massive spike in the $ value of GLD call volume - put volume is starting to come down:

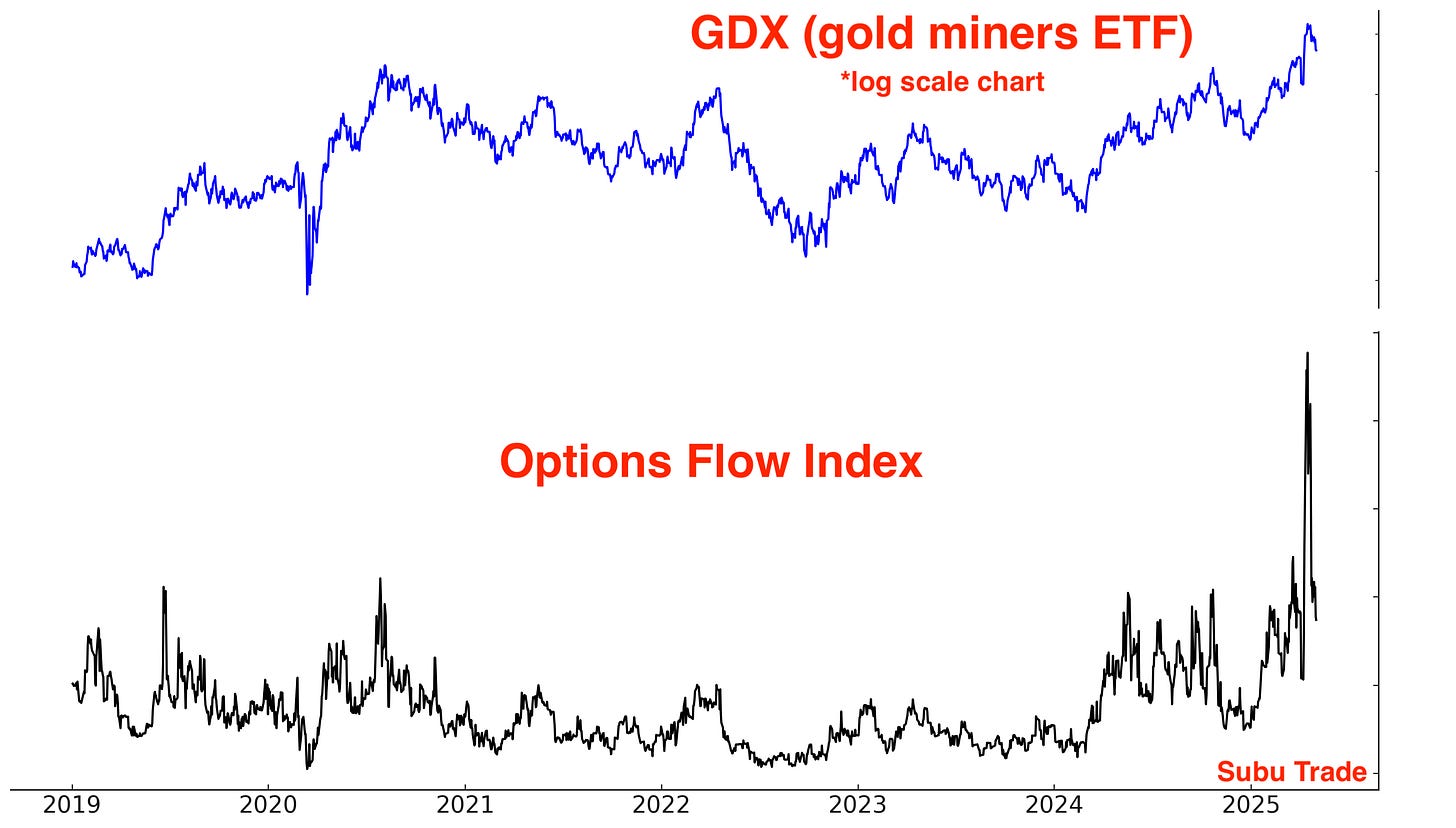

The GDX Options Flow Index spiked and is now coming down:

Sentiment

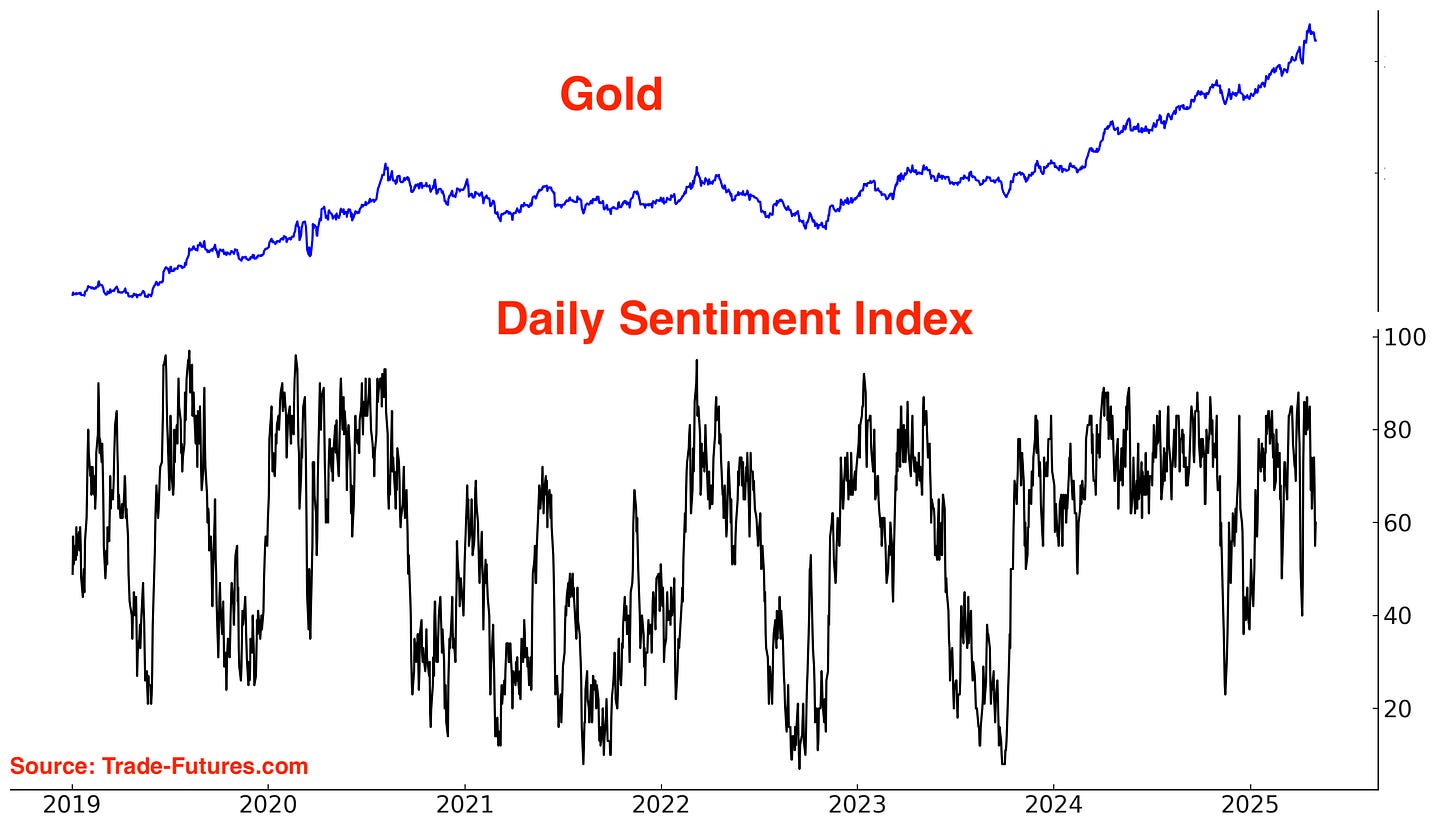

Sentiment is starting to come down:

