End of the 2023-2024 stock market rally? Looking ahead to 2025

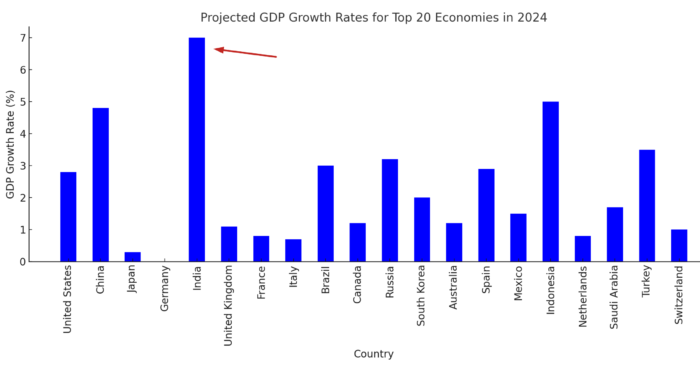

The past two years have been exceptional for U.S. equities, fueled by a sustained bull run. However, no rally lasts indefinitely. Looking ahead, we anticipate heightened volatility in U.S. markets during 2025. On the other side of the world, the long-term outlook for Indian equities remains promising, as the geopolitical dynamics of the U.S.-China conflict will primarily benefit India.

While we are NOT predicting the current bull run’s immediate demise, worrisome signs are piling up that will turn into major headwinds for U.S. equities in 2025.

Let’s delve into the details to see what’s happening in the U.S. stock market. Keep in mind that individual data points are less significant on their own—it’s the collective narrative that drives actionable insights.

Options

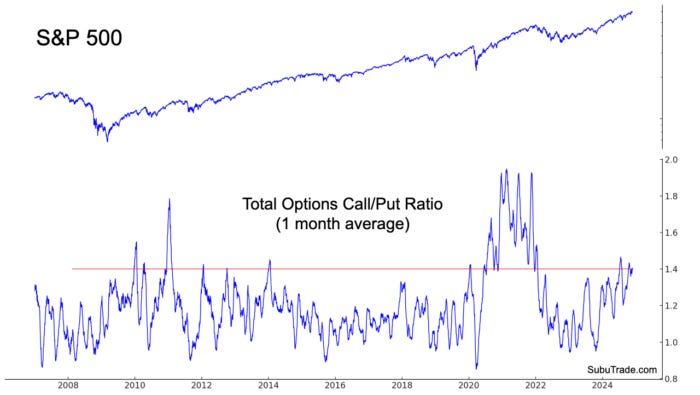

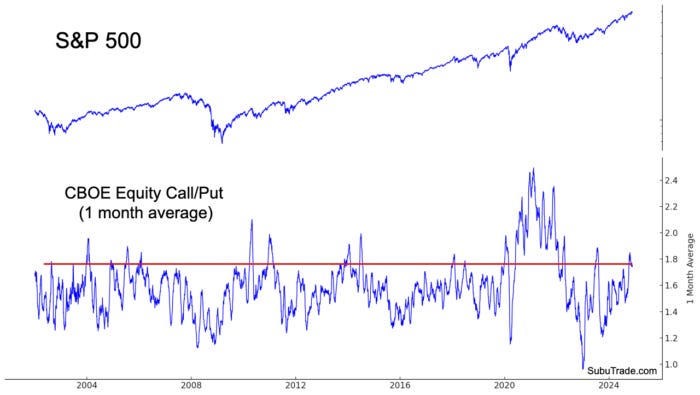

Bullish options traders, who faced steep losses during the 2022 bear market, have fully re-entered the market. Their renewed optimism is evident, though not as euphoric as at the peak of the 2020–2021 stimulus-fueled rally. A preference for calls over puts is now reaching levels that were worrisome during the 2009-2019 bull market.

The Total U.S. Put/Call Ratio and CBOE’s put/call ratios reflect this shift in sentiment.

Here’s the US Total Put/Call Ratio, flipped into a Call/Put Ratio for better visualization:

We can see a similar picture in the CBOE’s Equity Put/Call Ratio, flipped into a Call/Put Ratio for better visualization:

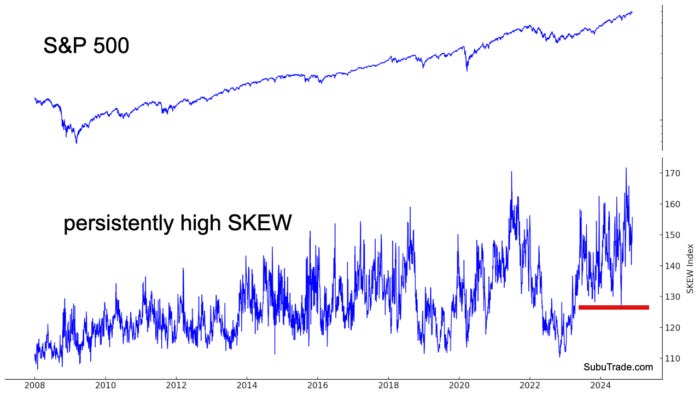

Meanwhile, the SKEW Index—indicative of perceived market crash risk—remains elevated. This suggests some traders are actively hedging against a potential market downturn, wary of a repeat of the 2022 collapse.

