Is the stock market rolling over into a correction?

Weak breadth and near-record optimism towards stocks.

While the broad S&P 500 rallied this week, many segments of the market underperformed. Small caps, consumer staples, financials, energy, healthcare, industrials, real estate, utilities…..

Breadth was weak, with large cap tech stocks leading the rally. Every day this week saw more declining stocks than advancing stocks in the S&P, even though the S&P gained almost 1%.

A pullback/correction could be about begin. As a result, I have further reduced my long U.S. equities position. This doesn’t mean that the pullback/correction will begin right now; it simply means that the risk:reward equation is shifting.

In this week’s market analysis I’ll share my outlook on:

U.S. Stocks: Evaluating the signals of a potential topping pattern.

Treasury Bonds: Likely to remain in a sideways consolidation.

Gold: Sideways consolidation may be necessary before any sustained rally.

Oil: Potential bottoming process, though risks of a further dip remain.

Bitcoin: Current sentiment is not bullish for Bitcoin, particularly with the risk of a U.S. stock market correction.

Let’s dive in.

*As a side note, please follow me on X if you haven’t already. I write this market analysis once every weekend, but I post my daily thoughts and charts on X.

U.S. stock market

Sentiment

Investors and traders are very bullish towards U.S. equities. The stock market rally may continue a little further (especially with the year-end seasonal rally), which would push sentiment up to truly worrisome levels:

Options

Many indicators reflect this broad bullishness towards stocks. For example, the CBOE’s Equity Call/Put ratio is extremely high. Such bullish positioning led to significant declines in the stock market in January 2018 and March 2020.

Granted, this was not an accurate SELL signal for stocks in the 2020-2021 stimulus-driven rally. But that was under a massive money printing regime. The environment today is different.

The SKEW Index—indicative of perceived market crash risk—remains elevated. This suggests some traders are actively hedging against a potential market downturn, wary of a repeat of the 2022 collapse.

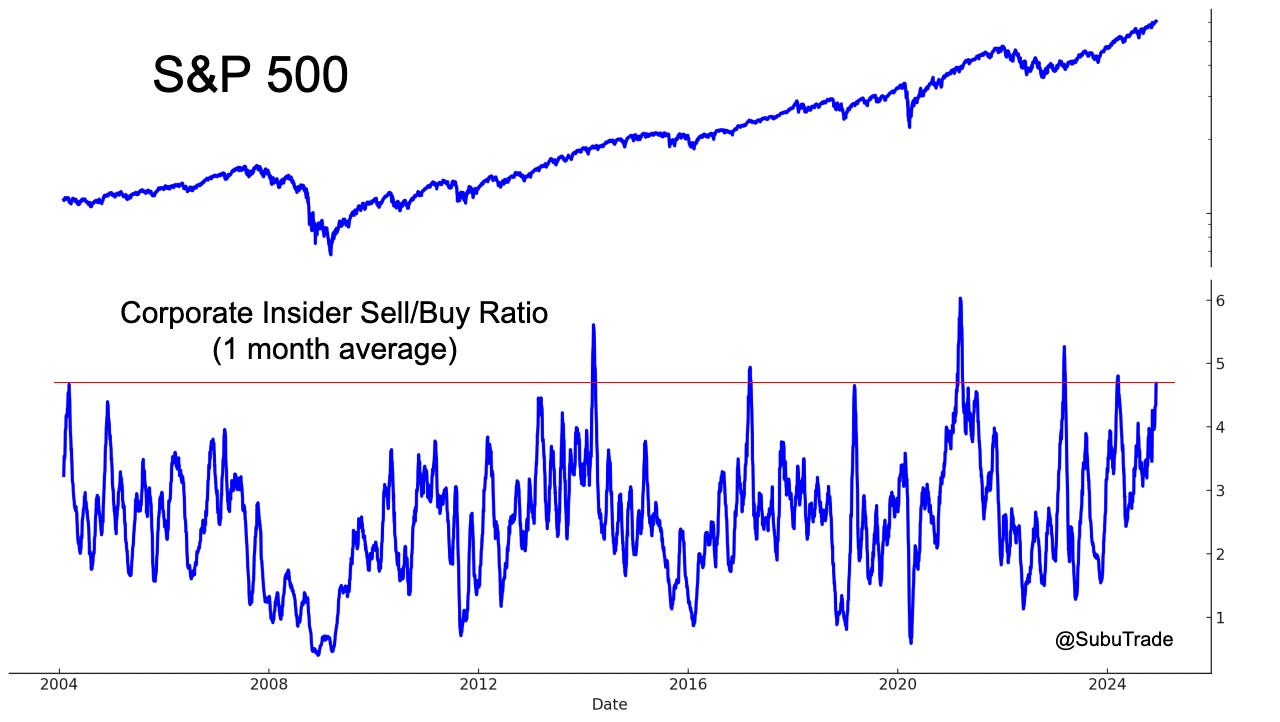

Insider Trading

As I posted on X, Corporate Insiders continue to sell stocks at an extremely fast pace. They tend to sell a too early though, before the stock market tops…

