Markets Report: non-stop rally and blow-off top

Stocks grind higher while retail-favorites soar.

U.S. equities grind higher, the U.S. Dollar bounced, and retail-favorites like Robinhood soared. The S&P 500 has been above its 20 day moving average for 59 consecutive trading days!

Could this winning streak end?

U.S. Stocks

On a positive note, the S&P trading above its 20 day moving average for 59 days is a sign of incredibly strong momentum. Momentum, which reflects the tribal human psychology of “monkey see, monkey do”, is bullish. The S&P 500 was consistently higher 3 months later:

COT Report (Commitments of Traders)

Retail traders made a killing buying every small dip during this rally. On the other hand, hedge funds either stayed on the sidelines or worse, were short.

According to the COT Report, Large Speculators/Hedge Funds increased their net short position against S&P 500 futures:

Meanwhile, they’re now the most net short Russell 2000 futures since the 2022 bear market bottom. This is not surprising considering that the Russell 2000 (small caps) has yet to make new all-time highs:

Corporate Insiders

The Corporate Insider Sell/Buy ratio is extremely high because there are no buyers. Corporate Insiders are not interested in buying stocks at these high valuations. However, this was not a consistently accurate bearish signal in the past: corporate insiders tend to turn bearish too early:

Sentiment Surveys

AAII Bulls-Bears fell this week. Bulls equal to Bears:

