2026 is off to the races

And so it begins

2026 is starting off with a bang. Breadth is broadening out, and many high beta stocks jumped higher.

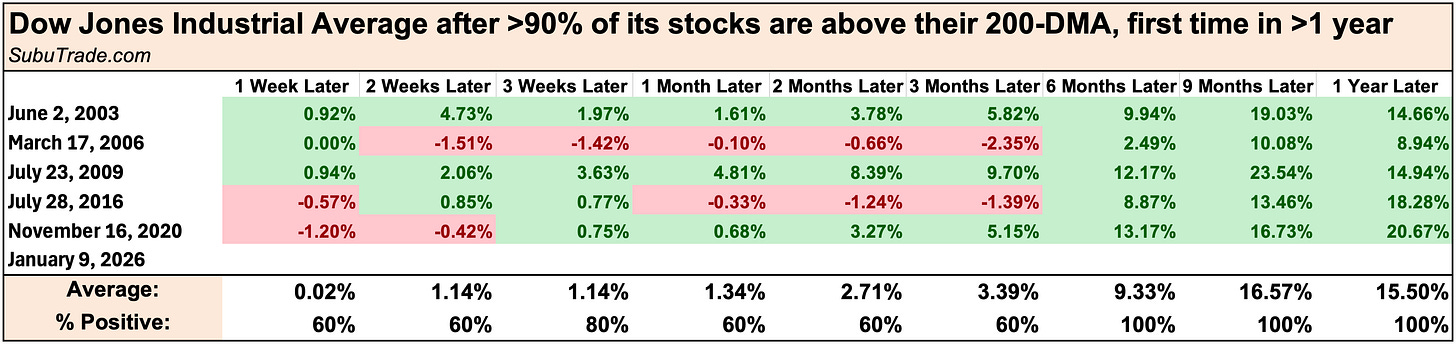

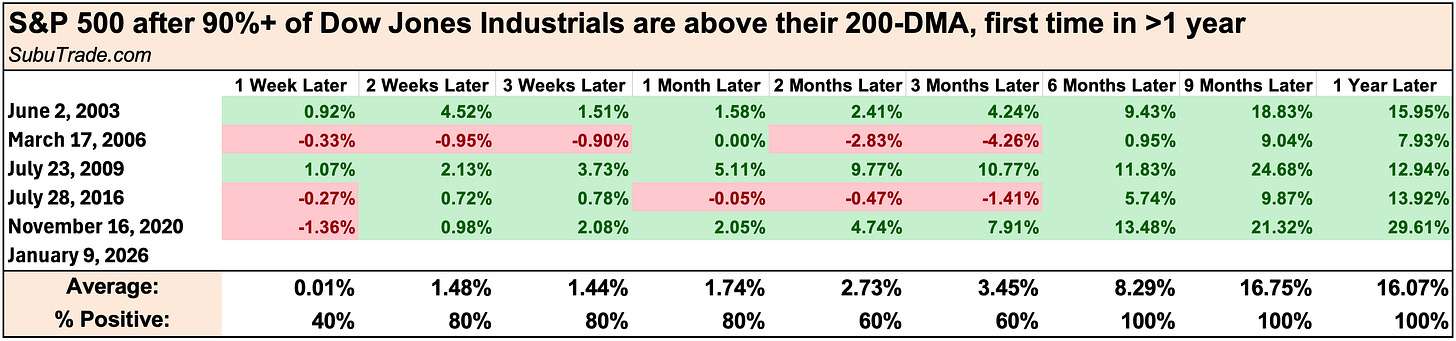

Nowhere is this more evident than in the Dow indices. For the first time since 2021, the Dow Jones Industrial Average saw more than 90% of its stocks above their 200-day moving average.

These breadth recoveries tend to occur 6-12 months after a bear market or market crash, such as the one we saw in April last year under Trump’s tariffs. The market’s short and intermediate term path may become more volatile, but more gains are usually ahead for both the Dow Jones Industrial Average and the S&P 500:

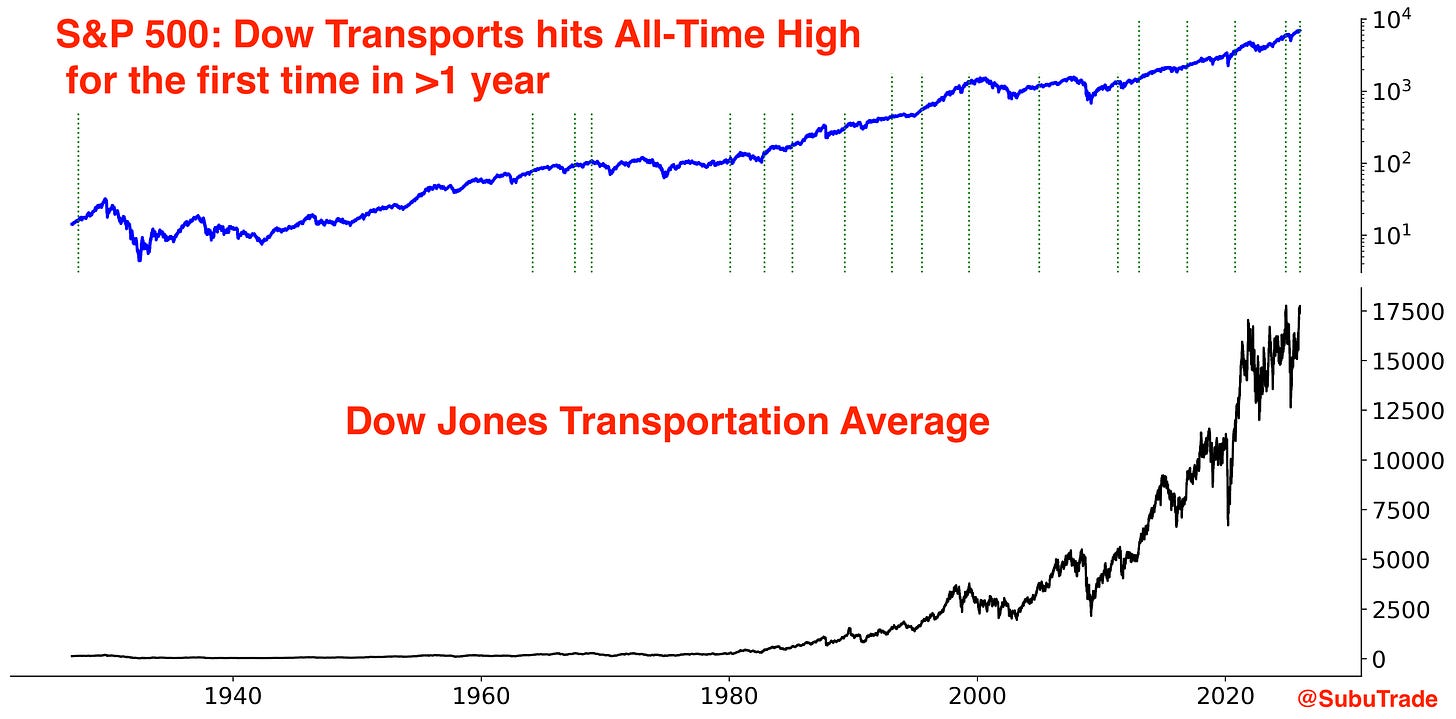

It’s also nice to see the Dow Jones Transportation Average make new all time highs for the first time in over a year. The Dow Theory Confirmation states that we need BOTH Dow indices (Dow Industrials & Dow Transports) to make all-time highs in order to confirm the rally. We finally got that confirmation this week.

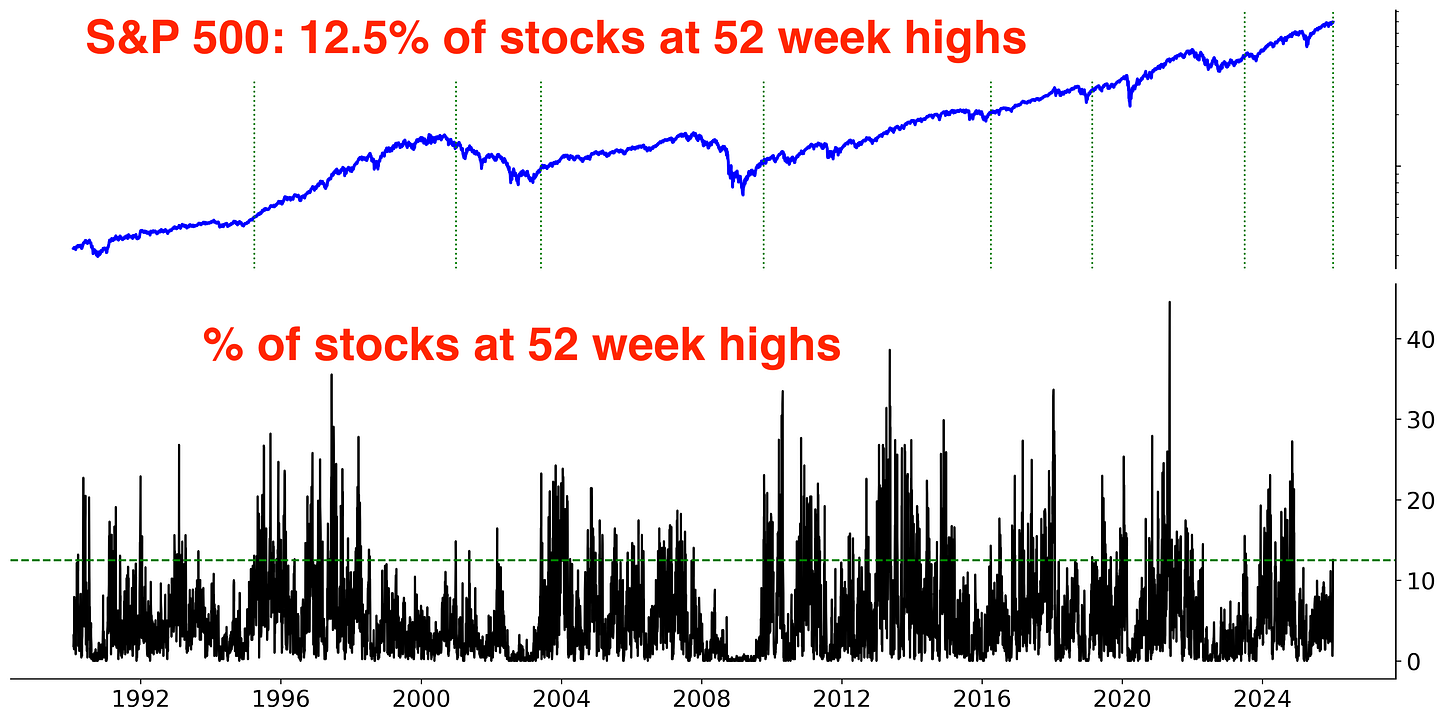

The % of S&P 500 stocks at 52 week highs also jumped to the highest level in over a year.

Looking under the hood, it’s more clear where market strength is coming from.