Fund Flows

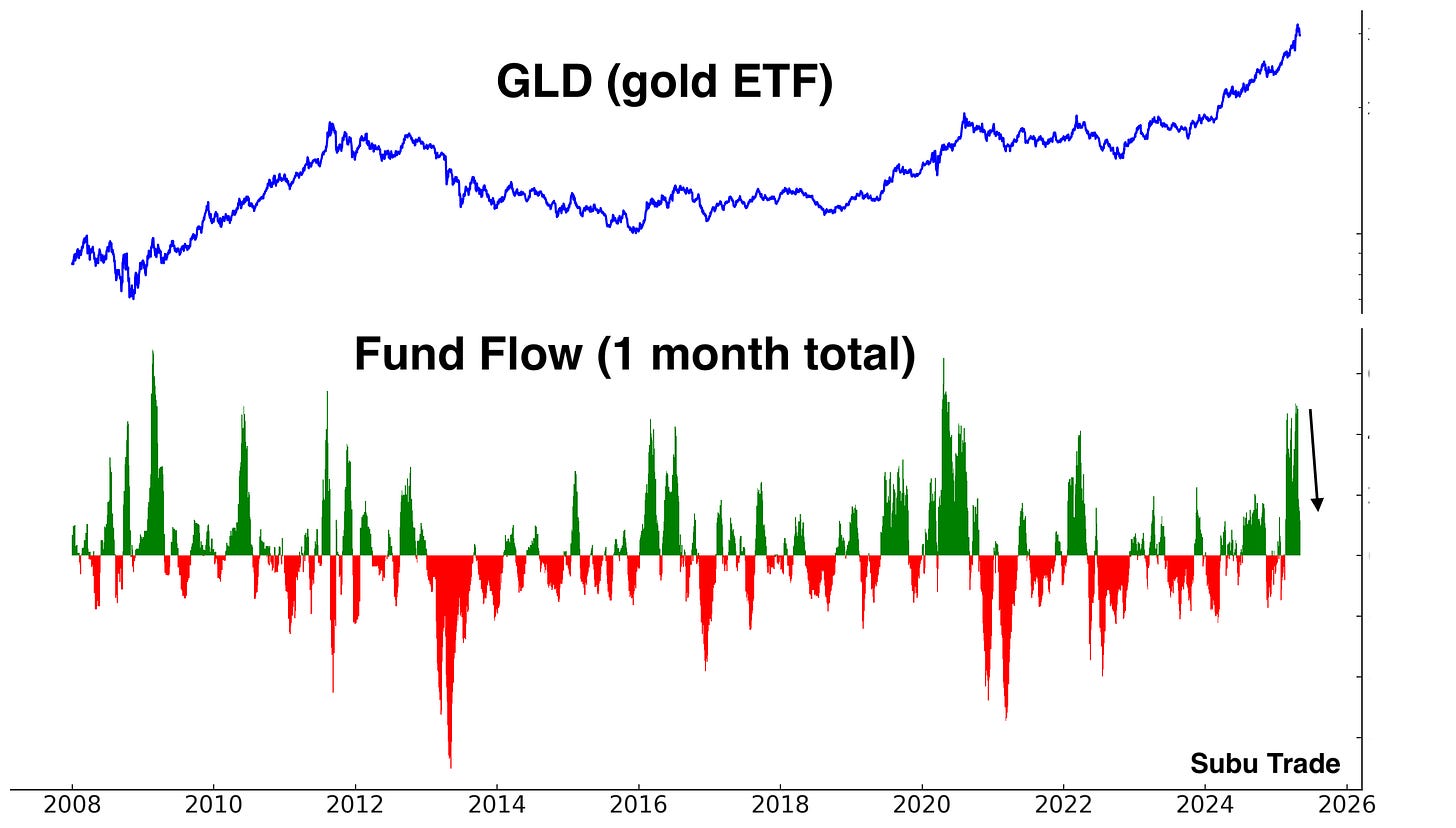

Inflows into GLD are starting to come down:

The long term bullish theme/narrative for gold remains: global central banks (primarily China) need to diversify their reserve holdings away from U.S. Treasuries. Gold will pick up some of that diversification.

Energy

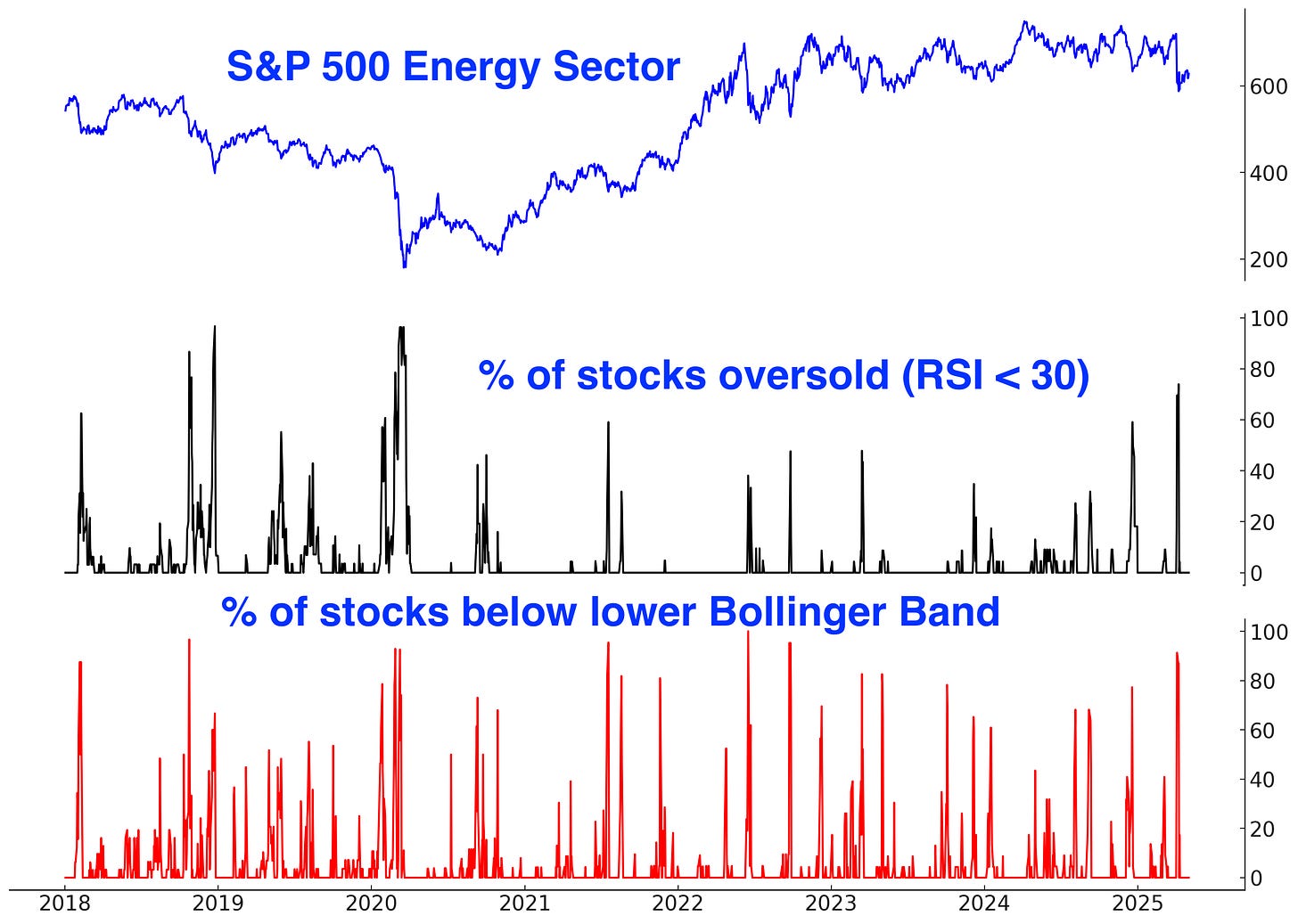

Energy prices and energy stocks declined when Trump's tariffs ignited global recession fears. As the U.S. pursues new trade agreements, easing recession concerns could set the stage for a rebound in energy.

