Markets Report: a double Big Bang

More and more opportunities emerging.

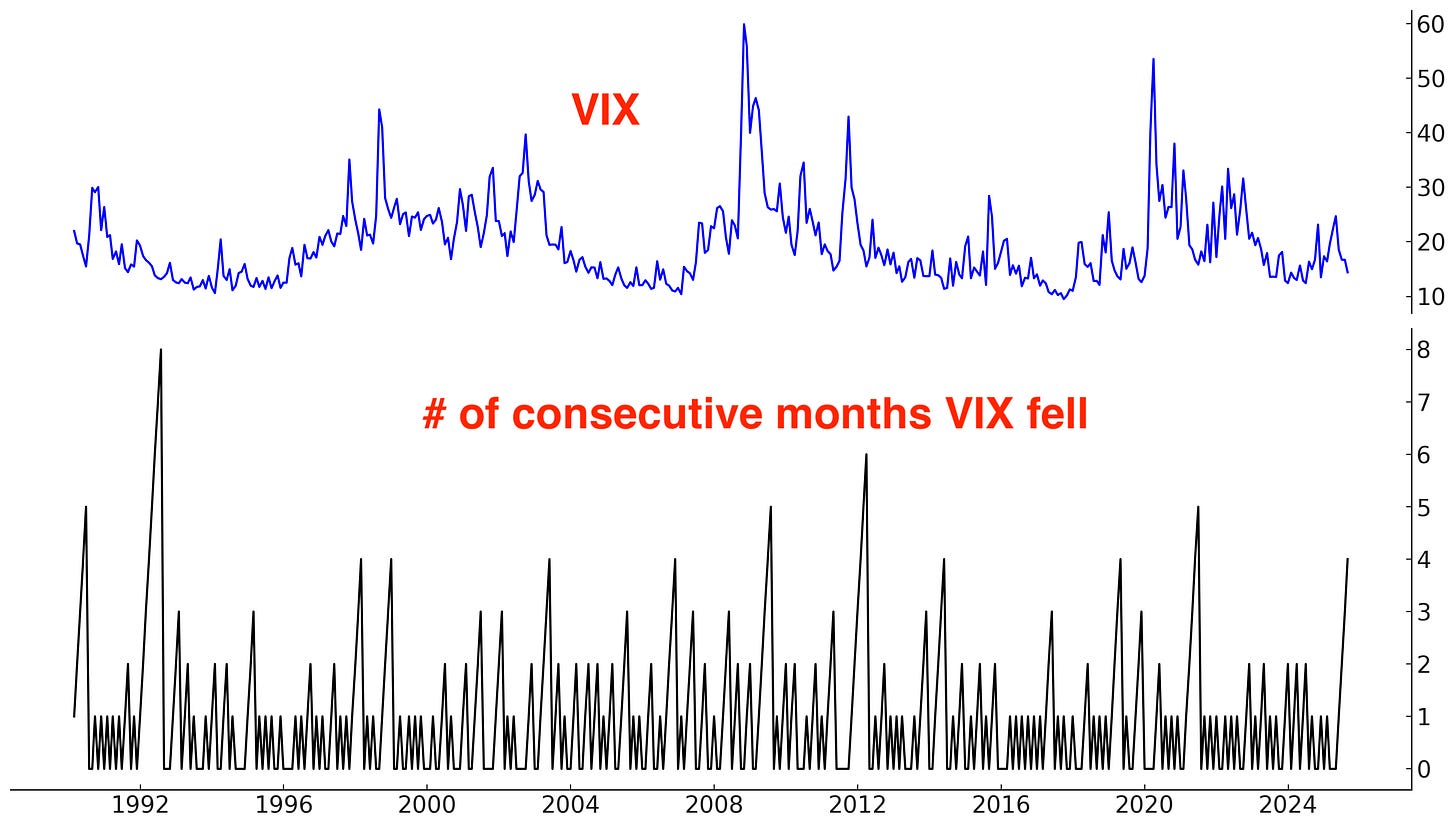

Stocks made new all-time highs this week. With August now in the rear-view mirror, VIX has fallen 4 months in a row:

Historically, such strong momentum for stocks (stocks up, VIX down) saw more gains for the S&P over the next 9 months. HOWEVER, the S&P 500’s gains over the next 9 months were not spectacular, which implies that the road ahead will be more volatile and less profitable for bulls than the past 4 months:

U.S. Stocks

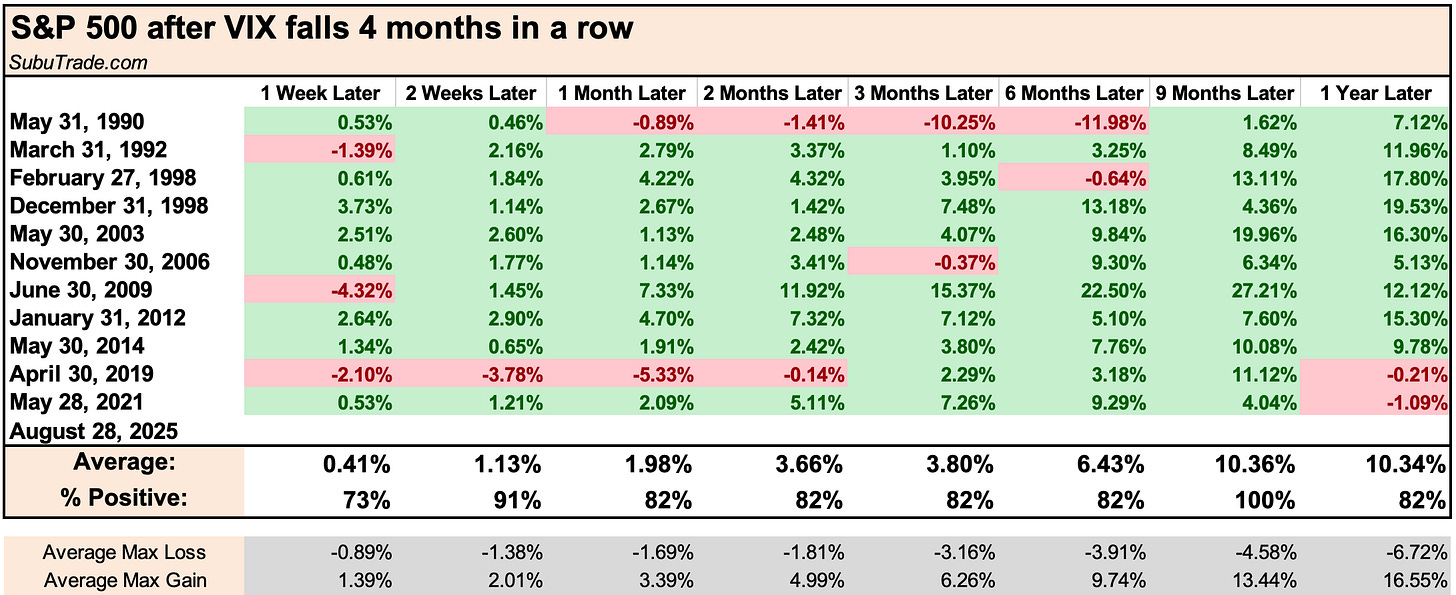

COT Report (Commitments of Traders)