Commitment of Traders Report

The Commitments of Traders Report highlights incredible bullishness towards equities from asset managers. The following chart illustrates the Net Asset Manager Positioning for Major U.S. Equity Indices, as a % of Open Interest:

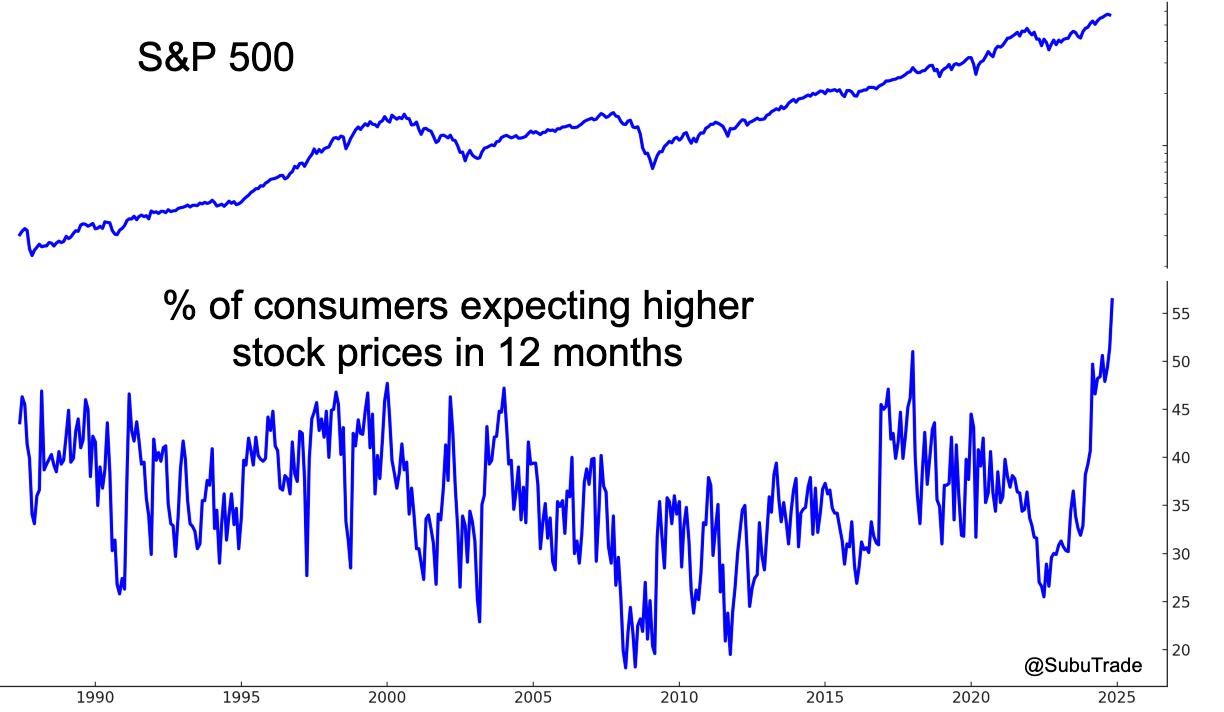

Consumers are extremely optimistic towards stocks

Consumers are also extremely optimistic, with a record % of consumers expecting higher stock prices in 12 months (according to the Conference Board). People expect the second Trump presidency to be similar to the first (stocks rallied strongly in Trump’s first year 2017). But the future rarely plays out just like the past. While we can learn lessons from history, history does not exactly repeat itself.

Overall, it’s easy to see that investors and traders are extremely optimistic. After all, nothing changes sentiment like price, and with the S&P up 28% year-to-date, investors/traders are extrapolating this year’s gains into the future. Extrapolating the recent past into the future is a grave sin that one must try to avoid.

I remain long U.S. equities, but have considerably reduced my position size to account for these mounting risks.