There’s an interesting analogy between energy stocks today and 2020.

While I don’t think U.S. stocks will rally to massive new all-time highs the way they did in 2020 (the Fed isn’t printing trillions of $ today!), it’s interesting to note energy’s price action.

When the broad U.S. stock market rallied after COVID, energy stocks first rallied, then fell, then rally again.

Could the same thing be happening today?

The % of energy stocks oversold and below their Bollinger Bands spiked in April:

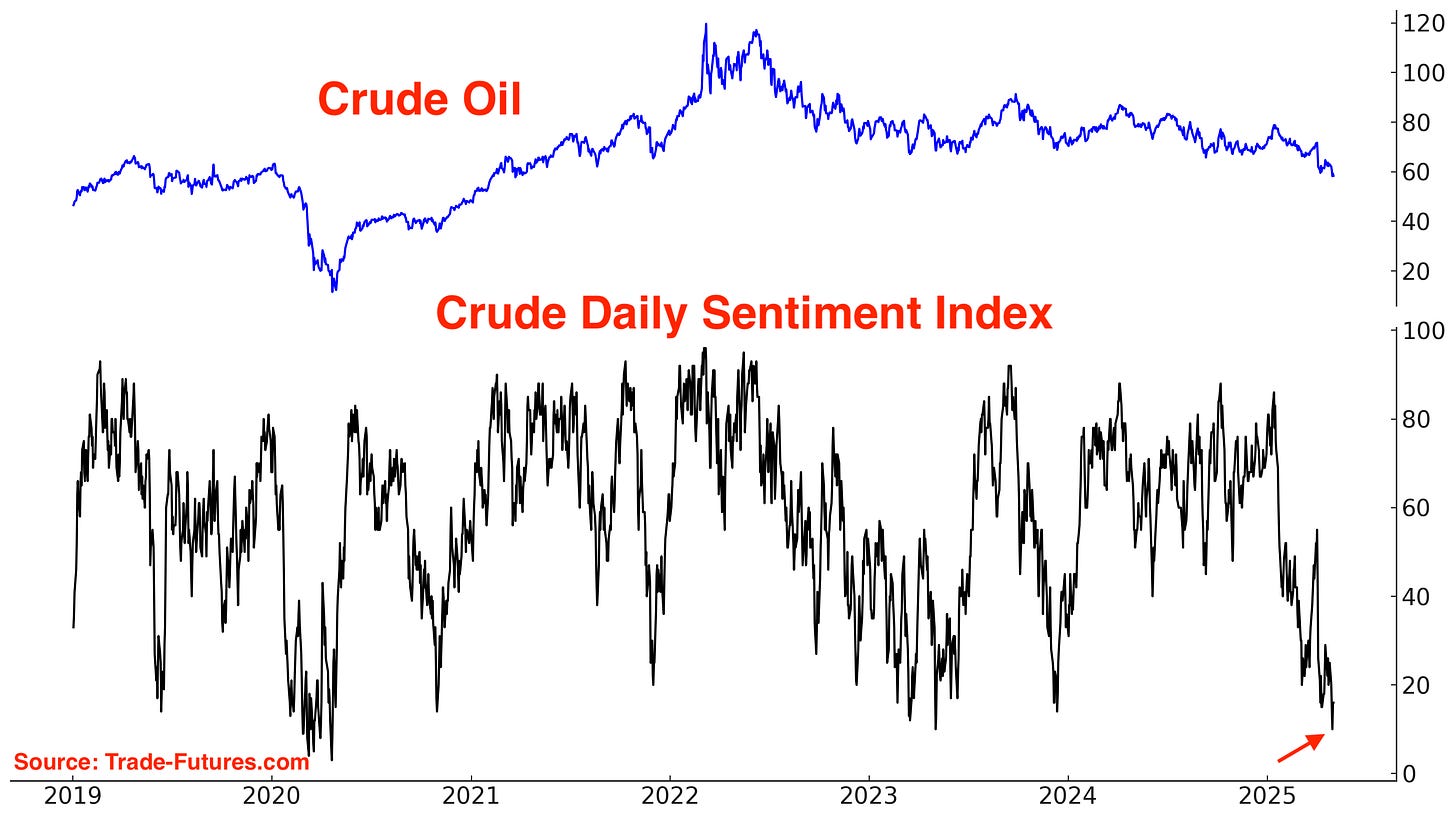

Sentiment

Sentiment for oil is extremely low:

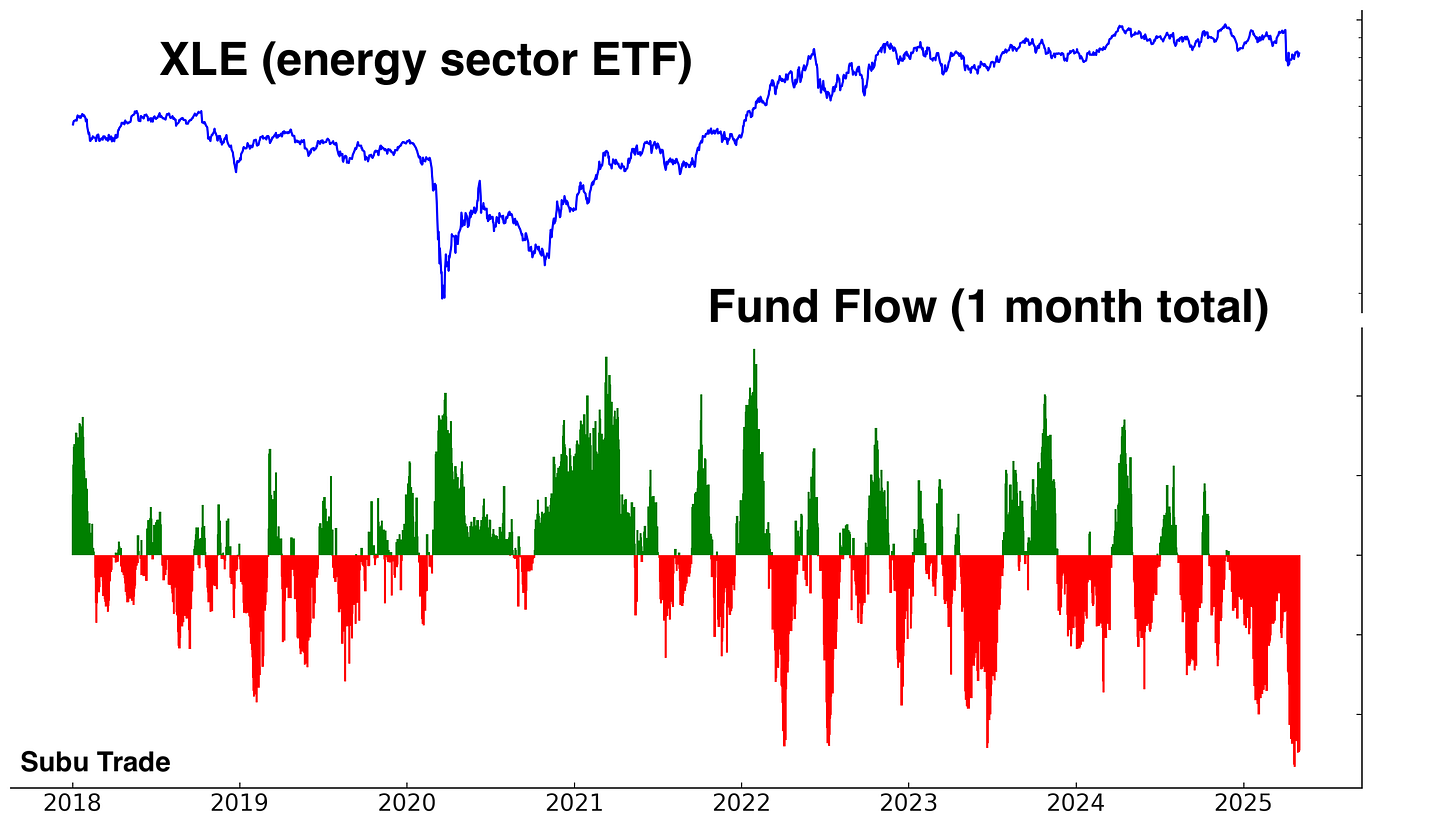

Fund Flow

Outflows from XLE are starting to stabilize:

India & China

I’m bullish on India and I believe this is the Indian Century. While much of the world is focused on the U.S.-China economic rivalry, few people recognize that India stands to be one of the biggest beneficiaries.

