Market & Portfolio Report: New trades and large potential moves in 2025

Short term trades + one new medium term position

Sector leadership in the U.S. stock market continues to rotate. Previous laggards have become leaders, and previous leaders have become laggards. Over the past 2 weeks:

Magnificent 7 tech stocks: +9.7%

Semiconductor index: +4.5%

NASDAQ 100: +4%

S&P 500: +0.3%

NASDAQ 100 Equal Weighted: 0%

S&P 500 Financials: -3.6%

Russell 2000 (small caps): -3.6%

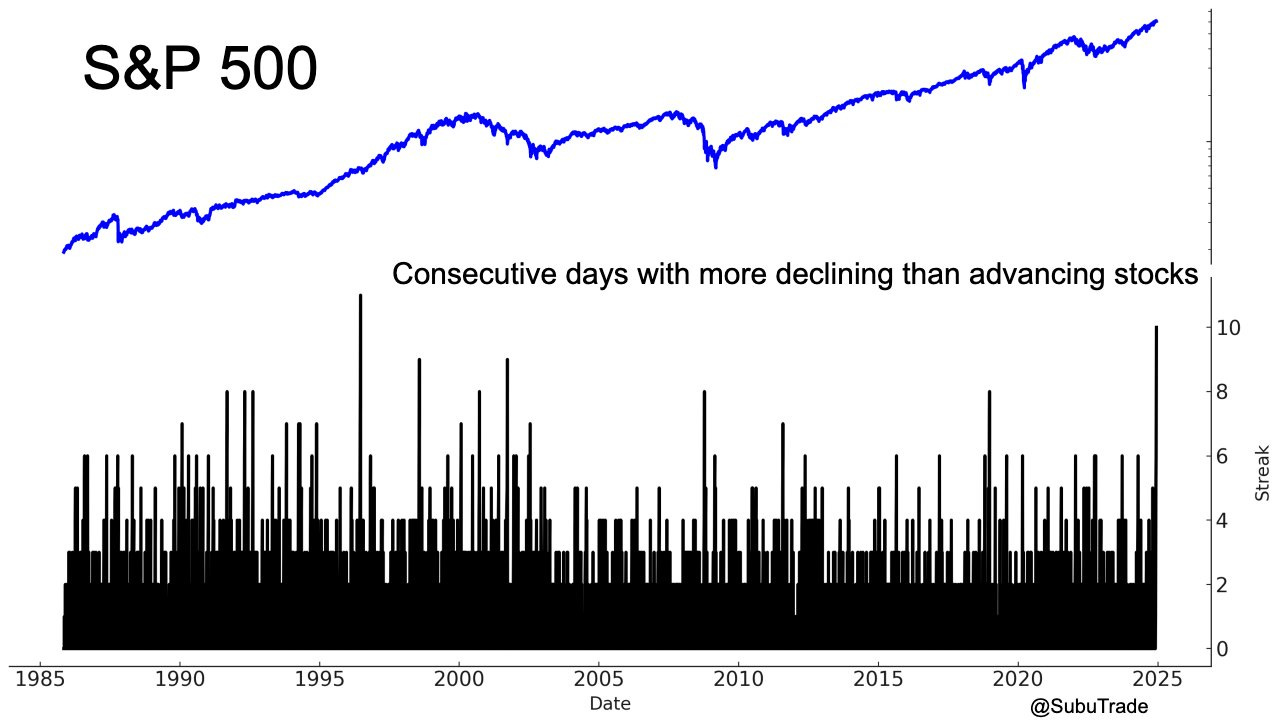

With a few large cap tech stocks lifting up the entire S&P 500 index, breadth remains weak. The S&P 500 has gone 10 straight days with more declining than advancing stocks, despite the index being flat from where it was 10 days ago.

My portfolio:

Follow me on X/Twitter to follow my trades in real time.

My core position remains long U.S. equities. My position size is 60% less than normal to account for downside risks. I will let the rest move along with the market, using a trailing stop loss.

On Friday I initiated small long positions in RSP (equal weighted S&P 500 ETF) and TLT (Treasury bond ETF). These are extremely short term trades. Explained below. Going forward I will be posting my trades on X/Twitter, so please follow me there.

On Friday I initiated a small long Chinese equities position. This is a small, medium term trade that will be held for several months. Explained below.

Several markets which are in wait-and-see modes with large potential trade setups in 2025:

Indian equities

Potential breakouts in oil, copper, silver, and platinum in 2025

Let’s dive in.