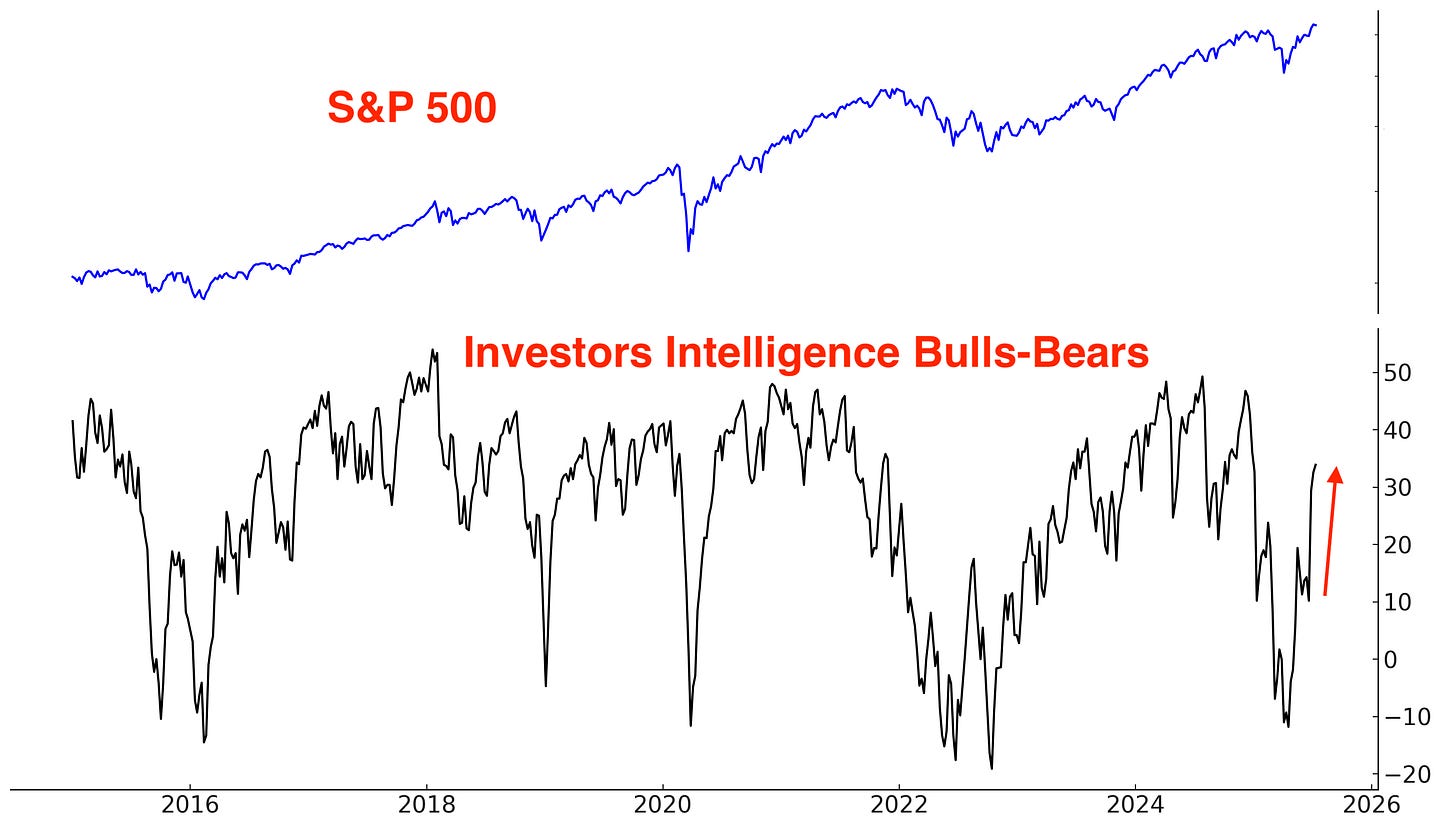

Investors Intelligence Bulls-Bears increased. Newsletter writers are increasingly bullish:

The NAAIM Exposure Index (National Association of Active Investment Managers) is bullish:

Other Sentiment

CNN Fear & Greed is elevated:

The S&P 500’s Daily Sentiment Index is elevated:

NASDAQ’s Daily Sentiment Index:

Options

The $ value of all Call volume - the $ value of all Put volume is elevated:

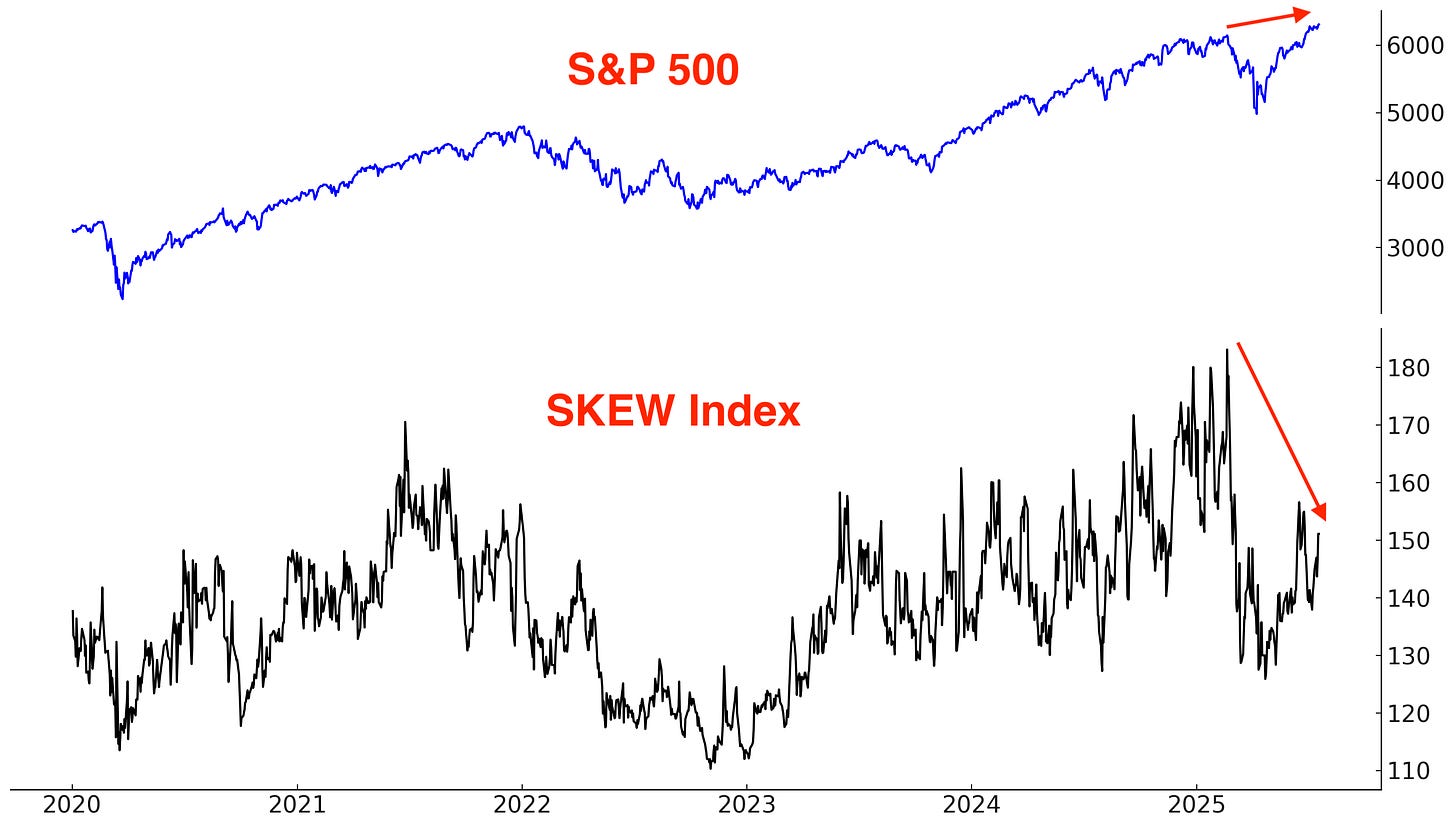

The SKEW Index, which reflects perceived tail risk in the options market — or the probability of extreme downside moves — remains muted. Despite the S&P making new all-time highs, SKEW fell!

Fund Flows

*Fund flows aren’t automatically contrarian. It depends on what type of trader is buying/selling and why. Some ETFs are traded by mean-reversion traders, while other ETFs are traded by trend followers. Moreover, many ETFs are small relative to the underlying market, so fund flows don’t always reflect broad sentiment towards that market.

TQQQ is traded by mean-reversion traders who buy the dip when TQQQ falls and sell (take profits) when TQQQ rallies.

TQQQ is still seeing outflows:

VIX ETFs are also traded by mean-reversion traders; they buy when VIX is low and sell (take profits) when VIX is high.

VIX ETFs have seen non-stop inflows over the past 2 months. These traders are betting on stocks to pullback and VIX to jump:

The 10 largest U.S. equity ETFs are seeing inflows:

Breadth

Here are the % of S&P 500 stocks above their 200 and 50 day moving averages:

Trend

The trend is your friend, until it ends. Stocks are trending higher:

Why does trend matter? Because at least from a trend following perspective, it’s better to buy when the market is trending Up (e.g. above its 200-DMA) than when the market is trending Down (e.g. below its 200-DMA).

*There is nothing “special” about the 200 day moving average, except the fact that it’s popular. It is not significantly different from the 195, 190, 185, 180, 205, 210, 215, or 220 moving averages.

Long above vs. below the S&P 500’s 200 day moving average:

Long above vs. below the S&P 500’s 50 day moving average:

Long above vs. below the S&P 500’s 20 day moving average:

Earnings & Valuations

Some traders say that valuations and fundamentals are useless, and that “only price matters”. While this is true for day traders (valuations have zero impact on the market’s short term direction), fundamentals matter for traders and investors with longer term horizons.

Valuations for large cap stocks (S&P 500) remain elevated compared to their 10 year average:

Here’s the S&P 500’s forward earnings expectations. In the long run, earnings and stock prices move in the same direction. Earnings are still growing right now.