Trump’s tariffs may bring back some high-end manufacturing to the U.S., but they won’t revive labor-intensive manufacturing. Labor in many developing countries costs a fraction of U.S. wages—often just 10%. Labor-intensive manufacturing for textiles, electronics etc. will likely move from China to India.

In the short term, Trump will probably lower some tariffs on China. While as much manufacturing as possible will move to India+SouthEast Asia immediately, most cannot move overnight. Building up manufacturing capacity outside of China will take years. There are many products for which finding non-Chinese sources cannot be done in a matter of weeks/months. So Trump will probably strike a short term trade deal with China, while slowly encouraging more and more manufacturers to leave China in the coming years.

From The Economic Times (India’s #1 business newspaper):

Indian equities’ price action has been a little disappointing this week, failing to push higher along with U.S. equities. Themes & narratives matter in trading, but so does price confirmation!

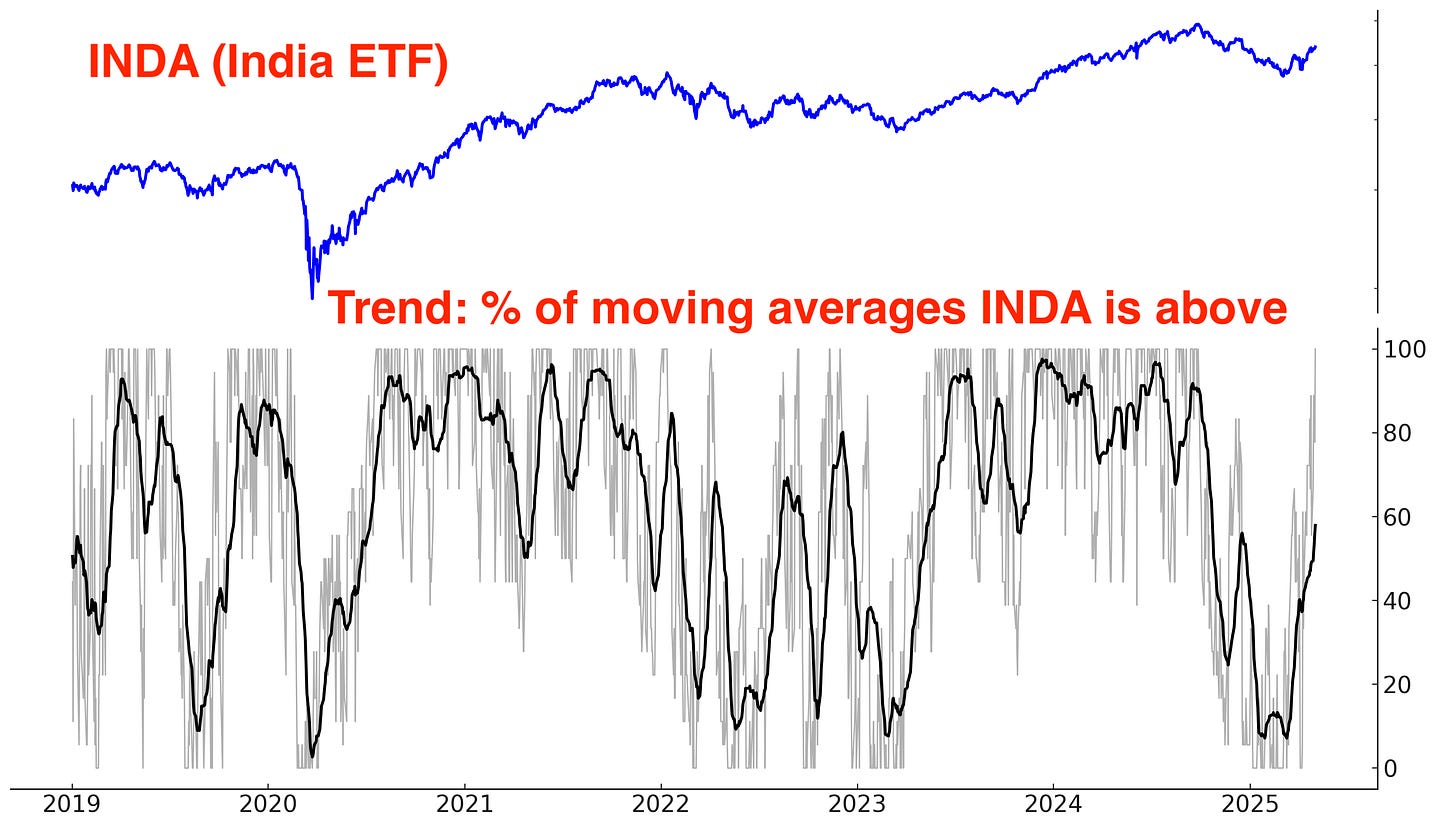

Trend

Indian stocks are slowly trending higher:

Breadth

Here are the % of Nifty 50 stocks above their 200 and 50 day moving averages:

Short Interest

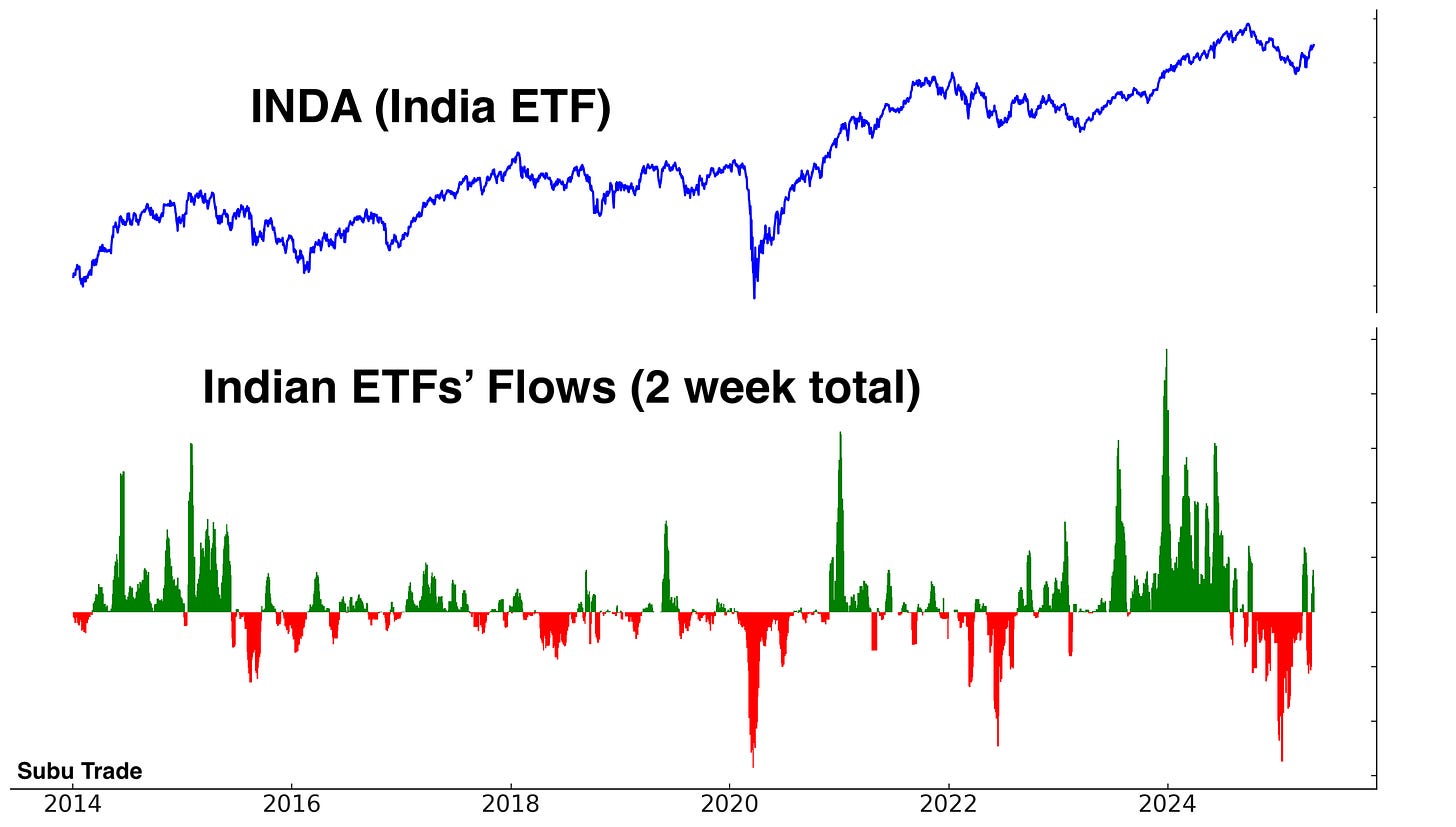

Indian Fund Flows

Outflows from Indian ETFs have stabilized:

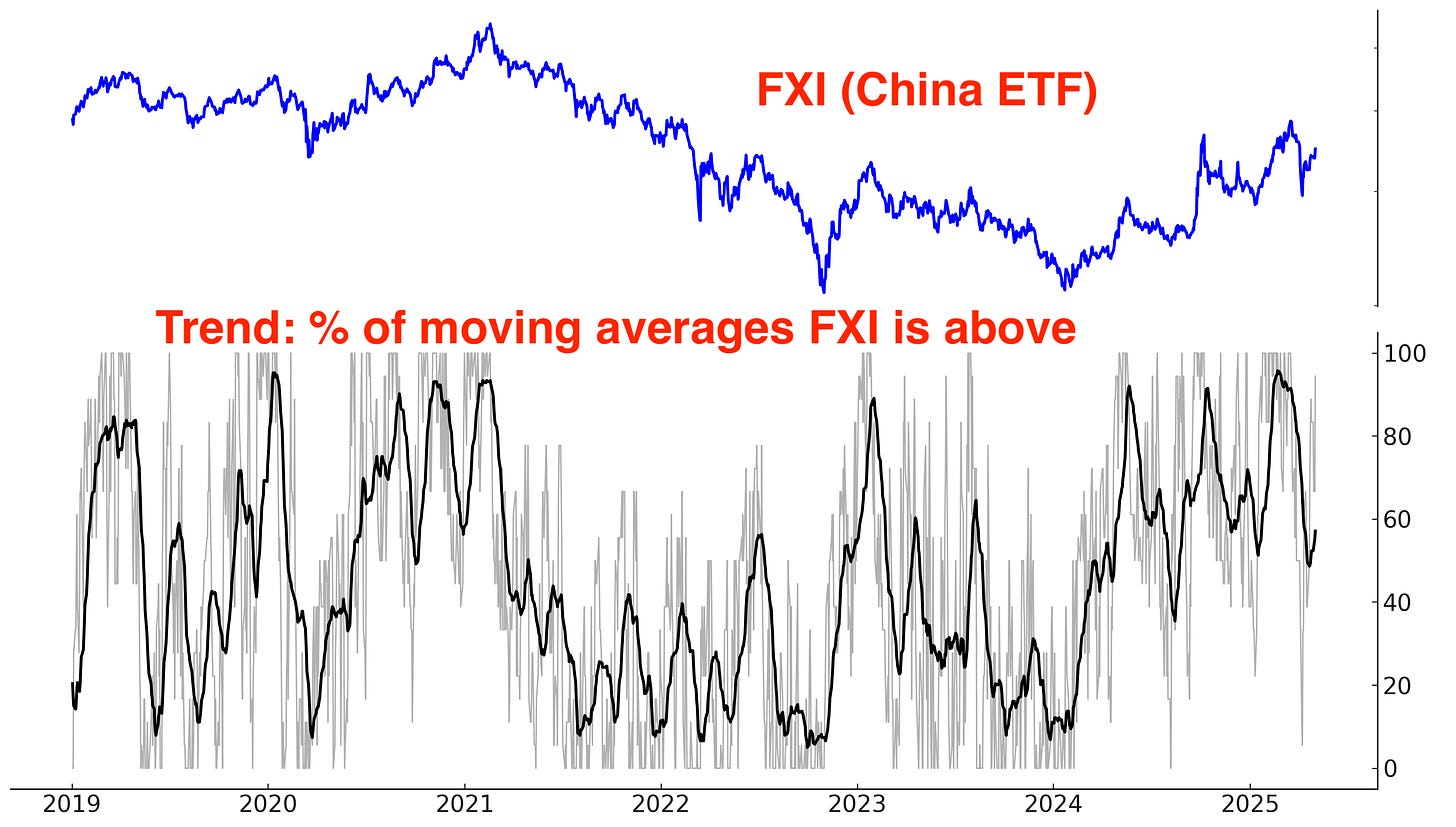

China Trend

Chinese stocks jumped on Friday in anticipation of a potential trade deal:

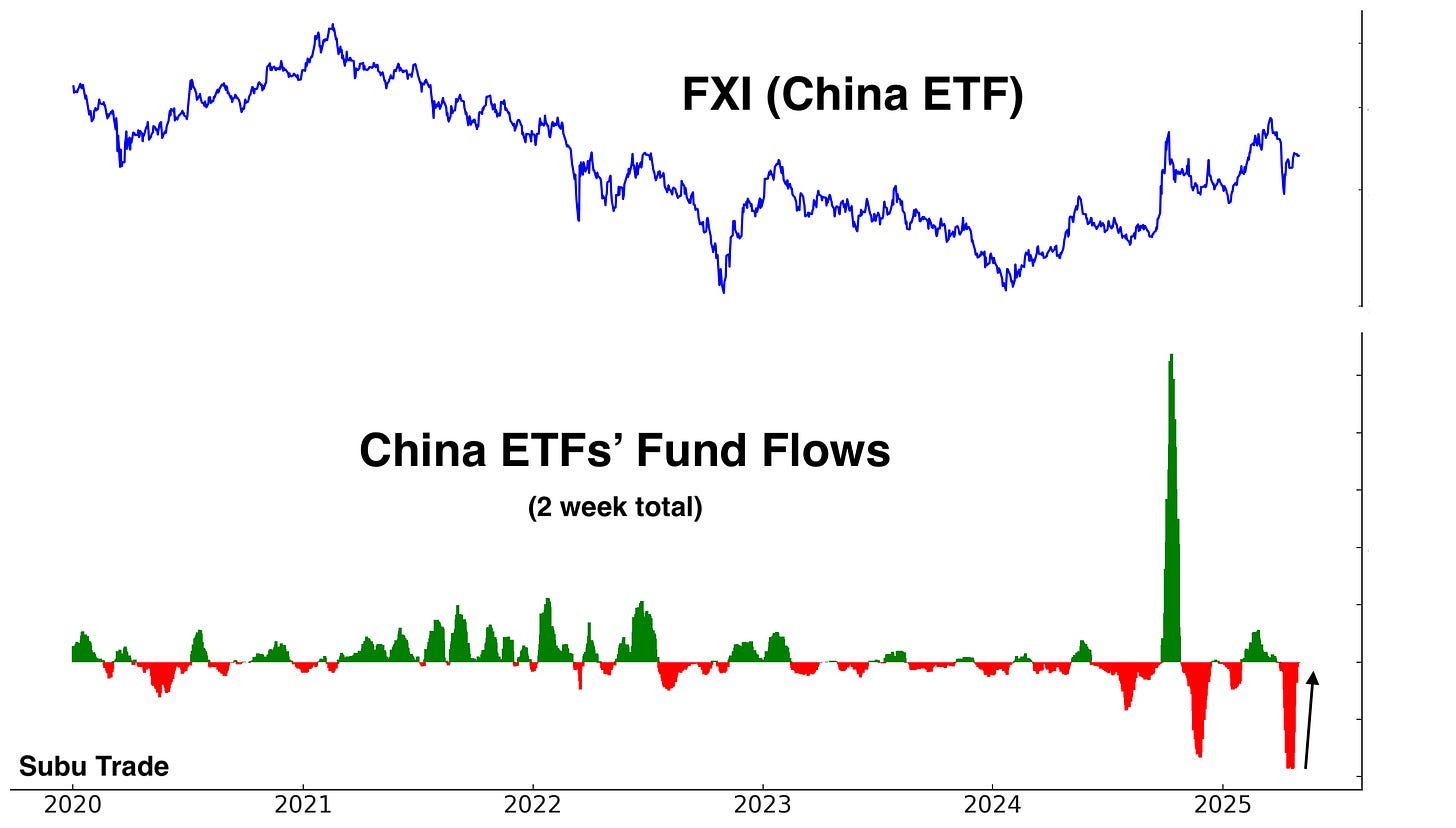

China Fund Flows

Outflows from major China ETFs have stabilized:

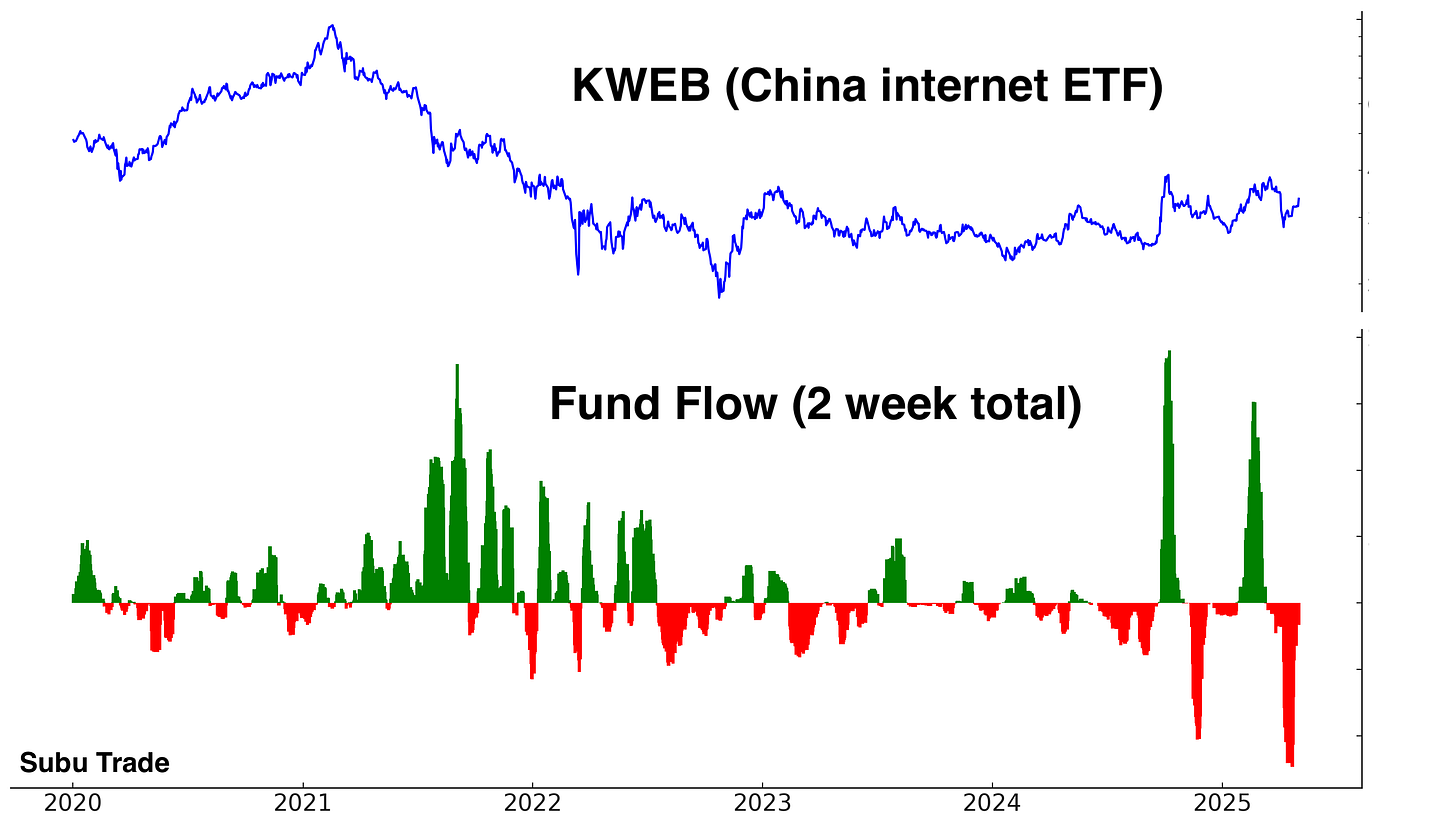

Outflows from KWEB have stabilized as well:

Chinese equities may continue to rally as trade negotiations with the U.S. commence. I have no Chinese equities position.

Bonds

Themes/narrative

The bond market is being pulled by conflicting forces, making a sustained trend unlikely. The most probable outcome is continued choppy price action within a broad range.

On one hand, inflationary fears from tariffs + foreigners selling U.S. bonds could be bearish for bonds. However, this is not enough of a bearish factor that it would cause bonds to crash.

On the other hand, both the U.S. Dollar and U.S. Treasuries are trying to mean-revert upwards after their recent crash.

Moreover, the Fed is neither interested in massive rate cuts nor massive rate hikes right now. This is a neutral factor for bonds (neither bullish nor bearish).

Outside of short-term traders seeking a mean-reversion bounce, I believe the bond market is best avoided for now. There are more favorable trading opportunities elsewhere.