U.S. stocks

The S&P and NASDAQ continue to trend higher despite the stock market’s problems (weak breadth, extremely bullish sentiment etc).

Breadth weakness pushed the equal-weighted S&P 500 down. RSP closed lower than its open 10 days in a row.

RSP is sitting near the bottom of its channel since August. I went long on Friday, looking for a small bounce. This is a very short term trade.

On a longer term time frame….

Sentiment

Sentiment remains elevated, but hasn’t quite reached the level that marked prior major tops:

Options

Options traders are still extremely bullish towards U.S. equities. This is a medium term warning sign.

Fund Flows

We continue to see massive inflows into U.S. equity ETFs (SPY, IVV, VOO, VTI, QQQ). This is a medium term warning sign.

Insider Trading

Corporate Insiders continue to sell stocks at an extremely fast pace. They tend to sell a too early though, before the stock market tops…

Commitment of Traders Report

The Commitments of Traders Report continues to highlight incredible bullishness towards equities from asset managers. The following chart illustrates the Net Asset Manager Positioning for the e-mini S&P contract:

Here’s that same indicator, adjusted for Open Interest:

Overall, the U.S. stock market continues to flash medium term warning signs. However, a short term long trade can be taken right here. This long position must be small.

Bonds: stuck in a range

I am neither long term bullish nor bearish on bonds. I see no reason for a large and sustained breakout or breakdown right now. Core inflation remains elevated, which depresses bonds.

TLT (Treasury bond ETF) fell to the bottom of its 1 year range and its 5 day RSI is low. I went long on Friday, looking for a short term bounce.

It is better to play Treasuries from the long side than the short side. According to the COT Report, Large Speculators are near record bearish towards Treasuries:

*Use Large Speculator positioning as a contrarian indicator

New Medium Term Position: Long Chinese equities

The conventional thinking is that Trump will crush China with tariffs. And while I also think this is the most likely scenario (>50% probability), what if it doesn’t happen?

I look for mis-priced opportunities. If the market thinks the probability of China being crushed by Trump is 80% but I think the probability is 60%, that gap in probability estimates is potential profit (positive Expected Value).

Here’s something interesting: Trump invited China’s President Xi to his inauguration. What if the upcoming trade war is not as bad as everyone thinks?

To be clear, I still think Trump will increase trade problems between the U.S. and China. Everyone thinks that a lot can go wrong with China. But a lot of the trade war problems are already priced in. The question right now, is what can go right?

Looking at the charts, Chinese stocks failed to breakout this week. See FXI:

Meanwhile, China’s 10 year yield has been crushed. Potential bounce ahead?

I went long Chinese equities using call options on Friday. This is a small position that I intend to hold for several months, looking for a medium term rally. Again, I agree that there are many problems in China. But the question remains, what can go right? What possibilities is the market underpricing?

Wait-and-see markets

There are several large potential trades in 2025. These are not trades for today. So wait and see.

Indian Equities: wait before buying

I remain long term bullish on India. This is the Indian Century.

Indian stocks continue to trend upwards. However, I think India will need to consolidate further before making new highs.

As India turns into an export powerhouse (offshoring of American office jobs + shifting Chinese manufacturing to India), India’s corporate earnings are trending higher.

Oil: breakout ahead?

Oil might breakout in 2025.

Meanwhile, Large Speculators are bearish towards oil.

*Use Large Speculator positioning as a contrarian indicator

Copper: breakout ahead?

Silver: broke out. Resistance turned into support

Platinum: breakout ahead?

Overall, there are several potential breakouts in the commodities sector. These markets will probably breakout if the Chinese stock market makes a large and sustained rally in 2025.

Conclusion

To recap:

My core position is still long U.S. equities. I reduced my position size to account for various risks to this rally.

I initiated small long positions in RSP (equal weighted S&P 500 ETF) and TLT (Treasury bond ETF). These are extremely short term trades.

I initiated a small long Chinese equities position. This is a medium term trade that will be held for several months. This trade may amount to nothing, but will benefit immensely if under-priced good news appears.

Although I am bullish on the Indian stock market, I think it will continue to consolidate sideways.

I think that Treasury bonds will continue to swing sideways, without a large breakout or breakdown.

2025 may bring several large breakouts in commodities. This is not a prediction; this is simply talking about potential trade setups. We shall see!

I’ll be posting my trades on X/Twitter in real-time, so please follow me there if you’re interested in seeing that.

I hope you’re enjoying your weekend as we approach Christmas! Please email me back if you have any questions/thoughts about the markets and trading you’d like to discuss. Cheers!