Small caps pushed higher this week. Large Speculators/Hedge Funds, who were caught offsides, are slowly un-winding their historic short positions against this sector:

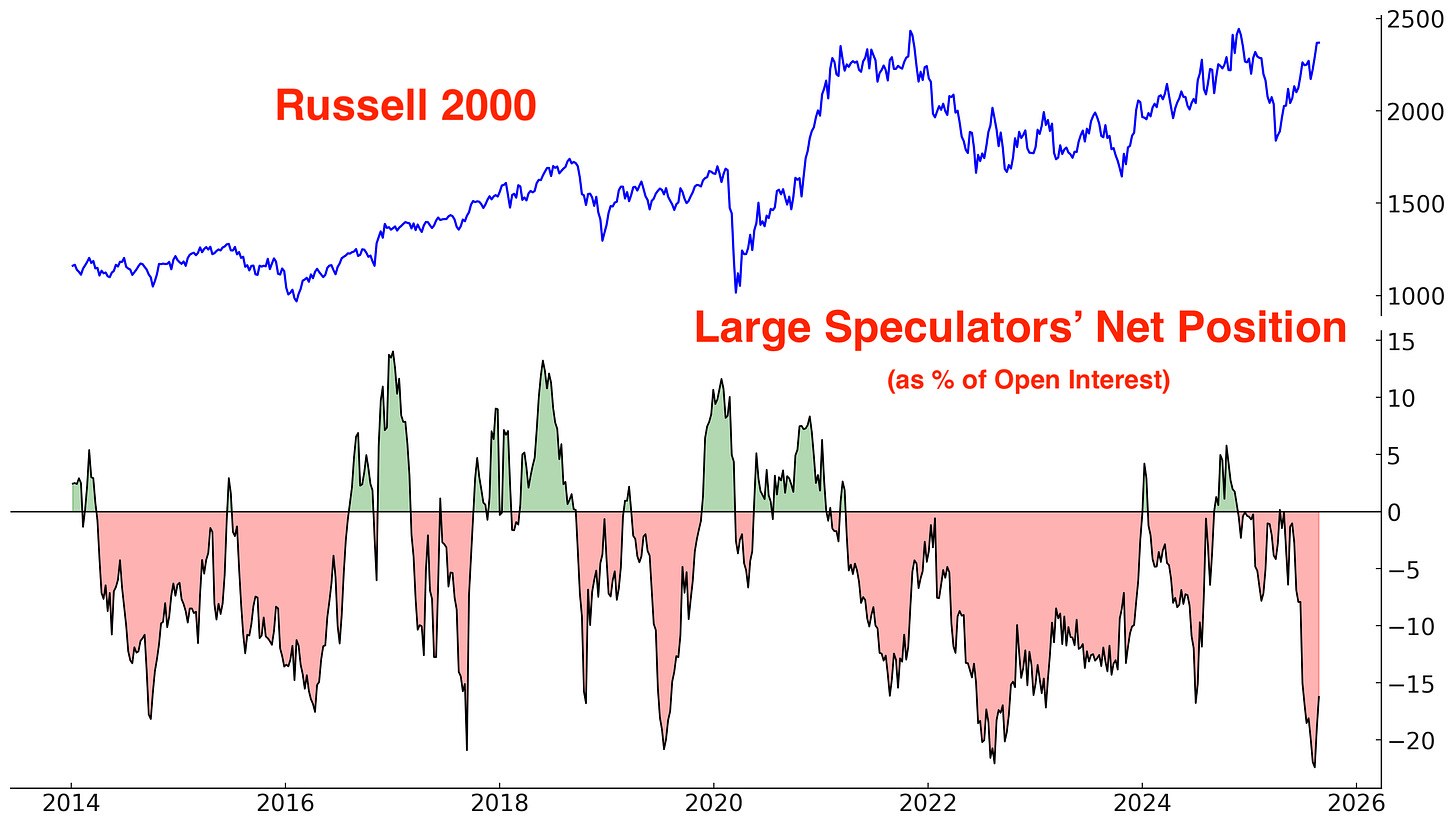

Sentiment Indicators

The CNN Fear & Greed Index leans bullish:

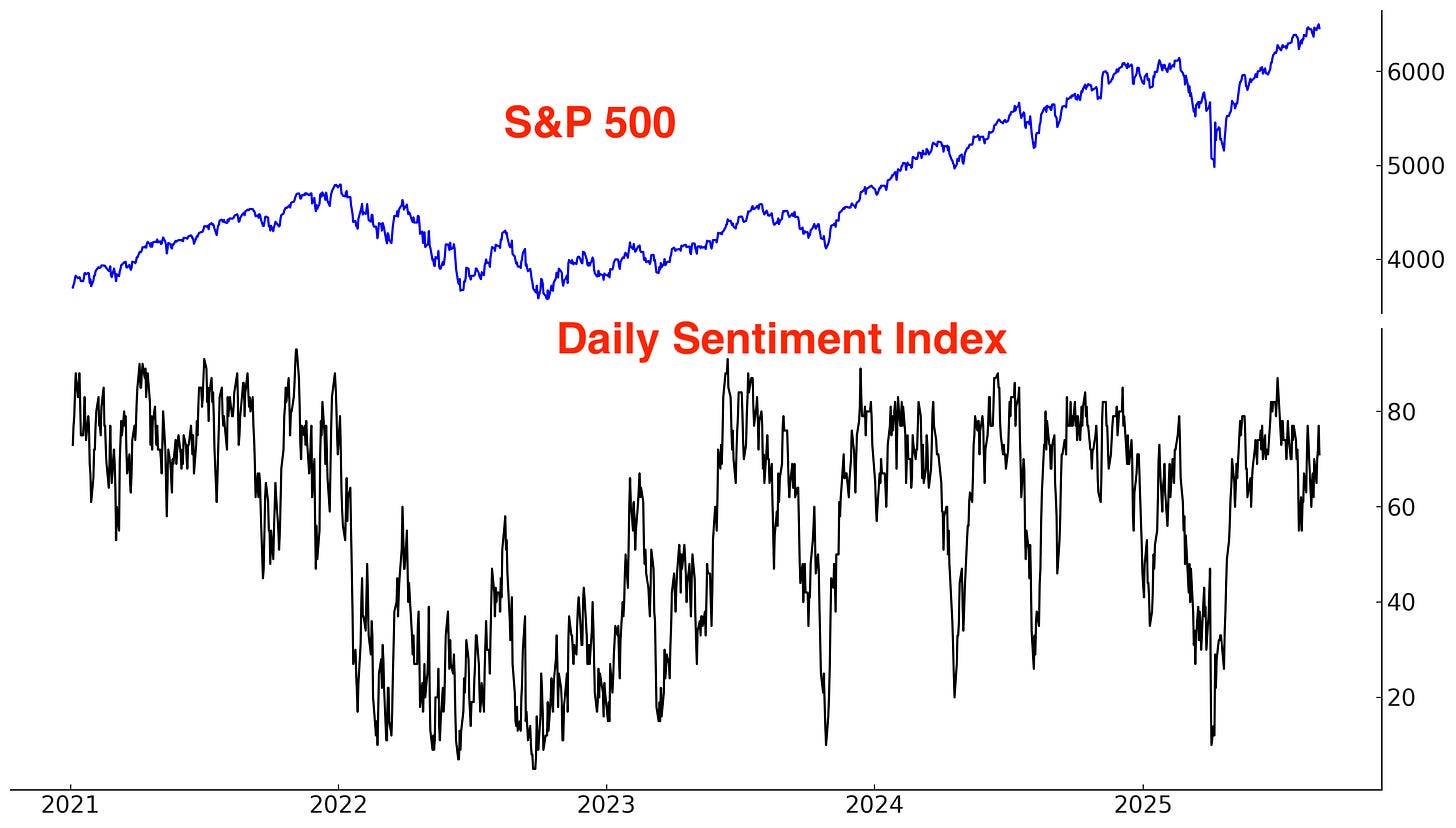

S&P 500’s Daily Sentiment Index leans bullish:

Sentiment Surveys

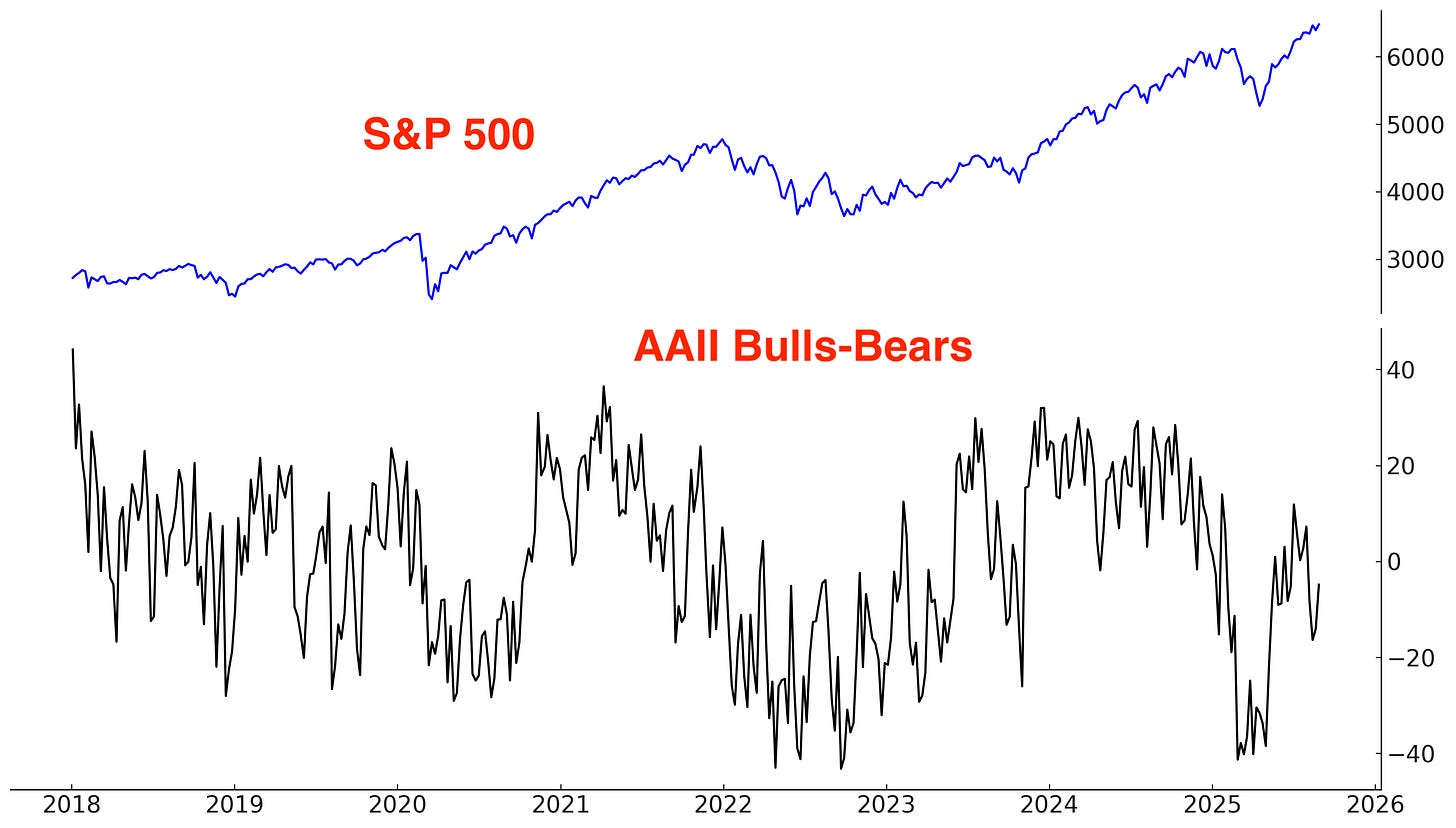

Sentiment according to the AAII survey remains muted:

According to the Investors Intelligence report, newsletter writers lean bullish:

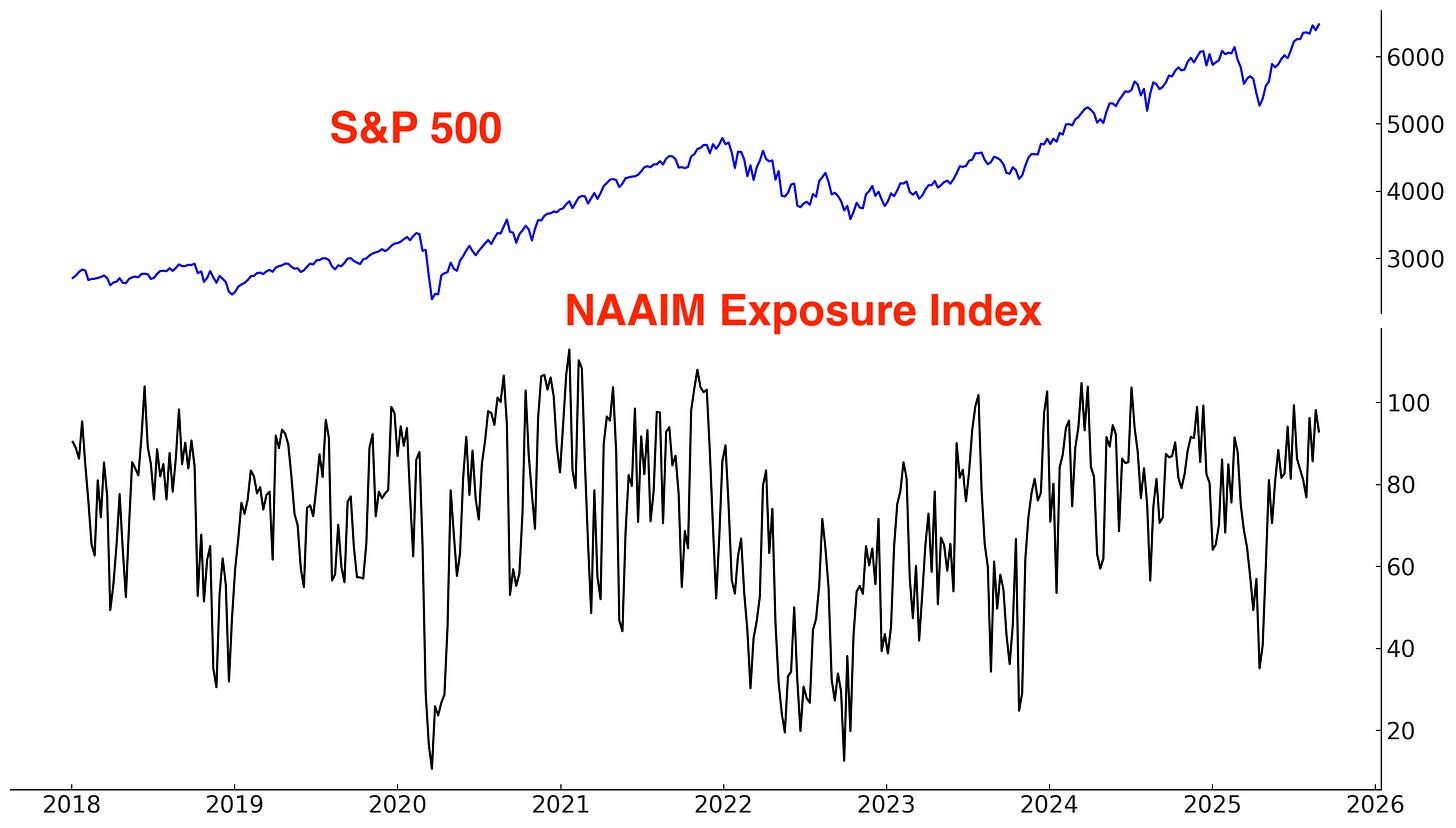

According to the NAAIM Exposure Index, active investment managers are bullish:

Corporate Insiders

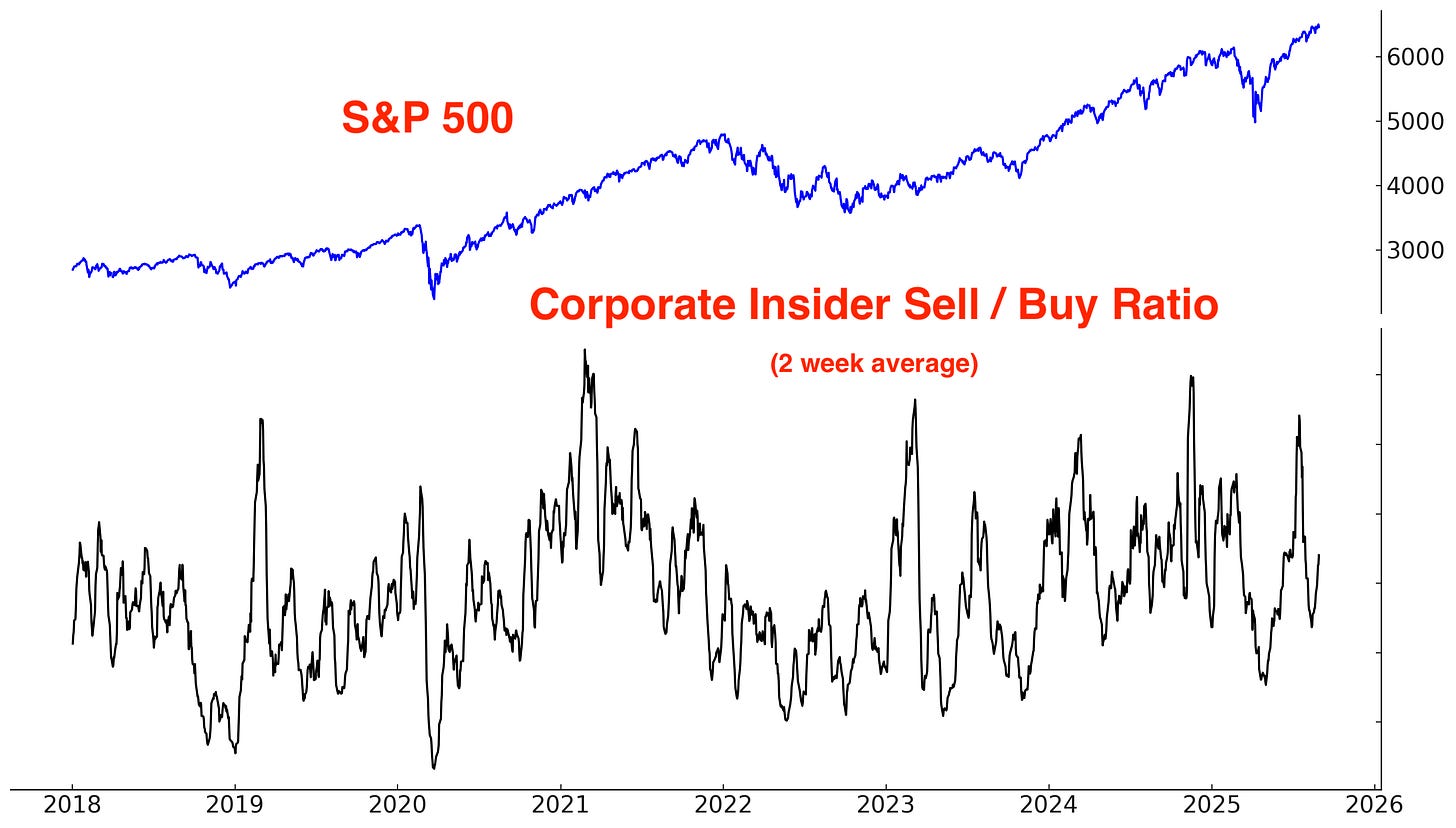

The Corporate Insider Sell/Buy ratio is in neutral territory - neither bullish nor bearish.