Looking at other markets, I see potential large trade setups for 2025, but nothing which is actionable right now. Let’s wait and see, and enjoy the holidays.

Treasury Bonds

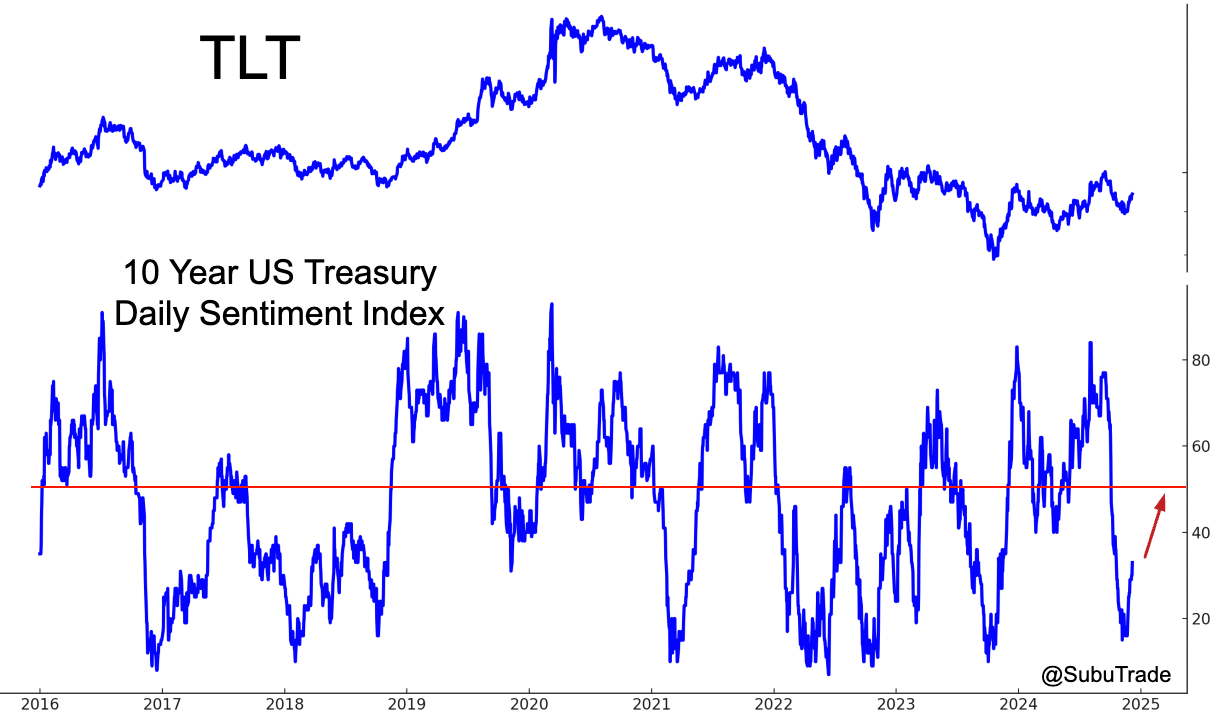

I remain neutral towards Treasury bonds; I don’t see a reason for Treasury bonds to breakout or breakdown from its sideways range over the past 2 years.

While commercial hedgers remain very bullish towards Treasuries, I do not see a catalyst that will trigger a large and sustained rally in Treasuries. Inflation remains elevated, which depresses bond prices.

This doesn’t mean that Treasuries can’t continue to make a short term bounce. The bond market is bouncing back after the September-November decline in bond prices pushed sentiment towards extreme pessimism. Past bounces usually saw sentiment rally further before the bond rally stopped.