Here’s the SKEW Index:

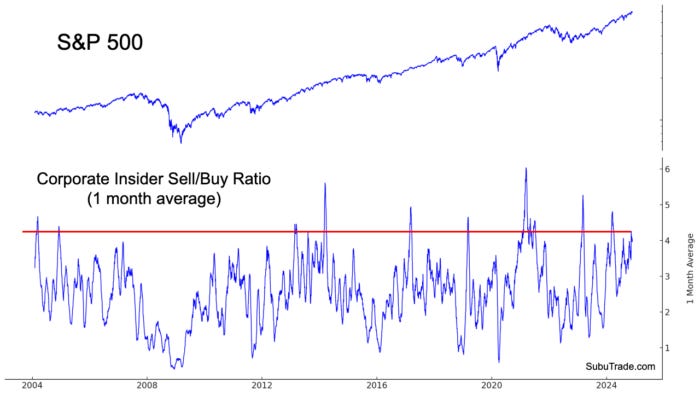

Corporate Insiders

Corporate Insiders are better at timing market bottoms than tops. When it comes to selling during a rally, corporate insiders tend to sell too early as they are eager to take their chips off the table.

The one-month average of the Corporate Insider Sell/Buy ratio is at elevated levels. Historically, this has not always led to immediate corrections but has often preceded increased market volatility in the following year.

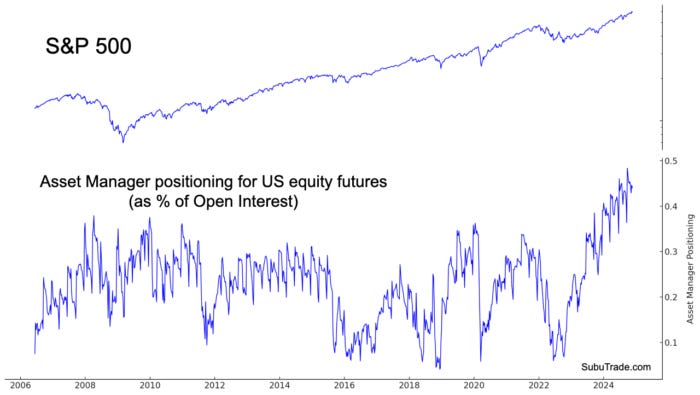

COT Report: Net Asset Manager positioning

The COT Report highlights incredible bullishness towards equities from asset managers. The following chart illustrates the Net Asset Manager Positioning for Major U.S. Equity Indices, as a % of Open Interest:

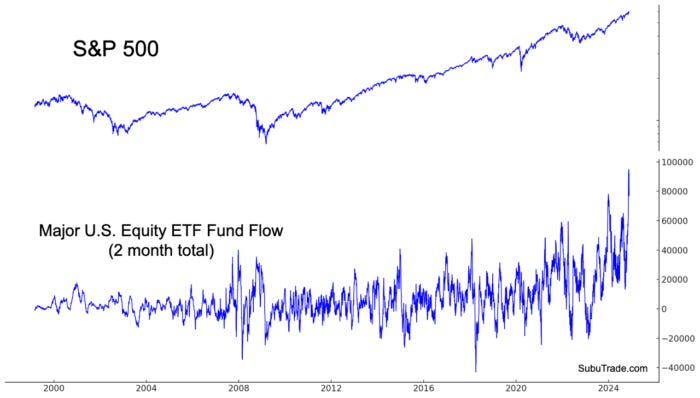

Fund Flows

The optimism from asset managers is echoed in fund flows, with investors pouring record capital into U.S. stock ETFs. Below is a 2 month sum of the total flows into the 5 largest equity ETFs (SPY, IVV, VOO, VTI, and QQQ).

Margin Debt

On a positive note, at least investors and traders are not going all-in when it comes to gambling on margin. While margin levels have risen over the past 2 years, they have not exceeded the previous peak seen in 2021. It’s important to look at margin debt relative to the stock market’s value; margin debt growth that lags the stock market’s growth (e.g. right now) means that excessive margin debt is one less thing to worry about for bulls.