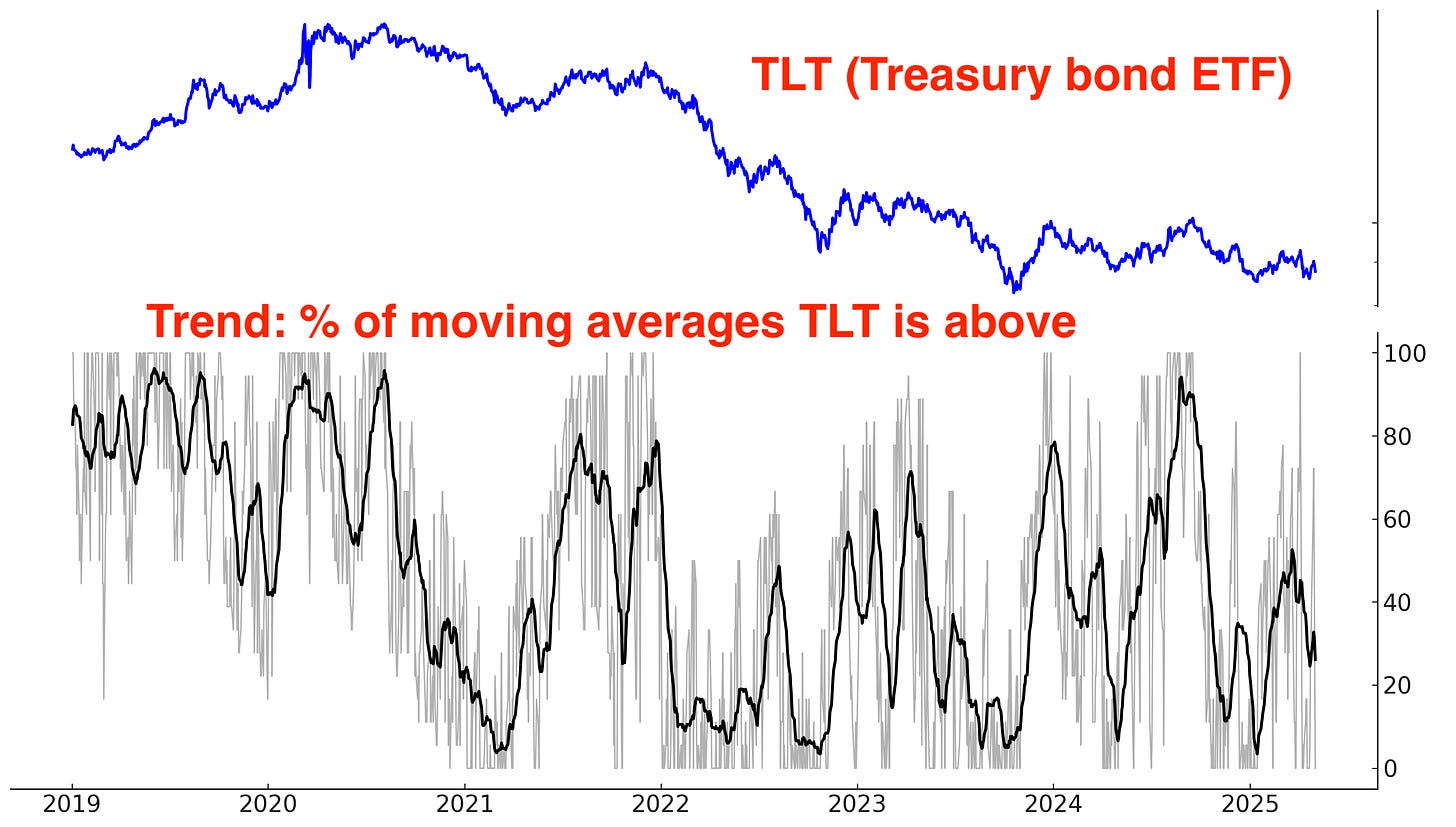

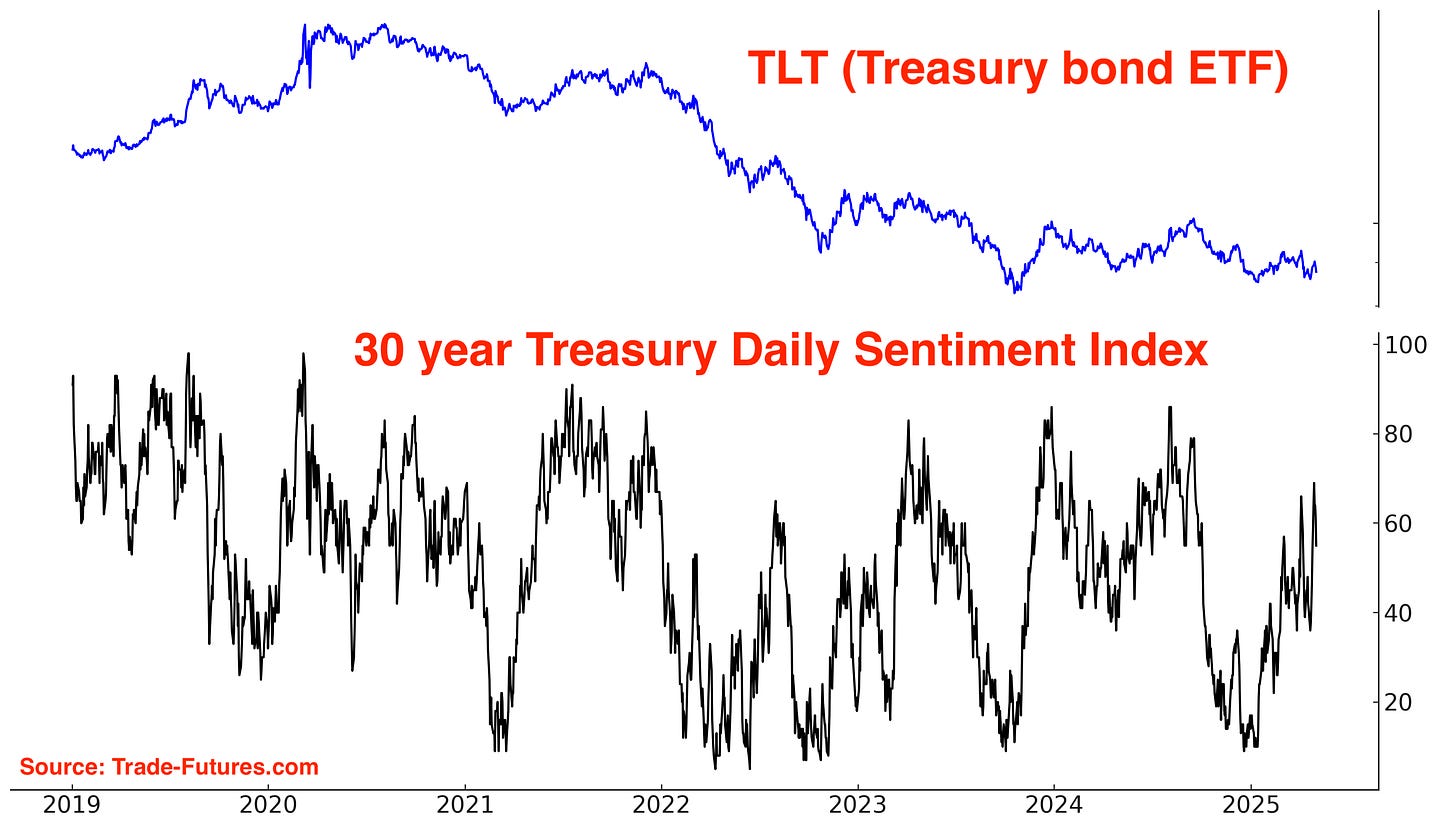

Trend

No real trend; bonds have been swinging sideways within a wide range since late-2022:

Sentiment

Sentiment remains in neutral territory:

I hold a small long position in bonds, but the position size is small and has little impact on my overall portfolio performance.