Options

The $ value of all Call volume - the $ value of all Put volume is elevated:

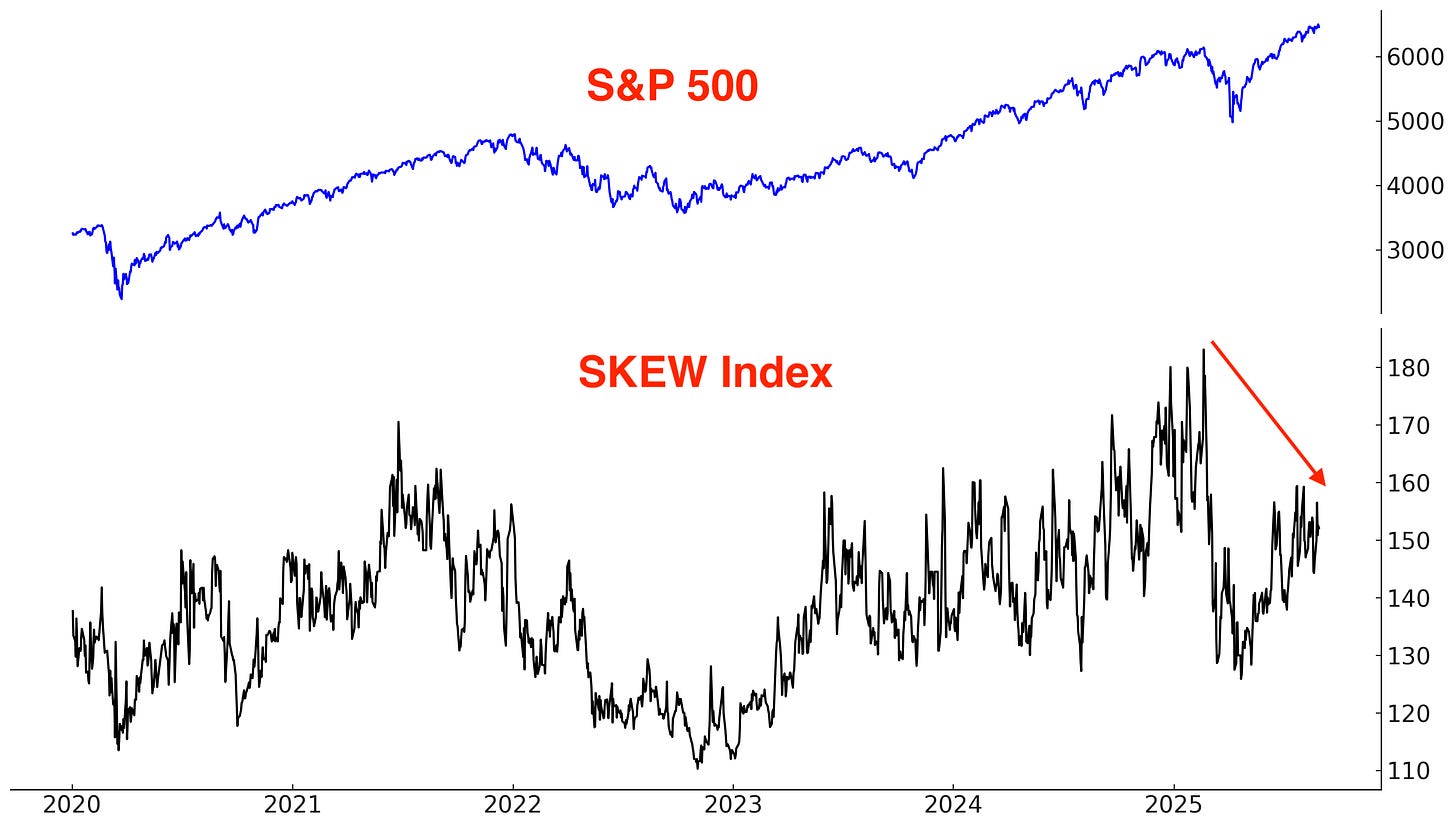

The SKEW Index, which reflects perceived tail risk in the options market — or the probability of extreme downside moves — remains muted. This suggests that any stock market pullback will not turn into a major crash.

Fund Flows

*Fund flows aren’t automatically contrarian. It depends on what type of trader is buying/selling and why. Some ETFs are traded by mean-reversion traders, while other ETFs are traded by trend followers. Moreover, many ETFs are small relative to the underlying market, so fund flows don’t always reflect broad sentiment towards that market.

TQQQ is traded by mean-reversion traders who buy the dip when TQQQ falls and sell (take profits) when TQQQ rallies.

For the first time in months, TQQQ is seeing inflows. TQQQ traders have finally finished taking profits (buying during the March/April crash, then selling as the NASDAQ rallied):