Investor Sentiment Surveys

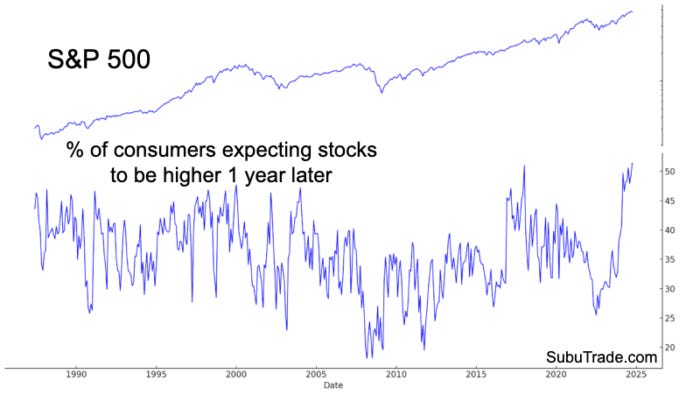

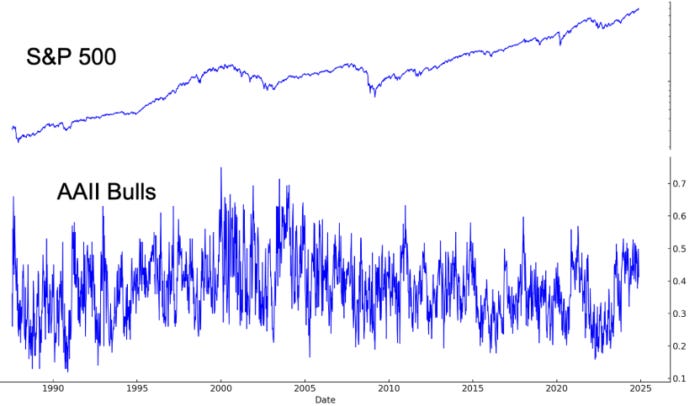

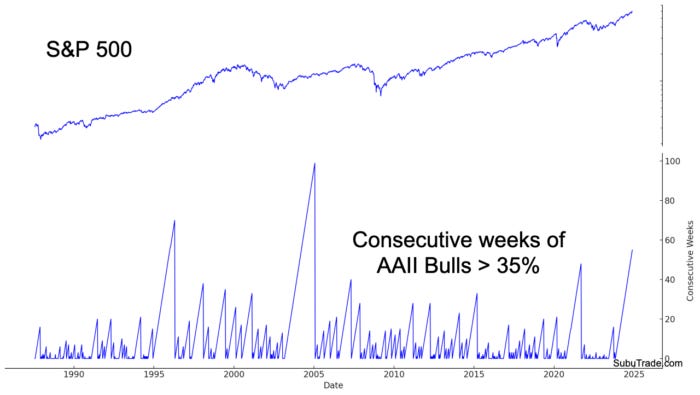

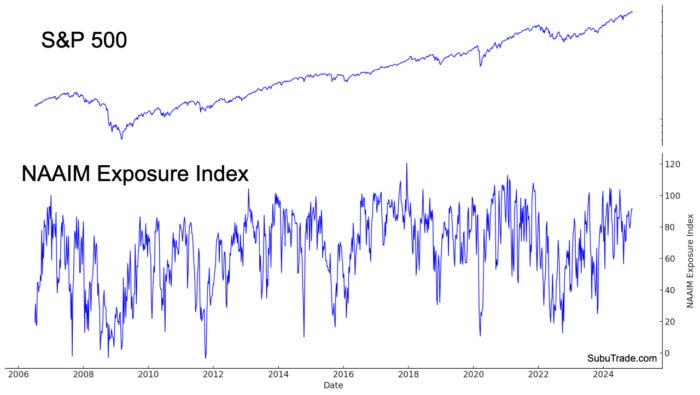

Sentiment surveys, such as those from the Conference Board, AAII, and NAAIM, paint a picture of elevated optimism, sometimes signaling extreme complacency.

Here’s the Conference Board’s % of investors expecting stock prices to be higher 1 year later, at a record high:

Here’s AAII Bulls:

AAII Bulls has remained above 35% for an incredible 55 consecutive weeks:

Similarly, the NAAIM Exposure Index shows a heightened level of bullishness, but not excessively so:

Breadth

The stock market’s rally from 2023-present has been significantly driven by tech/AI stocks. The U.S.’ world-leading tech sector is a major reason why Corporate America’s earnings continue to trend upwards while corporate earnings in other developed parts of the world remain stagnant (e.g. Europe).