Commodities

Gold

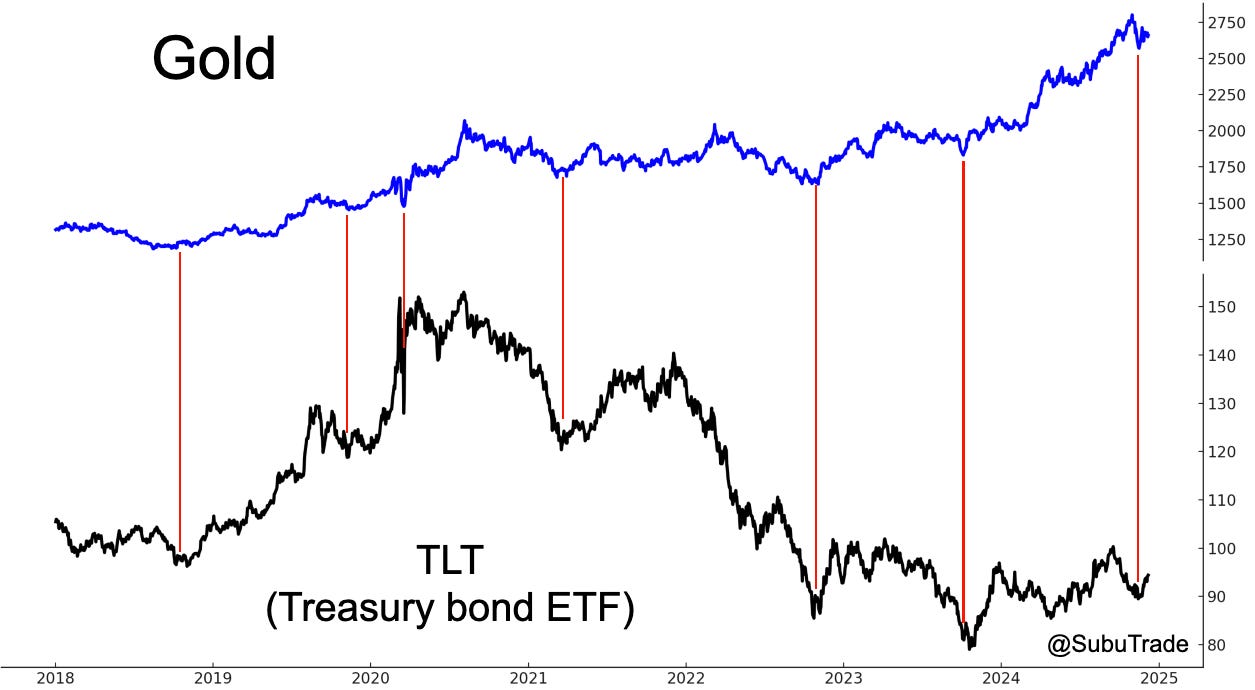

Gold is up 28% year-to-date. While it has far outperformed Treasury bonds, the 2 markets continue to move in sync in the sense that their cycle bottoms are the same. Gold bottoms coincide with bond market bottoms. But when bond prices consolidate sideways, gold surges. In other words, bond prices simply need to NOT fall, for gold prices to rally:

After gold’s monthly momentum (RSI) reached one of the highest levels ever in October, it is currently taking a much needed break. Gold’s historical consolidation patterns tend to last several months, which implies that gold will probably swing sideways right now.

That sideways consolidation will help wash out commercial hedgers’ bearishness towards gold.

*Commercials are contrarian.

Oil

There is a potential bottom forming in oil. This doesn’t preclude one final dip before oil bottoms. I am monitoring this market closely for a buying opportunity. For now, just wait and see…

And lastly, a market I do not trade but watch intensely:

Bitcoin

Bitcoin is fundamentally a vehicle for speculation. With such extreme volatility, Bitcoin is not a replacement for fiat currency because its value is not stable enough.

Bitcoin’s largest bull runs occurred when the U.S. stock market was also rallying. In a sense, it’s basically a high-beta play on speculative fervor.

With that being said, I have no opinion on Bitcoin here. I am neither long nor short. But I will caution that Bitcoin’s sentiment is extremely high right now, and historically, this at least led to a correction, if not more.

Key Insights and portfolio positioning

The U.S. stock market continues to trend upwards, so I remain long equities. However, serious pre-caution should be taken here. I continue to decrease my long positions and scale out on the way up.

As I mentioned last week, I remain long term bullish on Indian equities, but I do not think now is the appropriate time to buy. A U.S. stock market pullback/correction will probably drag down Indian stocks as well.

The next big trade is most likely on the short side of U.S. equities. But for now, wait for the stock market’s momentum to weaken; stocks might even melt up before a pullback/correction. Or perhaps the next big trade is in long Chinese equities, a truly contrarian position considering that Trump’s incoming tariffs will do great damage to China. As I tweeted on X, one individual trader just spent $200 million on call options on Chinese leveraged ETFs YINN and CHAU. What do they know that we don’t? With Trump assuming office in January and a U.S.-China showdown imminent, we’ll soon find out.

Thank you for reading my weekly market analysis. If you have any questions, feel free to email me or leave a comment below. I’d love to hear how you’re trading and what your thoughts on the market are. Let me know, and take care!

Great analysis. Would you recommend subscribing to Jake Bernstein's DSI?