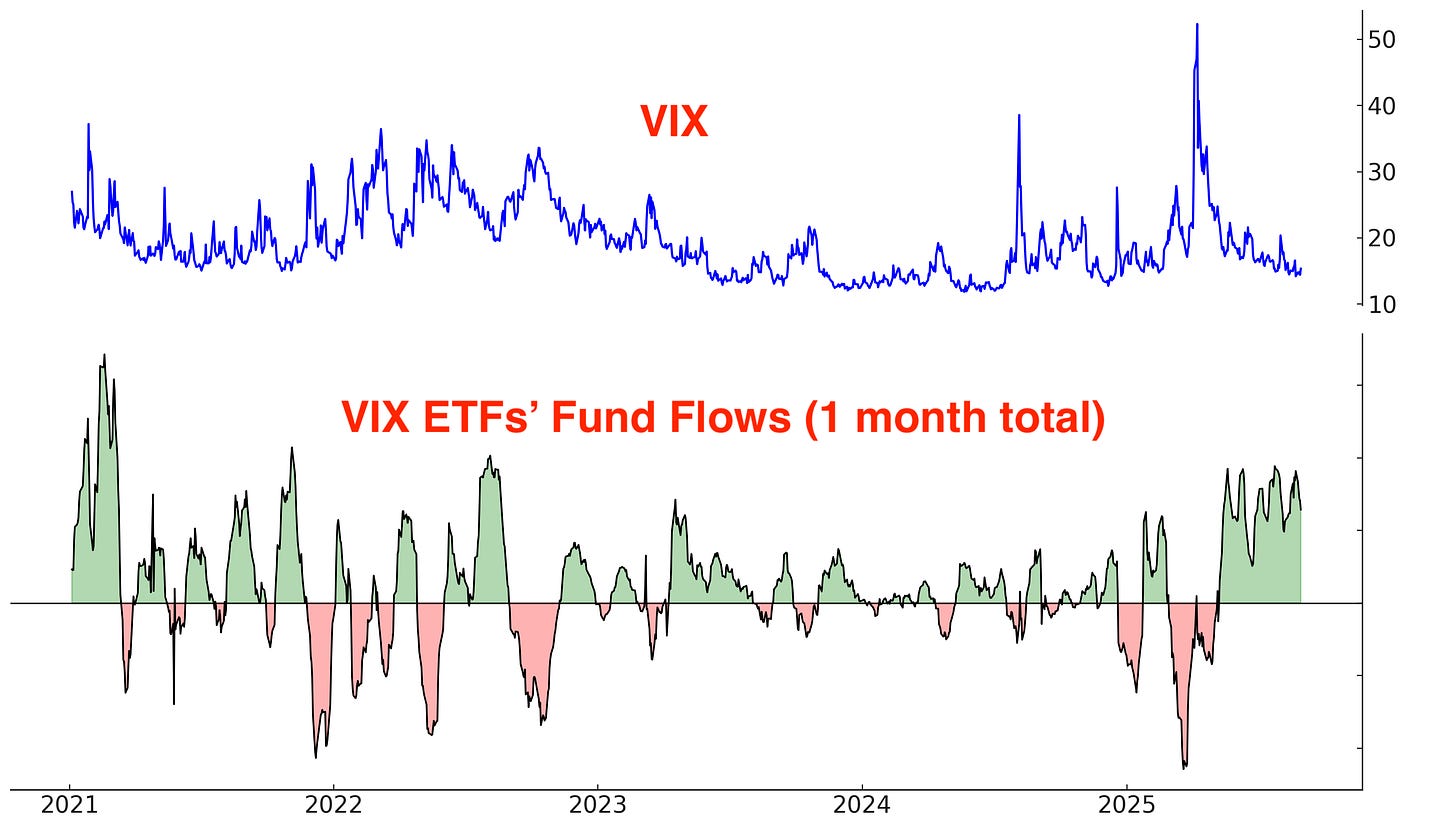

VIX ETFs are also traded by mean-reversion traders; they buy when VIX is low and sell (take profits) when VIX is high.

VIX ETFs have seen non-stop inflows over the past few months. These traders are betting on stocks to pullback and VIX to jump:

Breadth

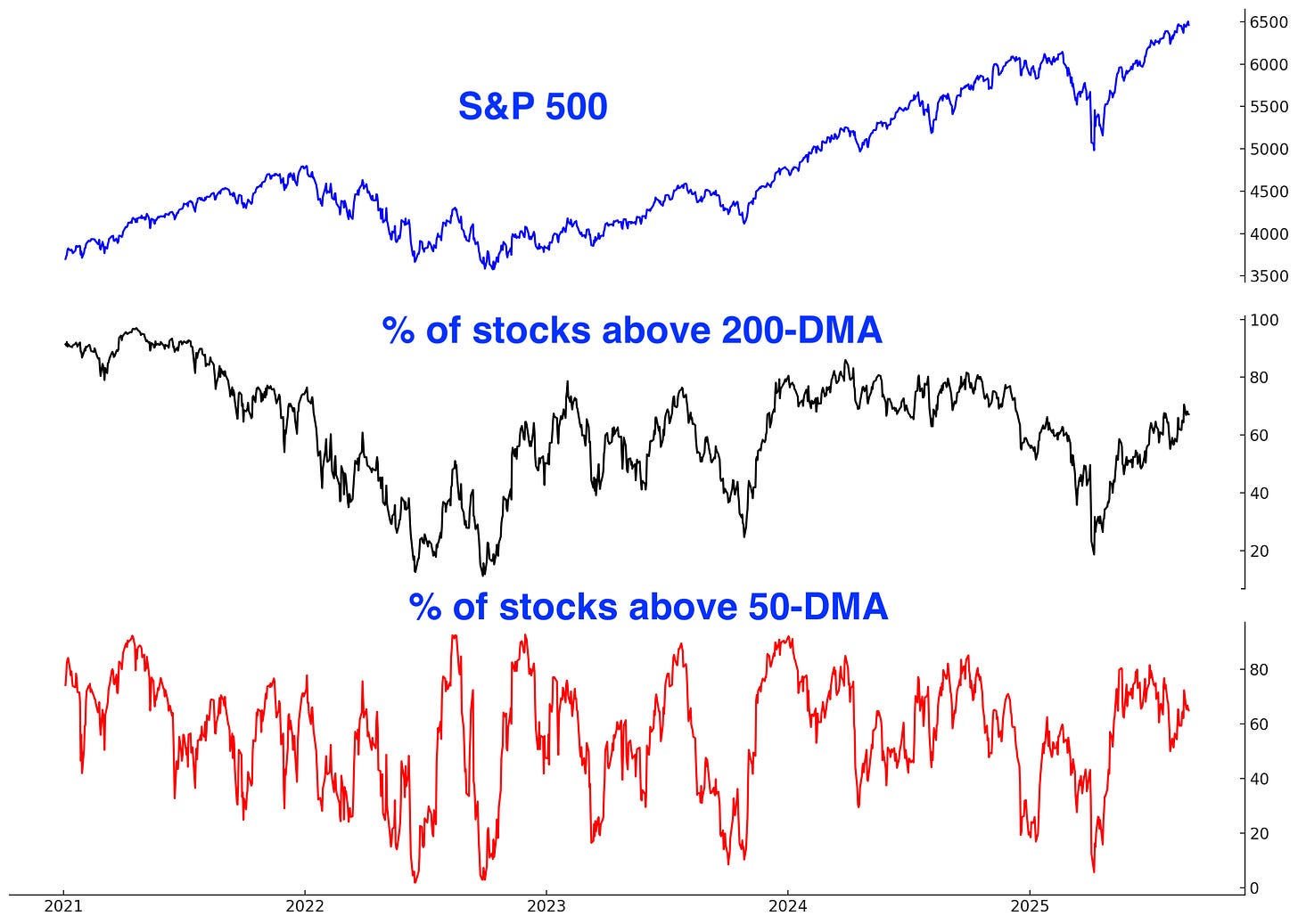

Here are the % of S&P 500 stocks above their 200 and 50 day moving averages. The rally is a little narrow, but that is not a major problem right now:

Trend

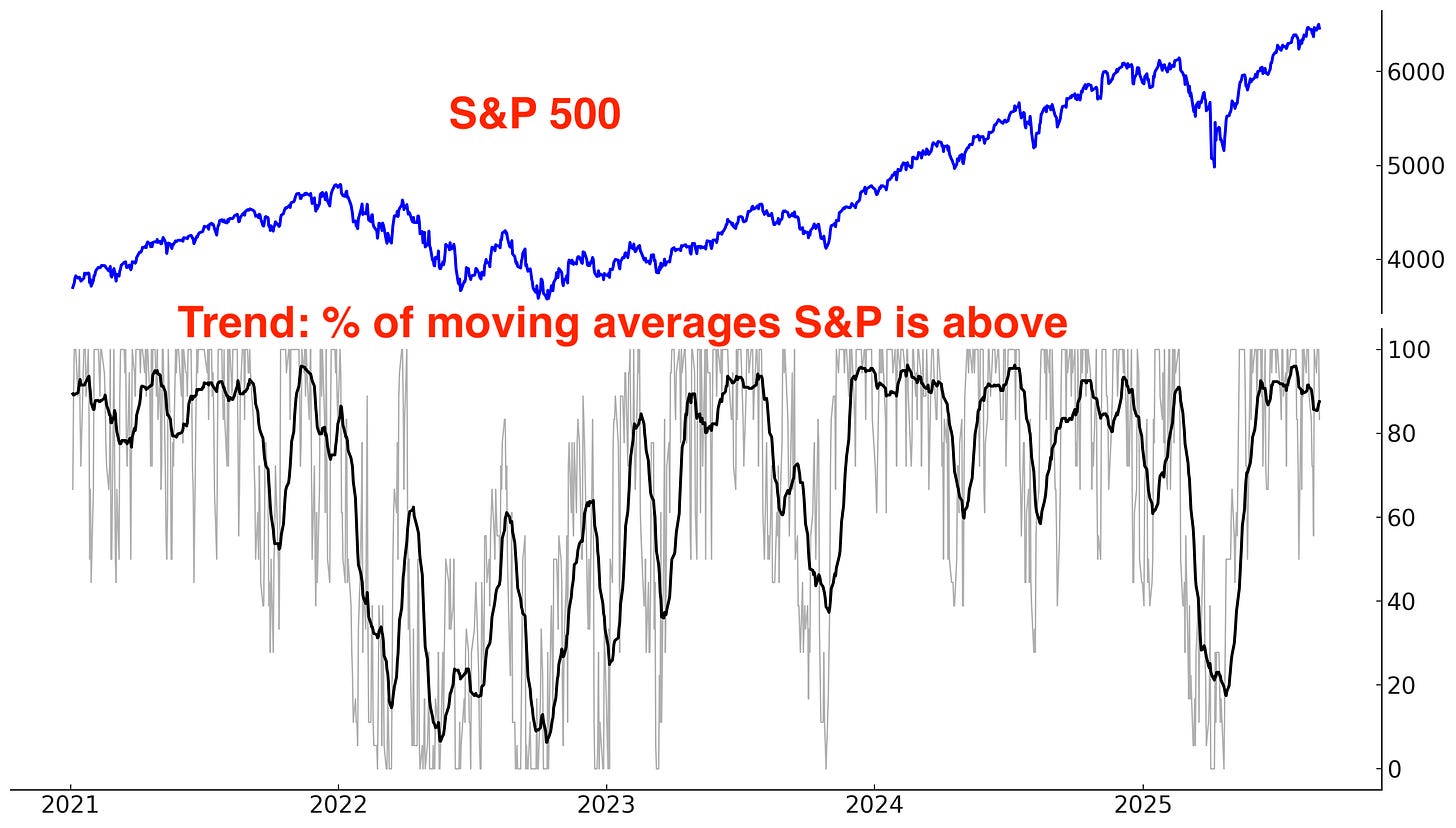

The trend is your friend, until it ends. Stocks are still trending higher:

Why does trend matter? Because at least from a trend following perspective, it’s better to buy when the market is trending Up (e.g. above its 200-DMA) than when the market is trending Down (e.g. below its 200-DMA).

*There is nothing “special” about the 200 day moving average, except the fact that it’s popular. It is not significantly different from the 195, 190, 185, 180, 205, 210, 215, or 220 moving averages.

Long above vs. below the S&P 500’s 200 day moving average:

Long above vs. below the S&P 500’s 50 day moving average:

Long above vs. below the S&P 500’s 20 day moving average:

Earnings & Valuations

Some traders say that valuations and fundamentals are useless, and that “only price matters”. While this is true for day traders (valuations have zero impact on the market’s short term direction), fundamentals matter for traders and investors with longer term horizons.