The current rally, driven largely by the tech and AI sectors, has begun to show cracks in breadth. Despite the NASDAQ 100’s rally, a declining percentage of stocks remain above their 200-day moving average, indicating weakening participation.

These breadth divergences can last a long time before the broader stock index falls, so this is not an immediately bearish signal for equities. Nevertheless, it is something worth keeping an eye on:

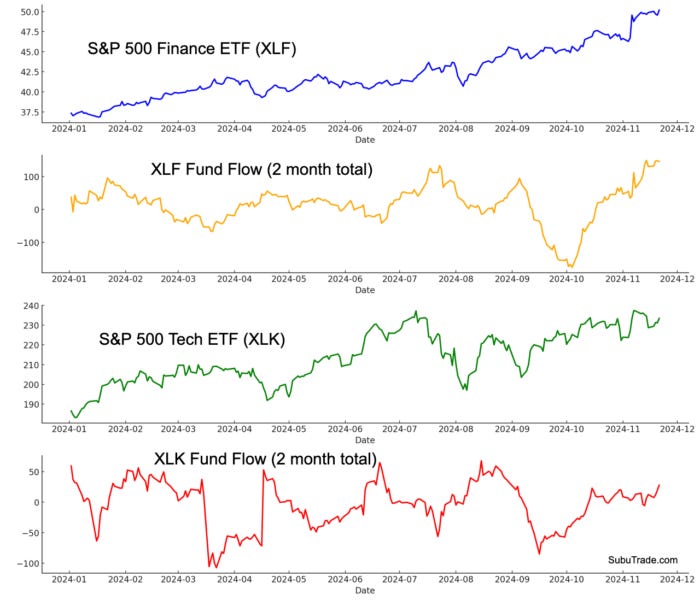

The tech sector, which once led the broad market rally, is now lagging. Once weak sectors such as financials are outperforming. The S&P 500 Finance sector is up 34.5% year-to-date, trouncing the S&P 500’s 25.1% gain.

The past month has seen strong inflows into finance ETFs, while flows into tech are muted:

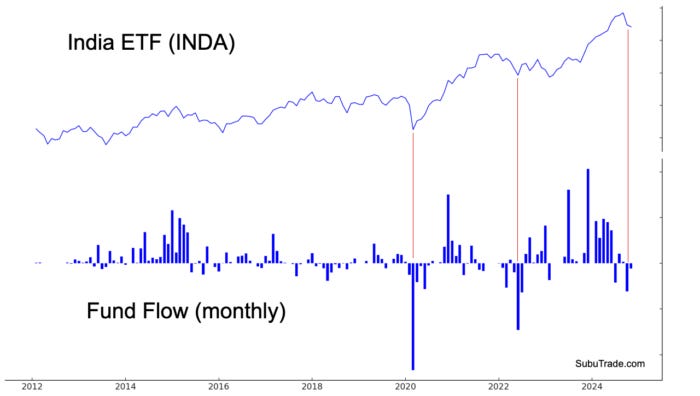

Indian Equities

India is the world’s fastest growing major economy and is projected to remain so. Moreover, India benefits massively from the U.S.-China conflict, which will only escalate as Trump assumes office. India dominates the world’s services exports market, and with the U.S.-China conflict, India will also dominate the world’s manufacturing outsourcing market. India’s economy will be supported by 3 main pillars:

Services Exports

Manufacturing Exports

Remittances to India from Indians living abroad

We remain long term bullish on Indian equities. The Indian stock market’s correction over the past month was to be expected: momentum (monthly RSI) was near an all-time high. With investors rushing for the exit gates, it’s time to start buying again.

Crude Oil

As a side note, we could get a rally in crude oil. COT Managed Money positioning remains depressed:

Key Insights

U.S.: The U.S. stock market remains in a powerful narrative-driven uptrend (“earnings growth”). Warning signs are starting to emerge, suggesting that the stock market will be far more volatile in 2025 than 2024. While now is not the time to outright sell all equities, it is certainly the time to reduce exposure.

India: Indian equities are experiencing a healthy technical pullback following historically high momentum. Long-term fundamentals remain robust, reinforcing our bullish stance.

Thanks for the clear analysis.

Long term, I'm very bullish on India. Largest democracy & population in the world, a free market, relatively high birth rates and number of english speakers.

Authoritarian regimes' economies are bound to collapse on themselves eventually (*cough* China *cough*) or experience significant stagnation in some form.

All of these are huge advantages for India in the upcoming decades.