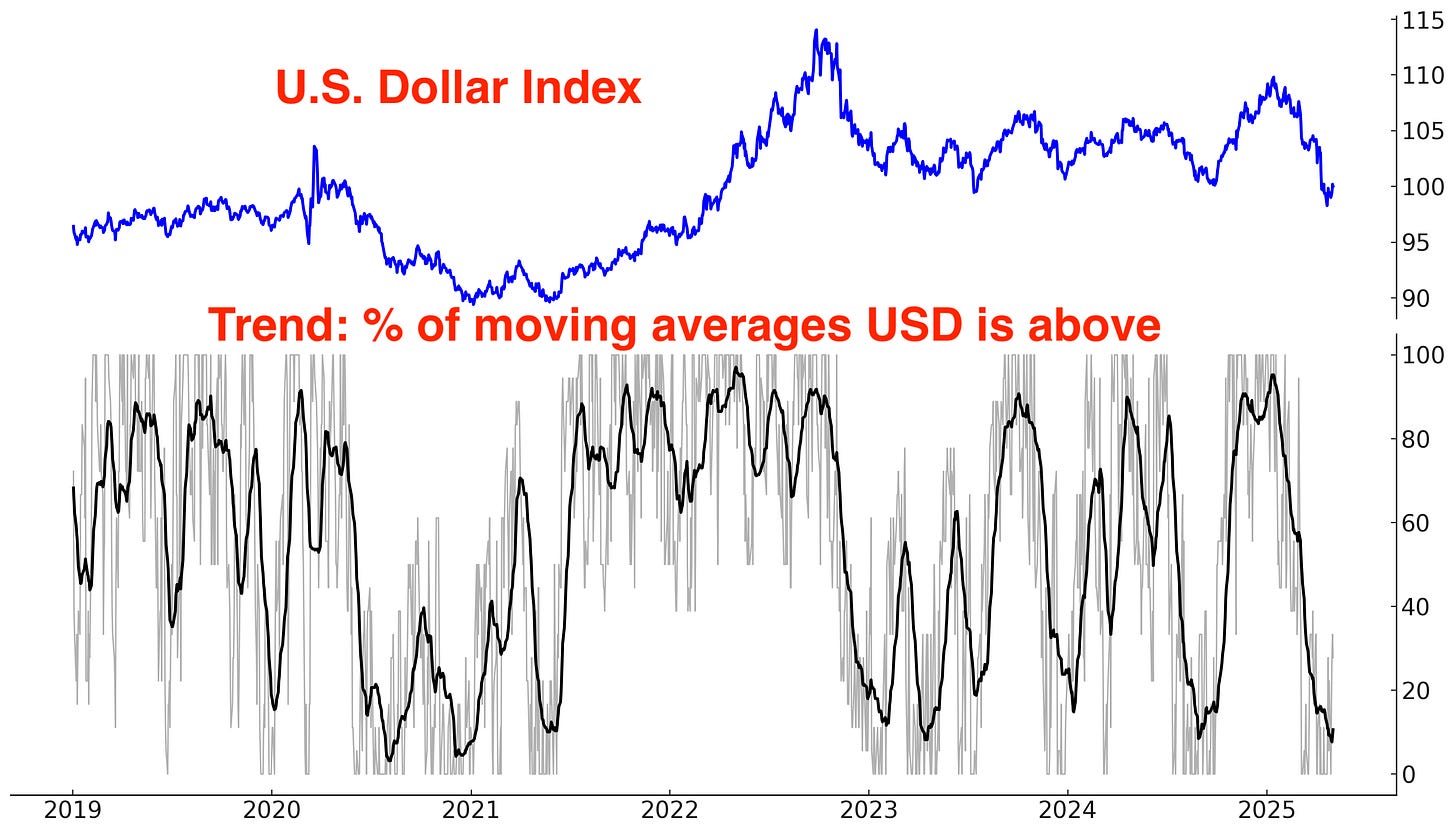

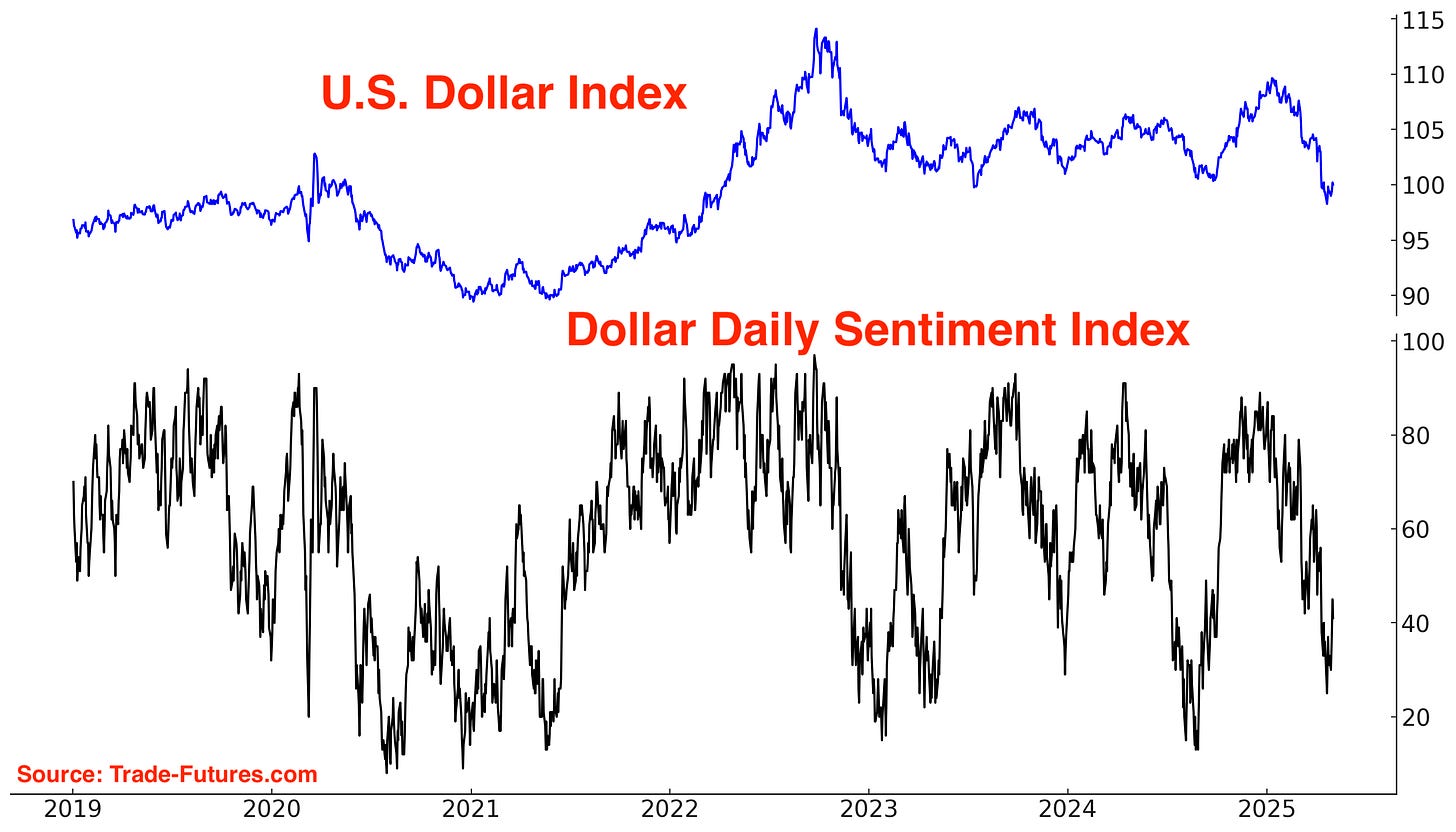

Currencies

The U.S. Dollar is stabilizing and attempting to bounce along with other U.S. assets (e.g. U.S. equities).

Trend

The Dollar was trending down, and is now trying to reverse higher:

Sentiment

Sentiment is mostly neutral:

I do not have a currencies position.

Summary & My Portfolio

*Click here if you don’t understand how I trade

Mean-Reversion Position – Long Oversold Tech Stocks: Currently my largest position. Targeting a mean-reversion rally. Reduced my position size by 1/4 & took some profits. Keeping the remaining 3/4 position.

*A rally in stocks could also push Bitcoin higher.

No position in Gold. Gold could correct/consolidate for weeks/months to work off the recent excess.

Mean-Reversion Position (Non-Core): long energy stocks. Small position size, will look to add more if energy stocks fall.

Mean-Reversion Position (Non-Core) - Long Indian Equities: Big beneficiary of U.S.-China trade war. Small position size.

Mean-Reversion Position (Non-Core) – Long U.S. Treasury Bonds: Small position size.

This content is for informational purposes only and is not financial or investment advice. I am not a licensed financial advisor. Trading involves risk, and past performance does not guarantee future results. You are responsible for your own financial decisions, and I am not liable for any losses.

Have a great weekend I appreciate the reports.

Lots of food for thought and extensive analysis. Much appreciated for sharing with the community. Enjoy the weekend.