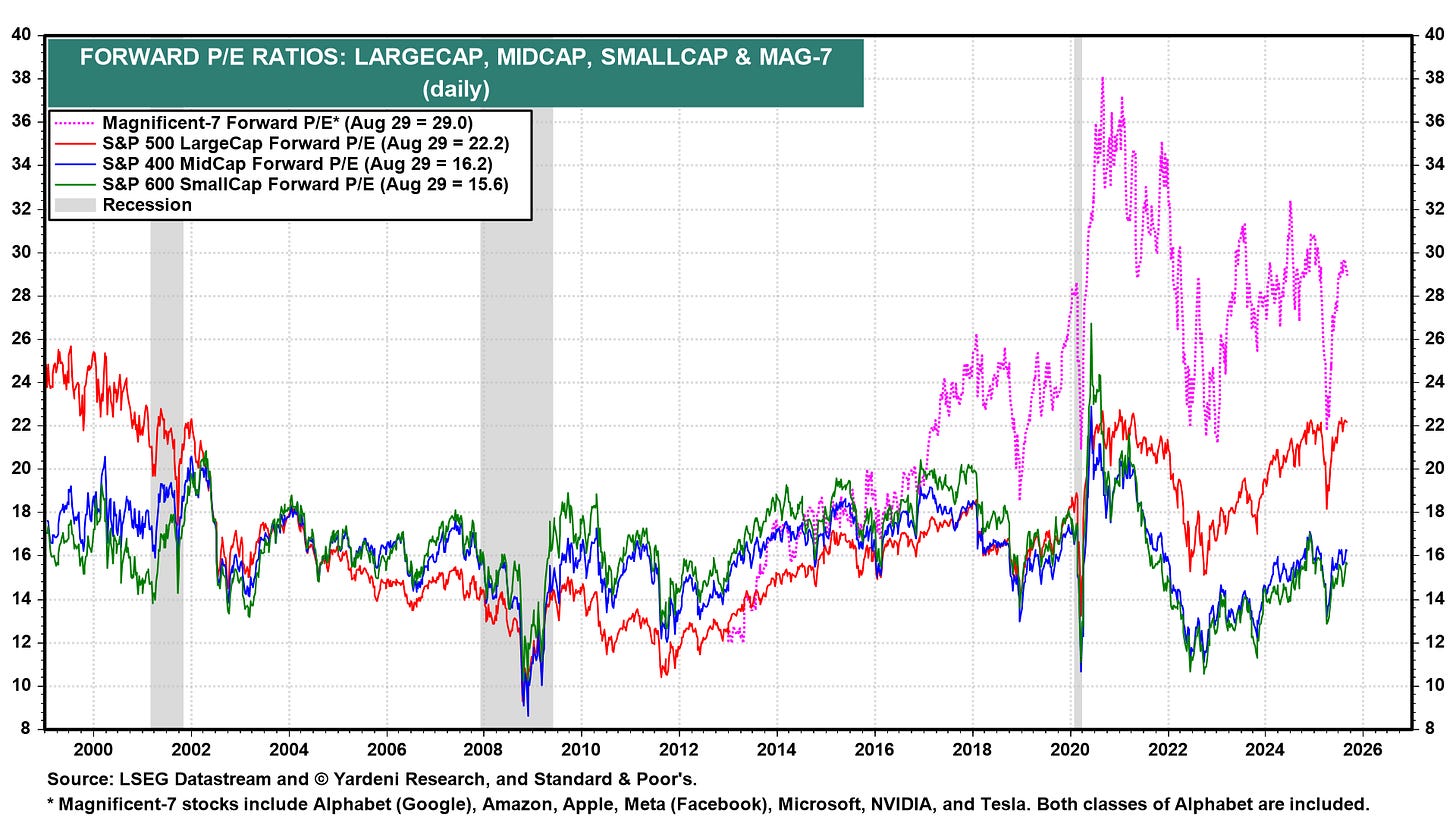

Valuations for large cap stocks (S&P 500) remain elevated compared to their 10 year average:

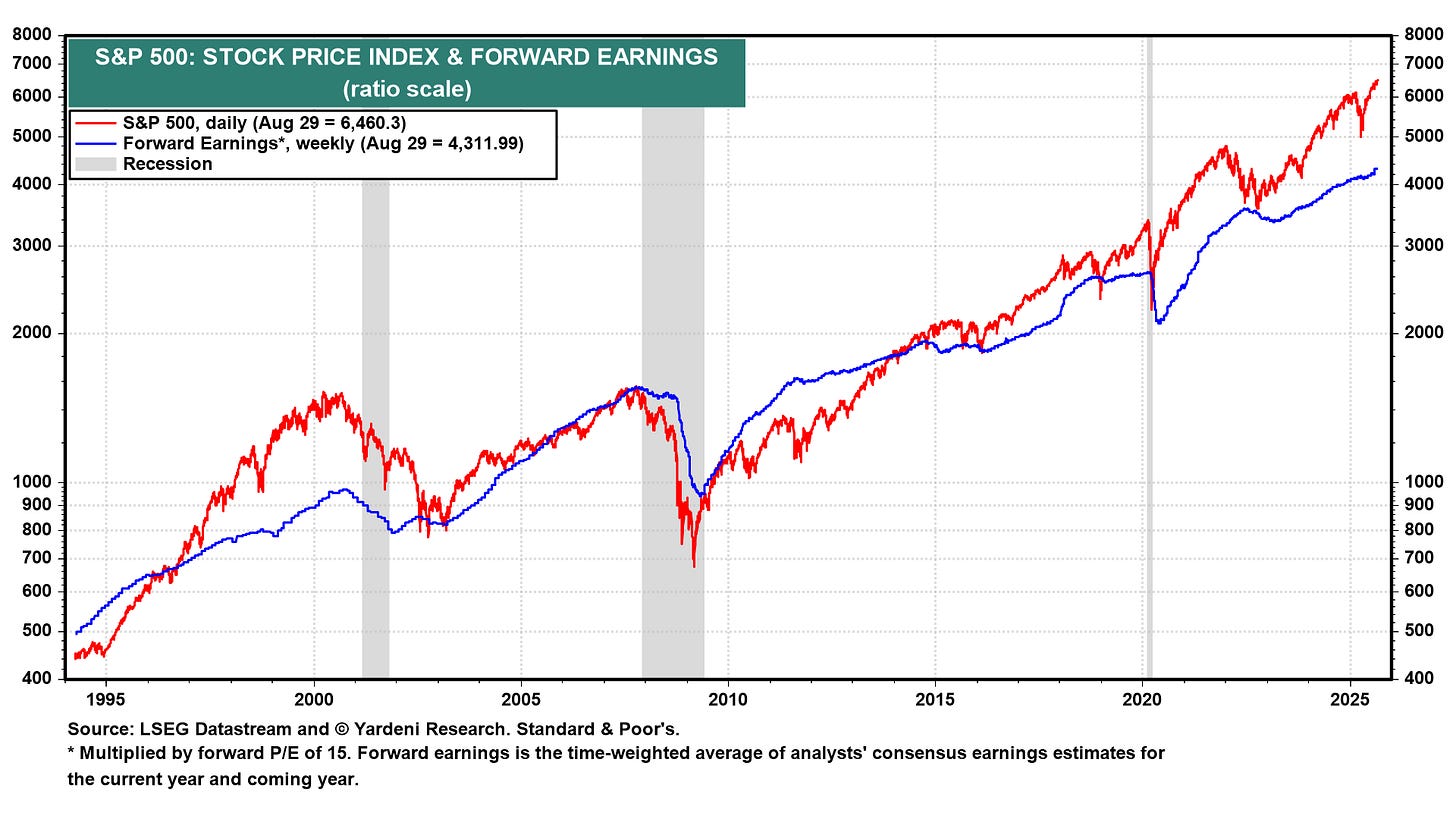

Here’s the S&P 500’s forward earnings expectations. In the long run, earnings and stock prices move in the same direction. Earnings are still growing right now.